Despite the government’s stated commitment to fairness, last week’s changes to taxes and benefits will have severe effects on those on low to middle incomes. Gavin Kelly, Chief Executive of the Resolution Foundation, looks at these changes and calls for a deeper understanding of the impacts they will have on families themselves.

Despite the government’s stated commitment to fairness, last week’s changes to taxes and benefits will have severe effects on those on low to middle incomes. Gavin Kelly, Chief Executive of the Resolution Foundation, looks at these changes and calls for a deeper understanding of the impacts they will have on families themselves.

With the Budget behind us and the new financial year starting last Wednesday, it is a timely moment to take stock of the prospects of those living on low-to-middle incomes. To do that we need to consider the combined impact of stagnant wages, rising prices, reduced tax-credits and benefits from the June 2010 Budget – as well as the measures that were announced in last month’s Budget (such as increased personal tax-allowances).

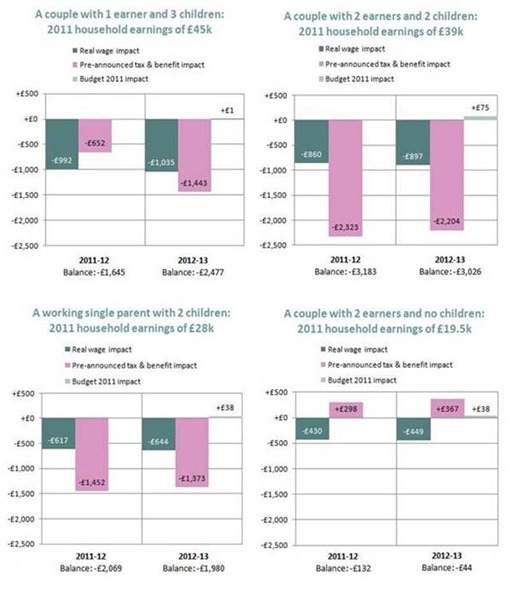

Each of these changes has of course been considered in isolation. But there hasn’t been much analysis that looks at them in the round – and considers the impact on different types of families. The charts below, based on a few hypothetical but fairly typical working-age families, provides some insight here. They show that falling real wages, together with swinging cuts to tax-credits announced in last year’s Budget and Spending Review, will lead to some staggering reductions in household incomes. In comparison, the changes made in the recent Budget are tiny (though positive).

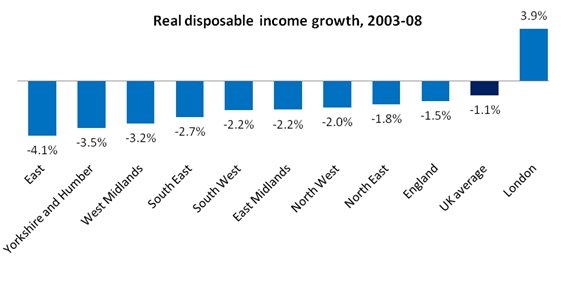

The severity of the living standards crunch will vary not just according to household-type, it will also play out differently across localities and regions – though the exact nature of this variation represents an important gap in our knowledge. To help remedy this, we recently undertook some analysis of the trends in regional disposable income that existed prior to the recession (based on newly released ONS data). It reveals that buoyant trends in London have long been cloaking a far more worrying picture in other English regions: disposable incomes had begun falling as back as 2003. (And we should bear in mind that this grisly data provides an overly optimistic picture, particularly in London, as it is based on ‘mean’ not ‘median’ income).

Looking at statistics and charts like this is, of course, crucial – but it only paints a very partial and somewhat abstract picture. To really understand what 2011 is actually going to feel like for working families we need a far richer and more in-depth understanding of the reality of household budgets, and how they are managed and juggled when they are hit by shocks.

That is why the Resolution Foundation is launching a year-long project that will track the household finances of a set of low-to-middle income families across Britain to see how they fare, the nature of the trade-offs they make and the patterns of income, expenditure and debt that they live by.

I’m pleased to say we are doing this jointly with the BBC’s World Tonight who, to their credit, are investing proper air-time over the next nine months (starting last week) in tracking the living standards of some of the families we are working with. I hope you get a chance to listen – do let us know what you think.

This article first appeared on the Resolution Foundation’s blog on 4 April.

Please read our comments policy before commenting.

1 Comments