Cryptocurrencies raise many potential problems for social inclusion. Thomas Kalafatis and Richard Nesbitt examine whether newer forms of cryptographically enhanced commerce, and more specifically central bank digital currencies, can address the issue. Their framework for contrasting currency features helps them consider issues of inclusiveness and glean some possible answers to the many questions that have been raised.

In a previous article, we posed the question, “Will cryptographically enhanced commerce (CEC) improve or compromise inclusivity within organisations and societies?” Our proposition was that the various private forms of cryptocurrencies and cryptographically enhanced commerce raise a number of issues and problems which may in fact be no fairer than the current system of currencies, cash, and markets. We specifically pointed out the following issues with current forms of CEC from private providers:

Control. It is likely that some private parties will seek to control these cryptographically enhanced commerce processes.

Concentration. It may be that CEC is as prone to concentration and lack of an inclusiveness as our current systems and is a self-re-enforcing loop.

Taxation. Authorities are often unable to collect revenues from the new CEC industry, which means that the burden of public spending falls on a smaller base of those in traditional activities who end up subsidising their very own displacement by the new untaxed industries who benefit.

Negative externalities. There may be just as many unpriced negative externalities in the CEC world as there are in the existing world of finance and business.

Regulation. Regulators are not yet able to protect the public as they do not have the laws, technology, or geographic footprint to cope with a new borderless industry.

This article will examine whether newer forms of CEC can address the issue of deteriorating inclusiveness. One specific form that is receiving much attention is called central bank digital currency (CBDC). In fact, on March 9, 2022 President Biden signed an executive order designed for “the responsible development of digital assets”. The executive order requires research and development (R&D) into whether a US CBDC would be in the national interest.

What is currency?

A properly functioning currency has a number of key characteristics. It can be physical (notes and coins), or it can be virtual. It can be fiat (by order of a central bank) or in a decentralised virtual form (created by code and the co-operation of citizens). These characteristics are only relevant to the extent they influence the degree of utility within those functional characteristics:

Acceptability (network adoption). The usefulness of a currency increases with the size of its user base. A currency with two users has less utility than one with two billion.

Uniformity/fungibility. A currency has individual units that are interchangeable with other units and each of whose parts is indistinguishable from any other. This allows any unit of currency to be utilised for a purchase or other use.

Anonymity. As any unit of a fungible currency can be used the same way, a fully fungible currency can therefore be used by anyone and is not tied to who the user is or how the user spends it.

Sponsor. The underlying creditworthiness of a currency. Historically, currencies could be backed by physical gold or other precious metals held at a central bank. In modern times, fiat currency is backed by the creditworthiness of a sovereign country. Virtual cryptocurrencies have a variety of structures but rely heavily on supply and demand to determine their value.

Limited supply (through cryptographic enhancement and the money creation process). The issuer of a currency needs to limit supply to ensure that scarcity creates value. There needs to be some measure of protection from forgery or false manufacture. Cryptography has enabled vast quantities of virtual commerce from capital markets to our ATMs to move beyond serial numbers on bank notes.

Portability. The currency allows for ease of carry and movement without obstruction.

Divisibility. Into smaller units, which reduces transaction costs and risks.

Durability. The currency as a store of value needs to be relatively long-lasting and safe from wear and tear

The different forms of currency which can affect functions are listed here:

- Fiat currencies are the banknotes in our pocketbooks backed by the full faith and credit of the sovereign or nation state. They have utility because the state mandates it through the monopoly of the state currency for the payment of taxes.

- Cryptocurrencies. Bitcoin and other forms of cryptocurrency do not possess many of the essential qualities of a currency (sponsorship and durability). However, they have become an asset class which represents a significant store of value.

- Stablecoins are a derivation of traditional cryptocurrencies such as Bitcoin and Ethereum, intended to track the value of an underlying asset. This is theoretically achieved through the exchange of fiat currency to a third-party private issuer in exchange for a unit of stablecoin. If properly structured, the stablecoin tracks the underlying value of the reference asset. In a simple case, one stablecoin could equal one US dollar. The issuer of the stablecoin would hold deposits in US dollars equal to the amount of digital stablecoins that are outstanding. In a stablecoin world, the underlying asset could be any other asset but would usually have an observable market price. A stablecoin can be based on gold, a barrel of oil, or platinum, just to name a few. Examples of stablecoins include Tether and USDC. In these cases, the Issuers are independent organisations, and they have varying qualities of cryptographic techniques.

- Central bank digital currencies are a subset of stablecoins which are issued solely by central banks. It is a liability of the central bank that is in a digital form. But do we not already hold our money in a digital form at our bank or various online payment processors? That is correct, but a CDC is a direct obligation of the central bank (as is cash) and holders would not need a bank as an intermediary to own the digital cash. If you hold deposits at a commercial bank, that is always subject to credit risk if the bank were to default. CBDC is a direct obligation of the central bank and would not have that intermediary credit risk.

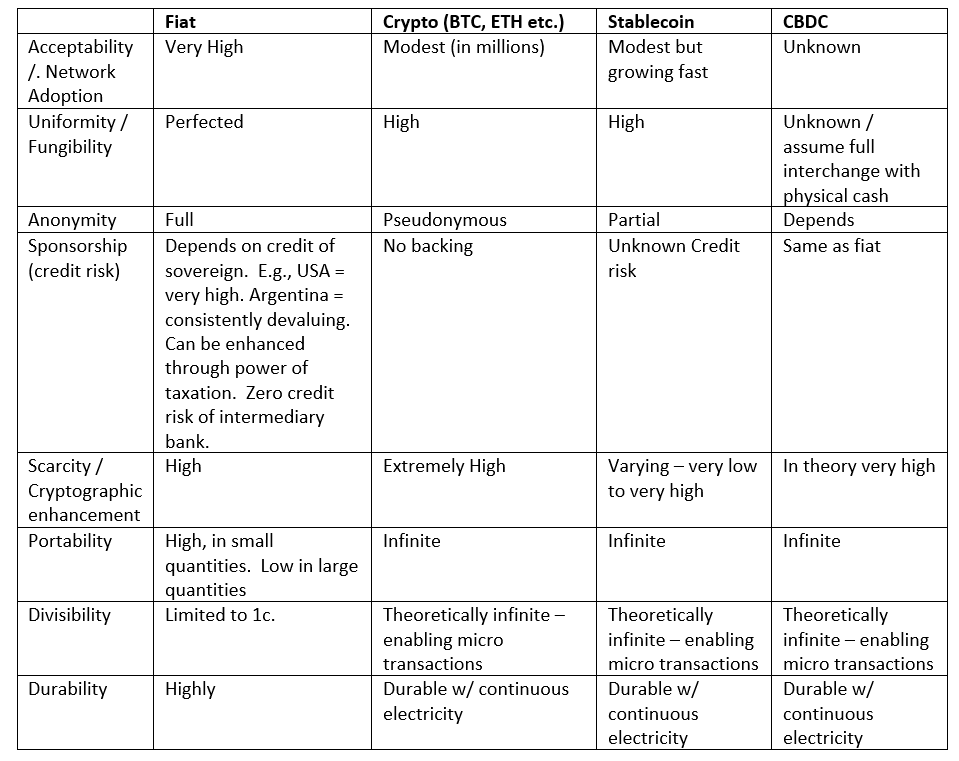

Table 1. Characteristics of different forms of cryptocurrencies

This framework, therefore, lets us contrast currencies across forms and characteristics. You may ask yourself, why bother with any of this? In many first-world countries, it may seem like a lot of work when we already have stable currencies, banking systems, and central banks. But most people do not live in the first world. Would a resident in a war zone prefer holding US dollars or Russian rubles? What if they could own a tether or a digital yuan? To the extent that portability has elevated value to those in the war zone, the benefits of digital currencies are obvious.

Why not just use a stablecoin?

Stablecoins can theoretically be used to purchase items. Both the buyer and the seller must be confident in the underlying value of the reference asset that is held in safekeeping. Therein lies the problem. Who is holding the underlying assets poses all sorts of risks, from the creditworthiness of the holder to the operational risk of actually realising on the value of these assets. Furthermore, if the underlying asset is not as clearly defined and secure as in the case of US dollars or gold, then there is uncertainty about the value of the reference asset itself. If the underlying asset is lent or deposited with third parties, then this raises further risk issues that the stablecoin holder has little control over. To solve the problem of the inherent credit and operational risk of stablecoins, you could envision a world where the underlying assets are deposited and held at the central bank. The private stablecoin would function almost identically to CBDC.

Why would a central bank want to outsource their provision of CBDC to any private enterprise? Two hundred years ago, commercial banks printed their own money, which was used widely in the economy. However, this practice has long since disappeared in developed economies, as impractical and uneconomic. Long ago considered a traditional “natural monopoly”, central bank issuers are the sole source of fiat currency today in physical and digital form. This is seen as necessary to maintain control over national monetary policy. Despite these issues, stablecoins have grown rapidly. From October 2020 to October 2021, the total value of stablecoin assets grew by roughly 495%.

China’s e-CNY

China is the furthest along in the development of a central bank digital currency and offers a glimpse into its potential. Since 2014, China has been moving towards its own CBDC, referred to as e-CNY. The digital currency has been rolled out on a city-by-city basis. The authorities have used interesting vehicles such as lotteries to get the e-CNY into users’ hands. In 2022, large online retailers such as WeChat and Alipay have taken steps to begin to accept the digital cash as payments on their websites. However, the challenge of rolling out an e-CNY is that it requires users to set up an account in a separate application in addition to the one they already have linked to their commercial bank payment methodology.

Some results of their work so far:

- The e-CNY has been used to conduct 62 billion yuan ($9.7 billion) in transactions as of the end of October 2021.

- By then, 140 million people had opened wallets for the e-CNY.

- Over 1.5 million merchants could accept payments using e-CNY wallets.

- 10 million corporate accounts have been created.

Yet, despite strong sponsorship from the central authorities and adoption in some centres, it is still uncertain when China will roll out the e-CNY nationally or if it will be available to international users.

Enhancing financial system inclusivity

Our framework for contrasting currency features helps us consider issues of inclusiveness and glean some possible answers to the questions posed at the outset of this article.

Control. By definition, CBDC is controlled by the central bank of the nation that creates them. This control is as legitimate as the country’s government itself. Sponsorship and accessibility, therefore, become key features of CBDCs.

Concentration. CBDCs are concentrated by one entity—the central bank. If fairness and inclusion is a priority, then much can be accomplished by chosen policies.

Taxation. CBDCs are by definition an instrument of the central bank. Its power is given by the central government in the country. Taxation authorities would be directly connected into this process, and we assume would collect their desired tax revenue.

Regulation. Similar to taxation, regulators will be fully in the loop on CBDC development, and their needs will be a priority in many cases. This may or may not improve inclusiveness in our societies, depending on what purpose the central authorities use regulation to accomplish. For example, is regulation used to track legitimate consumer transactions as a source of revenue or to eliminate the illegitimate transactions of criminals? Put simply, will anonymity features become a feature or a software bug?

Negative externalities. While these will undoubtedly exist, the issue of using massive amounts of electrical power to “mine” crypto currencies is largely avoided by CBDC.

As you can see CBDC has the possibility of addressing many shortcomings of private crypto instruments. Remember, though, this all comes at a cost to the original purpose of the private instruments. These trade-offs and choices made in the creation of CBDC may or may not be better to promote fairness and inclusion in our societies. But to achieve benefits we must answer the many questions on the structure of CBDC:

- Will CBDC preserve the privacy we currently enjoy from fiat currency, or will privacy be sacrificed to obtain other benefits?

- Will central banks seek to preserve the deposit-gathering monopoly of the commercial banks, including deposit insurance, by imposing limits on CBDC holdings and punitive interest on large holdings?

- What about the people a) Who do not have a bank account or b) Do not have a smart phone? How do they participate in CBDC or any of these developments?

- Will governments seek more control in what geographic region physical currencies can be used forcing most cross-border transactions to CBDC? Will they reduce the currency range and size, for example eliminating $50 and $100 bills?

These are just a few of the issues that central banks are pondering now. Do not expect a quick resolution to these and other questions. However, we have seen that CBDC has the potential for improving fairness and inclusiveness for legitimate participants in our economies. To realise these benefits, it is important that the work continues.

♣♣♣

Notes:

- This blog post represents the views of its author(s), not necessarily those of LSE Business Review or the London School of Economics and Political Science.

- Featured image by Kanchanara on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.