The UK business and security communities should be brought together to hammer out the details of the Hinkley Point nuclear power project, writes John Hemmings.

The UK business and security communities should be brought together to hammer out the details of the Hinkley Point nuclear power project, writes John Hemmings.

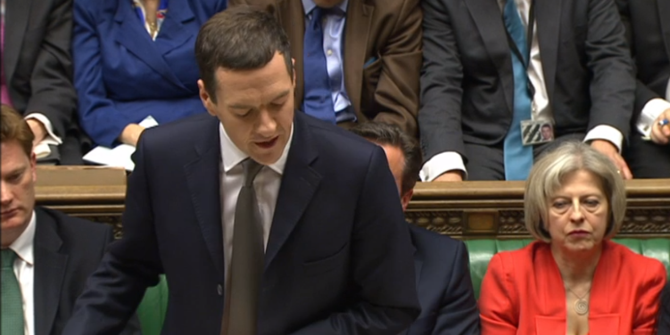

One of the first decisions taken by Theresa May as prime minister was to delay deciding on the £18 billion Hinkley Point nuclear power project. Because it was a centrepiece project as part of former Chancellor George Osborne’s “Golden Age” of closer bilateral ties with China, the issue was instantly politicised, provoking an intense debate in Parliament and across government departments. Defenders of the deal included the Chinese embassy and foreign ministry, which came out publicly to apply pressure on May over the issue.

Meanwhile, those close to the Prime Minister pointed out the security risks to Britain’s critical national infrastructure and national security. In the end, a face-saving compromise was reached: the Sino-French consortium would go ahead with the deal with Her Majesty’s Government keeping a majority stake in the company to calm nerves within the security agencies.

The fact that it was a Chinese company which provoked the issue was not incidental: Chinese companies – private and state-owned – have become increasingly active in investing and acquiring businesses and assets in economies across the developed world, particularly in the US (no.1), Australia (no.3), and the UK (no.1 in Europe). In 2014, the FT noted that China’s outbound investment had exceeded its domestic investment and the country was on its way to becoming the world’s largest cross-border investor. As the Hinkley Point debate was flaring up here in London, Australian Treasury Minister Scott Morrison announced that two separate Chinese bids to lease Australia’s largest electricity grid would be blocked for “national security” reasons. It is obvious that May is not alone in her concerns.

To some, China’s focus on infrastructure has a nefarious side: after all, national defence and intelligence agencies depend on critical national infrastructure to do their job. To others, China’s focus on critical national infrastructure is the result of its own domestic economy, which is heavily weighted in favor of big, capital-intensive infrastructure projects. Whatever the case, it is certain that many more private and state-owned Chinese investors will seek to purchase stakes in British companies and infrastructure. Some of these – like stakes in the UK’s hotel industry are clearly benign. Others – like the bid for Global Switch, Britain’s largest data centre, may have repercussions for national security, in the wake of the UK Ministry of Defence’s move to cloud computing. It may also have privacy concerns as a recent NATO report suggests that China is behind many hacks in the West and is said, by Stratfor, to have the largest domestic mass surveillance apparatus of any country.

Regardless of the answer, the need is clear in the UK for a more formal process than has taken place up until now. Australia and the United States – two of the largest recipients of Chinese investment – have long had treasury-linked agencies to deal with the foreign investment and security: the Committee for Foreign Investment in the United States and the Foreign Investment Review Bureau.

Naturally, their approach may or may not be a right fit for the UK, which has a strong culture of unregulated investment, but it would benefit both Government and business to initiate some sort of discussion on what is currently a very grey area. Such a review process would calm nerves on both sides – including those of Chinese investors who may have been riled by Hinkley Point. Clearly, Britain wants Chinese investment and even welcomes it within certain parts of the national infrastructure, but not all of its parts. What is most needed, according to Malcolm Rifkind – former Chairman of the Intelligence and Security Committee – is oversight, “This project went from consideration to contract, without ministers even hearing about it. There must be some sort of accountability with deals of this nature.” Under Rifkind, the ISC produced a strongly critical report in 2013 on the BT-Huawei deal in which BT was supplied components by a company said to have links with the Chinese military.

Credit: Rick Crowley, under a CC BY-SA 2.0 licence

Credit: Rick Crowley, under a CC BY-SA 2.0 licence

Prime minister May could best start this conversation in the Cabinet Office and bring members of the security community and business community together in order to hammer out the powers and processes of such a review body. One idea is to make it a committee or subcommittee within the cabinet office, with its own staff. The committee might be composed of business leaders or senior bureaucrats from within relevant ministries, Trade, Treasury, Ministry of Defence and the Home Office. Staffers could be seconded from among these same ministries. Certainly, the Treasury would have to have a large stake in any organization to give it traction, perhaps as Chair. Then there is the question of what it would do: in short, it would create guidelines for firms which operate inside Britain’s critical national infrastructure. It would also investigate adding new areas – particularly those in newly-developing technologies and computing – to areas of sensitivity. Whether it would be given teeth, or simply remain an advisory body – depends very much on whether May can rally her cabinet around the idea to pass legislation in Parliament. Either way, the committee could bring clarity to a gray area.

Creating such a committee makes sense for the UK at the moment. The number of Chinese investments into British infrastructure are only set to rise, and the UK is reconfiguring its EU-dated regulations. While the watchword of the day for many concerned British companies will be “continuity”, this process of rewriting the UK’s legal framework does provide Prime Minister May an opportunity to create a formal review process. Furthermore, a process might remind the UK of the need for investor diversity.

Winnie King, Professor of Chinese International Political Economy at Bristol University states, “The UK needs to frame its approach in terms of Brexit: “Now that we have left the bed of European supra-national governance, we shouldn’t just jump into bed with another big actor. We need to diversify.”

A recent report by the Oxford Review of Economic Policy has challenged some of the myths around Chinese infrastructure projects. The UK has had the fastest growing economy in the Group of Seven for the past four years. It deals in high value, not high volume goods, and its manufacturing includes luxury smart high-tech firms like McLaren, Deep Mind, and others. Britain has remained competitive and in the top 10 global economies by remaining open to foreign investment: a review process will not change that. But it will make future investment more open-eyed and transparent.

_______

Note: the above was originally posted on LSE Business Review.

About the Author

John Hemmings is pursuing his doctorate at the LSE in international relations and is an adjunct fellow at CSIS, a think tank in Washington DC. He writes with a focus on the Asia Pacific and at times, on trans-Atlantic issues. Previously, he worked at RUSI, the security and defence think tank in Whitehall.

John Hemmings is pursuing his doctorate at the LSE in international relations and is an adjunct fellow at CSIS, a think tank in Washington DC. He writes with a focus on the Asia Pacific and at times, on trans-Atlantic issues. Previously, he worked at RUSI, the security and defence think tank in Whitehall.

Presumably we know about the security risks because our security are already monitoring the Chinese?