After all the debunking it has had, including the admission from prominent ‘Leave’ supporters that it was phoney, the continuing hold on British public debate of the claim of £350 million per week for the NHS is an abiding mystery. Iain Begg explains that there is no such thing as a Brexit dividend.

After all the debunking it has had, including the admission from prominent ‘Leave’ supporters that it was phoney, the continuing hold on British public debate of the claim of £350 million per week for the NHS is an abiding mystery. Iain Begg explains that there is no such thing as a Brexit dividend.

Few doubt the need for increased funding for the NHS and the government plans to boost its budget by some £20 billion a year by 2023 will be widely welcomed. Yet to portray it as somehow connected to Brexit is, simply, dishonest, the more so when it is being spun as enabling pro-Brexit ministers to deliver on a referendum promise. It has been explained endlessly, but apparently has to be reiterated yet again, that the true UK gross contribution to the EU has to be measured after deducting the rebate received since 1985. Admittedly, the way this is presented in official statistics can be confusing, but the principle could not be more straightforward. Rather than £350 million a week, what the UK ‘sends to Brussels’ is more like £280 million, fluctuating from year to year. Some EU spending also flows back to the UK, mainly for subsidies to farming and fisheries, economic development projects in poorer regions and to pay for research.

Once these flows are taken into account the net contribution of the UK to the EU falls to around £10 billion a year, equivalent to a little under £200 million per week. The latter figure is still substantial and would be enough to pay for plenty of nurses and doctors, but plainly is not £350 million. For there to be a public spending dividend from Brexit – even one attaining the true gross figure of £280 million, a week two conditions have to be met. First, the UK has to reduce the amount of money it ‘sends to Brussels’ or uses instead to pay for policies currently funded by the EU; and, second, the tax base of the economy has to be stable. As things stand, neither condition will be fulfilled sufficiently and definitely not in time to pay for what is proposed over the next five years.

In the short-term, the government has already committed to maintaining subsidies for the farm and fisheries sectors up to the end of 2020, as well as honouring economic development and research contracts which could stretch to 2023. Then there is the Brexit divorce bill of some £35 to 40 billion, to be paid in instalments over a number of years and equivalent to around 4 years’ worth of the UK net contribution to the EU. These are sizeable – if transitional payments – which effectively negate any plausible Brexit dividend before 2023.

Beyond the current budgetary round, it is likely that new subsidies to farming and fishing will have to be introduced, and at least some support provided for economically disadvantaged communities. It is also conceivable that the UK will want to remain in certain EU programmes, such as research, and these will not come free.

Realistically, therefore, at least some of what is currently ‘sent to Brussels’ will remain a cost to British tax-payers indefinitely and, by extension, cannot be ‘sent to the NHS’. A future UK government may well decide to abandon subsidies for farmers, but don’t hold your breath. However, the indirect budgetary effects of Brexit are the real problem. To state the blindingly obvious, the public services an economy can afford depend on the success of the economy through building up the tax base.

Over the next five years, public sector receipts (the bulk of which come from the combination of VAT, income tax and national insurance) are projected by the Office for Budget Responsibility (OBR) to be on average 36.7% of GDP. If GDP is lower than previously expected, as has been the case since the referendum, these receipts will fall proportionally. Although the actual calculation is somewhat more complex, a simple back of the envelope summary provides a pretty robust indication of the magnitude of the amounts at stake. Thus, in the fiscal year 2017-18 (just ended), UK GDP at current prices was a little over £2000 billion, and the tax take projected by the OBR was £750 billion.

Had nominal GDP been one percentage point higher, taking it to £2020 billion, the tax take would have been some £7.5 billion higher. It is important to stress, too, that these figures cumulate: growth one percentage point below expectations for each of the five years of the proposed new health settlement will (assuming no change in the tax regime) mean public receipts five times £7.5 billion lower (£37.5 billion) by 2023 than expected. It does not need rocket science to show how this greatly exceeds the potential cut in payments to the EU: it is approximately double the infamous £350 million per week. Even half a percentage point per year shortfall would more than negate the potential gains from ceasing to pay into the EU.

The impact of Brexit on the UK’s prospects for economic growth ought, therefore, to be at the heart of any discussion of spending more on the NHS or, indeed, any other changes in the public finances. Yet we remain stuck with seeing this through the lens of the fictitious £350 million per week. Certainly, some of the blame for this state of affairs has to be levelled at the proponents of ‘project fear’, who portrayed Brexit as an inevitable and immediate economic calamity. This allowed the relative resilience of the economy in the months after the referendum to be interpreted by Brexiteers as a reason to reject any and all economic projections.

But after five quarters of disappointing growth figures since the beginning of 2017 and with growing evidence of an adverse Brexit effect on the economy, the risks to the UK public finances have to be recognised. This is why the new NHS promise has elicited such critical comment and even allowed John McDonnell (the Labour Shadow Chancellor) to look fiscally responsible. More funding for the NHS can be generated by raising taxes or by allowing the public sector debt to increase. But to quote George Bush the 1st, ‘read my lips’: a Brexit dividend will not be the solution.

_________

Note: the above was originally published on LSE Brexit.

Iain Begg is Professorial Research Fellow at the European Institute and Co-Director of the Dahrendorf Forum, London School of Economics and Political Science.

Iain Begg is Professorial Research Fellow at the European Institute and Co-Director of the Dahrendorf Forum, London School of Economics and Political Science.

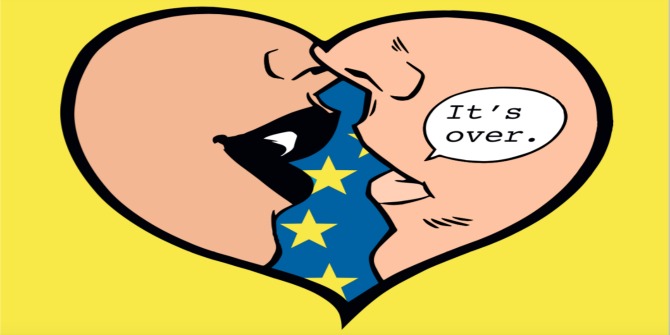

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science. Featured image credit: Pixabay (Public Domain).

As I come across more figures on the increase in NHS spending, I keep adding updates to a comment I’ve posted a few times in the last week.

Let’s start with a simplifying assumption: suppose that inflation falls to zero for the next six years.

Under the government’s plans, the present annual £115 million budget of NHS England would rise by 3.4% each year until it had reached £135 billion—a £20 billion increase—by 2023-24.

Why did the Conservatives chose £20 billion for the increase? Well, it’s an easy number to remember and it works out to be £385 million per week, which is bigger than the £350 million figure on the side of the Brexit bus.

Incidentally, in the year before 2023-24, the increase is £16.5 billion, which is £317 million per week and does not meet the Brexit bus target. In other words the £385 million a week is not coming soon.

Inflation will not, of course, fall to zero: the Consumer and Prices Index (CPI) is currently running at around 2.5% per year. (The CPI is always lower than the RPI which is why the Conservative prefer it.)

In her recent interview with Andrew Marr, Theresa May pledged that spending—in cash terms, not real terms—on the NHS will increase every year for five years until it rises to £600 million per week in 2023-24 (that’s £31 billion for the year).

So it would seem that the Conservatives are planning on raising spending on the NHS by 4.9% per year to offset the reduced spending power that inflation causes.

(According to the plan £31 billion will have the same spending power in 2023 as the £20 billion has now.)

However if you take 2.5% from 4.9% you’re left with 2.4% and this is somewhat less than the 3.4% which is the figure we’re all supposed to remember about the increase. To get a 3.4% rise you need inflation to fall to 1.5% per year.

The NHS since it was first formed in 1948 has had average annual rises in its budget of about 3.7% in real terms. So let’s hope, as I supposed earlier, that inflation heads downwards from its present value and stays down for five ye

What should be apparent to anyone by now is that the myth of fiscal responsibility has been a lie all along, during the Thatcher years her chancellors all proclaimed that they had to make cuts in public expenditure in order to bring inflation down and reduce our borrowing. Then if we achieved a fiscal surplus they would increase public spending accordingly, only when that happened and it was pointed out to them, they refused to increase public spending saying that they would rather pay off the national debt.

The truth behind that story is that the Tories and right wing politicians of all colours are on a single mission, that is to ensure that irrespective of what government is in office the corporate sector still governs.

What should also be obvious to any casual observer is that if these Tories were honest and taxes really were raised to maintain public expenditure, then why have they reduced income tax for the rich from 83p in the pound in the 1960s to the current level of 45p.

Again nothing adds up, because their real intent has been already mapped out in two documents as to how they would dismantle the state, the first came in 1977 under Nicholas Ridley’s so called research paper, that talked of the nationalised industries being inefficient and how they intended to dismantle them, attack trade unions and use the arms of the state to achieve those ends.

http://fc95d419f4478b3b6e5f-3f71d0fe2b653c4f00f32175760e96e7.r87.cf1.rackcdn.com/FABEA1F4BFA64CB398DFA20D8B8B6C98.pdf

The other document goes even further than the one above and is Margaret Thatchers secret 1982 cabinet papers, released under the 30 year rule in 2012. the policy name even gives the game away, “the longer term options”. which is the methods used to dismantle the state by privatising all public services, in this case education and the NHS etc.

http://discovery.nationalarchives.gov.uk/details/r/C13318082#imageViewerLink

To view this document one needs to click on the area where it sates “Preview a low image of this record”.

What academics and academia at large should concentrate on is not the finite details of the governments duplicity in delivering Brexit but the wholesale corporate takeover of our democracy,(if we even have a democracy) Brexit is a diversion and any final agreement will only satisfy the Tories other objective of doing an unnecessary trade deal with the USA.

The whole Brexit thing is a farce being played out by Neo-Liberal politicians here in Britain and in Europe, we need only ask why The EU tried to negotiate a TTIP agreement in secret with the USA, to understand what the whole agenda is actually about. Then we see how Europe treated Greece while happily bailing out the whole European Banking system with free money called Quantitative Easing. Just like we did here in Britain.

Our country needs to wake up and fast including those that should know better.