Over 20 per cent of British workers earn under two thirds of the median hourly wage, or £7.69 an hour. Adam Corlett writes that any concerted attempt to reduce the prevalence of low pay will also need to get to grips with the changing sectoral, demographic and distributional factors that keep Britain near the top of the low pay league table.

Over 20 per cent of British workers earn under two thirds of the median hourly wage, or £7.69 an hour. Adam Corlett writes that any concerted attempt to reduce the prevalence of low pay will also need to get to grips with the changing sectoral, demographic and distributional factors that keep Britain near the top of the low pay league table.

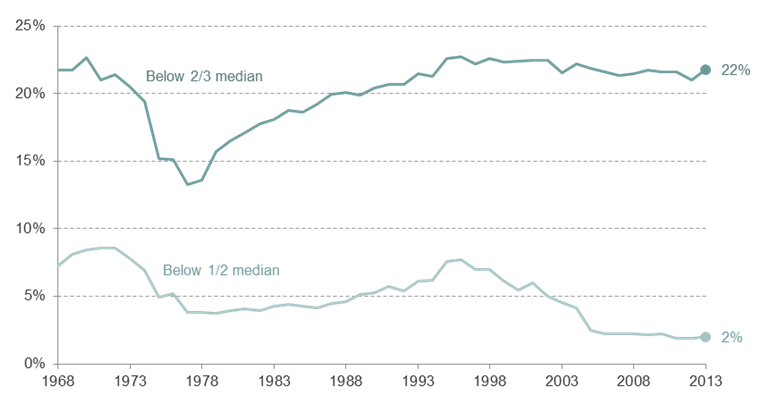

More than one in five employees in Britain are low paid, according to this year’s Low Pay Britain report. This latest figure is a small increase, reversing a welcome fall the year before. But the bigger picture is that the rate of low pay in Britain has barely changed over the past 20 years. Beneath this headline however, lie a number of shifts in the profile of Britain’s low-paid workforce.

We use a relative measure of low pay equal to two thirds of the median hourly wage for all employees. This means that the low pay threshold for 2013 – based on a median rate of £11.56 – is £7.69 an hour. Last year across Britain, 22 per cent of employees were paid below this rate.

Figure 1: Proportion of all employees below selected pay thresholds

The consistency of the one in five headline figure – at least since the mid-90s – could lead some to accept that this rate of low pay is inevitable. But we only have to look abroad to see that low pay needn’t cover such a large proportion of the workforce.

Many countries have far lower rates of low pay. OECD figures show that only 5 per cent of full-time Belgian employees earn below two thirds of the weekly median, and only 9 per cent in Switzerland, compared to 21 per cent in the UK (using a slightly different measure). Only a few OECD countries, notably the USA and South Korea (with rates of 25 per cent), perform significantly worse than the UK. More work is needed to say what distributional and sectoral differences are most responsible and whether the UK could or should change these factors.

A stable rate of relative low pay can also hide important changes in living standards. Following the financial crisis, pay growth has been extremely weak. After years of below-inflation growth, average earnings in real terms are now back to where they were in 2003. The fact that low pay rates have been stable suggests that those on low and average wages have experienced similarly sharp squeezes – but equality in falling living standards is not the most comforting pay trend. Instead of measuring low pay in relative terms, compared to the median, we can look at others based on the actual cost of living. The proportion of employees paid below the living wage, a level that supposedly supports a minimum standard of living on average, has shot up in recent years.

Finally, there have been large changes in the shape of low pay. For example, women remain considerably more likely to be low paid, but there has been a steady increase in the proportion of low earners who are male. The overall figures also conceal a marked rise in low pay amongst the under 30s – to higher levels than ever – together with falls for the over 50s.

Other groups are also especially likely to be low paid: while only 28 per cent of workers are part-time, they make up 56 per cent of the low paid. And in hotels and restaurants, the worst performing sector, the rate of low pay is extremely high at 70 per cent.

We can expect (or at least hope) that Britain’s rapidly falling unemployment will eventually up the pressure for real pay increases, but there is an awful lot of ground to make up after years of falling real pay. And ultimately, sustainable wage increases will depend on higher productivity, which to a large extent requires investment in education and training, equipment, new technology and infrastructure.

Any concerted attempt to reduce the prevalence of low pay from one in five will also need to get to grips with the changing sectoral, demographic and distributional factors that keep Britain near the top of the low pay league table. The main political parties often cite their plans for the minimum wage as a way to help the low paid. But while increases in the minimum wage will undoubtedly help many, we need to look beyond this at the fundamental causes of low pay in Britain and at how to help people avoid or progress out of low pay altogether.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting. Featured image credit: M.o.B. 68 CC BY-SA 2.0

Adam Corlett is an economic analyst at the Resolution Foundation. He can be found on Twitter @AdamCorlett.

Adam Corlett is an economic analyst at the Resolution Foundation. He can be found on Twitter @AdamCorlett.

1 Comments