The latest GDP data for 2018 shows an annual growth of about 1.6%. This may be reflecting expectations of an impending Brexit deal which would greatly reduce policy uncertainty, write Costas Milas and Michael Ellington. But if this growth is indeed conditional on a deal, no deal will result in no dividend.

The latest GDP data for 2018 shows an annual growth of about 1.6%. This may be reflecting expectations of an impending Brexit deal which would greatly reduce policy uncertainty, write Costas Milas and Michael Ellington. But if this growth is indeed conditional on a deal, no deal will result in no dividend.

The Office for National Statistics (ONS) has just published its latest monthly GDP data. This dataset suggests that our economy expanded on a rolling basis by 0.7% in the three months to August 2018 compared with 0.7% in the three months to July 2018. According to the ONS, this is evidence that “the economy continued to rebound strongly after a weak spring”. Indeed, the economy recorded quarter-on-quarter growth of only 0.1% in the first quarter of 2018 and 0.4% in the second, and has only done better since.

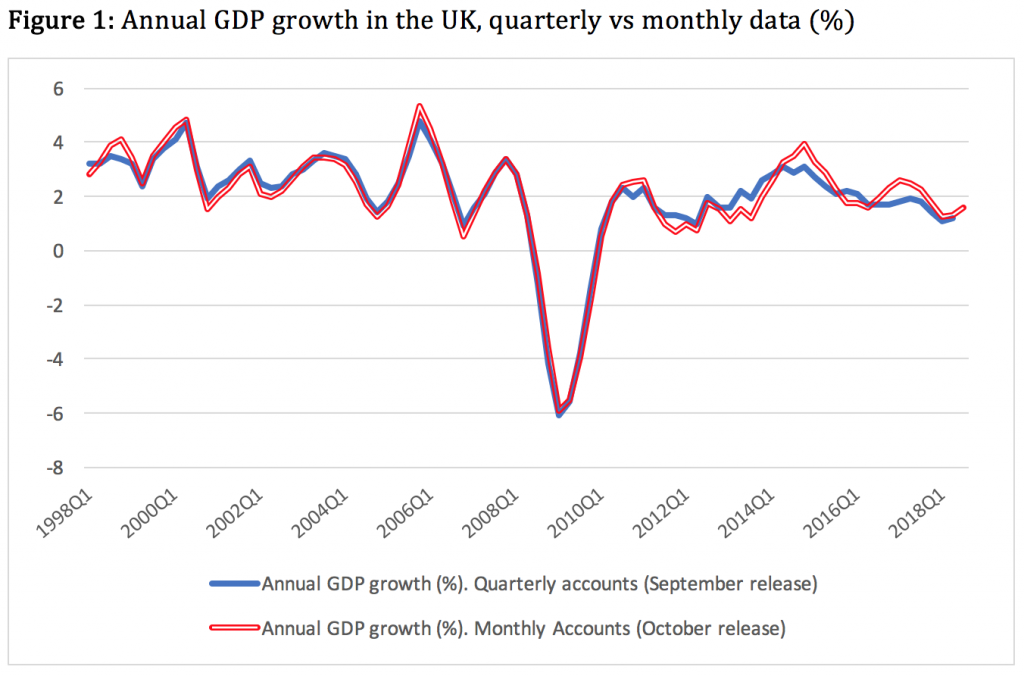

However the above data needs to be scrutinised more thoroughly, not least because the latest publication includes data revisions that appear to somewhat contradict the ONS’s own publication from two weeks earlier (in late September). To see this, we plot annual GDP growth (chained volume measure) based on quarterly data provided by the ONS on 28 September together with the annual GDP growth (gross value added measure) inferred from the monthly data provided by the ONS on 10 October.

Note: the data is available here and here.

Note: the data is available here and here.

We observe the following: the average growth rate for both series has been almost identical: 2% for the quarterly series and 2.01% for the monthly series. Nevertheless, there are important differences since the EU Referendum vote. In particular, the monthly GDP data indicate that the UK economy has over-performed by 0.5% per annum on average compared to the quarterly series.

This raises the issue of whether, at some stage, the quarterly data will be revised upwards to reflect this ‘additional performance’. From a political point of view, the monthly GDP series seems to offer support to those in the Brexit camp who believe that the impact of the referendum on the economy has not been as negative as Remainers seem to believe. The counter-argument, of course, is that (a) Brexit has not happened yet and (b) the better-than-previously-thought performance has to do with the cut in the policy rate from 0.5% to 0.25% and the additional Quantitative Easing authorised by the Bank of England. Notice, also, from Figure 1, that the latest ONS data indicate an annual growth rate of 1.6% in the third quarter of 2018, which is higher than the 1.46% forecast provided by the Bank of England’s policymakers in their latest Inflation Report.

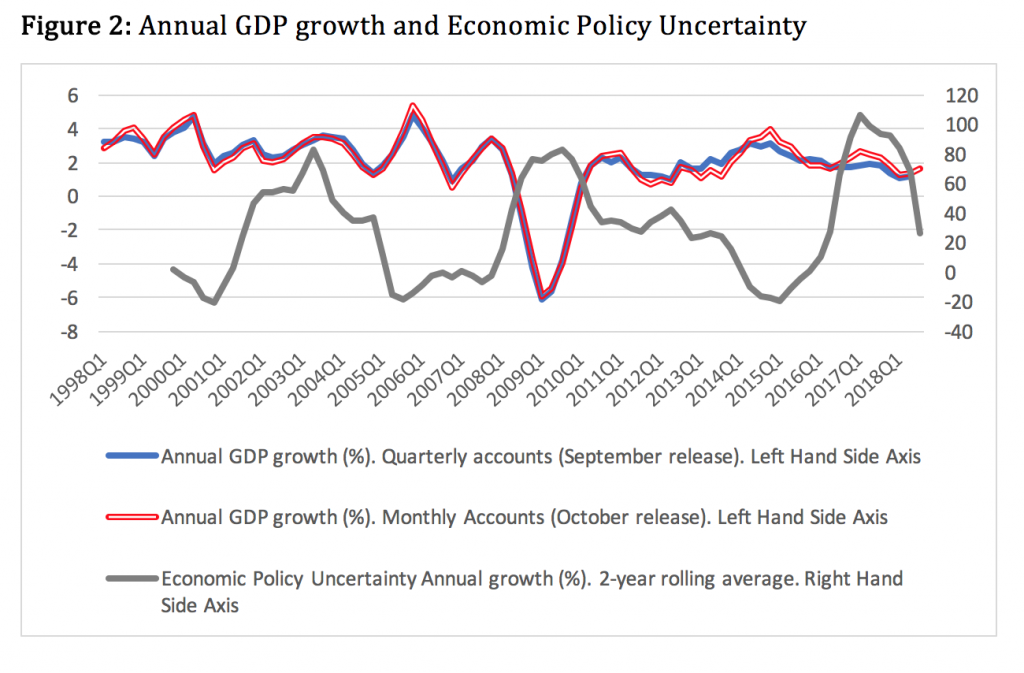

We interpret this positive performance as an indication of a forthcoming deal dividend effect. Annual GDP growth has been negatively affected by Brexit-related policy uncertainty (the latter constructed based on newspaper articles regarding policy uncertainty from The Times and The Financial Times). From Figure 2, policy uncertainty, which increased rapidly in the run up to the 2016 Referendum, recorded a notable decline only after early 2017 when Theresa May triggered Article 50. Doing so ‘forced’ government to start negotiating with the EU in a constructive manner. This helped GDP growth somewhat stabilise.

Assuming we see a Brexit agreement in the next few weeks, policy uncertainty will fall; and consequently GDP growth should bounce back. The annual growth of 1.6% in the third quarter of 2018 could reflect expectations of the so-called ‘deal-dividend’ effect (assuming, of course, today’s market vertigo recedes). If these expectations are not fulfilled, we may well end up with a ‘no-deal, no-dividend’ collapse.

Assuming we see a Brexit agreement in the next few weeks, policy uncertainty will fall; and consequently GDP growth should bounce back. The annual growth of 1.6% in the third quarter of 2018 could reflect expectations of the so-called ‘deal-dividend’ effect (assuming, of course, today’s market vertigo recedes). If these expectations are not fulfilled, we may well end up with a ‘no-deal, no-dividend’ collapse.

______________

About the Authors

Costas Milas is Professor of Finance, University of Liverpool.

Costas Milas is Professor of Finance, University of Liverpool.

Michael Ellington is Lecturer in Finance, University of Liverpool.

Michael Ellington is Lecturer in Finance, University of Liverpool.

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science. Featured image credit: Pixabay (Public Domain).

1 Comments