Carl Cullinane explains why a system of stepped fees and restored maintenance grants would reduce average levels of debt, and target resources at those from low-income households who need it the most, at a more moderate cost to the taxpayer.

Carl Cullinane explains why a system of stepped fees and restored maintenance grants would reduce average levels of debt, and target resources at those from low-income households who need it the most, at a more moderate cost to the taxpayer.

Since university tuition fees were introduced in 1998, the issue has become a political flashpoint for successive governments, and Theresa May’s administration has been no different. High fee levels and rising debt have become totemic for the problem of ‘intergenerational fairness’. The current generation of young people enter the workforce tens of thousands of pounds in debt, facing a labour market characterised by flatlining wages and increasing levels of precarious, low income and casualised work. The consequences of this fracturing of the social contract between generations has reignited student finance as a political issue.

While October’s announcements that tuition fees would be frozen at £9,250 and the repayment threshold increased to £25,000 will help graduates, it is becoming increasingly clear there is an appetite, both amongst the public and in Westminster, for deeper reform. There are two principles that should drive any system of higher education finance: fairness in access, and fairness in contribution. Financial barriers to young people from all backgrounds having equal opportunities to higher education should be minimised, and the costs of that education should also be borne across the population in an equitable way. While, over a period of 30 years of repayments, the current system begins to approximate fair contribution, this is not enough. Fairness must be embedded from the beginning.

Access to university

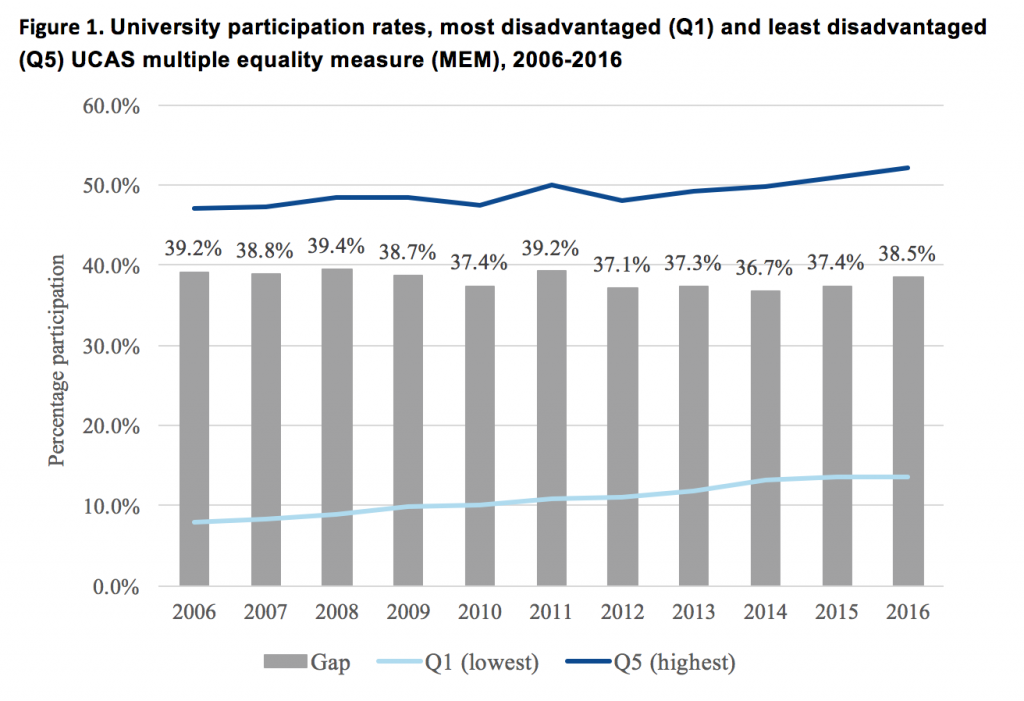

The numbers of young people going into higher education, including those from disadvantaged backgrounds, has continued to rise over the past decade, but there remains a stubborn socio-economic gap in access. The most disadvantaged remain four times less likely to attend university than their better-off counterparts, and the gap in participation rates was the same in 2016 as it was in 2006.

In the absence of experimental conditions, it is challenging to discern the role that tuition fees have played in the persistence of this gap. However recent research has demonstrated that: aversion to debt is higher among those from lower class backgrounds; this is having an effect on planned university attendance; and that the problem is getting worse. In fact, annual polling carried out by Ipsos MORI for the Sutton Trust has found that intentions to attend higher education among 11-16 year olds have been declining since £9,000 fees were introduced in 2012, reversing a long-term trend. Prospective students from low affluence families were also more likely to be worried about the cost of university (66%) compared to those from high affluence households (46%).

Those in favour of the current system frequently point to the increasing numbers of disadvantaged young people attending university as evidence there is no problem. But this has occurred in a context where student numbers overall have been increasing for some time, and universities have invested huge amounts of money in outreach to target those from disadvantaged backgrounds. And yet the gap has remained stable. If universities have to run merely to stay still, then it is a stretch to say that the system is currently working for disadvantaged young people.

Policy responses

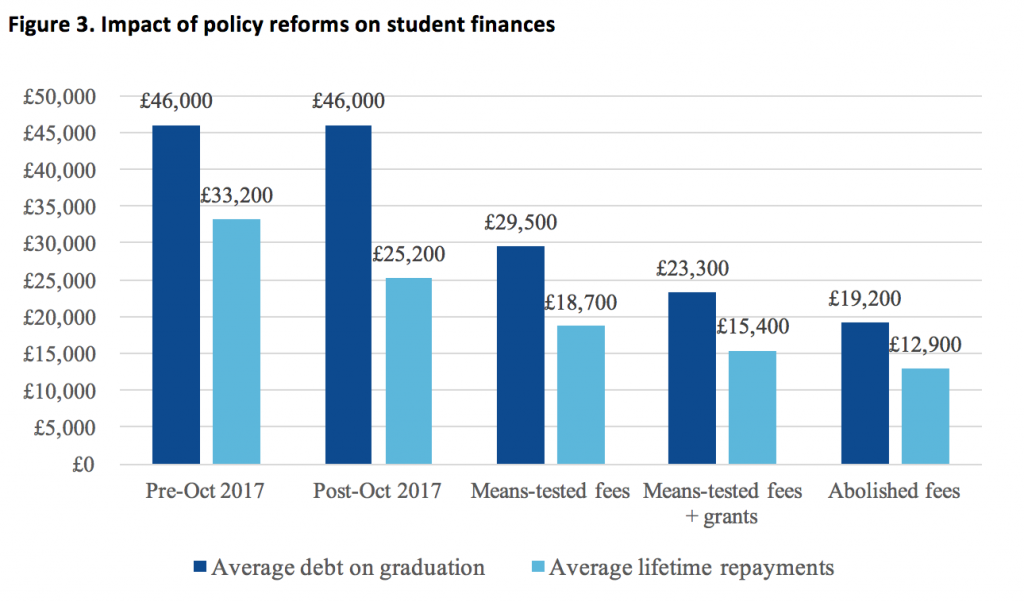

As the average debt spirals towards almost £50,000, something clearly needs to be done. The 2017 reforms, while low-key, will cost £2.9bn per cohort of students, and while saving graduates £8,000 in lifetime repayments, will mean over four fifths of them (81%) will never pay their loans back. These changes have the appearance of a short-term political sticking plaster, and fail to address the deeper issue of a system built around high debt and high levels of non-repayment.

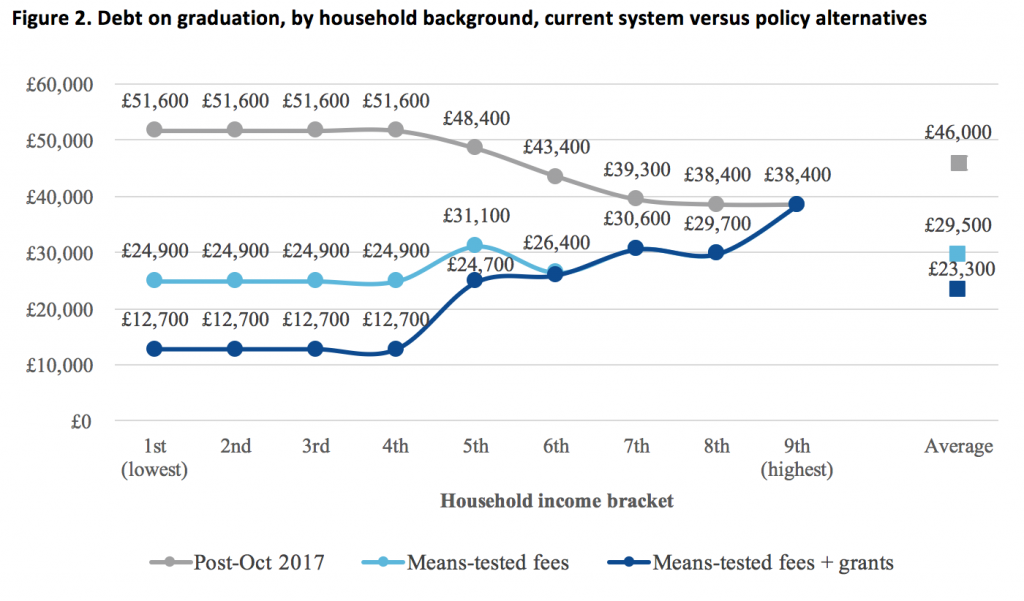

It may seem obvious, but there is a straightforward response to a system that is predicated on imposing vast amounts of debt which will never be paid back, and that is to reduce the amount of debt in the first place. Tackling levels of debt by eliminating fees entirely for those from the least well-off households, and putting in place a sliding scale for those on middle and higher incomes would have a dramatic effect on student finances. But on its own, this is not enough. As evidenced in the Diamond Review in Wales, the day-to-day costs of university are just as, if not more, important to young people. Restoring maintenance grants, abolished in 2016, should be a central element of any plan to ease the burden for those who need it most.

Analysis conducted by London Economics for the Sutton Trust shows that implementing these two measures would cut overall student debt in half from £46,000 to £23,300, and by three-quarters for the least well-off. This would mean the poorest students would no longer graduate with the most debt, and radically change the current regressive distribution of debt.

This could be achieved at a cost of up to £3.2bn, virtually the same as October’s policy change, and at a substantially lower cost to the taxpayer than full abolition of fees, which could cost over £5.5bn (including grants). It is far from clear that abolition is the most effective use of education budgets, at a time when the early years sector is struggling, and would effectively mean huge subsidies for those from the richest backgrounds.

The costs of university are currently shared between those who benefit from it most financially, and society as a whole. While this balance clearly needs to be addressed, abolishing fees would mean wider society, including many on low incomes or who never attended university, taking on the full burden.

While higher education is certainly a public good – training the doctors, nurses, lawyers and other professionals from which all of society benefits – it is also a private and positional good. That is to say, its benefits are very unevenly distributed: the career and earnings boost from attending Oxbridge is to a significant degree contingent on the fact that most people do not. Without transformational reform of higher education into a comprehensive system, the more natural approach to funding would be one of cost-sharing that reflects these differential payoffs, but one that also ensures that university education is open to young people regardless of background. Means-testing may not be a fashionable term, but, in an environment of severe economic uncertainty in the context of Brexit, it remains an important way of delivering public services progressively according to ability to pay.

A system of stepped fees and restored maintenance grants would reduce average levels of debt substantially, and target resources at those from low-income households who need it the most, at a more moderate cost to the taxpayer. This would significantly lower financial barriers to participation, while nonetheless sharing the cost between the taxpayer and those with the greatest ability to pay. If the government wishes to give young people a break, it would be one way to start.

______

Note: access the full paper on which the above draws here.

Carl Cullinane is Research and Policy Manager at the Sutton Trust, which he joined in October 2016 as Research Fellow. He previously worked as a statistician in NatCen Social Research and as a researcher in Democratic Audit UK.

Carl Cullinane is Research and Policy Manager at the Sutton Trust, which he joined in October 2016 as Research Fellow. He previously worked as a statistician in NatCen Social Research and as a researcher in Democratic Audit UK.

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science.Featured image credit: the_green_squirrel, Flickr/CC BY-NC-SA 2.0.

At the moment, you get a university place in exchange for subjecting yourself to the vagaries of the Graduate Tax. Like all taxes, it is set at whatever the Government thinks it can get away with (justified – if that’s the correct word – by fiddling with thresholds and notional interest rates). The loan gloss is to fool you into thinking that the Government is doing you a favour. David Willetts is on record (BBC Money Box) as stating that it is a tax, not a loan, but it would confuse people if this was explained to them.

It has also been pointed out that it is a regressive tax, in that you can buy your way out of it.

Now you are suggesting that it should be applied, or not applied, on the basis of your parents income. I think that is bizarre. To find that you are being taxed on the basis of your parents income twenty years ago?

As I move to a fixed mortgage with interest rate for 5 years at 1.9%, it occurs to me that my lender is still making a profit at 1.9%, so why cannot the government insist that lenders of student loans should never charge more than the best market rate (and still make a profit) rather than the 6% plus my two sons are paying.

I have not seen this simple issue broached in the media anywhere. It is independent, of course, of the issue of whether students should be paying high fees in the first place.

David Spence

Here’s a clue:

https://www.thetimes.co.uk/article/wrongful-dismissal-vg0glbsql

Here’s another clue

http://www.independent.co.uk/news/education/students-repaid-50-million-loan-repayment-student-loans-company-slc-hmrc-revenue-customs-a7962821.html

A bad idea badly executed. Trouble is, I end up with the Great British Education Paradox: all the guilty proponents and administrators have had the ‘free’ university education I believe should be preserved. . .

Oh, and if the Powers That Be can make such a spectacular lash-up of the present apparently simple system, goodness knows how they would cope with the proposals put forward above.

They’re making a net profit of 1.6% – add in the fixed costs of operating a business plus salaries etc – doesn’t appear to be the most likely business model

I disagree strongly with the premise that cost sharing is natural. Instead of devising ever more byzantine fees systems, we should simply use the general taxation system to ensure that the cost burden falls on the richest. If low income people are paying too much towards this, reduce their income tax and raise it on rich people in general. I fail to see why doctors should bear a larger burden for the university system than, say, premier league footballers.

Absolutely correct. Yes, the ‘wider society’ should take on the full burden. Income Tax is ‘fair’, Graduate Tax is not. This article tries to change this fundamental truth, but it’s just putting lipstick on the pig. Mind you, I warm to the idea of banging a 80% tax band on anyone graduating from Oxford with PPE, Geography, Classics, History, etc. (Who on earth could I be thinking of?).

Still, I look forward to the present system imploding when enough Graduate Tax-paying MPs are elected.