If global temperature increase is to be limited to 1.5oC, CO2 emissions must reach net zero in 2050, if not sooner. Consumption of oil must begin to fall in the next few years and fall substantially thereafter – far from the gentle plateauing expected by many in the industry. Gas consumption, considered by the industry to be a “growth engine”, must begin to decline by 2030. Most European oil and gas companies have responded to investor pressure by updating their emission targets, describing them as being consistent with net zero. Research shows that this is not the case. Dan Gardiner, Rory Sullivan, Simon Dietz, and Valentin Jahn say that oil and gas companies will have to go much further to genuinely claim 1.5C/net-zero alignment. For most, this is likely to require a substantial scaling back of investment in exploration and production activities, particularly for oil.

If global temperature increase is to be limited to 1.5oC, CO2 emissions must reach net zero in 2050, if not sooner. Consumption of oil must begin to fall in the next few years and fall substantially thereafter – far from the gentle plateauing expected by many in the industry. Gas consumption, considered by the industry to be a “growth engine”, must begin to decline by 2030. Most European oil and gas companies have responded to investor pressure by updating their emission targets, describing them as being consistent with net zero. Research shows that this is not the case. Dan Gardiner, Rory Sullivan, Simon Dietz, and Valentin Jahn say that oil and gas companies will have to go much further to genuinely claim 1.5C/net-zero alignment. For most, this is likely to require a substantial scaling back of investment in exploration and production activities, particularly for oil.

In October 2020, the IEA released its World Energy Outlook 2020 containing, for the first time, a chapter on net zero. It sets out, at a high level, the actions needed across society to limit emissions from the energy sector to net zero by 2050, thus ensuring the increase in global temperature does not exceed 1.5oC above pre-industrial levels. The report states: “realising the pace and scale of emissions reduction … require[s] a far-reaching set of actions”.

IEA expects to publish its full net-zero scenario, with data out to 2050, by May 2021. While the published scenario is incomplete, based on the 2030 datapoints provided, it is possible to reach some preliminary conclusions about the implications for the energy sector. The actions do not sit exclusively with the energy industry — there is an extensive discussion on the role of behavioural change in lowering demand, for example – but clearly this is where the most profound change is needed. Figure 4.5 (pg 129) of the World Energy Outlook shows that, on top of a dramatic fall in coal consumption, global consumption of both oil and gas must fall to around 3,000 Mtoe by 2030, implying gas consumption must fall by about 10% from 2019 levels and oil consumption must fall by about 34%.

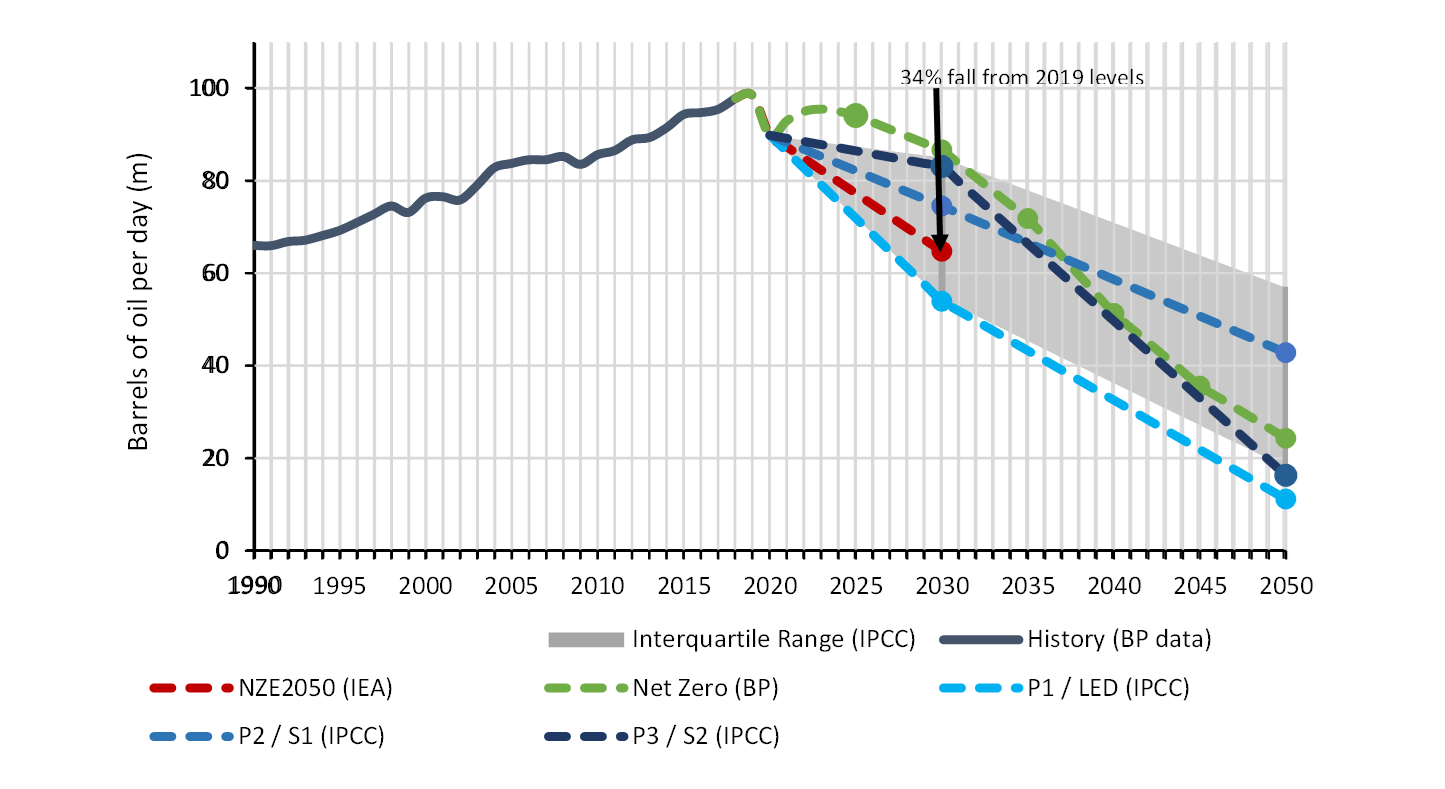

Figure 1 – Oil production/consumption trajectories consistent with a 1.5oC scenario with no or low overshoot according to the IEA, IPCC, and BP

The IEA’s estimate of the fall in oil and gas consumption needed by 2030 in a net-zero scenario is broadly consistent with other 1.5oC scenarios. The IPCC in its Special Report on 1.5oC warming set out four illustrative model pathways and their implications for reductions in oil and gas demand in both 2030 and 2050. Compared to the three pathways (P1, P2 and P3) that stipulate limited or no overshoot in global temperatures (i.e. no temporary increase beyond 1.5oC), the IEA’s 2030 estimate appears to be slightly below the middle of the range for oil (Figure 1) and above the middle of the range for gas. The data for oil are plotted in Figure 1, which presents: (a) historic trends in oil consumption (from BP’s Energy Outlook), (b) the IEA and IPCC scenarios, and (c) a net-zero scenario from BP’s Energy Outlook.

Taken together, the models suggest that, if global temperature increase is to be limited to 1.5oC, consumption of oil must begin to fall in the next few years, even from the current COVID-19 impacted levels, and continue falling thereafter. This is far from the gentle plateauing of oil demand at some point in the late 2020s expected by many in the industry. It also suggests that gas consumption, considered by the industry to be a “growth engine”, must begin to decline by 2030.

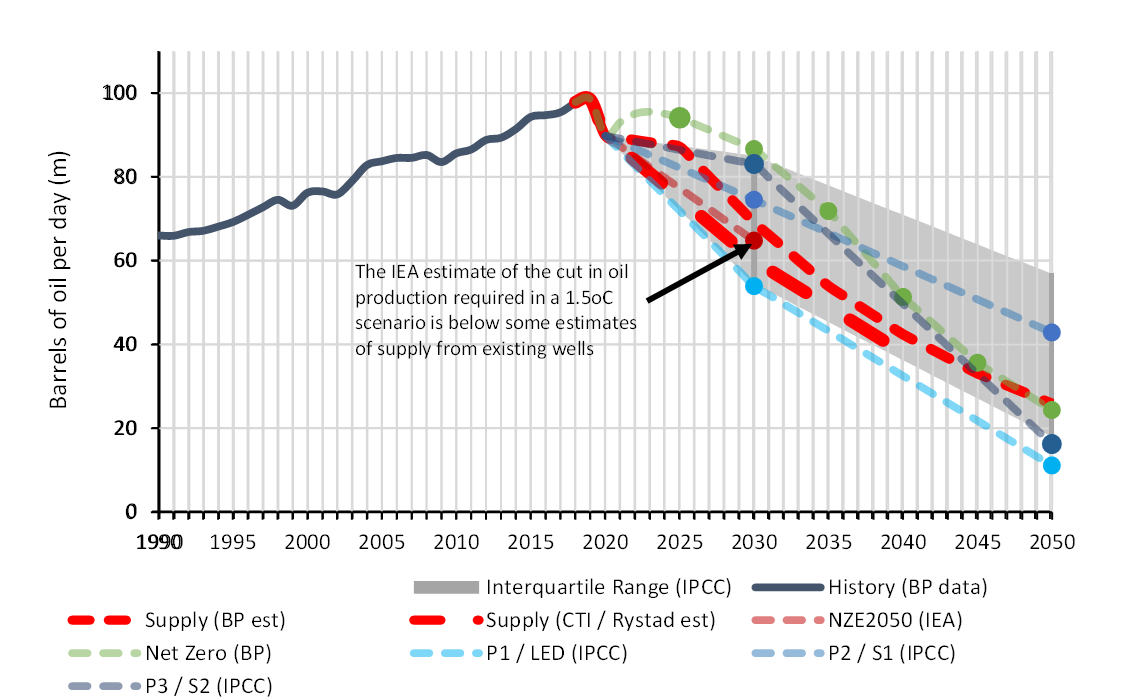

These findings have profound implications for E&P (exploration and production) businesses and the upstream divisions of integrated companies. Figure 2 compares the IEA’s trajectory with models of oil supply from existing production facilities by IEA, BP, and CTI. This analysis suggests that there is very little, if any, justification for adding new oil supply. Essentially production from existing wells is enough to meet demand in a 1.5oC scenario. An almost complete and immediate stop in exploration and sanctioning of new oil fields would therefore be required to avoid locking in future oil production that would see temperatures exceed a 1.5oC increase.

Figure 2 – Oil production/consumption trajectories consistent with a 1.5oC scenario with no or low overshoot compared to estimates of supply from existing wells from BP and CTI / Rystad

The particular significance of the IEA 1.5oC data, though, is that it is likely to be used by several organisations (e.g., the Transition Pathway Initiative (TPI), the Science-Based Targets Initiative, Carbon Tracker) to help investors assess the emission targets of oil and gas companies on behalf of investors. Against a backdrop of increasing policy momentum for 1.5oC and falling renewable/battery costs, investors are increasingly keen to minimise the transition risks to their portfolio and ensure their holdings are aligned with net zero. Climate Action 100+, an investor initiative backed by over 450 investors with a total of $52 trillion in assets under management, uses TPI and Carbon Tracker analysis to drive its engagement activities, for example.

Over the last year most European oil and gas companies have responded to investor pressure by updating their emission targets. Many have described their new ambitions as being consistent with net zero. However, analysis by the TPI based on existing IEA data concluded that none of them is, in fact, even aligned with 2oC, let alone 1.5oC. Carbon Tracker arrived at a similar conclusion. Critically most of the ambitions focus exclusively on reducing downstream emissions intensity without any commitment to lower absolute emissions or to reduce exploration and production activities.

When published in full, the IEA net-zero scenario is likely to reaffirm how much further oil and gas companies will have to go to genuinely claim net-zero alignment. They will need to lay out comprehensive strategic plans encompassing how their current intensity targets will impact absolute emissions and how they intend to align their upstream businesses and capital expenditure. For most, this is likely to require a substantial scaling back of investment in exploration and production activities, particularly for oil.

A rigorous framework will be needed to help investors assess these commitments. Over the last six months, drawing on feedback from the industry and others, a coalition of investors supported by Climate Action 100+ and co-ordinated by IIGCC has helped develop a sector-specific “net-zero standard”. This standard will build on the disclosure framework developed by Climate Action 100+ to drive its engagement activities, identifying the additional sector-specific actions oil and gas companies should undertake and the disclosure they should provide. This standard will be published in the first quarter of 2021.

With recent US elections and pledges from China, South Korea and Japan, momentum for stronger climate policies and net zero appears to be building. If we include the EU and the UK, economies accounting for roughly half of global oil and gas demand have now made some sort of commitment to net zero. Translating these commitments into action will be a huge effort, but with ever lower renewable and battery prices, delivery is now becoming technically and economically feasible. The IEA’s 2030 data confirms that there is substantial agreement between climate modellers about the implications of a net-zero policy environment for the oil and gas sector. Substantial falls in oil consumption in particular will be needed by 2030 and exploration activities should be severely curtailed. The extent and the speed of the actions required has yet to be fully communicated to investors or captured within most of the existing net-zero commitments made by the sector so far.

- This article first appeared at LSE Business Review and is based on research at the Transition Pathway Initiative (TPI), an investor-backed project at LSE’s Grantham Research Institute on Climate Change and the Environment that provides investors with data on the carbon performance and climate governance of the world’s largest listed companies.

- Featured image by ambquinn, under a Pixabay licence

Please read our comments policy before commenting

Note: The post gives the views of its authors, not the position USAPP– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: https://bit.ly/2OS1v6C

About the authors

Dan Gardiner – Transition Pathways Initiative

Dan Gardiner – Transition Pathways Initiative

Dan Gardiner is an environmental analyst at the Transition Pathways Initiative. He analyses tech/telecoms sectors for UK, European, and global investors. Dan is a director at Edison Investment Research (clean tech), and a consultant to pension fund on oil and gas sector. He has an MSc in environmental technology at Imperial College (with distinction) with battery thesis published in the Journal of Energy Storage.

Rory Sullivan – LSE Visiting Professor in Practice

Rory Sullivan – LSE Visiting Professor in Practice

Rory Sullivan is a visiting professor in practice at LSE. An internationally recognised expert on climate change, human rights, and investment, he is co-founder and director of Chronos Sustainability. He has almost 30 years’ experience in the public and private sectors on these issues, including over 15 years in investment management. He was previously a senior research fellow at the Centre for Climate Change Economics and Policy at the University of Leeds. He has advised a range of organisations – including DfiD, UNEP FI, the World Economic Forum, UNDP, the Institutional Investors Group on Climate Change, the Principles for Responsible Investment (PRI) – on the design and implementation of climate change and climate finance policy.

Simon Dietz – LSE Geography and Environment

Simon Dietz – LSE Geography and Environment

Simon Dietz is a professor of environmental policy at LSE’s Department of Geography and Environment and a co-editor of the Journal of the Association of Environmental and Resource Economists. He was co-director of LSE’s Grantham Research Institute on Climate Change and the Environment from March 31 2011 until 31 August 2017. He worked at the UK Treasury, as an economic adviser on the ‘The Stern Review on the Economics of Climate Change’. Simon holds a starred first class honours degree in environmental science from the University of East Anglia, and masters and PhD degrees from LSE, specialising in environmental policy and economics.

Valentin Jahn – Transition Pathways Initiative

Valentin Jahn – Transition Pathways Initiative

Valentin Jahn is a research assistant at the Transition Pathway Initiative. He focuses on carbon-intensive industry sectors and works on industry carbon assessment methodologies. Valentin holds a BA in philosophy and economics from Bayreuth University and an MSc in climate change, management and finance from Imperial College.