Spectrum auctions, the process by which a government uses an auction mechanism to allocate rights to transmit signals over specific bands of the electromagnetic spectrum, have come to form an increasingly important part of the regulator’s toolkit over the last two decades. Geoffrey Myers explains why the auction of radio spectrum licences for mobile phone networks has played a critical role in economic modernisation in the UK and beyond, and looks at the wider lessons it holds for developing more effective regulation.

The radio spectrum is a scarce natural resource that we use every day of our lives, whether browsing the internet on our smartphones, watching terrestrial or satellite television, listening to the radio, opening car doors with a remote key fob, or travelling on vehicles such as airplanes that use wireless communication.

It is now mainstream practice worldwide to carry out auctions in order to award licences providing rights to use specific frequency bands in part of the radio spectrum. This is especially the case for the spectrum which is the lifeblood of cellular mobile services, serving the ubiquitous smartphones which are deeply woven into the fabric of our everyday business and personal lives.

Avoiding the pitfalls

The regulators designing and running the auctions can face very different market conditions, economic and political contexts, and have varying degrees of experience and expertise. They face significant decision-making challenges and as a result, auctions remain risky. Outcomes can be hard to predict – auctions can work out broadly as expected, be highly successful, or go embarrassingly wrong.

Regulators face significant decision-making challenges and as a result, auctions remain risky.

Sometimes the circumstances can be unfavourable for reasons outside the control of regulators, such as poor macroeconomic conditions or inherently weak competition in the auction. But there are also avoidable failures, such as the common mistake of setting reserve prices too high, leading to valuable spectrum being left unsold and not brought into productive use to benefit the public and the economy.

Suitable analytical frameworks can help regulators to make better, more consistent decisions and improve the chances of the auction achieving desirable outcomes. A toolkit of frameworks is developed in my new open-access book, many of which have been successfully road-tested in the design of the UK’s internationally influential spectrum auctions.

Striking the best balance

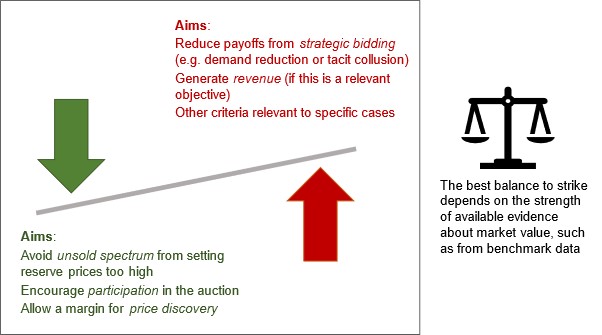

For example, the analytical framework for reserve prices shown in Figure 1 below can assist in avoiding the mistake of setting them too high. In some countries, reserve prices are set by political ministries, although in the UK the decision-maker is the independent regulatory agency, Ofcom. In either case, judgement is required because there is a trade-off to be made.

From an economic efficiency perspective, it is desirable for the decision-maker to be confident that reserve prices are low enough to be below market value, allowing bidding by the companies participating in the auction to do its job of setting prices. The weights to accord to different considerations, when choosing from among the wide range of candidate reserve prices, will depend on the circumstances such as the risks that are most likely or worrisome, and on the objectives of the auction. The strength of the available evidence, such as from international benchmarks, will also affect how to strike the best balance.

Figure 1: Framework of trade-offs when setting reserve prices

Reserve prices can be set more or less conservatively depending on an informed judgement about the specific balance of risks, and a careful interpretation of the available evidence on market value. Uncertainty favours setting lower reserve prices that can encourage firms to participate, improve price discovery (ie, the operators’ understanding of the spectrum’s market value), and mitigate risks of consumers failing to benefit from scarce spectrum because it is unsold.

For instance, in the UK’s auction in 2021, benchmarks were available from earlier European auctions for the low-frequency band which was valuable for operators to provide wide-area 5G coverage. Accordingly, Ofcom set the reserve price for the band at £600 million – this still left room for price discovery, and the bids in the auction by mobile operators EE, O2 and Three eventually reached £840 million.

By contrast, for another, less valuable band, which was expected to be used to provide supplementary 5G capacity, little reliable information about market value was available. This uncertainty led the regulator to set very low reserve prices at just £4 million for that band – a decision which was vindicated, because it allowed the spectrum to sell even though it only attracted a single bid at this price from EE (with apparently no other mobile operator having a value above even this low price).

Frameworks can lead to better decision-making

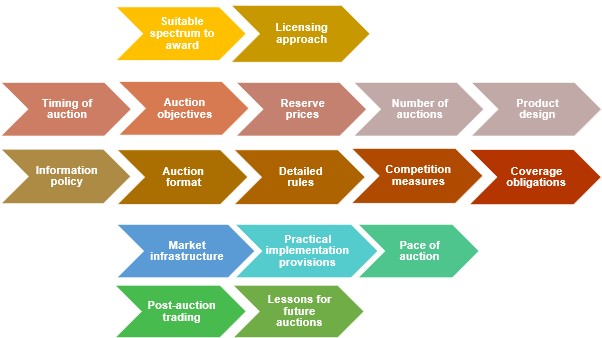

As well as reserve prices, the regulator has many other decisions to make. In my book, I look at how tailored analytical frameworks were implemented in the UK’s spectrum auctions to guide a wide range of design decisions, covering all the categories shown in Figure 2 below. The frameworks help to organise the relevant considerations, such as identifying the most important trade-offs, and to guide decision-makers to take account of differences in circumstances within a consistent overall approach. These frameworks can also be applied in other countries to assist decision-making for their auctions.

Figure 2: Range of decisions for a spectrum auction

In a world of imperfect choices and asymmetric information, public policy is challenging. Decision-makers often lack key information and have difficult trade-offs to judge in policy processes that can be slow, subject to human biases, and at risk of capture by particular interest groups. Tailored analytical framework can assist decision-makers to navigate these challenges – and the more consistent basis for decisions can enhance the predictability of the environment for businesses to invest and flourish, thereby benefitting the public, industry and the economy.

This post draws on analysis and research contained in the author’s open-access book, Spectrum Auctions: Designing markets to benefit the public, industry and the economy (LSE Press, 2023)

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science.

Image credit: Photo by Timothy Vogel, Attribution-NonCommercial 2.0 Generic (CC BY-NC 2.0)