In the second part of their analysis of US policy responses to the economic recession, Ethan Ilzetzki and Jonathan Pinder examine the policy efforts aimed at reducing US public debt. They argue that proposals put forward by both presidential candidates are woefully short of specifics. Given the UK’s approach to tackling government debt, this analysis provides reasons for having a clear plan to avoid political deadlock regarding unsustainable debt-levels.

In the second part of their analysis of US policy responses to the economic recession, Ethan Ilzetzki and Jonathan Pinder examine the policy efforts aimed at reducing US public debt. They argue that proposals put forward by both presidential candidates are woefully short of specifics. Given the UK’s approach to tackling government debt, this analysis provides reasons for having a clear plan to avoid political deadlock regarding unsustainable debt-levels.

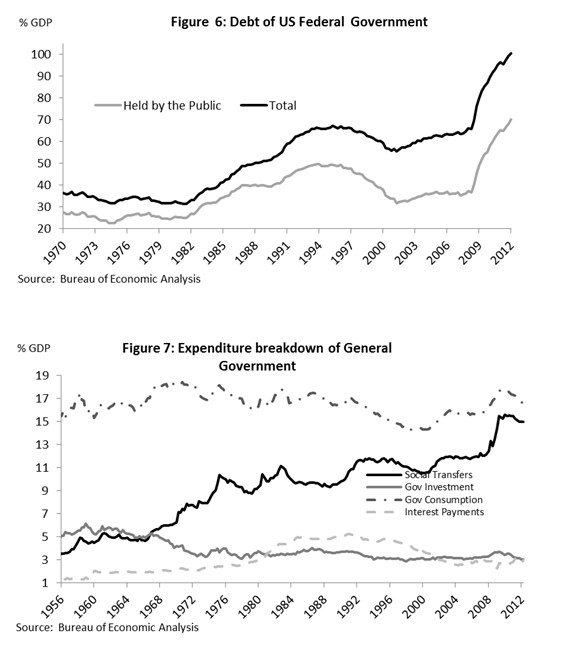

There is a cross-party consensus that US public debt levels are a serious problem, at least in the medium term. Debt levels rose significantly in the Great Recession (see Figure 6), but much of the increase can be explained by the automatic responses of public spending and taxes to the state of the business cycle.

The more worrying fact is that the long-run debt trend is clearly upwards. Public consumption as a share of income has not increased since the 1950s and public investment has actually declined (see Figure 7). The rise in spending is due to increases in public healthcare (Medicare and Medicaid) and social security (pensions), up from 3% of GDP in the 1950s to almost 12% today and projected to rise to 16% by 2037. Since tax revenues have not kept up with these spending trends, public debt has been marching upwards.

In December 2010, the bi-partisan Simpson-Bowles Commission released a majority report proposing a mixture of cuts in entitlement spending and tax reform, backloaded to avoid exacerbating the recession (see Table 1 for the details). Broadly, the commission recommended eliminating most tax deductions, increasing revenue by about $1.1 trillion.

Part of this higher revenue would be used to reduce tax rates and overall tax revenues would be targeted as less than 20% of GDP in the long run. The remainder would be allocated to debt reduction. Social security would be brought into balance through broadening payroll tax bases and increasing the retirement age. Simpson-Bowles recommended setting targets to contain Medicare’s growth beyond 2020 (unfortunately without much detail) and containing discretionary spending growth to half the rate of inflation.

Although the Commission’s proposals are broadly seen as the starting point for any serious reform, President Obama did not fully embrace it and Paul Ryan, a commission member and now Mitt Romney’s running mate, explicitly voted against it. The Simpson-Bowles commission did not obtain the super-majority required to bring forward legislation.

Political conflict peaked in the summer of 2011 over the ‘debt ceiling’. Congress not only approves tax and expenditure laws but also sets a limit to total government debt. As US federal debt approached this limit in July 2011, Congress was unable to reach an agreement on a change to the debt ceiling.

Republicans demanded that increases in the debt ceiling be linked to legislation on spending restraint. Democrats insisted that the debt ceiling be increased unconditionally or for the agreement to include tax increases (Woodward, 2012). With no ‘grand bargain’ on resolving longer-term debt problems, agreement was reached to raise the debt ceiling temporarily and to find a compromise on longer-term challenges over the coming year.

To give incentives to both sides to arrive at a long-term compromise, the legislation required automatic public spending cuts – the Budget Control Act – to be triggered in 2013 if no agreement is reached by then. The spending cuts were designed to target the essential priorities of both parties to force the two sides to an agreement.

With the presidential election approaching, no attempt has been made to find an alternative to the ‘sequester’ scheduled in the Budget Control Act. With no change in legislation following the November elections, the sequester will be triggered in January 2013.

In addition to the spending cuts in the Budget Control Act, the ‘Bush tax cuts’ of 2001 expire at the end of 2012.[1] The combination of these two factors is known as the ‘fiscal cliff’ (see Table 2), which will mean that taxes rise by about 2.7% of GDP and spending falls by almost 1%. This fiscal contraction of close to 3.7% in 2013 relative to current plans would almost certainly plunge the US into recession, even on the most optimistic estimates.[2] (Citibank forecasts a 1% decline in GDP and unemployment returning to 9% in this scenario.)[3]

To make things worse, the law does not address the root causes of the US debt problem – healthcare and pensions. If the economy falls over the fiscal cliff, it will cut only discretionary spending, which is not the main cause of the long-run debt problem.

The candidates’ fiscal policy proposals

No presidents can implement their budgets unmodified. The Republicans will almost certainly control the House of Representatives and the Democrats are expected to retain the Senate.[4] Whoever wins the presidential election is likely to face divided government.

Fiscal policy in the short run

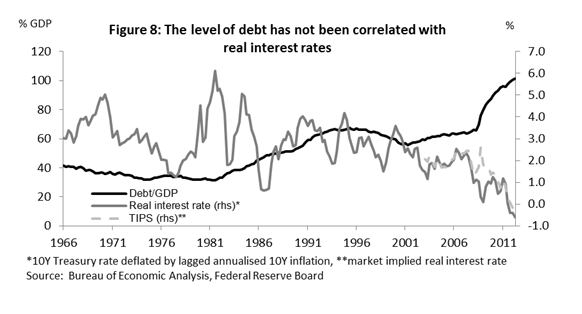

As discussed above, the aggressive monetary and fiscal action during the nadir of the Great Recession helped avoid a repeat of the 1930s. Furthermore, immediate action on the debt level is unwarranted as real interest rates on US Treasury Bills are at historic lows. There is no correlation between US debt levels and market interest rates and there are currently no serious market fears of US sovereign default (see Figure 8).

Governor Romney’s platform calls for an immediate 5% cut in non-defence discretionary spending and he was strongly against President Obama’s proposed second stimulus programme. The Republicans’ plan favours tax cuts that go beyond extending the Bush tax rates.

President Obama’s recent rhetoric has indicated that he too is currently more dedicated to contracting rather than expanding public expenditures, but Democrats are keener to have military expenditures share the burden of spending cuts. The President and Congressional Democrats have generally expressed support for extending the Bush tax cuts, except for higher-income households.

Both candidates have expressed a desire to avoid the fiscal cliff. Congressional leaders are already negotiating details of an agreement and it is probable that some agreement will be reached to postpone the sequester and prolong the 2001 tax cuts for most households before the January 2013 deadline. This would allow whoever is president some time to reach a broader bargain. But the enormous political uncertainty this engenders does the economy no favours.[5]

Fiscal policy in the long run: taxes

The Republicans’ plan would extend all of the Bush tax cuts indefinitely (at an annual cost of $450 billion), reduce marginal income taxes by an additional 20% (at an additional cost of $250-480 billion) and reduce corporate tax rates from 35% to 25%.[6] To finance these cuts, there would be an elimination of unspecified tax deductions. These estimates may overstate the budgetary cost of these tax cuts if lower tax rates stimulate economic growth.[7] Current evidence on the incentive effects of lower taxes on the rich do not give cause for such optimism, particularly as income inequality is already so high in the US.[8] Indeed, US growth was not spectacular in the period after the 2001 tax cuts were implemented.

But even allowing for generous growth effects of tax cuts and assuming elimination of deductions is feasible – a best case scenario – Governor Romney’s tax reform will contribute nothing to reducing the deficit but everything to financing tax cuts.

The most detailed information available on President Obama’s plans is in the 2013 budget proposal. His tax reform would eliminate tax breaks for ‘millionaires’ and reduce the tax rate applied to deductions to a maximum of 28% for households with incomes exceeding $250,000. President Obama also proposes making the Bush tax cuts permanent for households earning less than $250,000, but allowing them to expire for others.

Combined, these reforms are estimated to increase revenues by $150 billion a year, 1% of GDP.[9] These alone would be insufficient to close the budget gap in the long run and come on top of extending the Bush tax cuts for lower-earning households, costing $350 billion a year.

Fiscal policy in the long run: spending

Governor Romney and his running mate have proposed capping public spending at 20% of GDP and to do so through cuts in discretionary non-defence spending and through restraint in entitlement spending. The main driver of long-run debt increases is healthcare.[10] The ‘Ryan plan’ proposes that from 2023, seniors will be provided with vouchers to buy health insurance from private insurers or from Medicare itself. The value of the vouchers will be linked to a price determined through competitive bidding[11] with the aim of reducing Medicare costs through sharper competition among insurers.

But if healthcare cost inflation is due to increasing demand (Hall and Jones, 2007) or a rise in the underlying costs of healthcare provision, such competition may have little effect. As a backstop, Paul Ryan proposes capping Medicare spending at a growth rate 0.5% above the rate of GDP growth after 2023.

President Obama is committed to implementing his Affordable Care Act which combines expansion of coverage with controls over the growth of Medicare expenditure, through for example, lower reimbursement rates for hospital services. The Congressional Budget Office (CBO, 2011) estimates that the law will result in a net reduction in federal deficits of $118 billion from 2010 to 2019. Governor Romney is committed to repealing the Affordable Care Act.

There is little information on what either candidate would do on social security reform. Media reports suggest that the candidates allow the possibility of increasing the retirement age – an almost inevitable reform.

Conclusions

Given the enormity of the short- and long-run fiscal challenges facing the US, the lack of policy detail from both presidential candidates is disappointing. The initially aggressive action by policy-makers in the Great Recession was impressive, but political gridlock since then has hampered attempts to deal with the fiscal challenge. The Simpson-Bowles proposals should be the starting point in this debate with a clear need to specify more clearly how to raise tax revenues and contain healthcare and social security costs.

This is the second part of two of the Centre for Economic Performance’s (CEP) US election analysis on Recession and Recovery: The US Policy Debate on Taxes, Spending and Public Debt. All of the papers in the series can be accessed here.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Ethan Ilzetzki is Assistant Professor in the Department of Economics at the LSE.

Jonathan Pinder is a PhD student at the LSE.

For further information:

Contact: Ethan Ilzetzki (E.Ilzetzki@lse.ac.uk) or Romesh Vaitilingam (romesh@vaitilingam.com). The Centre for Economic Performance (CEP) is a non-profit, politically independent research institution funded by the UK’s Economic and Social Research Council (similar to the US NSF). CEP’s director is John Van Reenen (j.vanreenen@lse.ac.uk).

Table 1: The Simpson-Bowles Commission’s proposals

| Tax policy | |

| Income taxes | Eliminate most ‘income tax expenditures’, that is, all deductions from income taxes. Current income tax expenditures are estimated at $1.1 trillion annually. Use part of the savings to lower tax rates, limiting the top income tax rate to 29% and maintaining or increasing the progressivity of the tax code. |

| Payroll taxes | Increase social security taxes to cover 90% of income by 2050. |

| Corporate taxes | Lower the corporate tax to no higher than 29%. Eliminate all ‘tax expenditures’ for businesses. Move to a territorial tax system. |

| Revenues | Revenues to increase gradually, stabilising at just under 20% in the long run. |

| Expenditure policy | |

| Discretionary | Hold spending in 2012 equal to or lower than spending in 2011 and return spending to 2008 levels in real terms in 2013. Limit future spending growth to half the projected inflation rate through 2020. Require equal cuts from both security and non-security spending. |

| Medicare and social security | The commission only proposes small fixes to Medicare in the short run, while setting targets to contain the programme’s rate of growth after 2020. Increase the social security retirement age to 67 by 2027 and index the retirement age to average life expectancy thereafter. Index social security benefits to chain-indexed CPI. The plan is projected to close the social security shortfall over a 75-year horizon. |

| Deficit | |

| Reduce the deficit gradually to 2.3% by 2015, with most deficit reductions scheduled to coincide with economic recovery. Putting in place a credible plan to stabilise the debt over time, with debt (held by the public) stabilising at around 65% of GDP in 2020, after peaking at 72% in 2013. | |

Table 2: The ‘fiscal cliff’:

changes in tax and expenditures policy scheduled in current law

| Tax policy | |

| Revenues | Total revenue as a share of GDP projected to rise from 15.7% of GDP (2012) to 18.4% (2013) and 20.3% (2015). Personal income tax take to increase by 1.8% of GDP, social security taxes by 0.5% of GDP and corporate income taxes by 0.4% of GDP. |

| Income taxes | Scheduled to rise automatically from 2013, reversing the 2001 tax cuts. Tax rates to rise from 10-15%, 25%, 28%, 33% and 35% to 15%, 28%, 31%, 36%, 39.6%, respectively |

| Payroll taxes | Temporary payroll tax cut of 2 percentage points is set to lapse |

| Capital gains taxes | Scheduled to rise from 15% to a maximum rate of 20% for most taxpayers from 2013. |

| Expenditure policy | |

| Total | Total outlays projected to fall from 22.9% of GDP (2012) to 22.4% (2013) and 21.5% (2015). The Budget Control Act has defence and non-defence budgets falling by $55 billion each year from 2013 to 2022 (0.7% of GDP in 2013). |

| Defence | $55 billion of cuts, almost entirely discretionary spending, amounting to 10% of discretionary defence spending in 2013. These cuts are not restored in future years but, as the economy and the size of the defence budget grow, they fall to 8.5% of the planned discretionary defence budget in 2022. |

| Medicare, Medicaid and social security | Medicare is shielded from cuts: 90% of Medicare spending can only be cut by a maximum of 2%; a further 9% is exempt entirely. Medicare and social security are exempt from cuts. In January 2013, doctors’ payments under Medicare are due to fall by 27%. These cuts have been reversed by Congress each year since 2003 (the ‘doc fix’). Under current law, these cuts to payments would reduce expenditures by $10 billion. |

| Unemployment benefits | Extensions in emergency unemployment benefit are set to lapse. Total expenditure on unemployment benefit is set to fall by over a third from $94 billion to $60 billion in 2013, despite a baseline CBO scenario that has unemployment rising over the course of the next year. |

[1] The tax cuts were initially legislated to expire after ten years and have been subsequently extended.

[2] Current US GDP growth is approximately 1.5%. In a review of the literature on expenditure multipliers, Ramey (2011) gives a consensus view centred around unity. A $110bn cut in public spending would cut GDP growth by approximately 0.7%. Even under a more conservative estimate of 0.4 (Barro and Redlick, 2011), this figure would be approximately 0.3%. Romer and Romer (2010) estimate a tax multiplier exceeding 2. Using a far more conservative estimate of 0.5 would be enough to eliminate entirely the 1.5% GDP growth rate, given a tax increase of 2.7% of GDP.

[4] The Intrade betting market puts the probability of Democratic control over the Senate at 62% (10 October 2012).

[6] These are conservative estimates. Extending the Bush tax cuts would cost $4.5 trillion over ten years according to the CBO. The additional reduction in marginal rates would cost $250 billion per year, even if it only applied to those earning above $200,000. Cutting the corporate tax rate would cost $96 billion a year (see brookings.edu). We assume, as do most estimates that these latter costs will be fully covered by broadening the corporate tax base and eliminating tax loopholes, although no specifics have been provided about these plans. If Romney cuts taxes at this rate for all households, the cost would be higher, at $480 billion.

[7] The Tax Foundation estimates that the 60% of the revenues lost due to the Romney tax cuts would be recovered through higher growth.

[9] According to the CBO, capping deductions will save $50 billion a year and allowing the Bush tax cut to expire will save $100 billion a year.

[11] Formally, insurance companies and Medicare will post their insurance premia and the second-to-least expensive will determine the value of the vouchers. This is unless Medicare posts the lowest bid, in which case vouchers will be set to cover the costs of Medicare itself. Recipients will then be entitled to use their voucher to choose among the alternative plans, while paying or pocketing the difference in price.

Further reading

Daniel Aaronson, Jonathan Davis and Luojia Hu (2012) ‘Explaining the Decline in the U.S. Labor Force Participation Rate’, Chicago Fed Letter.

Alberto Alesina and Silvia Ardagna (2012) ‘The Design of Fiscal Adjustments’, NBER Working Papers No. 18423.

Alan Auerbach and Yuriy Gorodnichenko (2012a) ‘Fiscal Multipliers in Recession and Expansion’, in Fiscal Policy after the Financial Crisis, NBER.

Alan Auerbach and Yuriy Gorodnichenko (2012b) ‘Measuring the Output Responses to Fiscal Policy’, American Economic Journal: Economic Policy 4(2).

Nikita Bagaria, Dawn Holland and John Van Reenen (2012) ‘Fiscal Consolidation During a Depression’, National Institute Economic Review.

Robert Barro and Charles Redlick (2011) ‘Macroeconomic Effects from Government Purchases and Taxes’, Quarterly Journal of Economics 126(1): 51-102.

CBO (2011) ‘CBO’s Analysis of the Major Healthcare Legislation Enacted in March 2010’.

Lawrence Christiano, Martin Eichenbaum and Sergio Rebelo (2011) ‘When is the Government Spending Multiplier Large?’, Journal of Political Economy 119(1): 78-121.

Mary Daly, Bart Hobijn, Aysegul Sahin and Robert Valletta (2012) ‘A Search and Matching Approach to Labor Markets: Did the Natural Rate of Unemployment Rise?’, Journal of Economic Perspectives 26(3): 3-26.

Robert Hall and Charles Jones (2007) ‘The Value of Life and the Rise in Health Spending’, Quarterly Journal of Economics 122(1): 39-72.

Ethan Ilzetzki, Enrique Mendoza and Carlos Vegh (2012) ‘How Big (Small?) are Fiscal Multipliers?’, forthcoming in the Journal of Monetary Economics.

IMF (2010) World Economic Outlook, chapter 3: ‘Will it Hurt? Macroeconomic Effects of Fiscal Consolidation’ by Daniel Leigh, Pete Devries, Charles Freedman, Jaime Guajardo, Douglas Laxton and Andrea Pescatori.

Alan Krueger (2011) ‘Understanding Differences in Job Growth in Europe, Canada and the U.S.A: What Went Wrong in the U.S.A.?’, mimeo, Princeton.

Edward Lazear and James Spletzer (2012) ‘The United States Labor Market: Status Quo or A New Normal?’, NBER Working Papers No. 18386.

Thomas Piketty, Emmanuel Saez and Stefanie Stantcheva (2011) ‘Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities’, NBER Working Papers No. 17616.

Valerie Ramey (2011) ‘Identifying Government Spending Shocks: It’s All in the Timing’, Quarterly Journal of Economics 126(1): 1-50.

Christina Romer and David Romer (2010) ‘The Macroeconomic Effects of Tax Changes: Estimates based on a New Measure of Fiscal Shocks’, American Economic Review 100(3): 763-801.

Daniel Wilson (2011) ‘Fiscal Spending Multipliers: Evidence from the 2009 American Recovery and Reinvestment Act’, San Francisco Federal Working Paper No. 10-17.

Bob Woodward (2012) The Price of Politics, Simon and Schuster.