by Athanasia Stylianou Kalaitzi and Trevor William Chamberlain

Shuwaikh Port, Kuwait. Source: Kuwait Ports Authority

Conventional wisdom, supported by evidence from numerous countries, holds that exports have a positive impact on economic growth. In particular, expansion of manufactured exports increases imports of intermediate and capital goods essential for the manufacturing sector, leading to increased investment, technology development and economic growth. In turn, economic growth finances further import expansion, enhancing technology transfer to the economy at large and driving export diversification further.

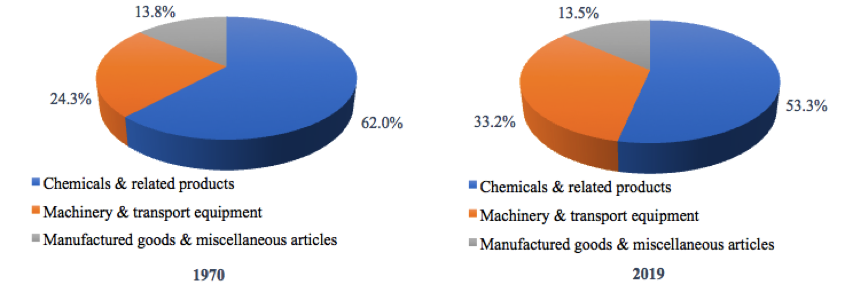

In the case of Kuwait, manufactured exports’ share of gross domestic product (GDP) increased from 1.4% in 1970 to 3.7% in 2019, while manufactured exports as a fraction of total merchandise exports increased from 4.7% to 7.8%. As for the composition of manufactured exports, the share represented by chemical and related products decreased from 62.0% in 1970 to 53.5% in 2019, while that of manufactured goods and manufactured miscellaneous articles decreased slightly from 13.8% to 13.5% during the same period. In contrast, machinery and transport equipment’s share increased from 24.3% in 1970 to 33.2% in 2019 (Figure 1).

Figure 1: Manufactured exports’ composition

Source: Authors’ calculations based on data obtained from the United Nations Commodity Trade Statistics Database. Manufactured exports include SITC, Rev.1 codes: 5 (Chemicals & related products), 6 (Manufactured goods, excl. code 68), 7 (Machinery and transport equipment) and 8 (Miscellaneous manufactured articles).

The GDP of Kuwait increased at an average annual growth rate of 2.3% over the period 1970–-2019, with primary imports and manufactured imports increasing at rates of 5.2% and 6.0% respectively (World Bank, World Development Indicators; United Nations Commodity Trade Statistics). But have manufactured exports and disaggregated imports contributed to Kuwait’s economic growth?

To answer this question, the present study uses time series data for Kuwait over the period 1970–-2019 and a Cobb-Douglas production function augmented with manufactured exports and primary and manufactured imports. In particular, GDP and gross fixed capital formation, which are used as proxies for economic growth and physical capital respectively, are taken from the International Monetary Fund – International Financial Statistics, while working age population, used as a proxy for human capital, is obtained from the World Bank – World Development Indicators. Manufactured exports and primary and manufactured import data are taken from the United Nations Commodity Trade Statistics. All the variables are in logarithmic form and measured in real terms (2010=100).

The study assesses the stationary properties of the variables using the augmented Dickey-Fuller and Kwiatkowski-Phillips-Schmidt-Shin unit root tests as well as the modified Dickey-Fuller test with a breakpoint. The Johansen cointegration test and dynamic ordinary least squares (DOLS) are applied to examine the existence of cointegration among the variables, while the short-run causality is investigated using the Granger causality test in a vector error correction model (VECM) framework. In addition to the diagnostic tests conducted to ensure that the VECM is well-specified, its stability is confirmed based on the calculations of the inverse roots of the characteristic autoregressive polynomial. In addition, the cumulative sum of squares test and recursive residuals test are applied to examine the stability of the error correction model parameters. Finally, the Toda and Yamamoto test is conducted to investigate the long-run causality among the variables.

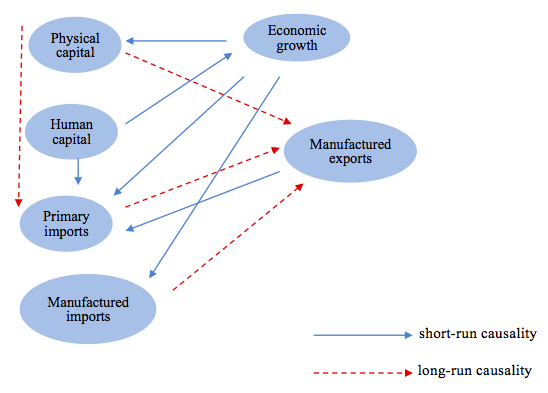

The variables are found to be integrated of order one, while the Johansen and DOLS analyses confirm that the variables are cointegrated. As for the short-run causality, the Granger test suggests that the hypothesis of non-causality from manufactured exports to economic growth cannot be rejected (p = 0.41). As for the imports-economic growth nexus, short-run causality runs from economic growth to primary imports (p = 0.03) and to manufactured imports (p = 0.02). At the same time, manufactured exports also cause primary imports (p = 0.05). In addition, all the variables in the model jointly cause economic growth (p = 0.02), primary imports (p = 0.00) and manufactured imports (p = 0.02).

The Toda and Yamamoto test suggests that, in the long run, the hypothesis of non-causality from manufactured exports to economic growth cannot be rejected (p = 0.20). In contrast, the hypotheses of non-causality from primary and manufactured imports to manufactured exports are rejected (p = 0.06 and p = 0.01 respectively). In addition, all the variables jointly cause manufactured exports and primary and manufactured imports (p = 0.03, p = 0.02 and p = 0.03 respectively) in the long run. Figure 2 summarises the short-run and long-run causal relationships among the variables in the model.

Figure 2: Short-run and long-run causal relationships

Source: Created by the authors for the purpose of this study.

This study provides evidence that all the variables in the model contribute to short-run economic growth, which, in turn, enhances import expansion. Moreover, the study finds that further increases in both primary and manufactured imports drive export diversification in the long run; however, export diversification does not cause long-run economic growth. These results suggest that further export diversification itself does not create cumulative bi-directional causation in the Kuwaiti economy. Achieving long-run economic growth through export diversification requires revisiting and revising export promotion policies and making parallel investments in physical and human capital.

This study is funded by the LSE Kuwait Academic Collaboration supported by KFAS.

This is part of a series on the possibilities and obstacles for economic growth, exports and diversification in the GCC states, based on contributions from participants in a closed LSE workshop in June 2021. Read the introduction here, and see other pieces below.

In this series:

- Exports, Diversification and Economic Growth by Kendall Livingston

- Economic Complexity and Exports: Kuwait in the Context of the GCC Region by Margarida Bandeira-Morais, Simona Iammarino and M. Adil Sait

- Growth in the Gulf: Four Ways Forward by Frederic Schneider

- The Role of Economic Complexity in Increasing Exports and Growth by Anis Khayati

- Beyond Oil: Have Manufactured Exports and Disaggregated Imports Contributed to Economic Growth in Kuwait? by Trevor Chamberlain and Athanasia Stylianou Kalaitzi

- The Nexus Between Export Diversification, Trade Openness and Economic Growth in the UAE by Saima Shadab

- Export-Led Growth in the UAE: Causality Between Non-Primary Exports and Economic Growth by Athanasia Kalaitzi, Samer Kherfi, Sahel Al-Rousan and Maria-Salini Katsaiti

- Reaching for the Stars: How and Why do the Gulf States Aim to Transform Their Economies to ‘Knowledge-Based Economies’? by Martin Hvidt