The rapid and global spread of the new coronavirus within just a few weeks is infecting the global economy. While containment of the virus and efforts to reduce the loss of life have ultimate priority, policy makers need to act quickly to contain the economic fallout. In a new paper, we study how the arrival of the new coronavirus leads to an increase in economic anxieties both through inferred patterns around Google search activity and through a survey experiment in a representative sample from the US.

The rapid and global spread of the new coronavirus within just a few weeks is infecting the global economy. While containment of the virus and efforts to reduce the loss of life have ultimate priority, policy makers need to act quickly to contain the economic fallout. In a new paper, we study how the arrival of the new coronavirus leads to an increase in economic anxieties both through inferred patterns around Google search activity and through a survey experiment in a representative sample from the US.

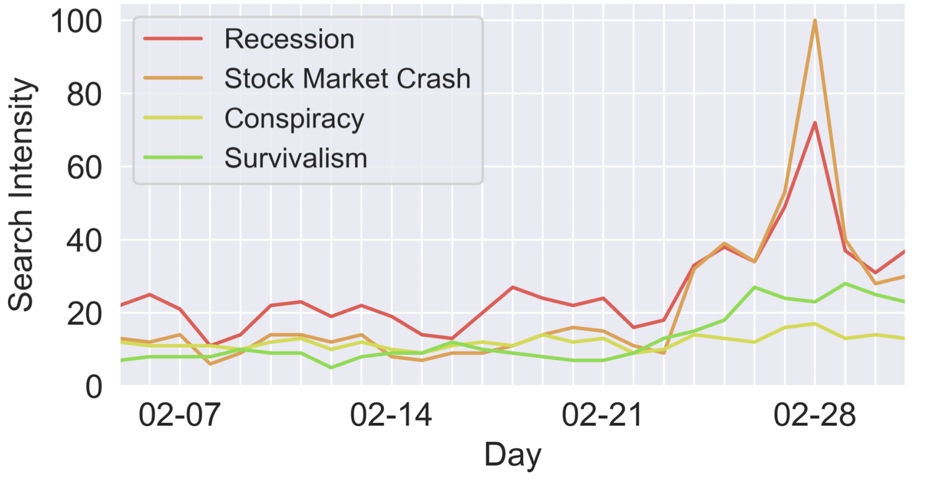

Using day-to-day Google search activity around 190 countries, the paper exploits the fast global expansion of the new coronavirus, spreading to now more than 100 countries, within a matter of a few weeks. After the arrival of the first confirmed case of coronavirus, we observe a notable and sharp increase in Google search activity around topics such as recession, survivalism and conspiracy theories. This type of search activity increases by between 20-50% relative to the period before the first coronavirus case arrived in a country.

Figure 1. Number of Google searches around recession, market crash, survivalism, and conspiracy theories

Why is Google search activity important? Why does this matter from an economic perspective?

If we study historical data on GDP growth from a large panel of countries, we observe that historically, sharp increases in search activity, in particular for the “recession topic’’, are associated with subsequently sharp contractions in growth rates – in particular, consumption growth. We find that a 100% increase in search intensity for the “recession topic’’ in a quarter vis-à-vis the country-specific average intensity is associated with a 1.5 percentage points lower growth in consumption or a 1 percentage point lower growth in real GDP in the subsequent quarter.

What may lie behind these economic anxieties? And how can the economic fallout be limited? To shed some light on this, we conduct an online survey experiment in a nationally representative sample with around 1000 participants from the US on March 4th.

Through an online survey experiment conducted in partnership with Luc.id in a representative sample of the US population, we shed light on the underlying mechanisms through which the new coronavirus may be driving economic anxieties.

We elicit peoples’ beliefs about both the case mortality and its contagiousness (R0) and contrast this with what the medical literature has documented so far. The WHO recently estimated that the mortality of Covid19 disease triggered by the new coronavirus is around 3.4%. Earlier estimates were closer to 2%. The contagiousness R0 was estimated around 2.

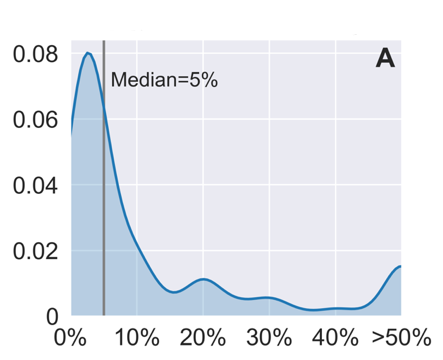

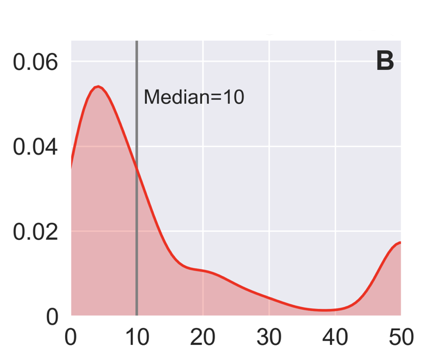

Empirically, the beliefs about mortality are quite heterogenous. More than 50% of respondents think mortality is higher than 5% (average at 19%). This seems substantially higher than what the medical literature on the new coronavirus suggests to date. The beliefs about contagiousness are also heterogenous, with 50% of respondents thinking that every infected person infects at least 10 others. The average is substantially higher with 43. Early medical research suggest an R0, i.e., contagion rate, of around 2 (see here or here).

Figure 2A. Beliefs about mortality

Figure 2B. Beliefs about contagiousness (R0)

Notes: Figure (A) and (B) plot the distribution of beliefs about mortality and contagiousness (R0) of the new coronavirus as measured in a representative sample (N=915) of the US population on 4 March 2020. Source: “Perceptions of Coronavirus Mortality and Contagiousness Weaken Economic Sentiment”.

When asking people about their economic anxieties the group of people that seem to be overestimating the contagiousness and the mortality seem to exhibit significantly higher degrees of anxiety about the disease. If such anxieties and beliefs change the way people behave and interact, it may itself be effective in reducing the further spread of the disease. Yet, it could also increase anxieties further.

A natural question to governments, and decision makers across the globe is how the economic fallout from the new coronavirus can be contained. The media may be playing a very important role in shaping how people perceive the underlying risks. Through an experiment, we randomly expose a subset of the respondents with information comparing the estimated mortality of the new coronavirus with that of the regular seasonal flu. Another subset of people were given a comparison of the mortality estimates with to that of SARS.

Framing the new coronavirus in terms of mortality similar to that of the flu vastly increases economic anxieties. This highlights that the way the press is conveying information about the new coronavirus may matter a lot in shaping the economic crisis that is to come.

The role that information plays is key. Yet, the last decade has seen a steady erosion of trust in institutions and traditional media, with social media often facilitating the spread of fake news – often times politically engineered. This may undermine the public sector’s ability to effectively communicate with citizens and exacerbate the fallout. Nevertheless, it is imperative that governments aim for clear communication explaining specific actions and measures.

As for the likely economic fallout, the Google search patterns, along with the historical association between Google activity and subsequent growth suggests that a dramatic slowdown in growth is very likely. This puts specific emphasis on governments to develop measures easing the likely economic pressures that firms and consumers will soon be under.

♣♣♣

Notes:

- This blog post is based on “Perceptions of Coronavirus Mortality and Contagiousness Weaken Economic Sentiment“.

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by panos13121, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Thiemo Fetzer is an assistant professor of economics at the University of Warwick and a research associate at the Centre for Competitive Advantage in the Global Economy (CAGE.)

Thiemo Fetzer is an assistant professor of economics at the University of Warwick and a research associate at the Centre for Competitive Advantage in the Global Economy (CAGE.)

Lukas Hensel is a postdoctoral research fellow in the Mind and Behaviour Group (University of Oxford’s Blavatnik School of Government). His research interests lie in the areas of political economy, labour economics, and development economics.

Lukas Hensel is a postdoctoral research fellow in the Mind and Behaviour Group (University of Oxford’s Blavatnik School of Government). His research interests lie in the areas of political economy, labour economics, and development economics.

Christopher Roth is an assistant professor at the University of Warwick’s department of economics. His research interests are: beliefs, psychology and economics, political economy, and macro expectations.

Christopher Roth is an assistant professor at the University of Warwick’s department of economics. His research interests are: beliefs, psychology and economics, political economy, and macro expectations.

Figure 1 does not seem to be uploaded

Thanks for the heads up, Muhammad. I could see it from one browser but not from two others, so I just uploaded it again in a different format and it seems to be working now. Please let me know if you still can’t see it. – Helena