The LSE Conduct Costs Project, led by Roger McCormick, points the way to how banks might provide more useful and accessible information to the public about how “well-behaved” they are. By adding up fines and sums akin to fines that banks have been paying out for their misbehaviour (e.g. manipulating LIBOR or mis-selling PPI), the project gives information on how ‘ethically healthy’ they are.

The LSE Conduct Costs Project, led by Roger McCormick, points the way to how banks might provide more useful and accessible information to the public about how “well-behaved” they are. By adding up fines and sums akin to fines that banks have been paying out for their misbehaviour (e.g. manipulating LIBOR or mis-selling PPI), the project gives information on how ‘ethically healthy’ they are.

Banks are well-used to the regulatory requirement that you should “know your customer” (often abbreviated to “KYC”) and we are all used to the numerous KYC boxes that have to be ticked whenever we want to do anything remotely out of the ordinary with our money. One can hardly blame the banks for being a trifle picky about such things: getting it wrong could easily lead to dreaded mis-selling claims, for example, or to allegations of helping money-launderers. And, in any event, banks can’t help knowing rather a lot about us, their customers, simply by virtue of the fact that they know a lot about our finances and what we do with our money. But do we know as much as we should about them?

The ongoing concerns about our banks have brought to the surface a well-recognised phenomenon: we may have various problems about how the banks, and bankers, behave but we are slow to change accounts, however disgruntled we may feel. This is partly due to inertia – it’s seen to be something of a hassle to change banks when compared with, say, trying a new supermarket. But it’s also due, at least in part, to the lack of readily available, accessible information about just how “good” or “bad” banks actually are. They say they are (at last) trying to be more ethical than in the past and determined to “restore public trust”. How can we test that? Is it just the latest PR message or is there some substance to it?

The LSE Conduct Costs Project, which I am leading, points the way to how banks might provide more useful and accessible information to the public about how “well-behaved” they are (or, at least, are in the process of becoming). The project is based around the analysis of banks’ “conduct costs” – essentially fines and sums akin to fines that banks have been paying out for their misbehaviour (e.g. manipulating LIBOR or mis-selling PPI).

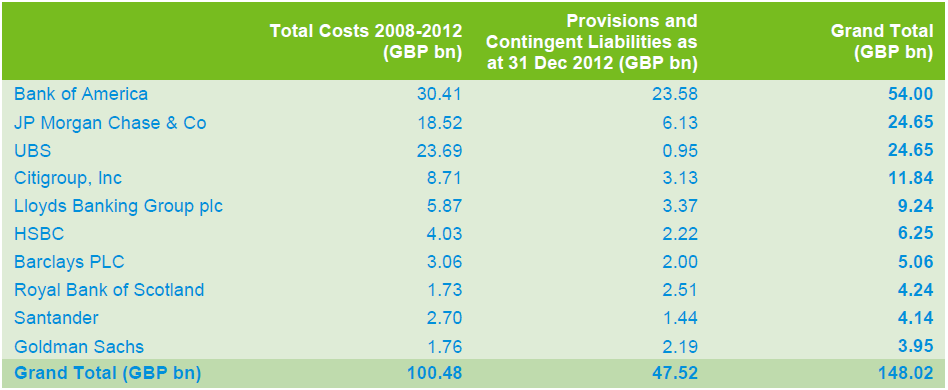

The idea behind the project is very simple: take 10 major banks and add up their conduct costs for the five years ending 2012 (with 2013 to follow in due course, then 2014 and so on). The result is the table set out below:

Table 1: Summary table of bank conduct costs results (5 yr. period ending 2012), all figures are in billions of GBP

Note: These figures should be read subject to the points made under “Notes on the Interpretation of the Figures” which can be found in our blog, here

These figures are subject to various qualifications and assumptions, as detailed in the ICLR forms relating to each bank which can also be found on the blog referred to above.

The figures for each individual bank are rounded to two decimal points.

Strange that no one seems to have done this before. The amounts involved are serious. As can be seen, the grand total is around £150bn. What do the numbers tell us? They convey a range of stories and merit ongoing comment and analysis by anyone who is interested in our financial system and what we expect of our banks. If we were to look for a proxy of how “ethically healthy” a bank is (and evidence to support its management’s assertions and promises on the subject) it is hard to think of a better indicator than the scale of its ongoing conduct costs. A bank with a sound ethical culture and acceptable “values” should not habitually have very high conduct costs.

Details of the statistics behind the above table (and there are a lot of them) can be found on the LSE Conduct Costs Project blog. Those who want to keep up with ongoing comment and discussion are also encouraged to join the related LinkedIn group (which can be accessed directly from the LSE blog).

It is intended that the project should now continue on a rolling five year basis. There is just one snag. What has been achieved so far has been done on a shoestring budget (supported by the Higher Education Innovation Fund) with dedicated and enthusiastic researchers and a great deal of unpaid work. If we are to expand the project as we would like, we will need a comprehensive funding package for the next phase.

The project delivers, in large part, what the Financial Services Compensation Panel asked for regarding banks’ “regulatory history” when it commented on the FCA’s “transparency” paper (DP 13/1) in April this year. There are also echoes of comments from the FCA’s Martin Wheatley, who was quoted earlier this year (Guardian 21st March) as saying that changes in bank behaviour will be not happen “unless individuals are held to account…and the consumers make a decision themselves that we’d rather bank elsewhere”. One of the objects of the project is to put consumers in possession of the relevant information.

All the data forming the basis of the analysis are in the public domain but an awful lot is in very obscure places, cloaked by ambiguous and unhelpful accounting practices. If the banks are serious about wanting to be more open and transparent, this project offers an opportunity for them to support their fine words with concrete action by being more forthcoming in disclosing and presenting material of this kind.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Roger McCormick is a Visiting Professor at LSE, where he runs LLM courses on Legal Risk in Financial Markets and Project Finance. He is also the Director of LSE’s Conduct Costs Project. The second edition of his book, “Legal Risk in the Financial Markets” was published by Oxford University Press in December 2010. Roger retired from full-time private legal practice in 2004, having practised law in the City of London (principally as a partner of Freshfields) for nearly thirty years.

Roger McCormick is a Visiting Professor at LSE, where he runs LLM courses on Legal Risk in Financial Markets and Project Finance. He is also the Director of LSE’s Conduct Costs Project. The second edition of his book, “Legal Risk in the Financial Markets” was published by Oxford University Press in December 2010. Roger retired from full-time private legal practice in 2004, having practised law in the City of London (principally as a partner of Freshfields) for nearly thirty years.