Some have argued that over-the-top applications are undermining the capacity of network operators to invest and are free riding. Brian Williamson of Plum Consulting discusses their latest findings, which show that growth of internet based over-the-top applications is a key driver of investment in ubiquitous higher speed higher capacity access networks, and far from free riding creates the demand conditions that will support investment in next generation networks and contribute to the achievement of European Digital Agenda goals for high speed broadband.

Some have argued that over-the-top applications are undermining the capacity of network operators to invest and are free riding. Brian Williamson of Plum Consulting discusses their latest findings, which show that growth of internet based over-the-top applications is a key driver of investment in ubiquitous higher speed higher capacity access networks, and far from free riding creates the demand conditions that will support investment in next generation networks and contribute to the achievement of European Digital Agenda goals for high speed broadband.

Has over-the-top disrupted telcos?

The open internet supports innovation, and innovation that expands the economy and opportunities for consumers and citizens is disruptive to established business models.

In Europe the telecoms sector has had a relatively high level of dependence on service revenues, as opposed to broadband access and data revenues. Mobile termination rates were high and some operators were particularly dependent on voice and text revenues.

The telecommunications sector was therefore vulnerable to innovation by internet based over-the-top application providers, who offer network independent applications.

Whilst over-the-top communications applications have existed for some time, the rapid adoption of smartphones, apps and improved broadband access have enabled communications applications including Skype, WhatsApp, Facebook and Google+ to reach a wider customer base and offer an array of communications services.

Competition from such applications has benefited consumers whilst disrupting the telecommunications sector’s reliance on legacy voice and text revenues. It has also improved the prospects for monetising investment in ubiquitous higher speed higher capacity broadband access.

For example, Verizon, which has invested in fibre to the home and will complete LTE rollout in 2013, views demand and traffic growth – including that driven by over-the-top applications – as an opportunity rather than a problem.

“…we saw that we had opportunity from a tiered structure and the proliferation of video through the LTE network that we would grow our revenue streams. And that is what we are seeing…” Verizon, 2012

The opportunity has also been recognised in Europe:[2] Over-the-top applications, by increasing demand for more ubiquitous, higher capacity higher speed networks, support rather than hinder achievement of Digital Agenda goals.

Is there too much traffic growth?

The implications of traffic growth for network costs and revenues differ between core and access networks, and fixed and mobile broadband access.

In relation to core networks that link data centres and continents, fibre optic capacity has grown according to Butters’ Law (that the cost of transmitting a bit over an optical network decreases by half every nine months). Capacity comes not only from laying new cables, but also by upgrading existing ones – with no end in sight to innovation.[3] Core network costs are a small part of overall end-to-end connectivity costs, and costs may fall as innovation outstrips declining data growth.

In relation to the last mile fixed networks, fibre upgrades may meet demand for higher speeds, but are not required to keep pace with traffic growth. Last mile networks – from the exchange or cabinet to the premise – are uncontended, i.e. there is one line per customer. A 10 Mbps connection, whether copper or fibre, can support around 3 TB per month per household – 100-fold more than existing demand.

The rationale for upgrading the fixed access last mile is to increase access speed, not to cope with traffic growth. Further, whilst traffic growth improves the revenue prospects for fibre, it does not increase fixed network last mile costs.

In relation to mobile access capacity is shared and additional capacity is required to meet traffic growth. However, substantially greater spectrum availability and the transition to more spectrally efficient LTE (4G) technology will not only increase capacity and speed, but also lower the cost of meeting traffic growth. Further gains, including a transition to heterogeneous networks incorporating small cells and greater Wi-Fi offload, are anticipated. The means to deliver a 1000-fold increase in mobile network capacity at reasonable cost appear within reach.[4]

In relation to mobile access capacity is shared and additional capacity is required to meet traffic growth. However, substantially greater spectrum availability and the transition to more spectrally efficient LTE (4G) technology will not only increase capacity and speed, but also lower the cost of meeting traffic growth. Further gains, including a transition to heterogeneous networks incorporating small cells and greater Wi-Fi offload, are anticipated. The means to deliver a 1000-fold increase in mobile network capacity at reasonable cost appear within reach.[4]

Is there a disconnect between traffic and revenue?

The debate over whether there is a disconnect between sources of revenue and sources of demand was brought into focus by proposals made in the context of the ITU’s World Conference on International Telecommunications for ‘sender pays’ in relation to internet traffic. A number of papers have argued that sender pays is neither practical nor necessary to support investment.[5]

The current model, whereby consumers and businesses pay for connectivity to their own premises, has worked well. A virtue of this payment model is that those causing demand, namely consumers requesting services such as a video stream, face the associated costs.

Content and application providers use efficient compression, content caching and invest in infrastructure since they pay for carriage and have an incentive to deliver a positive end  user experience. Further, over-the-top service providers offering rich content and applications also enhance demand for broadband access, thereby supporting telco investment.

user experience. Further, over-the-top service providers offering rich content and applications also enhance demand for broadband access, thereby supporting telco investment.

Is there evidence of harmful discrimination in Europe?

BEREC investigated existing practices and found that several fixed and mobile network operators apply restrictions including blocking or slowing down certain services affecting a significant number of subscribers in Europe.[6]

Existing practices go beyond legitimate traffic management and differentiation of service offers and involve harmful discrimination including blocking, degradation and anti-competitive discrimination; but also opportunistic behaviour (the so called “hold-up” problem) where the aim is to extract favourable terms and/or payments but not to discriminate against competitors per se.[7]

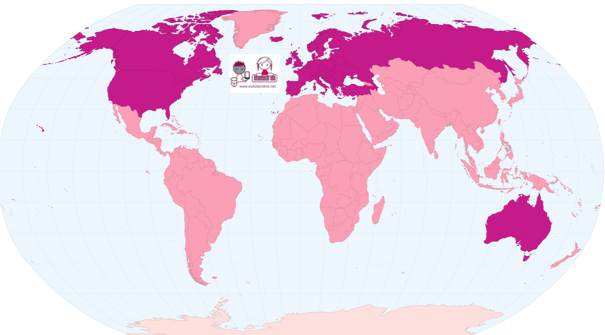

Such conduct harms consumers and businesses in Europe since it harms innovation in content and applications, thereby harming the overall internet ecosystem including networks. Harmful discrimination and opportunism also makes Europe a less attractive place to startup and stay in the rapidly growing global market for applications.[8]

What should be done?

Network investment and applications innovation both generate economic benefits. The aim should be to seek a win-win arrangement. Both network operators and applications providers and developers seek a predictable framework within which to innovate, invest and compete.

On the network access side the 12 July 2012 statement by the European Commission proposed copper price stability and pricing freedom for fibre, subject to non-discrimination (“equivalence”) in relation network access seekers. Pricing freedom is intended to support innovation and service-price differentiation. Whilst it is legitimate to differentiate on the basis of service characteristics such as latency, speed or capacity, discrimination by network operators in favour of traffic generated by their own services as opposed to traffic generated by an over-the-top provider is illegitimate.

The latter would include blocking, degradation and inclusion of over-the-top service data within data caps whilst excluding their own integrated services from such caps. Further, the threat of opportunistic behaviour by either over-the-top players or network operators would discourage specific investments which depend on access to end users or content and applications respectively.

Over-the-top players also seek freedom to innovate, invest and compete; the right to innovate without permission and freedom from harmful discrimination and opportunism.

Finding the right balance of policy is challenging. However, the following options – which aim to discourage or prevent anti-competitive discrimination and opportunism whilst ensuring that both network operators and over-the-top providers have the freedom to compete, innovate and invest – should be considered:

- Promotion of the principle that consumers should have access to lawful applications and content of their choice.

- Limiting use of the term “internet access” to those access providers who offer full and non-discriminatory access to lawful internet based applications.

- Extending the concept of equivalence to internet applications in addition to network access and requiring equal treatment for over-the-top and vertically integrated services.

Conclusion

Over-the-top applications, by increasing demand for more ubiquitous, higher capacity higher speed networks, support achievement of Digital Agenda goals. Experience of discrimination to date suggests policy action to support the freedom of over-the-top to innovate and compete is required and would benefit all in the value chain, including the telecommunications industry.

Note: This is an excerpt from Plum Consulting’s original document released in April 2013, which can be found here. The article gives the views of the author, and does not represent the position of the LSE Media Policy Project blog, nor of the London School of Economics.

[1] We acknowledge the financial support of the Computer & Communications Industry Association (CCIA) in preparation of this Plum Insight.

[2] FT-ETNO Conference October 2012. http://www.key4biz.eu/etnodigital/newsletter/video/carsten-schloter.html

[3] January 2013. “NEC and Corning achieve petabit optical transmission.” http://optics.org/news/4/1/29

[5] Michael Kende. September 2012. “Internet global growth: lessons for the future.” http://www.analysysmason.com/internet-global-growth-lessons-for-the-future

Plum. October 2011. “The open internet – a platform for growth.” http://www.plumconsulting.co.uk/pdfs/Plum_Oct11_The_open_internet_-_a_platform_for_growth.pdf

Robert Kenny. August 2011. “Are traffic charges needed to avert a coming capex catastrophe? http://www.commcham.com/storage/publications/TrafficChargesATKReview.pdf

WIK. May 2011. “Network Neutrality: Challenges and responses in the EU and in the U.S.” http://www.europarl.europa.eu/committees/en/studiesdownload.html?languageDocument=EN&file=36351

[6] BEREC. May 2012. “A view of traffic management and other practices resulting in restrictions to the open Internet in Europe.” http://ec.europa.eu/digital-agenda/sites/digital-agenda/files/Traffic%20Management%20Investigation%20BEREC_2.pdf

[7] The “hold up” problem can undermine incentives to invest, see Weiser. 2009. “The future of internet regulation.” http://lawreview.law.ucdavis.edu/issues/43/2/articles/43-2_Weiser.pdf