Our high corporation tax is punishing successful, revenue generating companies. Tim Knox argues that the Coalition government should cut the tax immediately so businesses and the country at large can reap the benefits of restored growth, innovation and a simplified tax regime.

Our high corporation tax is punishing successful, revenue generating companies. Tim Knox argues that the Coalition government should cut the tax immediately so businesses and the country at large can reap the benefits of restored growth, innovation and a simplified tax regime.

We have heard rather a lot recently about how we must not tolerate “high rewards for failure”. There runs a logical corollary to this particular line: we should be equally enthusiastic about not imposing high penalties on success.

But penalising success is what our tax system often does. Consider the Corporation Tax. This is a tax paid by businesses on the amount of profit they make. If you make no profit, you pay no Corporation Tax. And (at least in theory), if you make lots of profits, you pay lots of Corporation Tax (readers of Private Eye will know that there are some multinationals corporations that are able to manage their affairs in a perfectly legal way so as to minimise the tax they pay. That is an important subject in its own right but one which is not directly relevant to the arguments made here).

So in principle, Corporation Tax is effectively a tax that is only paid by successful businesses. It is a tax that is paid by the people who will be the source of future economic growth: the owners of a flourishing start-up, the brilliant innovators and successful entrepreneurs. A corporation tax is also money taken by the state from these sorts of highly productive enterprises, money that could otherwise have been reinvested in new ventures.

The state is penalising the only organisations which can get us out of the hole that we are in. For growth will only come from business: the state and the consumer are both far too indebted. That is why, as leading tax expert David Martin argues in his recent Centre for Policy Studies paper that Osborne should announce an immediate cut in the main rate of Corporation Tax from its current level of 26% to 20% in his March Budget. At the same time, he could also announce his intention to reduce it even further – to 15% or even 10% once the appropriate anti-avoidance measures are in place.

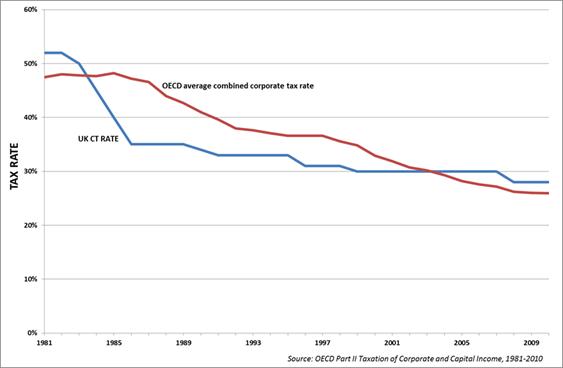

Such a move would have numerous benefits. For one, it would boost business confidence, encourage new investment by businesses (as it would improve net returns) and would send a strong signal that the Coalition is taking the supply-side measures necessary to restore growth. It would also immediately fulfil the Coalition pledge to “create the most competitive corporate tax regime in the G20”. As the chart below shows, until 2005, UK rates of Corporation Tax were lower than the OECD average. Since then—despite the Coalition’s efforts so far, we have fallen behind.

A cut to the corporation tax would also present an opportunity for a major simplification of the tax system. If the tax base was defined simply as business profits, then we could sweep away the separate rules and calculations for different sources of income, for capital gains, and for capital allowances. We could also then abolish all the complex rules for aggregating the results of these calculations, and also for how profits and losses can be offset.

Furthermore, a reduction of the tax could also enhance the impact of any further Quantitative Easing – or possibly reduce the need for more QE. The use of QE by both the Bank of England and the Fed tends to result in higher equity prices thereby enhancing consumer confidence through the “wealth effect”, a consequence that has been welcomed by both central banks. A reduction in Corporation Tax should achieve precisely the same wealth effect and moreover that effect might well be leveraged by resulting in an upward re-rating of P/E multiples caused by greater investor confidence in a regime of lower Corporate Tax rates.

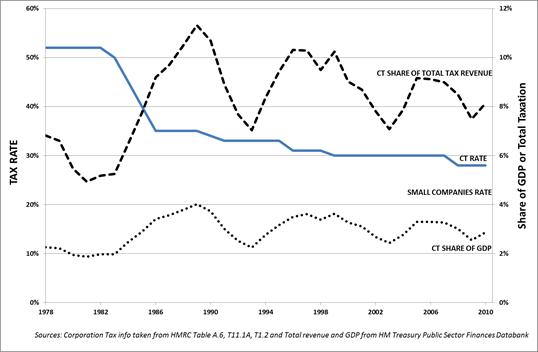

All very well, some will say. But how on earth can we afford to do this at a time when the Government has such a huge deficit? A quick look at the graph below should reassure everyone that cutting the rate of Corporation Tax does not necessarily lead to a fall in the revenue it generates for the Treasury. Indeed, the main rate of Corporation Tax has fallen from 52% in 1982 to 26% today. This halving of the rate of Corporation Tax has been accompanied by an increase in the revenue it has generated for the Treasury: in 1982-83, it yielded revenues equivalent to 2.0% of GDP. In this financial year, the Treasury expects Corporation Tax to yield 2.8% of GDP (or £43.2 billion).

However, given the weak state of the public finances, the static costs of a cut to 20% should be noted, not least to reassure the financial markets that the Coalition remains committed to its deficit reduction plan. Depending on the approach used, this might involve a loss of revenue to the Treasury of between £4 billion (according to the Treasury ready reckoner) and £8.5 billion (on a straight line basis). Those who insist on a static approach should also remember that cutting Corporation Tax rates at a time of relatively low corporate profitability (as is currently the case) is going to be cheaper than in times of high growth. Finally, if it were thought absolutely necessary to fund this tax cut, this theoretical fall in revenue could easily be matched by the abolition of higher rate tax relief on pensions.

The recent spate of “banker-bashing” will hopefully have dissipated by the time of that George Osborne announces his Budget on 21 March and that the Coalition will feel confident and bold enough to make this substantial reform. The potential benefits – economic and political – are huge; the downside is limited. So the right question is not: can we afford to do this? Rather, can we afford not to cut Corporation Tax to 20%?

Tim Knox is the Director of the Centre for Policy Studies.

Nice piece of analysis.

Just as some background information/reading on the current corporation tax policies, I would recommend reading:

http://goringeaccountants.co.uk/corporation-tax/

The author makes some good points, but not so much concerning the urgent necessity for lower corporate tax rates I think. I concur with Matthew in the comments, the same phenomenon has been happening in Canada over the last few years. Simon’s point about the disproportionate effect on smaller companies is also valid.

A lower tax on profits will not, by itself, spur private investment or raise wages. There are many other factors at play. Bottom line though, a balance must be struck that will see companies adequately pay back to the society which allowed them to succeed in the first place. Rates are always worth discussing and adjusting, but lowering for the sake of lowering is short-sighted.

This is a very interesting point – but surely the high level of corporate surpluses could be another reason to cut corporate tax rates? Some companies may be sitting on piles of cash, waiting for investment opportunities and the return of market confidence. A lower corporate tax rate would automatically increase the post profit rate of return; and may also increase confidence. Only the private sector can get us out of the economic mess we are in – both the state and consumers are too indebted. This cut in rates could be the most effective way of unleashing private sector investment, to the benefit of all.

This contrasts rather glaringly with today’s article by Martin Wolf in FT. One of the critical problems in the UK is the size of the corporate surplus – in other words businesses are making plenty of profit and not investing. In macroeconomic terms we need less profit, not more. We need companies to be spending money, not hoarding it. Which makes a cut in corporate taxes a step in the wrong direction.

Also worth noting the microeconomic point that a tax on profits (as opposed to inputs or outputs) is very efficient, with fewer distorting effects than other taxes. It adds up to a tax on capital – but at a time when capital is having it relatively easy.

The ‘assertions’ are summarised conclusions from the TUC report that contains the data. Feel free to peruse at your leisure.

And what happens when you run a pro-business/light-touch regulation regime like the UK over the last 30 years? This is not the time for neo-liberals to get all morally superior.

The TUC report is full of selective data and charts. Some basic facts on corporation tax:

1. Those countries with low rates grow faster

2. The UK has halved its main rate and revenue has gone up

“those countries with low rates grow faster”

Do you mean countries such as Ireland?

or the USA? Some of the lowest corporation tax in the world, but even the moderate recent growth has been more a result of direct public spending.

Plus, I thought the TUC looked out for workers?

Read this report – there’s 75% pass-through from corporate taxes to lower wages: http://www.sbs.ox.ac.uk/centres/tax/Documents/working_papers/WP0917.pdf

A few reasons why this may be both unpopular and unwise:

“- There is no current competitive pressure to undertake these tax reforms;

– The consequence of those reforms will be declining corporation tax yields at a time when increased revenues are needed to reduce the deficit;

– Large companies will see a disproportionate decline in their tax charges when compared to small companies, creating an unfair competitive advantage for large companies. This will hinder internal tax competitiveness in the UK;

– There is a significant prospect of there being outflows of profit from the UK as a result of proposed changes in the UK corporate tax base;

– There will be some disadvantages for developing countries as a result of the proposed changes in the UK’s corporate tax base that will harm their prospects of collecting the taxes legitimately due to them.

– There is little prospect of significant growth resulting from these changes in corporation tax;

– Consequently these tax cuts represent a poor use of government resources at a time when these are exceptionally scarce.”

Source: http://www.taxresearch.org.uk/Blog/2011/05/28/corporation-tax-cuts-do-not-stimulate-growth/

Please see this TUC report for data and a further discussion: http://www.tuc.org.uk/economy/tuc-19619-f0.cfm

Most of these points are assertions with no evidence to back them up. Richard Murphy and the TUC think there’s something morally wrong with profit – ask Greece what happens when you have you get governments full of Big Government, anti-business views like theirs.

All good points well made. It’s also worth noting that literature on tax and economic growth suggests cutting corporate taxes have larger effects than any other tax type. It’s a relatively inexpensive no-brainer and has been shown to lead to high levels of FDI.

I don’t see why a cut in corporation tax would be unpopular? Surely anyone can see that in a time of high unemployment and negative growth (or close too) then doing everything to make businesses (of any size) succeed has to be a ‘no brainer’.

I can’t fathom why anyone would be against it.