Alfred Wong

(BSc International Relations)

Image rights: Lay Sheng Yap

(BSc Government and Economics)

To view the accompanying blog piece, please click here.

The Governance Deficit in Central Asia and the Threat to China’s Central Asian Energy Strategy

Abstract

Over the past decade, China has invested heavily in Central Asian energy sources and pipelines, on the grounds that an overland energy supply from friendly, stable authoritarian countries would be more secure than continued reliance on a maritime energy supply. This paper argues that this strategy rests on false assumptions, and that China’s investment in and growing dependence on Central Asian energy imports is not safer than the alternative. This is largely due to the various governance failures in the five Central Asian states, which create regime instability, succession risk, corruption, labour tensions and intraregional energy conflict. Furthermore, the fact that the Chinese oil and gas pipeline network traverses all five Central Asian countries means that unrest and conflict in any one country can disrupt China’s energy supply from the entire region. These threaten China’s energy supply in Central Asia by undermining the supposed foundation of China’s energy strategy in the region, namely the friendliness and stability of the local regimes and the supply security provided by overland transport routes. Furthermore, China’s economic, diplomatic and legal initiatives to mitigate these governance risks are unlikely to succeed in doing so. Not only do such initiatives presume the continued survival and pro-China attitudes of the Central Asian regimes, they also focus on alleviating the consequences of underlying governance failures in Central Asia rather than addressing the corruption, authoritarianism and other problems which constitute the principal threat to China’s energy strategy in the region.

Introduction

China’s massive investments in Central Asian oil and gas over the past decade have been justified by Chinese policymakers and academics as strategically necessary, due to the relatively secure nature of the supply thus obtained 1 This argument follows from the geographical advantage of dependence on overland pipelines as well as the Beijing-friendly governments in the region. However, it ignores the governance failures which today pose the greatest threat to Central Asian governments. This article will argue that China’s financial and strategic investment in a Central Asian energy supply is not only less safe than relying on seaborne imports, it is further imperilled by the bad governance in the region and the various consequent problems.

There are important qualitative differences between which are relevant to Chinese energy security. ‘Oil’ generally refers to crude oil or petroleum, which is predominantly transported and traded globally, via tankers. This makes oil a relatively efficient but less secure market, meaning that oil prices adjust nearly instantaneously to world demand and supply, and oil supplies can be quickly redirected and sold in alternative markets. ‘Gas’ refers to natural gas, which is mainly transported overland via pipelines. As such, gas is a less efficient but more secure market because redirecting gas flow requires years of building new pipelines. This means that gas prices cannot adjust quickly, and gas supplies cannot be easily transported and sold to alternative clients. While there is no universally-accepted definition of ‘governance’, for the purposes of this article, governance will be defined as “the set of traditions and institutions by which authority in a country is exercised. 2

China’s energy supply in Central Asia and its underlying strategy

China’s unprecedented economic expansion over the past three decades has resulted in a boom in energy demand. China’s total energy consumption has increased 5.5 times from 1978 to 2013. 3 Domestic oil consumption in 2014 was 11.06 million barrels per day (bpd) and has far outstripped China’s domestic oil production of 4.25 million bpd. Similarly, China’s gas consumption in 2014 of 185.5 billion cubic metres (bcm) exceeds production of 134.5 bcm. 4 This has made China heavily reliant on importing hydrocarbon energy. In 2014, China depended on imports for 60% of its oil and 30% of its natural gas, together accounting for 24.2% of Chinese energy consumption.5 China’s dependence on imported energy sources means that the Chinese government views the sources of the country’s energy supplies as strategically critical to national security. Beijing is thus aiming to diversify the country’s sources of energy imports away from geopolitically unstable regions like the Middle East, which in 2013 supplied 52% of Chinese oil imports. 6 Beijing also aims to reduce its reliance on maritime energy import routes, which are vulnerable to disruption by American naval power, or Western political pressure on oil-producing countries and multinational energy companies to redirect their oil and LNG tankers away from China. 7 8 The ultimate corollary of China’s two strategic aims to secure its energy supply is to seek energy sources available via overland routes with friendly, stable governments.

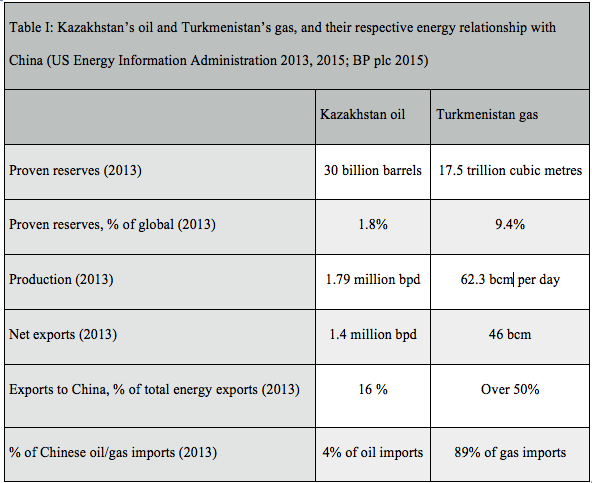

The most prominent example of this change in strategy is China’s May 2014 deal with Russia, whereby Russia will supply China with 38 bcm of natural gas annually from 2018 onward, via pipelines from eastern Siberia to the Beijing-Tianjin-Hebei area of China.9 For the same reason, China is rapidly expanding its oil and gas trade with Central Asia. Of the five Central Asian states, only Kazakhstan and Turkmenistan currently export significant amounts of energy out of the region. Table I shows those two states’ energy reserves, production, total exports and exports to China.10

Turkmenistan in particular is crucial to China’s energy security. Turkmenistan supplied 24.4 bcm of the 27.4 bcm which China imported in 2013, equalling 89% of China’s gas imports. This is made even more important by the Chinese government’s stated aim of reducing its reliance on coal by consuming more natural gas: the State Council in 2014 announced a goal of raising the share of natural gas in energy consumption to above 10 percent, and reducing coal’s share to under 62 percent.11 This is already being seen in the 10.8% increase in Chinese gas consumption in 2013.12

While the energy China imports from Central Asia originates in Kazakhstan and Turkmenistan, the countries through which China’s oil and gas pipelines run are equally important to China’s energy supply. These currently comprise the Kazakhstan-China oil pipeline (KCP) and the Central Asia-China gas pipeline (CAGP), both of which are constructed, operated and owned by China National Petroleum Corporation (CNPC). The KCP began operating in 2006, and runs 1200 km from Atasu in central Kazakhstan to Alashankou on the Xinjiang-Kazakhstan border. 13. In 2013, China imported over 86 million barrels of oil through the KCP. 14In April 2013, Kazakhstan and China signed an agreement to expand the KCP to a capacity of 20 million tonnes, or 146 million barrels annually.15

Compared to the KCP, the Central Asia-China gas pipeline (CAGP) is both more important to China’s energy security as well as more complex. The CAGP is more important because a much larger proportion of Chinese gas imports come via the CAGP than Chinese oil imports via the KCP. The CAGP is also more complex because Turkmenistan is not contiguous with China, which means that the CAGP’s three existing lines, A/B/C, run from Turkmenistan through Uzbekistan and Kazakhstan to Khorgas, Xinjiang. 16 A planned fourth, line D, will run from Turkmenistan and through Uzbekistan, Tajikistan and Kyrgyzstan before ending in Ulugqat, Xinjiang. Lines A/B/C have a transmission capacity of 55 bcm p.a., and line D when completed in 2020 will have a capacity of 30 bcm p.a.17 The strategic importance which China places on the CAGP is seen in the massive, long-term contract underlying it, in which China commits to purchasing 40 bcm of gas annually, and the China Development Bank extends at least $8 billion in gas export-backed loans to Turkmenistan. 18 In 2015, lines A/B/C of the CAGP will supply 20% of China’s annual gas consumption.19

Governance failures in Central Asia and the threat to the Chinese energy supply.

Clearly, China’s energy supply in Central Asia is dependent on all five Central Asian countries, particularly with regards to natural gas and the CAGP. This energy strategy was based on the premise of a more secure supply for oil and gas transported by overland pipelines from friendly governments not allied with the US. This is reinforced by the Chinese government’s belief that economic growth increases political stability, stemming from Beijing’s conviction that delivering prosperity will guarantee political legitimacy and stability. Thus, Beijing’s foreign investment and aid strategy follows this doctrine: China’s spending in Central Asia is partly aimed at helping regional governments achieve the desired stability from economic growth, and consequently to also improve the Xinjiang security environment by stabilising Xinjiang’s neighbourhood. 20. However, “many Chinese scholars argue that [China’s] biggest long-term security concern [in Central Asia] is internal turmoil within the regimes and its effects.” (International Crisis Group 2013). This poses a considerable threat to China’s financial and strategic investment in its Central Asian oil and gas supply. Central Asian states currently face several significant threats stemming from bad governance, including the patrimonial-authoritarian regime, unclear succession plans, corruption, and labour tensions. Each of these threats will now be analysed in turn.

The political situation undoubtedly results in several direct and indirect threats to China’s energy relationship with the region. Regime type is arguably the root cause of bad governance in the region, and thus of the other risks to China’s energy supply addressed in this section. China is primarily pursuing Central Asian energy sources due to these countries’ friendliness towards the Chinese government. These countries are perceived in Beijing as much less likely than American-allied oil producers to yield to foreign pressures to cut off oil and gas exports to China. The problem with this justification is that it ignores the fragility of the China-friendly Central Asian regimes, which stem from the regime type predominant in the region. Von Hauff, 2013 defines Central Asia’s post-Soviet political regimes as ‘patrimonial-authoritarian,’ meaning that they exist by combining the formal institutions of authoritarian presidential systems with informal networks of ‘vested interests.’ This governance structure depends firstly on generating sufficient economic rents to satisfy the various factions, and secondly on repressing and disenfranchising the rest of the population.21

This situation results in several direct and indirect threats to China’s energy relationship with Central Asia. Faction rivalry within Central Asian governments destabilises those governments’ trade relations, or the ‘rules of the game,’ with Chinese firms. According to Minchenko Consulting Group, even the Chinese government’s political clout and good relations with Central Asian governments merely means “certain limits of arbitrary treatment rather than full immunity from corruption.” 22

Secondly, the patrimonial-authoritarian system eliminates any incentive for the president or ruling elite to provide for basic goods and services for the wider population. This undermines the legitimacy and popular support for the entire system and threatens its medium-term survival (Deutsche Gesellschaft für Auswärtige Politik 2013). China’s energy supply would be threatened by the fall of Sinophile regimes and their replacement by individuals who had not profited from the rents resulting from the energy trade with China. In the case of the CAGP, if even one intermediary country drastically changes its attitude to energy relations with China, China would lose at least 30 bcm p.a. of gas.

A related long-term governance risk to China’s energy supply is the unclear succession plans in Kazakhstan and Uzbekistan, both of which are currently stable and pro-China under their respective authoritarian leaders. Neither Kazakhstan’s Nazarbayev, who is 75, nor Uzbekistan’s Karimov (77) have definitely resolved the succession issue, possibly because of the ‘succession dilemma’ whereby an authoritarian leader becomes a lame-duck once he chooses his successor 23

The patrimonial-authoritarian governance structure in Central Asia means that what legitimacy exists is centred on the person of the president. Oxford Analytica argues that the primary source of legitimacy for the current regimes are the current Central Asian presidents’ achievements, from Kazakhstan’s relative prosperity to Uzbekistan’s relative stability, bolstered by cults of personality.24. Whether a new Central Asian president, chosen by the ruling class rather than by popular support, can perform the same role is uncertain. Two past examples illustrates the range of possible outcomes: Turkmenistan had a successful and stable transition from Niyazov to Berdymukhammedov in 2006-7, while Kyrgyzstan experienced two coups and near-constant political instability after removing its first post-Soviet leader, Akayev, in 2005.25. While the succession issue does not necessarily endanger China’s energy supply in the near-term, it remains an uncertainty inherent in Central Asian governance structures which reduces the strategic value of China’s commitment to Central Asian oil and gas.

Dysfunctional governance structures in Central Asia also lead to corruption, which results in an unstable business environment and weakens the state structure guaranteeing China’s energy investments. As mentioned above, rent-seeking is an integral part of the governance systems of the Central Asian states, and inevitably reaches the highest levels of government. Corruption threatens China’s energy supply in Central Asia by creating an unstable business environment; Chinese businessmen have complained of the “brash and unpredictable manner” of handling graft. 26According to the Institute of Developing Economies, the fundamental problem is “not so much the receipt of shadow income (bribery) but rather its legalisation by joining or acquiring legal businesses” by individuals close to the leader, such as in the 2003 Giffen or ‘Kazakhgate’ case. 27 All five of the Central Asian states rank below the 70th percentile of Transparency International’s Corruption Perceptions Index in 2014. Turkmenistan and Uzbekistan rank 169th and 166th respectively, out of 175 countries.28 Moreover, despite China’s claims of “win-win cooperation” (双赢合作) with Central Asian countries, it is mainly political elites who profit from China’s oil and gas investments.29 The International Crisis Group argues that perceptions of China’s role in fuelling Central Asian corruption drives “antipathy to China and its nationals…across Central Asia.” (International Crisis Group 2013). This threatens China’s energy supply, as public perception of Chinese complicity in systemic corruption makes Chinese assets like mines or pipelines targets for local political or industrial protests, which may lead to significant damage to Chinese investments (International Crisis Group 2013). More broadly, systemic corruption increases the possibility of regime change causing the replacement of the current government with a populist, possibly anti-China, one. However, this scenario is relatively unlikely. Indeed, high levels of corruption can have a stabilising effect on authoritarian and hybrid regimes by strengthening the informal patronage networks of vested interests that keep the incumbent leader and regime in power. 30 Nonetheless, corruption contributes to regime change by amplifying public anger over more immediate causes of revolution and turmoil. In Central Asia, these may include regime succession disputes, ethnic tensions and labour unrest.

Labour unrest and industrial action in the oil- and gas-producing Central Asian countries would also directly threaten China’s energy imports from the region. This is primarily seen in western Kazakhstan, where an oil workers strike over pay in Zhanaozen ended in December 2011 when police killed at least 17 people.31. As this strike shows, industrial action in energy-producing regions can cripple energy production and exports, with huge consequences for Chinese energy security. As a result of the seven-month strike, the Kazakh state energy firm KazMunayGaz produced approximately 8.4% less crude oil, and strike-related costs to the Kazakh state were around $365 million.32 Mangistau region produces nearly 70% of Kazakhstan’s oil output, but also saw seven labour-related protests in 2013, more than any other region in the country.3334 Part of the problem is Kazakhstan’s weak, government-linked trade unions and increasing post-2011 restrictions on labour rights. The most recent of these were in 2014, when the Kazakh parliament passed legislation to allow courts to rule strikes “illegal” and make participation a criminal offence. 353637 The absence of effective unions or other ways to advance workers’ interests increases the chances of oil sector strikes in Kazakhstan. Moreover, Kazakh oil workers’ grievances of low pay, pay inequality compared to foreign workers, and harsh working conditions are echoed throughout Central Asia’s energy-producing regions.38. The bilateral nature of the KCP route does not protect China from disruption of oil production at its source in western Kazakhstan. China’s Central Asian energy strategy is based on intergovernmental engagement, and assumes that those governments can provide stability and security of supply. But persistent labour tensions show that governance failures and institutional weakness in Central Asia may disrupt energy exports to China, even if falling short of regime change.

Intraregional conflicts in Central Asia and the threat to China’s energy supply

Beyond domestic governance problems, intraregional conflicts stemming from strong interdependence over natural resources present a very large potential threat to China’s energy supply. The five Central Asian states are heavily interdependent in both water and energy resources, a situation termed the ‘energy-water nexus’. This interdependence, however, is often the source of conflict between these nations, and such conflicts have serious potential to endanger China’s energy supply.

While Kazakhstan, Uzbekistan and Turkmenistan have abundant hydrocarbon energy supplies, the latter two countries depend on the region’s two main rivers, the Amu Darya and Syr Darya, for sources of water. Energy-poor Kyrgyzstan and Tajikistan lie upstream of these countries on the Amu Darya and Syr Darya, and thus control 80% of regional water resources (International Crisis Group 2014). Thus, Uzbekistan’s and Turkmenistan’s water source is essentially controlled by Kyrgyzstan and Tajikistan. At the same time, Kyrgyzstan and Tajikistan are strongly reliant on imported hydrocarbon energy. Tajikistan imports 35.6% of consumed energy, and Kyrgyzstan 47.7%, both primarily from Uzbekistan. 39. This regional interdependence was optimised under the Soviet-era single power system to develop the region as a whole: Kazakhstan, Turkmenistan and Uzbekistan provided coal, gas and oil to Kyrgyzstan and Tajikistan in winter, and received surplus hydropower generated in Kyrgyzstan and Tajikistan in summer (Granit et al. 2012). Water supplies were allocated by regional water management and state planning authorities according to Moscow’s economic priorities (International Crisis Group 2014).

Today, Central Asian intraregional interdependence has created acrimony between the five countries due to energy exports outside of Central Asia and more importantly, incessant discord between the five regional governments. After 1991, the energy-rich Central Asian states had huge financial incentives to export their hydrocarbon resources out of Central Asia, as they opened up to world markets and high global demand for oil and gas. This threw the energy-water nexus into disarray as Kazakhstan began exporting oil to Europe and the world via swaps with Iran, and Turkmenistan began exporting gas to China as well as Russia (Energy Information Administration 2013; Energy Information Administration 2015). Intraregional conflicts over the energy-water nexus, manifesting in a vicious cycle of both sides cutting each other’s water and energy supplies, further exacerbated this problem. Uzbek President Karimov has repeatedly cut off gas exports to neighbouring countries in pursuit of regional dominance, including a gas shutoff to southern Kyrgyzstan since April 2014, in response to Gazprom’s takeover of Kyrgyzstan’s state gas company Kyrgyzgas. 40 Kyrgyzstan and Tajikistan thus rely on hydropower for 93.3% and 98.8% of their generated electricity respectively (International Crisis Group 2014). The result is that Uzbekistan, and to a lesser extent Kazakhstan and Turkmenistan, face a rapidly worsening water deficit in the near future. The World Bank estimates that Uzbekistan’s water deficit will increase from 2 km3 in 2005 to 11-13 km3 in 2050. 41

This affects China’s energy supply from Central Asia because the trans-regional nature of China’s energy strategy in the region will backfire if intraregional conflicts over energy and water worsen. China has invested heavily in energy pipelines that span all five Central Asian countries. China’s biggest exposure to intraregional conflicts is via Line D of the CAGP, which runs from Turkmenistan through Uzbekistan and Kyrgyzstan and Tajikistan. As discussed above, these countries have previously clashed over energy and water interdependence, including the usage of gas shutoffs. Just one of the intermediary countries through which Line D runs could cut off at least 30 bcm p.a. of gas to China. This situation presents a medium-term expropriation risk for China’s supply of gas via CAGP line D when it is completed, because Uzbek-created gas shortages in Kyrgyzstan and Tajikistan will cause domestic political pressure to appropriate the gas flowing through the CAGP. The current Ukrainian crisis presages this danger: in June 2014, Russian gas exports to Ukraine were cut while exports destined for the EU continued to pass through Ukraine. As the European Commission noted in October: “the risk that gas destined for the EU is cut off as it transits through Ukraine is considerable.” 42 China’s energy supply will be similarly endangered if Central Asian energy-water disputes intensify in the future.

China’s actions to mitigate governance risks to its Central Asian energy supply.

The Chinese government’s Central Asian energy policy is complemented by other initiatives aimed at tying the region closer to China. Beijing is likely to be aware of the governance problems in Central Asia, not least in the context of China’s own crackdown on corruption. China’s efforts to mitigate these risks is two-pronged: firstly, strengthen the current Central Asian governments through economic aid and multilateral cooperation; and second, use legal measures to ensure that intraregional disputes have only minimal impact on China’s energy supply.

Beijing’s approach is informed by its belief that domestic political stability resulted from the prosperity induced by Deng Xiaoping’s economic reforms in the 1980s and 1990s, despite a lack of political liberalization.43. China’s actions to mitigate governance risks to its Central Asian energy supply therefore focus on encouraging widespread and inclusive economic growth in the Central Asian states. The most prominent of these initiatives is the New Silk Road Belt (NSRB, 新丝绸之路经济带) project, first proposed by President Xi Jinping in September 2013. The ‘New Silk Road’ aims to open an overland transportation route between China and Europe via Central Asia. To this end, China has announced investments of $50 billion in the Asian Infrastructure Investment Bank (AIIB) and $40 billion in a Silk Road infrastructure fund.4445 This massive project is partly aimed at increasing incentives and mechanisms for intraregional cooperation within Central Asia, especially on infrastructure construction and protection. 46 China is also providing development assistance to the region through the China Development Bank and the Export-Import Bank (ExIm). The World Bank stated that China ExIm Bank was Tajikistan’s largest creditor in July 2014, holding more of the country’s external debt than the World Bank and Asian Development Bank together.47 The specific infrastructure focus of Chinese development aid to Central Asia reflects Beijing’s emphasis on enabling trade and domestic growth in the region, which would strengthen Sinophile regional governments and safeguard China’s investments.

A more direct approach in China’s efforts to reduce Central Asian governance risks to the Chinese energy supply is through multilateral cooperation. China aims to use the Shanghai Cooperation Organisation (SCO) as a multilateral initiative to strengthen Central Asian security cooperation against the so-called ‘three evils’ (三股势力) of terrorism, separatism and religious extremism. These efforts include annual multilateral counterterror military exercises, as well as modest military aid to all five Central Asian states.48. The SCO is also the conduit for multilateral, Chinese-led initiatives on trade, economics and culture, with China having previously proposed a $10 billion SCO Anti-Crisis Fund in 2008 and 2009, as well as an SCO Regional Development Bank in 2012 (Cooley A. 2015). These China-led initiatives are intended to strengthen the political status quo within the five Central Asian states, keeping in power the friendly governments with which Beijing had signed energy agreements.

China is also utilising legal measures to reinforce its control over the CAGP and KCP. The CAGP’s first three lines are legally not one single structure, but are divided into three separate joint ventures with the country it runs through. Each section is jointly owned by China and Turkmenistan, Uzbekistan and Kazakhstan respectively, with China and the Central Asian state each owning 50%. This means that China will in future be able to act as regional gas distributor. More importantly, however, this arrangement also ensures that future intraregional disputes over the CAGP will be resolved by China, as the only party that owns part of the entire pipeline (Cooley A. 2015). This reduces the risks to China’s energy supply posed by the tensions over the energy-water nexus in Central Asia.

China’s economic, legal and multilateral measures to mitigate governance risks to its Central Asian oil and gas supply is likely to have very limited effect in doing so. As has been discussed above, China’s infrastructure investment and development aid to the region has been dispensed in ways that exacerbate corruption and public anger towards elites in Central Asia. Both China’s legal and multilateral measures also presume the continued rule of the current regimes. China’s legal rights over its pipeline network may prove difficult to enforce without supportive Central Asian governments and courts. More importantly, China’s foreign policy principle of non-interference in the internal affairs of other sovereign states means that its efforts do not attempt to address the underlying fragilities in Central Asian governance structures. Indeed, this principle is enshrined in Article 2 of the SCO Charter, which means that China has, at least de jure, no right to try to address the fundamental governance problems in Central Asia. Despite the SCO’s multilateral military cooperation initiatives, this again presupposes a cooperative Central Asian governmental partner with military capabilities. The ineffectiveness of the SCO in militarily securing China’s energy supply in future is demonstrated in its inaction during the 2010 Kyrgyz coup. 49

Conclusion

China’s massive investments in Kazakh oil and Turkmen gas, as well as in oil and gas pipelines through all five Central Asian countries, are the direct result of China’s economic overdependence on oil and gas imports from politically unstable or unreliable countries via maritime routes. The Chinese government’s strategic concern about China’s dependence on foreign energy sources has prompted various measures to diversify the countries energy supply. These include pressuring Chinese state-owned National Oil Companies (NOCs) to invest in oil and gas fields overseas, investing in domestic energy sources such as unconventional gas extraction, and pursuing energy sources available from friendly neighbouring states via secure overland routes. The latter tactic has resulted in China’s heavy investments in oil from Kazakhstan and gas from Turkmenistan, as well as in the pipelines traversing Central Asia necessary to transport these hydrocarbons to China.

While China’s Central Asian energy strategy appears superficially sound, it overlooks the governance risks simmering beneath the surface of the seemingly stable Central Asian regimes, which may inevitably affect China’s energy supply. The patrimonial-authoritarian regimes characteristic of Central Asian states, as well as the uncertain succession plans of ageing rulers, combine to create a looming threat of regime infighting, political instability and thus disruption to the oil and gas supply to China. Even short of regime change, the corruption endemic in all the Central Asian governments is a significant factor in widespread public discontent, manifesting in labour unrest and possibly violence in future. Finally, the intraregional tensions in Central Asia arising from strong interdependence in water and energy adds another, transnational risk to China’s energy supply. China’s attempts to strengthen the Central Asian regimes through economic aid plans like the AIIB and New Silk Road project, as well as by diplomatic and military ties like the SCO, remain untested except in the 2010 Kyrgyz coup where China failed to affect the outcome. While it is too early to definitively state whether China’s measures to mitigate the governance risks to its Central Asian energy supply have succeeded, the fact that none of them address the underlying governance problems in Central Asia does not bode well for their viability.

While this article has focused on one aspect of China’s energy strategy in one region of the world, further investigation into China’s global hydrocarbon strategy is an increasingly important avenue of future research. China pursues energy security through a variety of means, including via bilateral governmental relations as well as its state-owned companies. One area of further study is the complex and intertwined nature of the Chinese government’s financial and diplomatic relations with African and Latin American countries, its energy strategy in those regions, and its state-owned energy companies’ positions in those countries.

Notes

- Acknowledgements: I am indebted to Mme. Olga Spaiser for her highly enlightening class at Sciences Po Paris, which introduced me to the topic of this article.

Bibliography

Wei B. 2013 “中國在中亞的能源佈局 (China’s Energy Situation in Central Asia),” Paper presented at the 8th Annual Conference of The Asian Studies Association of Hong Kong, Hong Kong, 8 March 2013. http://goo.gl/Z1TzGb.

Appendix

The information and views set out in this article are those of the author and do not necessarily reflect the official opinion of the LSE Undergraduate Political Review, nor the London School of Economics.