In our final pre-election post Zack Cooper analyses the debate surrounding health care in the United States. Health care ranks as one of the most important issues for voters in this years presidential election, and Cooper looks closely at the proposals both candidates have put forward.

In our final pre-election post Zack Cooper analyses the debate surrounding health care in the United States. Health care ranks as one of the most important issues for voters in this years presidential election, and Cooper looks closely at the proposals both candidates have put forward.

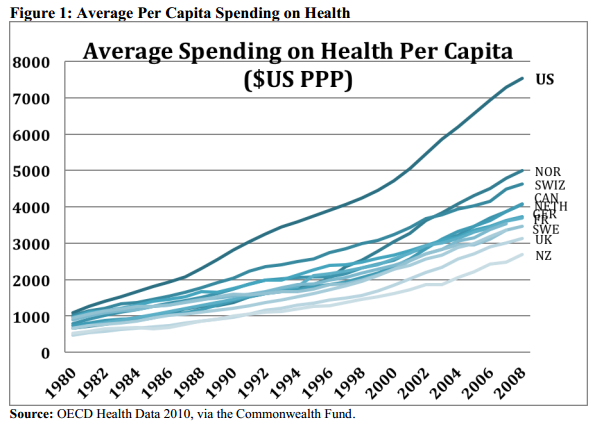

Healthcare reform sharply divides US voters. But what cannot be disputed is that the US spends more on healthcare than any other country without getting uniformly better health outcomes. Despite spending a quarter more per capita on healthcare than the next highest spending country, 47.9 million Americans did not have health insurance in 2011 and US life expectancy was ranked 38th in the world.

Escalating healthcare spending is also a drag on the economy. High healthcare costs have helped to crowd out more productive spending, for example, on education; they have also depressed wage growth below productivity growth (Baicker and Chandra, 2005; Herring et al, 2011; Pessoa and Van Reenen, 2012).

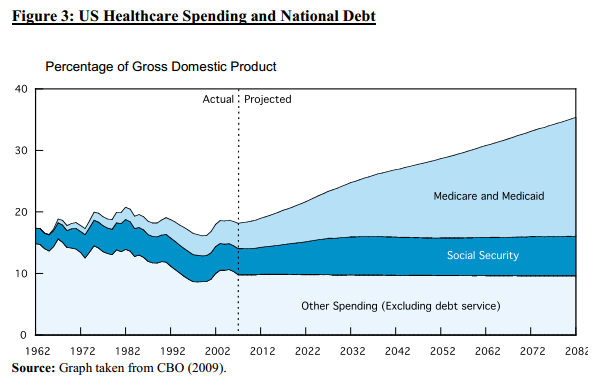

Even after including savings from the Affordable Care Act (ACA or ‘Obamacare’), the nonpartisan Congressional Budget Office (CBO) estimates that healthcare spending will grow from 25% of the federal budget today to 40% of the federal budget in 2037 (CBO, 2012a). Federal spending on Medicare (for the old) and Medicaid (for the poor) will increase from 5% to 10% of GDP.

Unfortunately, the healthcare commitments made to future generations exceed the revenue that is expected to be generated by taxation, leaving $37 trillion in healthcare liabilities. To put that $37 trillion in context, paying off the unfunded liabilities would require increasing federal income taxes across the board by 60% or raising the top marginal tax rate to 92% (GAO, 2010).

In 2010, President Obama passed the ACA. Since then, the federal government has begun implementing the legislation although most provisions come online in 2014. The ACA dramatically expands and regulates insurance coverage; it introduces changes to how the federal government pays for healthcare; and it includes a number of provisions to raise revenues to pay for the expansion of coverage.

Despite having passed a similar reform when he was governor of the state of Massachusetts, Mitt Romney wants to repeal the ACA. Instead of the ACA, he proposes giving individual states significantly more control over healthcare policy, creating tax equivalence between insurance purchased in the group and the individual market.

He also proposes shifting Medicaid to a block grant and transforming Medicare into a voucher program that would allow seniors to purchase insurance from the government or private companies. Governor Romney has argued that his reforms would increase competition and transparency in healthcare, which would be a vehicle to drive down costs and improve quality.

The state of the US healthcare system

In 2010, the US spent nearly $2.6 trillion on healthcare. This amounted to 17.9% of the country’s GDP, a substantially higher proportion than in any other country in the world (see Figure 1). Although healthcare spending has been rising faster than GDP across the globe, growth in the US has occurred more swiftly. US healthcare spending is now 55% above the average for wealthy countries.

The US healthcare system is a mesh of public and private insurers and for-profit and not-for profit providers. The federal system is primarily composed of Medicare (insurance for people aged 65 and above), Medicaid (care for people and families on low incomes and for people with disabilities) and the Veterans Health Administration. Medicare is financed through a combination of payroll taxes and federal general revenues. Medicaid is administered by the states, which receive 50-70% of their funding from the federal government.

Of the non-elderly US population, approximately 55.6% of the population obtain insurance through their employer, 5.7% buy private insurance through the non-group market, 20.5% receive insurance from a federal program (Medicaid) and 18% are uninsured. While the insurance coverage is generally good for individuals who are insured publicly or privately, the US healthcare system breaks down at the boundaries between the different programs. It is between these boundaries that we find the substantial proportion of Americans who lack health insurance.

Despite spending more on healthcare than any other country, the quality of care in the US is disappointing. In 2011, 48.6 million Americans were uninsured, up from 37 million in 1980.

In 2010, 75 million Americans reported that they did not access necessary healthcare services because of the cost (Collins et al, 2012).

While the US has some of the best cancer outcomes in the world (see Figure 2), it lags behind on life expectancy (at 77.9 years, this is below much poorer countries, such as Greece and Spain). While Americans can access high-tech medicines and specialists, the US has high rates of medical errors and it lacks the coordination of other healthcare systems. This leads to worse outcomes for conditions that require continuous medical care, such as diabetes and high blood pressure. Putting high US healthcare spending in context, the Institute of Medicine (2012) concludes that a third of the expenditure does not lead to improved health.

Healthcare spending is also creating long-term fiscal problems (see CEP US Election Analysis No. 001.) Between now and 2050, Medicare and Medicaid spending will rise from 5.5% of GDP to over 12%. In contrast, Social Security is projected to rise from 5% to only 6% of GDP over this period. As Figure 3 shows, healthcare spending is the primary driver of future growth in government spending.

President Obama’s proposal

President Obama wants to implement the ACA in full. The ACA has the twin aims of increasing insurance coverage and slowing the growth rate of healthcare spending. The program dramatically expands insurance coverage to nearly all Americans; it requires coverage of many basic and preventative services without co-payments; and, in an effort to reduce costs, it changes the way that Medicare pays healthcare providers.

This approach is predicated on the idea that the federal government should have a prominent role in healthcare policy and that the US government, as the single largest domestic purchaser of care, should use its purchasing power to introduce payment changes that will be likely to create spillovers to the market for privately funded care.

To achieve near universal coverage, the ACA introduces subsidies for individuals earning between 133% and 400% of the federal poverty line ($11,170 for individuals; $23,050 for a family of four) to purchase coverage and it extends eligibility for federal programs for all individuals earning below 133% of the federal poverty line. Previously, only nine states provided Medicaid coverage to adults without dependent children and the median upper income threshold for Medicaid eligibility for parents was 64% of the federal poverty line (Families USA, 2012). The ACA maintains the current employer-sponsored insurance market and creates a new market for individuals to purchase insurance.

The ACA also introduces a mandate for individuals to purchase insurance, which was recently upheld by the Supreme Court. Those without coverage will eventually pay a tax penalty of whichever is the greater of $695 per individual per year (up to $2,085 per family) or 2.5% of household income. This mandate was added to prevent healthy individuals from not purchasing insurance and waiting to enrol until they become sick (that is, to solve the ‘adverse selection’ problem that plagues healthcare markets).

Historically, the US market for individual non-employer-based health insurance has been dysfunctional. This market is typically where small business employees, the self-employed and the jobless try to obtain insurance coverage. Prices are usually very high because premiums are directly related to the likelihood of illness and people are often denied coverage because they have pre-existing conditions. Since people pay premiums that depend on their age, gender and health status, those with a history of ill health and who most require insurance are those who are most often priced out of the market.

The ACA has created ‘insurance exchanges’ to let people purchase insurance. The exchanges are run by individual states and allow people to shop for insurance online. The federal government has stipulated that insurance companies can offer insurance plans in four classes based on how much financial protection the plans provide.

This creates a market with standardised products, where it is easier for individuals to compare insurance plans across providers. Within the exchange, insurance companies can only adjust prices based on age (up to a 3:1 ratio), tobacco use (1.5:1 ratio), the location of the beneficiary and whether the product is purchased as part of an individual versus family plan.

In addition, the ACA introduces significant regulation to the broader insurance market. This includes:

- Preventing denial of coverage because of pre-existing conditions.

- Banning lifetime caps on insurance coverage.

- Banning the cancellation of active policies.

- Creating medical loss ratios whereby a fixed portion (80-85%) of insurance companies’ revenues must go towards medical care for beneficiaries.

The ACA also includes a number of provisions designed to rein in healthcare spending that are primarily driven by the federal government and focused on the Medicare program. The law reduces the payment rates for hospitals; gives the Centers for Medicare and Medicaid significant scope to experiment with new ways to pay for care; and creates the Independent Payment Advisory Board. Should Medicare exceed a targeted growth rate, the Board will be allowed immediately to implement policies designed to slow spending growth (as long as the changes do not involve excluding items for coverage).

In addition, the ACA limits payments to insurance companies providing coverage to Medicare beneficiaries as part of the Medicare Advantage program. Historically, private Medicare Advantage plans have charged 13% higher rates than the equivalent federal programs. On the payment side, the government will reduce payments for facilities with higher admission and infection rates and reward hospitals for publishing quality data and adopting electronic medical records.

Estimated impact of the Affordable Care Act

There are several government and academic estimates of the likely effects of the ACA on healthcare coverage, healthcare spending and the long-term deficit. The CBO estimates that the ACA would result in a net reduction in federal deficits of $118 billion between 2010 and 2019 (CBO, 2011). The largest reduction in federal spending would be the result of reductions in the annual payment rates for hospital services and reductions in payments for Medicare Advantage plans.

In addition, the CBO estimates that the ACA would increase insurance coverage in the US to 92% of the population (an extra 30 million non-elderly people). But the CBO also estimates that the ACA would slightly raise insurance premiums because the legislation requires that insurance coverage now include significantly more benefits like mandatory preventative screening without co-pays.

Governor Romney’s proposals

It is less clear what Governor Romney would do in place of the ACA. We can glean five fairly specific policies from Governor Romney’s campaign website, his speeches and the recent presidential debates:

- First and foremost, he has stated that on his first day in office, he would work to repeal the ACA.

- There would be a reduced role for the federal government in regulating the insurance market and more insurance sold across state lines.

- He has advocated giving states the bulk of the responsibility for improving quality, reducing costs and increasing access to care. To that end, he will turn Medicaid into a state block grant and allow states to decide the share of the poor that receive coverage.

- He has argued for introducing a voucher for Medicare that seniors could use to purchase insurance from private insurers or the federal government. The size of this voucher would be pegged to grow at 1% more than the growth of the economy and the size of the voucher would vary based on individuals’ wealth.

- In addition, he has said that he will eliminate the tax preference given to employer sponsored insurance (although he has not specified how).

The CBO estimates that the cost of repealing the ACA (Republican bill, H.R. 6078) would “cause a net increase in federal budget deficits of $109 billion over 2013-2022” (CBO, 2012b). This is the result of rolling back the increases in revenue generated by the ACA and the reductions in Medicare spending from lower reimbursement rates.

In addition, the CBO concludes that the rollback of the ACA would also increase the deficit during the period 2023-2032. It also estimates that were the repeal legislation passed as law, “about 30 million fewer non-elderly people would have health insurance in 2022 than under current law, leaving a total of about 60 million non-elderly people uninsured.”

At present, individuals can purchase employer-sponsored health insurance using pre-taxed dollars. In contrast, insurance purchased in the individual market receives no such tax preference. Governor Romney has proposed to “end tax discrimination against the individual purchase of insurance”. He has not stated whether he would do this by repealing the tax exemption on employer-sponsored insurance (which would be unpopular) or issuing a tax exemption to purchase private insurance (which would be very expensive).

Governor Romney has also proposed substantial changes in how Medicaid is funded. At present, the federal government has agreed to finance a fixed proportion of state’s spending. Instead, Governor Romney proposes funding Medicaid via a fixed block grant that rises each year at 1% greater than GDP growth.

While this proposal would substantially reduce federal healthcare funding, it is likely that it would also lead to a significant scaling back of the insurance program for the poor. Indeed, the proposals are predicated on the idea that the reduction in Medicaid funding would be picked up by improvements in efficiency. If these improvements failed to materialise, that would mean reductions in access and services for less wealthy citizens.

Finally, Governor Romney has proposed shifting Medicare from a “defined benefit” to a “defined contribution” and introducing more active competition from the private sector. Currently, the federal government defines the benefits that seniors will receive. As a result, if the costs of the benefits increase, then the cost of the program increases as well.

Instead, Governor Romney has proposed giving seniors a defined contribution that rises at 0.5% greater than GDP growth. This contribution, in the form of a voucher, could be used by seniors to enrol in Medicare or to purchase a plan from a competing private insurer. The goal of this proposal would be to use competition as a vehicle to improve the efficiency of Medicare. This change is part of Governor Romney’s plan to use transparency and competition in the US healthcare system to increase efficiency.

Governor Romney’s plans for Medicare and Medicaid are an extension of proposals articulated by his running mate, Congressman Paul Ryan. Because the CBO has analyzed Congressman’s Ryan’s proposals, this gives a sense of the potential impact that the campaign’s proposals would produce.

According to the CBO, the Ryan proposals clearly reduce spending by the federal government. The CBO predicts that under current law, federal healthcare spending will rise from 7% to 12% of GDP in 2050. In contrast, under Congressman Ryan’s plans, spending would be approximately 5% of GDP in 2050 (CBO, 2012c). But the CBO predicts that seniors would pay significantly more for their healthcare, so much so that overall healthcare spending would rise by 40-60% by 2030 compared with the fully implemented ACA.

It is important to note that while Congressman Ryan included the approximately $700 billion in Medicare savings generated by the ACA, Governor Romney has argued that these savings are a “cut to Medicare” and has pledged not to include them in his future plans.

Conclusions

As President Obama struggled to pass the ACA, many argued that he should forego healthcare reform and focus on the economy. But at nearly a fifth of the US economy and as the largest driver of long-term US debt, what happens to healthcare will determine what happens to the economy in the long run. The ability of the next president to rein in healthcare spending and improve the productivity of the US healthcare system is going to determine the country’s fiscal future.

President Obama and Governor Romney have presented two radically different visions of healthcare reform. President Obama’s legislation expands coverage for the uninsured and uses the power of the federal government to slow the growth of healthcare spending. The legislation includes a host of payment changes designed to push providers to increase their productivity, improve quality and adopt electronic medical records more rapidly.

This approach to cost reduction is predicated on the idea that the government should use its purchasing power as the single largest purchaser of healthcare to prod healthcare providers to improve their performance. In terms of improving access, President Obama has regulated the market for private insurance, mandated insurance coverage and increased federal subsidies for insurance and eligibility for federal coverage. Ultimately, the CBO estimates that the legislation would expand insurance coverage by 35 million people and reduce the debt by over $100 billion by 2022.

In contrast, Governor Romney has advocated that states should take the lead in tackling the challenges facing the healthcare system. This is a more traditionally conservative view than his Massachusetts plan, which was a precursor of the ACA. Governor Romney’s new plans would substantially reduce the federal government’s role in healthcare public policy, change Medicare and Medicaid to defined contribution programs and dramatically expand the role of the states in tackling healthcare reform. While this approach would clearly reduce federal costs, it is likely to provide less access to insurance and it is unclear whether it would reduce overall healthcare spending.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Zack Cooper is Assistant Professor of Health Policy and of Economics at Yale University and Resident Fellow at the university’s Institution for Social and Policy Studies. Professor Cooper is also a Faculty Associate at the LSE’s Centre for Economic Performance