Given the global environmental and societal challenges of the 21st century, the concept of sustainability is becoming increasingly important in the financial markets. It seems necessary to involve private individuals in the transition to a sustainable economy. However, investment preferences are very heterogeneous, so that investment products customised to “averaged” preferences often fail to achieve the goal of promoting sustainable investment behaviour.

What are your requirements for sustainable investments? Which industries should be avoided and which should be supported? Which behaviour patterns of companies or states are worth promoting, just acceptable or even reprehensible? Do you attach more importance to social or environmental issues? Or do you perceive both areas as equally important?

Based on a representative survey among German retail investors at the end of 2013 we empirically researched positive (inclusions) and negative (exclusions) screening preferences towards sustainable investments. Despite some widespread taboos (e.g. ‘arms and defence industry’, ‘exploitative child labour’, and ‘violation of human rights’) as well as criteria deemed necessary by the majority (e.g. ‘combating poverty’, ‘good working conditions and fair income’, and ‘respect of democracy and human rights’), screening preferences are very different and rarely coincide among the survey respondents.

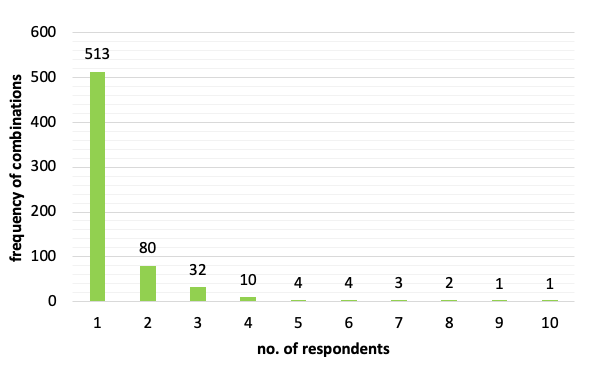

The main investigations are based on three closed questions regarding industry sectors, and companies’ as well as states’ behaviour patterns each for positive and negative screening issues. “Given a selection of 21 different sectors and industries, please mark a maximum of seven in which you believe a sustainable investment should never be made“, is an example of one of these questions. Pre-defined answering options are for instance ‘pornography’, ‘industrial cattle breeding’ or ‘nuclear power’. Figure 1 visualises the frequency of chosen combinations for a given number of respondents (from one to ten), indicating that most of the combinations were selected by rather few respondents. More than 500 different combinations were chosen by a single respondent each. This reflects investors’ widely dissimilar comprehensions regarding which industry sectors should be excluded from a sustainable investment in any case.

Figure 1. Investors’ heterogeneous screening preferences regarding reprehensible industry sectors

Even though the respondents were not requested to pick the maximum number of exclusion criteria, most of them frequently did. Therefore, their selection could be interpreted as an individuals’ minimum demand on sustainable investments, suggesting that the preferences might be even more heterogeneous than already shown. The results that emerge for the remaining five questions are comparable. German retail investors impose very heterogeneous requirements, which manifest in a diverse selection of what should be excluded from or included in sustainable investments.

Shouldn’t one think that investors with similar investment behaviour are also similar in their screening preferences? The investors pre-categorise themselves according to their actual investment behaviour into current sustainable investors and non-sustainable investors who are either generally interested in sustainable investments or who exclusively consider conventional investment criteria.

The chosen combinations (as e.g. shown in Figure 1) reflect the different opinions of the respondents regarding what should basically be taken into account or excluded from sustainable investments. In order to measure the degree of difference within and between the three investor types, we use metrics of intra-group – ‘standardised’ Shannon Entropy – and inter-group – Dissimilarity Index – heterogeneity and apply them to the emerging answers (i.e. combinations) for all the sub-questions. Results indicate that the pre-categorised investor groups are heterogeneous with very individual demands regarding sustainable investments. The intra-group heterogeneity measures (‘standardised’ Shannon Entropy) indicate that the disparity seems to be even more pronounced within than across the different investor groups, with current sustainable investors representing the most heterogeneous group. Beyond that, according to the results of the Dissimilarity Index, there is greatest agreement between the group of investors interested in sustainable investments and the conventional investor group, while the screening preferences of current sustainable and conventional investors differ most.

But how to best design a sustainable investment fund that is suitable for different screening preferences? How can sustainable investment behaviour be promoted? Our research suggests that the solution is certainly not the development of “average” investment products. It seems to be more important to aid the investor in his search for investment products which correspond best to his personal screening preferences and understanding of sustainability. Among others, support could be provided by appropriate internet platforms that allow a thorough comparison of products. We are also convinced that an adequate, individualised investment advice is necessary for most interested but uncertain investors. This would break down information barriers and correspond to the active approach of banks and fund providers demanded by most investors. This necessarily requires the anchoring of sustainability criteria within the regulation of investment advice (i.e. MiFID II).

In this context, we also question whether the distinction between “sustainable” and “non-sustainable” investment products makes sense at all. We believe it would be suitable to think in contributions to certain goals. These could, for example, be contributions towards the achievement of different objectives that form the Sustainable Development Goals.

♣♣♣

- This blog post is mainly based on the authors’ paper On the heterogeneity of sustainable and responsible investors, Journal of Sustainable Finance & Investment, Vol. 9, Iss. 4, 2019.

- The post gives the views of its author(s), not the position of LSE Business Review or the London School of Economics and Political Science.

- Featured image by geralt, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Bernhard Zwergel is a research fellow at the chair of corporate finance at the Faculty of Business Administration (University of Kassel). He studied business administration and wrote his doctoral thesis “On the Forecastability of Financial Markets” at the University of Augsburg. Currently his research interests focus the analysis of the behaviour of sustainable investors and on sustainable investments.

Bernhard Zwergel is a research fellow at the chair of corporate finance at the Faculty of Business Administration (University of Kassel). He studied business administration and wrote his doctoral thesis “On the Forecastability of Financial Markets” at the University of Augsburg. Currently his research interests focus the analysis of the behaviour of sustainable investors and on sustainable investments.

Anett Wins is a doctoral researcher at the chair of statistics, Faculty of Business and Economics, at the University of Augsburg (Germany). She got her diploma in statistics from the LMU Munich (Germany). Her research focuses on sustainable and responsible investments and data mining methods for cross-sectional data.

Anett Wins is a doctoral researcher at the chair of statistics, Faculty of Business and Economics, at the University of Augsburg (Germany). She got her diploma in statistics from the LMU Munich (Germany). Her research focuses on sustainable and responsible investments and data mining methods for cross-sectional data.

Christian Klein is professor for corporate finance at the University of Kassel. He has studied economics and management in Augsburg/Germany and Swansea/United Kingdom. As researcher, he is mainly interested in the areas of sustainable finance. Therefore, he is primarily choosing an empirical approach. He is the author of more than 25 professional papers in peer reviewed journals.

Christian Klein is professor for corporate finance at the University of Kassel. He has studied economics and management in Augsburg/Germany and Swansea/United Kingdom. As researcher, he is mainly interested in the areas of sustainable finance. Therefore, he is primarily choosing an empirical approach. He is the author of more than 25 professional papers in peer reviewed journals.