Max Nathan and colleagues have recently published a new research report on the digital economy. Using some innovative ‘big data’ provided by Growth Intel, they found that there are over 40 per cent more digital companies than official estimates suggest and that hotspots of digital activity exist across the country and not just in London, including some perhaps surprising places like Aberdeen, Middlesbrough and Blackpool. They suggest policymakers gather better data which should lead to better industrial policy.

Max Nathan and colleagues have recently published a new research report on the digital economy. Using some innovative ‘big data’ provided by Growth Intel, they found that there are over 40 per cent more digital companies than official estimates suggest and that hotspots of digital activity exist across the country and not just in London, including some perhaps surprising places like Aberdeen, Middlesbrough and Blackpool. They suggest policymakers gather better data which should lead to better industrial policy.

I’ve just published some new analysis of the UK’s digital economy, joint with Anna Rosso and Growth Intelligence, and funded by Google. We had a launch session yesterday with Vince Cable (see here for a good write-up by the Guardian). We’ve also done pretty well for media so far: see coverage from the BBC, FT [£], Sky,Telegraph, Independent, Scotsman andGuardian (again) among others, and a nice blog post from Google’s Hal Varian. This is the first phase of a research programme with roots in the resurgence of industrial policy around the world. Like many others, the UK government wants to promote ICT and digital content activities – in the global North at least, this is generally high value activity, with spillover effects to the rest of economy.

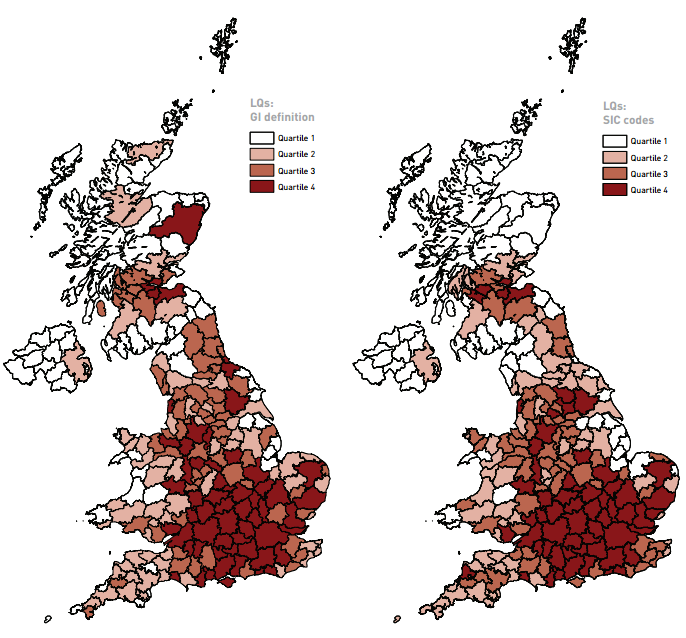

A big problem is that we have little idea of the true size and nature of these digital companies. That’s because official definitions use SIC codes, which don’t work well for companies doing innovative, high-tech stuff. To try and fix this, we use big data provided by Growth Intelligence. GI pull in data from the web, social media, news feeds, patents and a range of other sources, and layer this on top of public data from Companies House. That gives a much richer picture of who’s out there, their characteristics and their performance.

Crucially, GI’s data buys us a lot more precision than SIC-based analysis. We can look at industries and at products, services, clients and distribution platforms. For increasingly tech-powered sectors like architecture, that allows us to distinguish ‘digital’ companies producing (say) CAD specialist software from ‘non-digital’ ones making buildings.

Overall, we find over 40 per cent more digital companies than official estimates suggest. We also find that digital companies who report revenue or employment are pretty resilient, with faster revenue growth and higher average employment than non-digital companies. And contrary to the popular sense that it’s all about London start-ups, we find hotspots of digital activity across the country, including some perhaps surprising places like Aberdeen, Middlesbrough and Blackpool.

Okay, this is all fascinating stuff for researchers. But what should government do differently? First, the big data field is still in its early days, and we’d encourage officials to explore how it can complement conventional statistics. Second, better data should lead to better-designed industrial policies. Finding the optimal policy mix, however, is a separate and much harder question to answer.

BIS’ information economy strategy is rightly cautious about hands-on intervention. This NBER paper by Aaron Chatterji, Ed Glaeser and Bill Kerr is a good overview of the wider evidence. Henry Overman and I will be publishing a piece in the Oxford Review of Economic Policy soon too, which puts the case for a more agglomeration-focused approach. We’ll also be continuing the data analysis, thanks to further support from NESTA. Look out for further mapping and econometric work in the months ahead.

This article was originally published on Max Nathan’s blog, SquaredGlasses.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Dr Max Nathan is a Research Fellow at LSE Cities and at the Spatial Economics Research Centre (SERC), where he works on urban economics and economic development issues. He completed an economic geography and spatial economics PhD in LSE’s Geography Department in Autumn 2011. He blogs on urban policy at http://squareglasses.wordpress.com. He also enjoys photography: his pictures have variously appeared in The Wire magazine, Londonist, Der Spiegel and Getty Images.