London is the key engine of UK economic growth, whose taxes finance public services in many other regions. But historically its special needs have not attracted the investment and public support they need, and the new austerity climate could spell disaster for the capital’s capacity to grow effectively. Tony Travers explains why the capital needs the same kind of public finance devolution that Scotland, Wales and Northern Ireland already enjoy.

London is the key engine of UK economic growth, whose taxes finance public services in many other regions. But historically its special needs have not attracted the investment and public support they need, and the new austerity climate could spell disaster for the capital’s capacity to grow effectively. Tony Travers explains why the capital needs the same kind of public finance devolution that Scotland, Wales and Northern Ireland already enjoy.

On a typical day in London, nearly four million people go to work, 3.4 million use the Underground and over 6 million take buses, that in total, travel over 1 million kilometres. Over 70 hospitals keep London healthy, hundreds of schools and universities help us to learn and between £38 and £52 million in tax revenue is collected by the Exchequer for the use of the entire country. To put these figures in perspective, there are more Tube journeys than there are people in Wales (3 million), almost as many hospitals as there are in Scotland, and London’s buses travel the distance to the moon and back, and then back again, in just one day.

London’s importance to the UK economy cannot really be underestimated; through a concentration of economic activity, a high population, and associated economies of scale, London generates about 18 per cent of the UK’s output, while having 12.4 per cent of its population. Importantly, government expenditure on services has been 13-14 per cent in the past ten years, lower than the city’s tax contribution (also about 18 per cent), meaning that London contributes between £14 billion and £19 billion to the rest of the country via a tax export

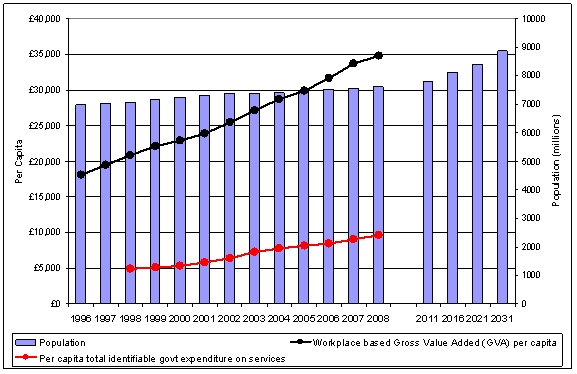

Looking at the chart below, we can see that while London’s output has grown over the last ten years, government investment per person has lagged behind, growing much less:

Investment, Output and Population in London 1998 – 2031

*2011-2031 figures are projections

*2011-2031 figures are projections

Over the decade from 1999-2009, government expenditure in London more than doubled from £34 to nearly £74 billion. But in the last five years government expenditure has grown at virtually the same rate as expenditure in the rest of the country. The measure of workplace gross-value-added (GVA) gives us a rough indication of economic activity in London (shown by the black line in the chart above). Comparing the black and red lines also gives a sense of how far public expenditure is changing in relation to the overall size of the economy. That is, it shows how far State spending is expanding (or contracting) in relation to the capacity of the public sector to service the private sector economy (as shown by the red line). In London, government spending accounted for 23 per cent of GVA in 1998-99; this rose gradually over a decade to 28 per cent in 2008-09. However, this percentage point increase was relatively low as compared to the rise in the UK as a whole, where expenditure on services made up 33 per cent of GVA in 1998-99 and 40 per cent in 2008-09.

As can also be seen in our chart, London’s population is expected to sharply increase to over 9 million by 2013 – a rate of increase of over 9 per cent per annum. This means that the pressure for London’s services to increase will continue in the future, particularly given the far higher population densities in London as compared to all other regions. For example, to accommodate housing needs, London will need to build 34,000 homes every year until 2031; with needs for social housing in particular being far in excess of the rest of the country. Additionally, the projected figures for the capital’s school age population show an increase of 16.2 per cent by 2021 and also in 2031. These percentages are slightly bigger than those for England as a whole, meaning that the relative pressure on London’s public services will be greater for schools and children’s services. These pressures exist alongside those such as rising employment and the likelihood of increasing deprivation.

In common with all major cities, London depends on public services and infrastructure to allow it to function effectively. The density, scale and make-up of population together create a need for railways, roads, schools, hospitals, police services and other provision that, while also required in rural and suburban areas, are of particular importance if so many people and businesses are to be able to co-exist in a relatively small geographical space. Given the economic productivity and environmental benefits of large cities, there are numerous reasons for investment in London and other key cities.

Public spending represents broadly one third of the London economy in the long term. Of this expenditure total about 12 to 13 per cent represents capital spending (though it may be a little higher if PFI-type projects were included). Consequently, public sector capital investment appears to amount to 3½ to 4 per cent of the whole London economy. For a city that depends so much in its infrastructure, this total is surprisingly low. In the longer term, if London’s productive capacity is to be maintained the amount of resources devoted to publicly supported infrastructure (whether provided by the public sector or the private sector) will have to be increased. The balance between revenue and capital expenditure suggests under-investment in the infrastructure needed to secure growth and tax yield.

Can we invest more in London?

London’s population and employment have grown sharply since 1985 – the city now has almost a million more residents than it did 25 years ago. There have been periods (such as in the early 1990s, and between 2001 and 2008) when there have been sharp increases in public expenditure. But at other times investment has fallen sharply. Looking ahead, it is easy to see a decade in which UK public sector capital spending falls by over 50 per cent. Yet at the same time, demand for services and the government’s need for tax yield will increase. Even a broadly proportionate cut (i.e. no more or less than other parts of the country) in London’s investment would be likely to have a disproportionate effect in the city because of its capital-intensive urban economy.

Scotland (with a population of 5 million) has been promised that a proportion of the income tax paid there will be transferred to the control of the Scottish government, with a corresponding reduction in the block grant paid under the terms of the Barnett Formula. Wales (with a population of 3 million) is being given substantially greater powers over its own legislation. London which was also an element in the government’s constitutional reforms in the late 1990s, is, however, treated very similarly to the rest of England. However, in institutional terms, the existence of the Greater London Authority – and its particular powers – makes London significantly different from the rest of England. Given the economic importance of London and its power as a political entity, it would be logical to consider a move in the direction of ring-fenced, Barnett Formula-protected, funding for the city. Scotland, Wales and Northern Ireland already have such blocks of grant. If ring-fenced funding were extended to London, more radical tax reforms could then be considered.

London is trapped within the ‘England’ system of public finance, which has itself proved impossible to reform. Capital spending controls have been reduced since 2004, though authorities remain unwilling to use the so-called ‘prudential rules’ freedom to spend over-much because of the revenue spending consequences it produces. The Greater London Authority (GLA) controlled by the Mayor has rapidly used its borrowing capacity to fund new transport and other infrastructure. Such additions to debt cannot continue within a system where the authority’s income is so circumscribed. It is likely that London, given greater autonomy, would invest more in infrastructure than is currently allowed within national control of public expenditure. In the longer term, London could be moved towards a more devolved model of government and finance, akin to those in Wales and Scotland. But to achieve this, it would require the agreement of the GLA and the boroughs, whose expectations would each need to be met. The lobby group for all London boroughs, London Councils, has itself been active in proposing radical transfers of power and funding over public services to local government in the capital. There is no reason why other changes could not be envisaged.

Click here to download the full report by LSE London – Public Spending Priorities in London.

1 Comments