The ECB recently announced that its quantitative easing programme will stop at the end of 2018. Corrado Macchiarelli and Mara Monti write that the way this decision is managed will be crucial for avoiding potential market disruptions in the eurozone. However, the key long-term concern will be achieving political consensus in the coming years given the challenge posed by the rise of populist parties and declining support for the EU’s institutions.

The ECB recently announced that its quantitative easing programme will stop at the end of 2018. Corrado Macchiarelli and Mara Monti write that the way this decision is managed will be crucial for avoiding potential market disruptions in the eurozone. However, the key long-term concern will be achieving political consensus in the coming years given the challenge posed by the rise of populist parties and declining support for the EU’s institutions.

Quantitative easing (QE) has been the monetary policy innovation tool of the 21st century. With the global economic recovery now seemingly robust, the challenge facing policymakers is how to reverse this exceptional monetary policy stimulus. The Fed has already started, whereas the ECB recently announced that its quantitative easing programme will stop at the end of 2018 given the eurozone’s recovery in growth and inflation is expected to continue. The way this decision is managed will be crucial for avoiding potential market disruptions in the eurozone and, in particular, in the periphery via a widening of spreads.

Since the collapse of Lehman Brothers, central banks have bought 14.2 trillion dollars of financial assets overall, mostly sovereign bonds. This has been the biggest and fastest accumulation of assets since the beginning of the financial crisis, but now that a post-QE era has started, greater uncertainty is mounting. Generally speaking, the end of QE constitutes a tightening of financial conditions. In a recent note to the European Parliament, we underlined the crucial role played by the ECB’s collateral policy in the financial system as a mean of increasing the flow of money from where it is currently being held to where it is most needed. In this way, the collateral acts like a lubrication for the financial system.

The ECB’s collateral frameworks played an important role in defining what was considered a safe asset before the crisis. The 2008 financial crisis and the adoption by the ECB of non-standard measures led to a revision of the collateral framework, with a widening of the balance sheet of the Eurosystem, reflecting the growing amount of assets accepted as collateral. At the same time, some haircuts were increased to ensure the ECB against the greater liquidity risk and greater price volatility of these newly admitted debt securities, suggesting that the riskiness of the collateral underlying the ECB’s liquidity operations did not necessarily increase much during those phases.

Not only had the ECB taken into account preempting measures in line with changes in the risks underlying the refinancing operations, but it had also increased its exposure against potentially larger benefits (i.e. liquidity considerations). As discussed in the note, the arguments for protecting the ECB against losses via higher average haircuts, particularly during acute phases of the business cycle, clearly exist. It is important, however, that borrowing from the central bank is not done on highly unattractive terms, or in a way in which haircuts become evidently pro-cyclical.

The importance of collateral as an instrument for monetary policy has increased in recent years not only in the light of the aforementioned changes in the collateral framework to cope with financially distressed sovereigns and banks post-2010, but also due to the progressive replacement of the unsecured money market segment with the secured one: based on the Euro Area Money Market Survey 2015 (the last year for which the survey is available), the proportion of the secured market segments over the total money market transactions moved from 50% in 2003, to 90% in 2015. Both aspects are set to have consequences for collateral availability and the scarcity of high-quality assets, particularly as these interact with non-standard monetary policy, such as the ECB’s Expanded Asset Purchase Programme (EAPP).

In the note, we looked for evidence in the ECB’s EAPP effects through the quantity of collateral, i.e. the number of eligible assets by type and issuers, and its quality, as captured by the distribution of the haircuts across asset types and issuers, based on the detailed Eurosystem Collateral Data. On the public purchase side, in particular, we find sovereign bonds’ haircuts have not returned to what was observed back in 2010. The distribution has shifted slightly overall mainly due to some large haircuts related to particular issuers. There could be signs of a restrictive revision of the haircut policy preempting a ‘normalisation’ phase of monetary policy.

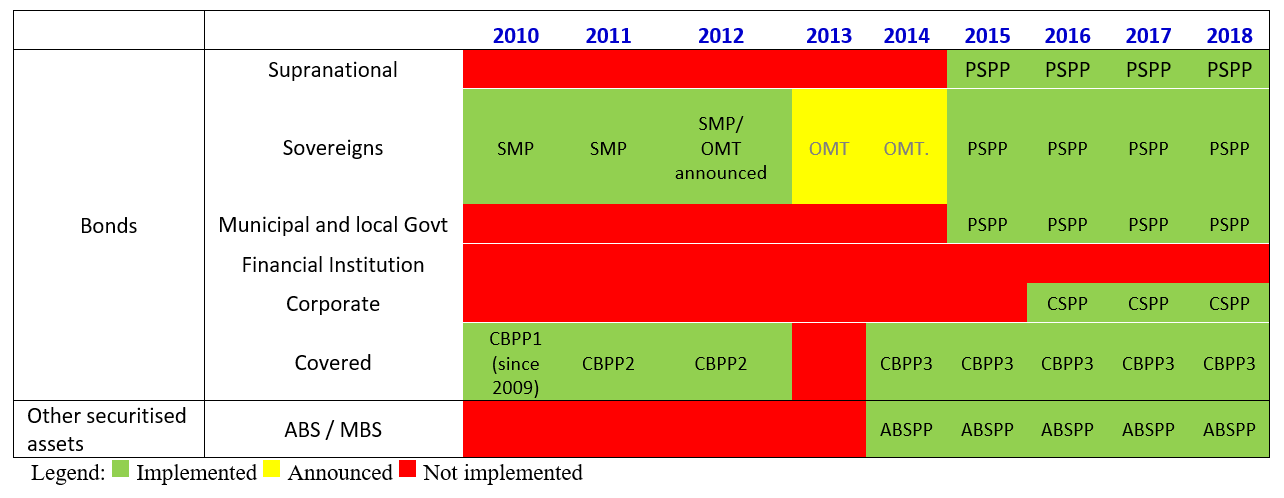

As a result of the EAPP, the spreads of all asset classes have shrunk except for bank bonds as they are excluded from the ECB purchase programme (as shown in Table 1). The haircut distribution on these asset classes has continued to shift considerably as a whole after 2014, suggesting further increases in the average haircut for this whole asset class, and possibly signalling market fragmentation.

Table 1: Introduction of different measures as part of the Expanded Asset Purchase Programme

Note: The Eurosystem started to buy corporate sector bonds under the corporate sector purchase programme (CSPP) on 8 June 2016. On 9 March 2015, the Eurosystem started to buy public sector securities under the public sector purchase programme (PSPP). The asset-backed securities purchase programme (ABSPP) started on 21 November 2014. On 10 May 2010, the central banks of the Eurosystem started purchasing securities in the context of the Securities Markets Programme (SMP). Following a Governing Council decision on 6 September 2012 to initiate outright monetary transactions, the SMP was terminated. It is assumed in the Table the OMTs announcement is long-lived, owing to the permanent availability of the ECB to use it if warranted. On 2 July 2009, the Eurosystem launched its first covered bond purchase programme (CBPP1). The programme ended, as planned, on 30 June 2010 when it reached the announced nominal amount of €60 billion. In November 2011, the Eurosystem launched a second covered bond purchase programme (CBPP2). The programme ended, as planned, on 31 October 2012 when it reached a nominal amount of €16.4 billion. Source: Based on the ECB’s explanation of its Expanded Asset Purchase Programme

Now that the European Central Bank has communicated its plans to wind up the bond-buying programme at the end of this year, the question remains of whether and how financial markets will cope with the lack of excess demand coming from the ECB’s EAPP. This might release some government debt but risk creating a dual market for collateral between core and periphery. In this respect, the possibility for the ECB to extend monetary policy beyond the conventional if warranted, as announced by the ECB President recently, will be crucial, at least in the short term.

In the medium and long-term, however, the completion of a Banking and Capital Market Union will be of paramount importance to avoid future high haircuts or the scarcity of safe assets affecting the ability of banks in the periphery to shift to secured funding. With the new populist governments in Europe, in particular in Italy and Austria, and cold sentiments towards European institutions being on the rise in some countries, achieving a political consensus towards greater solidarity will represent the biggest challenge for Europe as it aims to safeguard its very nature and deliver on economic and financial stability in the future.

Please read our comments policy before commenting.

Note: This article first appeared at our sister site, LSE Brexit. It gives the views of the authors, not the position of EUROPP – European Politics and Policy or the London School of Economics. Featured image credit: Ralf St. (CC BY-ND 2.0)

_________________________________

Corrado Macchiarelli – Brunel University London / LSE

Corrado Macchiarelli – Brunel University London / LSE

Corrado Macchiarelli is a Lecturer at Brunel and a Visiting Fellow in European Political Economy at the LSE European Institute.

–

Mara Monti – LSE

Mara Monti – LSE

Mara Monti is Visiting Fellow at the LSE’s European Institute and a journalist at Il Sole 24 Ore, Italy’s leading financial/economic newspaper, based in Milan.