by S. Kalaitzi, S. Kherfi, S. Al-Rousan and S. M. Katsaiti

Non-primary exports include machinery and transport equipment. The registration plate of a Sharjah car destined for export. Source: woody1778a, Flickr

Export-Led Growth (ELG) is a strategy aimed at enhancing economic growth – in some cases, with great success. However, not all export categories contribute equally to economic growth, and for some countries, export expansion does not offer the desired positive outcomes. The literature shows that countries with abundant natural resources experience lower levels of economic growth than those with fewer resources. Specifically, primary exports tend to slow economic growth, as this category of exports is subject to excessive price fluctuations, creating economic uncertainty.

In the case of the UAE, merchandise exports are found to contribute positively to economic growth in the short run. However, there is evidence that primary exports do not cause economic growth, with fuel and mining exports slowing economic growth. Based on the above evidence and on the fact that oil prices depress incomes, emphasis must be placed on non-primary exports and their components.

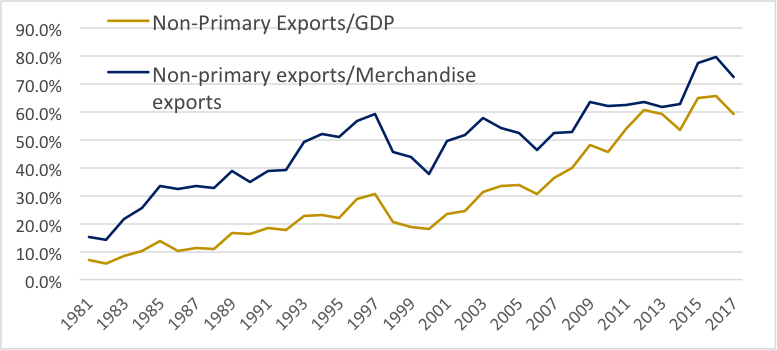

Between 1981 and 2017, the UAE enjoyed export diversification and significant economic growth. As can be seen from Figure 1, the share of non-primary exports among total merchandise exports has increased from 15.1% in 1981 to 72.4% in 2017, while the GDP share of non-primary exports has gradually increased from 6.9% in 1981 to 59.3% in 2017 (World Trade Organization; World Bank). At the same time, the gross domestic product (GDP) has increased at an average growth rate of 3.4%, which exceeds that of world GDP (2.9%). However, are non-primary exports the source of the UAE’s economic growth success?

Figure 1: Non-primary exports’ share of GDP and merchandise exports

Source: Authors’ calculations using data taken from the World Bank-Word Development Indicators and World Trade Organization

This study examines the validity of the ELG hypothesis in the UAE between 1981 and 2017 by shedding further light on the causal effects of non-primary exports on economic growth. The study uses an augmented neoclassical production function and annual time series obtained from the World Bank, the International Monetary Fund, and the World Trade Organization. The variables comprise GDP, gross fixed capital formation, working-age population, non-primary exports, and imports of goods and services. In particular, non-primary exports (based on Standard International Trade Classification, Revision 3) include chemical and related products, machinery and transport equipment, manufactured goods and miscellaneous articles, commodities and transactions (including non-monetary gold). All variables are expressed in real terms and in logarithmic form.

Before investigating the causal effect of non-primary exports on economic growth, the integration order of the variables is examined by applying the Augmented Dickey Fuller test (ADF), the Phillips-Perron test and the modified ADF test with a breakpoint. To establish the existence of a long-run relationship between the variables in the model, we apply the Johansen cointegration test, while the direction of the short-run causality is examined through the Granger causality test using a vector error correction model framework (VECM). In addition, the structural stability of the estimated ECM parameters is assessed by applying the cumulative sum (CUSUM), the CUSUM squares (CUSUMQ) and recursive coefficients tests. The long-run causality between the variables is examined using the Toda and Yamamoto Granger causality test.

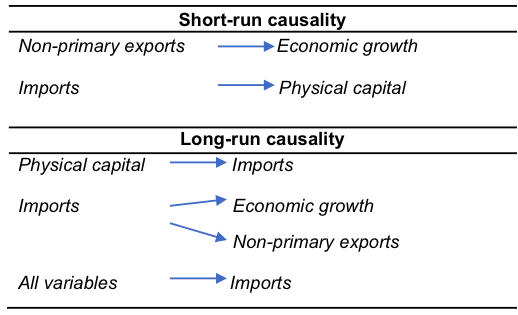

The unit root test results at the log level indicate that the variables are non-stationary (p > 0.05), while the first differenced variables are found to be stationary (p < 0.05). The Johansen cointegration test shows that the variables are cointegrated with two cointegrated vectors. Therefore, a VECM model is estimated and the diagnostic tests reveal that the model is well specified and stable. The short-run Granger causality test results provide evidence that causality runs from non-primary exports to economic growth, indicating that the ELG hypothesis is valid in the short run (p < 0.05). It should be noted that there is no evidence that economic growth causes non-primary exports, showing that bidirectional causality does not exist between non-primary exports and economic growth in the UAE.

With regard to long-run causality, the results do not provide evidence in support of ELG in the UAE, and, as in the short run, causality does not run from economic growth to non-primary exports. The analysis also finds that imports cause economic growth (p < 0.05), indicating that import expansion contributes to long-run economic growth. Moreover, all the variables in the model jointly cause imports (p < 0.01), while indirect causality runs from physical capital to non-primary exports through imports of goods and services (p < 0.10). If we combine the above results, indirect joint causality runs from all the variables to non-primary exports and economic growth through imports. Therefore, imports, together with physical and human capital, contribute to export diversification and long-run economic growth in the UAE. Figure 2 summarises the short-run and long-run causal relationships.

The next step is to focus on a deeper disaggregation of the non-primary export components in an effort to determine whether the relationships between disaggregated non-primary exports and economic growth mirror the relationships at the aggregate level. Doing so will also identify the non-primary export categories that are most likely to accelerate further economic growth in the UAE.

Figure 2: Short-run and long-run causal relationships

Source: Created by the authors for the purpose of this study.

This paper is funded by LSE Academic Collaboration with Arab Universities Programme supported by the Emirates Foundation.

This is part of a series on the possibilities and obstacles for economic growth, exports and diversification in the GCC states, based on contributions from participants in a closed LSE workshop in June 2021. Read the introduction here, and see other pieces below.

In this series:

- Exports, Diversification and Economic Growth by Kendall Livingston

- Economic Complexity and Exports: Kuwait in the Context of the GCC Region by Margarida Bandeira-Morais, Simona Iammarino and M. Adil Sait

- Growth in the Gulf: Four Ways Forward by Frederic Schneider

- The Role of Economic Complexity in Increasing Exports and Growth by Anis Khayati

- Beyond Oil: Have Manufactured Exports and Disaggregated Imports Contributed to Economic Growth in Kuwait? by Trevor Chamberlain and Athanasia Stylianou Kalaitzi

- The Nexus Between Export Diversification, Trade Openness and Economic Growth in the UAE by Saima Shadab

- Export-Led Growth in the UAE: Causality Between Non-Primary Exports and Economic Growth by Athanasia Kalaitzi, Samer Kherfi, Sahel Al-Rousan and Maria-Salini Katsaiti

- Reaching for the Stars: How and Why do the Gulf States Aim to Transform Their Economies to ‘Knowledge-Based Economies’? by Martin Hvidt