It may not be possible to change centuries-old spatial distributions of economic activity, argue William F. Maloney and Felipe Valencia Caicedo.

It may not be possible to change centuries-old spatial distributions of economic activity, argue William F. Maloney and Felipe Valencia Caicedo.

Does economic fortune persist in the long run? This question has been the object of intense research; while some studies find a reversal at the national level for colonised countries (Acemoglu, Johnson and Robinson 2002) others show that fortune has largely persisted for thousands of years (Comin et al. 2010; Ashraf and Galor, 2013), especially in terms of populations and their descendants (Davis and Weinstein 2002; Chanda et al. 2014).

The question of persistence is important as it speaks to the role of geography, agglomeration, institutions and other deep-rooted factors of comparative economic development. It also serves to assess the role of pre-colonial vs. colonial determinants of economic development (for African case, see Gennnaioli and Rainer, 2007; Michalopolous and Papaiannou 2013). Ultimately, this type of research helps inform the ongoing debate about path dependence and place-based policies (see, for instance, Ades and Glaeser (1995); Bleakley and Lin, 2002). In this piece, we provide new evidence of persistence from pre-colonial times using data at the sub-national level for the Americas based on Maloney and Valencia Caicedo (2016).

Data

We focus on the Americas, and follow the literature in taking the continent as a large historical natural experiment. We are also aided by the availability of precise anthropological and archaeological data, the product of a long tradition of research summarised in William Denevan’s (1992) The Native Population of the Americas in 1492. These historical measures of population density can be seen as what they are, but also, following Malthus, as a historical proxy for prosperity in attempting to explain current patterns of economic activity. We test for the continued influence of this variable as we control for standard geographic and weather controls, suitability for agriculture, river network density, ruggedness and prevalence of malaria. We use country fixed effects to net out the effect of national level variables such as policies and institutions, as well as different estimators to assess the potential role of outliers.

Empirical Findings

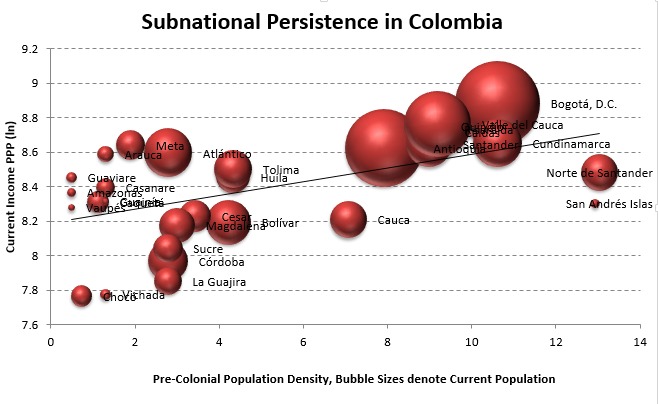

We reach three main conclusions in our research. First, and most surprisingly, we document that settlements today are located where there used to be antique (pre-colonial) settlements (see Colombia example, below). This persistence is far from obvious given that in many cases the original indigenous populations were practically decimated during the colonization process. We also show that certain geographic and weather characteristics – most notably agricultural suitability, distance to the coast and malaria prevalence – were important to determine where indigenous people settled in the first place. Lastly, we show that places that used to be rich back then also tend to be richer today.

Potential Mechanisms

Potential Mechanisms

The persistence of demographic and economic activity could work through different channels. Geographic determinants aside, agglomeration effects arise from path dependence à la Krugman. This in turn might be the product of externalities and complementarities in production, as hypothesized by Marshall. With time the costs of moving a city could become prohibitive and urban structures could survive extreme natural and manmade disasters.

Geographical factors appear to be important in explaining initial indigenous settlements. California, had and retains rich farmland, a productive coast and a temperate climate. But “locational fundamentals” are not enough to explain the patterns we see: controlling for a rich set of geographical fundamentals does not eliminate the importance of pre-colonial density on present population density and income. Further, history provides important counterexamples. The Aztec capital Tenochtitlan was founded on a small, swampy island whose chief attraction appears to be that it was un-coveted by the neighboring tribes. Its weather was unreliable, its growing season was short and famine was not uncommon. Moreover, frequent flooding inundated the city with its own filth, breeding epidemics. But in founding Mexico City, on top of Tenochtitlan, Hernan Cortés valued not only the available labor force, but also the area’s pool of skilled artisans, dense commercial networks, organizational structures, and collective knowledge – attributes that we associate with dynamic cities and dense population agglomerations. Similar phenomena are present in North America, where British, French and Dutch explorers used indigenous knowledge, maps and trade routes to survive, establish colonies, trading posts and fur-trading networks.

Discussion and Conclusion

The finding of persistence is somewhat surprising in the literature, as other articles have stressed a “Reversal of Fortune” at the national level – a finding that we replicate in the aggregate for the Americas. This reversal is attributed to the emergence of growth-inhibiting exclusionary institutions arising from the need to control larger indigenous populations. Although we find some evidence for this – we confirm that slavery has a depressive effect on current social outcomes – the forces leading to persistence appear to dominate at the subnational level. We do not find, for instance, any effect of pre-colonial density on income inequality.

For modern-day policymakers, the reality of such long-term continuity first, implies that there may not be anything “optimal” about the present distribution of economic activity – agglomeration effects may simply be driven by economic considerations millennia old. By the same token, policymakers attempting to radically change the spatial distribution of economic activity should be mindful of the centuries-old, even pre-colonial, forces working against them.

Notes:

• Based on the authors’ paper The persistence of (subnational) fortune, The Economic Journal (126: 598, Dec 2016)

• Originally posted by LSE Business Review

• The views expressed here are of the authors and do not reflect the position of the Centre or of the LSE

• Featured-image credit: Antony Stanley (CC-BY-SA-2.0)

• Please read our Comments Policy before commenting

William F. Maloney – World Bank Group

William F. Maloney – World Bank Group

William F. Maloney is Chief Economist for Equitable Growth, Finance and Institutions in the World Bank Group. Previously he was Chief Economist for Trade and Competitiveness and Global Lead on Innovation and Productivity.

Felipe Valencia Caicedo – Bonn University

Felipe Valencia Caicedo is an Assistant Professor in the Department of Economics at Bonn University, where he is a member of the Institute for Macroeconomics and Econometrics and the Macrohistory Lab.