Green bitcoin has been proposed as a way to counter the excessive energy consumption and CO2 emissions of cryptocurrencies. However, Martin C.W. Walker writes that the whole idea that you can create a green type of bitcoin that would work alongside non-green ones is hard to maintain. That would mean ignoring the way the cryptocurrency “mining” system works. He finds a potential solution in a joke white paper by an author purporting to be Natoshi Sakamoto’s wife: a single ordinary server to process the same volume of transactions as the entire bitcoin network.

“Celebrity investor” Kevin O’Leary, a former would-be prime minister of Canada, recently provided CNBC with a startling vision of the future of bitcoin, the world’s most valuable cryptocurrency. “I see, over the next year or two, two kinds of coin: blood coin from China, (and) clean coin mined sustainably in countries that use hydroelectricity, not coal.” Various cryptocurrency firms are already working to fulfil the desire for ‘green bitcoin as opposed to a “blood bitcoin.” Cryptocurrency miner Argo Blockchain plans to create the world’s first mining pool for the creation of bitcoin that is powered exclusively by renewal energy. It aims to do this by making use of the “abundant” solar and wind power in Texas.

Though bitcoin has been criticised for many things over the years, including facilitating crime and operating as a giant Ponzi scheme, the price has increased so fast recently that it is increasingly hard for the conventional financial sector to ignore it. However, the excessive energy consumption and CO2 emissions of bitcoin are a major concern for investment managers under increasing pressure to demonstrate they follow environmental, social and governance (ESG) principles. Rather alarmingly for investors, increasing bitcoin prices lead directly to increased pollution, even if the volume of transactions remains the same. Since the world entered a new cryptocurrency bubble in May 2020, the ballooning price of bitcoin has led to doubling of energy consumption by the bitcoin network.

Leading cryptocurrencies such as bitcoin, ethereum, litecoin and dogecoin use a form of transaction processing (normally referred to as “mining”) that involves an energy-hungry technique called “proof of work”, which incentivises greater energy consumption as prices rise. This has reached the point where each individual bitcoin transaction uses the same amount of electricity as 778,988 credit card transactions (with the same carbon footprint as processing 1,218,903 transactions). Argo Blockchain’s plans for green bitcoin could prove attractive to institutional investors, and their money is essential to keep the crypto bubble inflated, if not growing, since cryptocurrencies do not generate any real-world value and rely entirely on “new money” from investors to pay off old investors cashing out.

An alternative view on green bitcoin (if not green crypto in general) has come from a recently formed body called the Crypto Climate Accord (CCA), founded by cryptocurrency firms, renewable energy producers, and even a crypto friendly environmentalist group. The CCA claims it can make all crypto “greener” through a combination of technology improvements in cryptocurrency mining, using 100% renewable energy and “open-source technology to measure and report—on a completely anonymous basis—how much mining is green”. They reject the whole idea of green versus non-green bitcoin. “The solution to making crypto green is not to mark individual tokens as green or not green. We want cryptocurrencies like BTC and ETH to remain 100% fungible. This is one of the primary benefits of crypto.”

So which model is most plausible? To evaluate whether distinctly green bitcoin can be produced requires a correct understanding of “mining”. Mining is not simply the process of creating new bitcoins; fundamentally, it is the process of validating and settling bitcoin transactions by updating the bitcoin ledger. New bitcoins are created to incentivise people to “mine”. The inventor of bitcoin described the processing in his whitepaper.

- New transactions are broadcast to all nodes [miner].

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

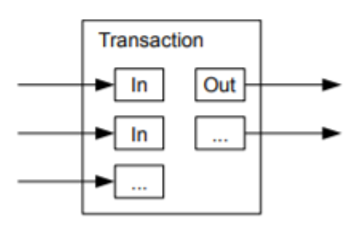

Put simply, it does not matter how clean the creation of an individual bitcoin is. The moment it gets used in transactions, it will be processed by all miners attempting to solve the “proof-of-work” calculation first, regardless of how their electricity is generated or where they are located. Any green bitcoin would rapidly become covered in soot or blood, depending on your preferred metaphor. Things get even messier if the green bitcoins are transferred to people and exchanges who do not segregate them into specific “addresses”. Bitcoin payments are generated from their holder’s wallets, using what is called the unspent transaction output (UTXO) model (see diagram).

Figure 1. Unspent transaction output (UTXO) model

Source: xxxxxxxxx

The bitcoin ledger does not keep a record of account balances. It maintains an ever-growing list of transactions received and made, including the entire chain of payments that made up a payment, back to when the coins were originally generated. Put very simply, green bitcoins would very quickly get blended with dirtier bitcoins. Green bitcoins simply do not make sense, unless another branch or clone of bitcoin is created that only has green bitcoins, but that would require centralised control of who could mine. And, like all new versions of bitcoin, the coins would only be worth a small proportion of the value (if anything) of “real” bitcoins.

Do the ideas of the CCA make any more sense? Using “open source” technology, whether based on a blockchain or not, to measure what type of energy miners claim to use, sadly falls for a classic error of blockchain fans, the garbage in-garbage out (GIGO) problem. Simply recording data on a blockchain or any computer system does not mean it is complete or accurate. Current methods of determining the type of energy used by miners rely on questionnaires sent to miners or analysis of sources of energy in the location where mining took place. CCA’s idea has no real chance of improving the accuracy of data, let alone changing behaviour.

Simply aspiring for miners to use more renewable energy is also likely to have negligible impact. Miners use whatever is the cheapest and most reliable source of electricity they can find. Finally switching to more energy-efficient forms of mining again seems rather more aspirational that a solid plan. Over the course of several years, bitcoin miners have blocked any significant change in the technology used in bitcoin because it was not in their interest. For six years, Ethereum, the second most valuable cryptocurrency, has been attempting to move to a more energy-efficient process called proof of stake.

The decentralised nature of cryptocurrency (or at least lack of clear accountability), combined with the incentive and technical models designed by Satoshi Nakamoto, make the concept of green bitcoin close to impossible to achieve in any practical way, though there is the scope for reducing the damage from smaller and more centralised cryptocurrencies. Even a cryptocurrency that is entirely mined using renewables may still have a major carbon footprint because of the CO2 produced in creating mining hardware and the displacement of other industries that use less renewables because cryptocurrency is using a greater share. The CCA looks in many ways like the worst type of greenwashing and their desire to keep crypto “fungible” is primarily in the interests of “big crypto”.

There is, however, one simple solution for reducing bitcoin energy consumption. Three years ago, a white paper was posted on the internet called “Centralised Bitcoin: A Secure and High-Performance Electronic Cash System” by an author called Nancy Nakamoto, who claims to be the widow of Satoshi Nakamoto and suggests her system would reduce bitcoin energy consumption by “99.9999999947853%”. Though the paper is obviously a joke, the suggestion that a single ordinary server could process the same volume of transactions as the entire bitcoin network is entirely true. If a cryptocurrency intentionally designed as a joke, such as dogecoin, can achieve a valuation of $50 billion, then perhaps a joke scientific paper can identify a less damaging way for people to play fantasy finance.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), and do not necessarily represent those of LSE Business Review or The London School of Economics and Political Science.

- Featured image by Executium on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Great article. I understand the importance of green energy, but I think people should be more concerned about the energy that is providing power for all these electric cars that are being produced.

Great article! Most academicians discuss about Bitcoin’s high energy cost per transaction, which is misleading. It is during the mining process that majority of the energy consumption happens. The energy required to validate blocks is minimal. Simply looking at BTC’s total energy draw and dividing that by the number of transactions is misleading. Also, energy consumption is not similar to carbon emissions.