Adam Tinson analyses the combined impacts of the individual changes to the social security system which have come into force this month. He focuses on four major changes: the bedroom tax, the replacement of council tax benefit, the overall benefit cap and the uprating of out of work benefits and some elements of tax credits.

Adam Tinson analyses the combined impacts of the individual changes to the social security system which have come into force this month. He focuses on four major changes: the bedroom tax, the replacement of council tax benefit, the overall benefit cap and the uprating of out of work benefits and some elements of tax credits.

A great deal of attention has been paid to the many individual changes to social security that are taking place this month. Not known are the combined impacts – when individuals and households get hit by numerous changes. It is a notable omission that no official estimates of the overlap between different reforms have been published. Our research, published today, tries to fill that gap.

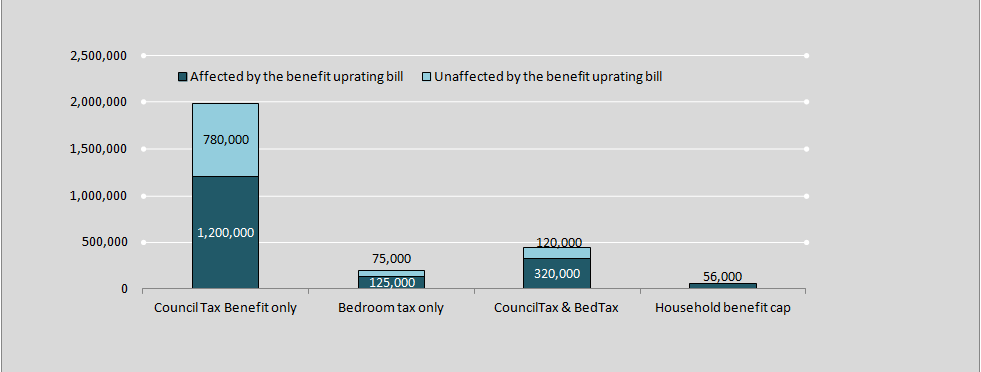

We have analysed four major changes. Three of them are “absolute” cuts: the bedroom tax; the replacement of council tax benefit by council tax support; and the overall benefit cap (which is being piloted this month, with the aim of full rollout by September). All of these will result in a reduction of the amount of money these households have to spend on everything else. Additionally, the uprating of out of work benefits and some elements of tax credits by only 1%, below the level of inflation (2.7%), will result in a cut in real terms for those families receiving such benefits.

The headline figures show that 2.6 million families are affected by at least one of the three absolute benefit cuts, and 440,000 are affected by more than one. Almost two thirds (63%) of the families affected by an absolute cut in benefit have also seen a fall in real terms to other benefits.

The biggest single group of losers from this month’s absolute cuts are those being hit by change to council tax benefit only, some 2 million families. Their average loss per week is around £2.60, but most will lose out additionally from a below-inflation increase in benefits. The smallest group to lose out are those being hit by the Household Benefit Cap: around 50,000 families. The average loss per week for these families is huge, however – some £93 per week.

Those families hit by the bedroom tax are likely to be hit by other changes as well. More than two thirds of them will also lose out through changes in council tax benefit – around 440,000 families. The average loss in weekly income for these families is £16.90, which is 20% higher than the individual bedroom tax cut. Around 320,000 of those hit by both changes, more than 7 out of 10, will also see a cut in real terms in the value of their benefits as a result of the 1% uprating.

These changes inevitably hit those on lowest incomes. 63% of those hit by any of the reforms are already in poverty, which rises to 67% of those affected by both the bedroom tax and council tax benefit changes. 75% of families hit by a single cut and 82% losing out from both are workless. Around half of the families losing out have a disabled adult, and a third of these adults receive Disability Living Allowance (DLA). Some of these families might be hit again by the transfer from DLA to the Personal Independence Payment, as 20% are expected to lose their entitlement entirely under the changes, according to the DWP Impact Assessment.

This is, of course, only part of the picture. There have been various other reforms since 2010, such as the caps on Local Housing Allowance (Housing Benefit for the private rented sector); changes to Working Tax Credits; and the abolition of the Social Fund. These will have further overlaps with this month’s changes, particularly with council tax benefit changes.

The point here is not that any reforms are bad, even if they take money away from people in poverty. But the fact that there has been no analysis from government of the overlapping effects of these changes is indicative of a poorly thought-through process. Social housing could be better allocated, benefit uprating does need a consistent principle when wages stagnate, and council tax does need reform. But this month’s changes address symptoms, not causes, leading to misery for many for no good end.

First posted on the New Statesman ‘Staggers’ blog, reproduced here with permission of the author.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Adam Tinson is a Research Analyst at the New Policy Institute. has previously worked for the Centre for Cities and Citizens Advice Northern Ireland, as well as for a member of the Northern Irish Assembly. His research background includes various aspects of social and economic policy.