Growth is key to the government’s plans for the recovery. Tony Dolphin, Senior Economist at the Institute for Public Policy Research looks at this year’s budget and finds that while it may promote growth now, a broader strategy may be needed in the long term.

Growth is key to the government’s plans for the recovery. Tony Dolphin, Senior Economist at the Institute for Public Policy Research looks at this year’s budget and finds that while it may promote growth now, a broader strategy may be needed in the long term.

Once the Office for National Statistics said that the economy shrank by 0.5 per cent in the final quarter of 2010 (an estimate that was subsequently revised to 0.6 per cent), it was clear that George Osborne would have to produce a ‘Budget for Growth’ today.

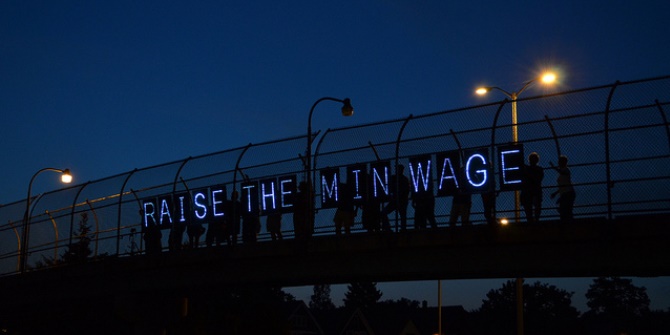

However, it was also clear that there was little he could do by way of tax cuts or public spending increases to boost aggregate spending in the economy. The aggressive deficit reduction plan that he set out last June, and his stubborn refusal to consider any deviation from that plan – never mind a full-blown ‘Plan B’ – meant that he had painted himself into a corner.

In the absence of any scope to boost demand in the economy, a Chancellor wishing to present a ‘Budget for Growth’ needed to come up with a comprehensive assessment of the right ‘supply-side’ policies for the UK – policies that would boost the economy’s long-term potential growth rate.

On this score, the Chancellor failed. His basic approach – cut government spending, cut corporate tax rates, cut regulation and re-introduce enterprise zones – harks back to the 1980s. There is little evidence to suggest these measures led to an increase in sustained jobs growth in the private sector then, and there is no reason to believe they will fare any better now.

The measures announced today were, in style, reminiscent of Gordon Brown, sounding more like a shopping list of ideas producing by a trawl through the Treasury than a coherent plan for the economy’s future. Lots of small ideas – though many of them, such as the extra £100 million for the science budget, are welcome – that do not amount to an adequate response to the big problems facing the economy.

Cutting the deficit involves tough political choices – increasing VAT, slashing the budgets of local councils etc. – but mechanically it is relatively easy: ask the OBR for an estimate of how much needs to be cut, ask Treasury officials how much money various tax increases would raise or spending cuts save, and choose enough to add up to the OBR’s number.

Promoting long-term growth in the economy is a lot harder. It involves finding the right combination of free markets and private enterprise with supportive state institutions. What the country needs now is a modern industrial strategy centred on innovation, state-led investment in infrastructure which will generate income further down the line, support from the banking sector for small and medium-sized businesses and new ways of thinking about skills.

Nothing the Chancellor said today suggests that he recognises the need for such a broad-based approach. Instead, he hopes to take a short-cut to private sector growth, a move that is likely to end in disappointment.