The real problems for the UK are inadequate long-run investment in infrastructure, innovation and human capital. What Britain needs is an independent infrastructure body to recommend and deliver national infrastructure projects. Unfortunately, short-term expediency has once again trumped long-term reform, writes John Van Reenen.

The real problems for the UK are inadequate long-run investment in infrastructure, innovation and human capital. What Britain needs is an independent infrastructure body to recommend and deliver national infrastructure projects. Unfortunately, short-term expediency has once again trumped long-term reform, writes John Van Reenen.

The UK economy was trumpeted by Chancellor George Osborne as the fastest growing major economy in his autumn statement this year (only briefly though – the US GDP numbers came in later on the same day showing more growth in the US). So has the UK model of fiscal austerity been vindicated?

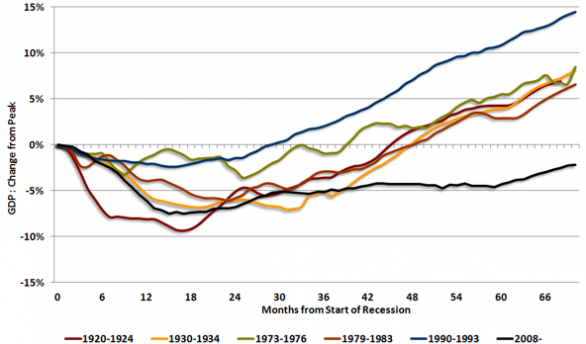

The Treasury is forecasting growth in 2013 to be only 1.4% and 2.8% in 2014. This is hardly escape velocity for a recovery as next year’s GDP prediction is barely above historical trends. Indeed, the recovery has been the weakest for over a hundred years – real national income will still be smaller than it was in 2008 (see Figure 1). Productivity is around 15% lower than we would have expected from historical trends.

Figure 1: UK Recovery this time Slower than in the Great Depression

Source: NIESR (2013, downloaded December 14th 2013)

What about the fact the employment levels in the UK in 2013 are higher than in 2008, though? Doesn’t this contradict the depressing picture from GDP which is notoriously hard to measure accurately? The goods jobs picture is partly explained by population growth, the employment to population rate has fallen since the start of the recession. Nevertheless, the British flexible labour market has held up well, with unemployment peaking at 8% of the labour force, a lower level than America’s 10%, let alone the Eurozone, more than one in four are jobless in Spain. But the main reason for the good UK jobs performance is declining labour costs – real wages fell by about 8% in the four years since Lehman’s – a post-war record. Although low pay is better than no pay, declining living standards for the average worker is not something to boast about.

Why has British economic performance been so lousy over the last five years? Low demand is a major factor. Following the deep global recession the new government in 2010 frontloaded a fiscal austerity programme which raised taxes and slashed public investment by half. Standard macro policy recommended the opposite. In very deep recessions even an ultra-loose monetary policy by the Central Bank loses effectiveness because interest rates cannot fall below zero. The demand problem exacerbated by the crisis in the Eurozone crisis which absorbs half of UK exports. Their governments were also pursuing similar tough austerity policies. Unlike the UK, however, these countries were locked into a single currency, so many had little choice. As the UK recovery collapsed, the Chancellor quietly (and thankfully) shifted from his Plan A to Plan B slowing down the pace of fiscal consolidation.

Did the recession reveal the fundamental weaknesses of the UK economy? In Warren Buffet’s phrase, did we finally discover Britons were swimming naked when the economic tide went out? Inadequate financial regulation is a glaring problem. Nevertheless, the UK economy performed well in the three decades leading up to the financial crisis, reversing a century of relative decline in per capita GDP relative to the US, Germany and France. In the “boom decade” prior to the crisis business value added per hour rose by 2.8% per annum with finance contributing only 0.4% of this – most of it came from more “boring” sectors such as business services, retail, wholesale and manufacturing. The improvements were rooted in policy changes increasing competition in labour and product markets, reforming welfare and expanding higher education. Privatisation under independent regulators, toughening competition policy, weakening union power and improving job search assistance all played a tangible part in this improvement.

Nor was public debt out of control in the pre-crisis period as it was in some countries like Greece. The enormous rise in debt to GDP ratios during the crisis was the freefall of output not the rise of debt. More should have been done to build up fiscal surpluses during the good times, but the government was not too far away from its own fiscal rules. An independent currency and the long-maturity of government bonds meant there was no rollover crisis. The markets recognised this through low yields on UK debt.

The fact that the fundamentals of the UK economy were far better than is popularly imagined should not make anyone complacent. The longer a period of low growth persists the more likely it is to become structural as the long-term unemployed lose skills and motivation. As my colleague Chris Pissarides recently pointed out, this is leading to a lost generation of young people

The real problems for the UK are inadequate long-run investment in infrastructure, innovation and human capital. The country has world-standard universities but serves the bottom third of the ability range poorly and this is reflected in high income inequality, which has risen dramatically since the late 1970s. The LSE Growth Commission highlighted that these problems reflected political short-termism with important decisions being prevaricated, delayed and reversed. The debacle over expanding South-East air capacity (Heathrow) is the most glaring example, but it is reflected also in energy policy, post-school training and numerous other areas. What Britain needs is an independent infrastructure body to recommend and deliver national infrastructure projects, as exists in countries like Australia.

Political myopia is symbolised by the fact that the nascent recovery is strongest in real estate which is being propped up by the “Help to Buy” scheme. This subsidises demand, stokes up prices in the UK’s already over-inflated housing market and stores up problems for future public debt. The UK’s problem is inadequate growth of new housing due to severe planning restrictions and a reluctance of planners to adequately compensate those who lose out from new developments. There is a need to increase supply (especially of entry-level housing) through changing planning and invest in the housing stock – the recession would have been a perfect opportunity when costs are low and resources under-utilised.

Unfortunately, short-term expediency has once again trumped long-term reform. Until this culture is changed, under-investment will persist.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

John Van Reenen is Director of the Centre for Economic Performance at the London School of Economics.

John Van Reenen is Director of the Centre for Economic Performance at the London School of Economics.