The UK’s gambling laws are failing to keep pace with the emergence of new forms of gambling that are infiltrating children’s gaming practices. In this post, Lulu Freemont outlines how the gaming industry and policy-makers must work together to ensure that children are protected from such risks and that parents are made aware of the dangers. Lulu Freemont has recently completed a MA in Human Rights Law at SOAS. She has specialised in children’s rights and is now working as a Policy Officer at Parent Zone, a social enterprise which improves outcomes for children in a digital world.

The UK’s gambling laws are failing to keep pace with the emergence of new forms of gambling that are infiltrating children’s gaming practices. In this post, Lulu Freemont outlines how the gaming industry and policy-makers must work together to ensure that children are protected from such risks and that parents are made aware of the dangers. Lulu Freemont has recently completed a MA in Human Rights Law at SOAS. She has specialised in children’s rights and is now working as a Policy Officer at Parent Zone, a social enterprise which improves outcomes for children in a digital world.

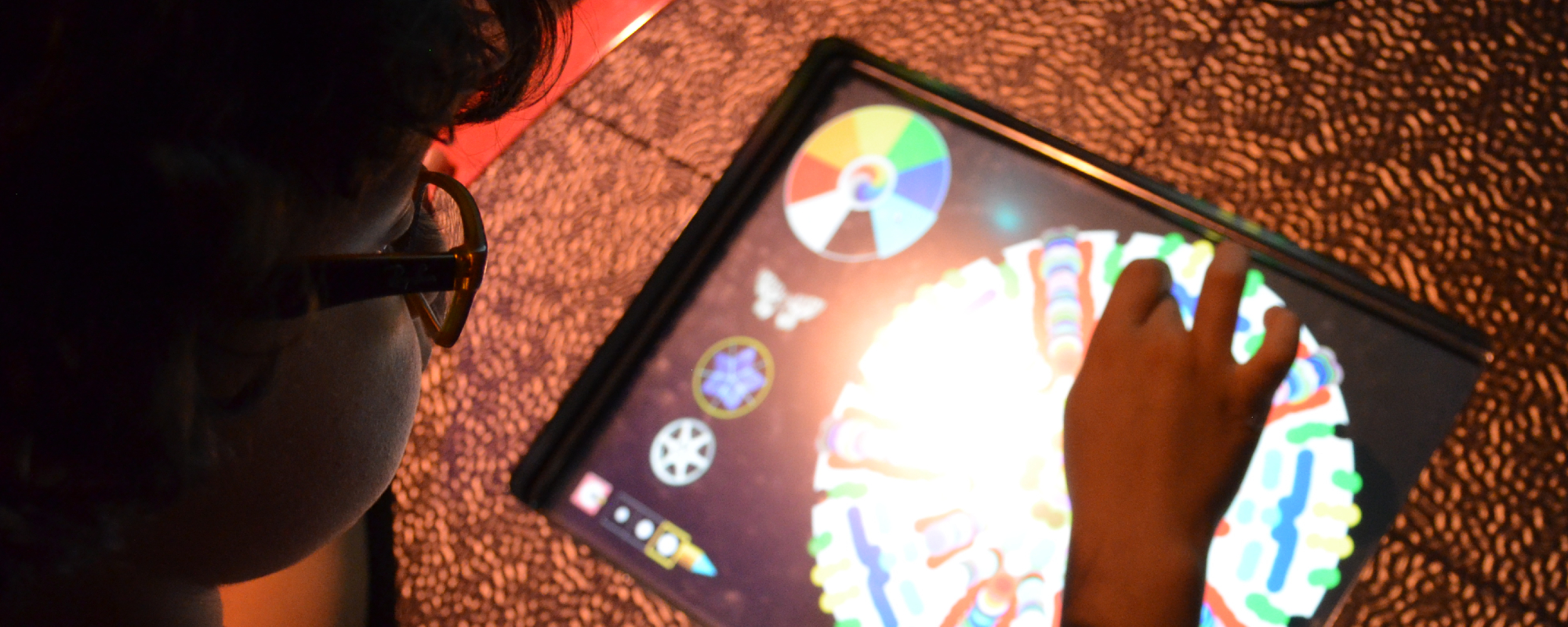

Skin gambling represents a generational knowledge gap. Under our noses, skin gambling is becoming a normalised part of children’s vocabulary and gaming activities – nearly 500,000 UK children aged 13-17 participate in some form. Meanwhile, parents and professionals barely recognise the term, and the UK’s gambling legislation is failing utterly to keep pace with technological change. Under the 2005 Gambling Act, skin-gambling is not recognised as gambling, virtual currency is not defined, and the gaming industry is allowed to side-step its involvement. Unless legislation is brought up to date to address emerging online trends, it cannot protect the people it exists to serve.

What are skins – and how are they gambled?

In 2012, US publisher Valve released a multiplayer online combat game called Counter-Strike: Global Offensive (CS:GO), which introduced – ‘skins’ – costumes or designs with which a player could customise their character or equipment. Although they do not give the player an advantage within the game, CS:GO skins became popular collectable items, exchanged by users within Valve’s online marketplace platform, Steam.

Skins from games like CS:GO and DOTA 2 have individual valuations within the Steam marketplace – from as little as a few pence to thousands of pounds – with Valve taking a 5% share of trades. With millions of trades made daily, skins have become a form of virtual currency, which can be bought and traded by children. At the same time, third-party websites began to offer Steam users the chance to gamble their skin collections, either by betting on esports matches or in casino-style games like roulette.

These third-party betting sites are connected to Steam’s open application programming interface (API), which enables users to access their skins from elsewhere, gamble with them, and then transfer any winnings back into their Steam account. With further third-party sites offering instant cash payments in exchange for skins, this network of interconnected but unaffiliated platforms allows players to use skins like chips in a casino.

None of these sites, including Steam, operate robust age verification processes – children are able to access them either through use of an adult’s credit card, by paying with Bitcoin, or by connecting with a PayPal account. Occasionally, Valve has served several third-party sites with cease-and-desist orders – but it continues to operate the open API interface that facilitates these gambling sites’ operations. Meanwhile new skin gambling sites continue to pop up, in what is now a multi-billion-pound global industry.

Why does current UK legislation not adequately control skin gambling?

UK gambling legislation came into force in 2005, shortly after Steam was launched and before many of the current technologies were developed, so there is currently no legal definition of virtual currency or of skin gambling.

The Gambling Act considers gaming to be gambling when there is an “element of chance and an element of skill” resulting in a prize of money or something of specific value. Skins are problematic because they do not have a fixed currency worth, making them hard to regulate within these parameters.

While skins are a “de facto virtual currency“, in that they have fluctuating online valuations based upon market demand, in law they are not, as there is no way of measuring the value of all skins at all times, as one might with a fixed currency. The 2005 Gambling Act’s lack of clarity on the definition of virtual currency makes it hard to legally determine whether skin gambling is, in fact, gambling at all.

This leaves children as young as 12, some of whom have lost skins nominally worth over £1,000, entirely unprotected. Crucially, it also lets the gaming industry off the hook: Steam’s open API technology and the network of third-party gambling sites that use it combine to create a virtual online casino where no regulations, nor enforceable age verification processes, currently exist – yet they are not held to account. Europe’s regulators are attempting to create a dialogue with a few responsible gaming developers, but have no statutory power.

The truth is that, even if UK legislation covered skin gambling and virtual currency effectively, it would struggle with the global nature of the internet. UK law exists to protect UK citizens, and where possible, the UK Gambling Commission has prosecuted sites which facilitate skin gambling within the UK’s borders. But third-party betting sites tend to be registered abroad – primarily in areas where legislation is ineffective or non-existent; a few UK prosecutions cannot hope to address the scale of the global issue. Regulators are hamstrung, unable to prevent non-UK based skin gambling sites from targeting children.

What are the negative impacts of this legislative failure?

The Gambling Commission has found that children often do not understand the consequences of their actions when skin gambling and Parent Zone’s report (‘Skin gambling: teenage Britain’s secret habit’, June 2018) found that, even when they do, many continue to gamble. There have even been reported cases of children who have become addicted to skin gambling. So the vulnerability of children cannot be underplayed; children are not naturally resilient to many risks of the online world, and need help in building resilience to be able to flourish.

What should be done to tackle skin gambling?

To mitigate this failure of legislation, three actions need to be taken.

- Parents need to be made aware of skin gambling and children need to understand the difference between games and gambling. Education and awareness are critically important in addressing the issue, especially to bridge the knowledge gap between adults and children. A recent report by the Gambling Commission, and the resultant media coverage, has been a positive development but more is needed to inform parents about the dangers.

- The games industry and others involved in this process must both acknowledge, and take responsibility for, the damaging effect skin gambling has on children. This includes Valve, the wider gaming industry, and sites like PayPal that play a small but crucial role in the interwoven process.

- Finally, policy-makers must consider how UK law can engage with the global nature of the online ecosystem that allows children to gamble. Parent Zone’s report calls for policy-makers to, “establish independent inquiries into new forms of online gambling” as a first step towards protecting children.

Regulators are making efforts to reduce children gambling online. The Gambling Commission’s recent age-verification consultation proposes to abolish the rule which allows children to gamble by requiring age verification only after 72 hours of gambling on licensed sites – at the cashing out stage. We can work hard to bridge the adult knowledge gap and educate children about the risks of online gambling, but without a fit-for-purpose legislation that takes into account emerging technologies and online spaces, children will continue to gamble freely in an unlicensed and unregulated environment.

This article gives the views of the author, and not the position of the LSE Parenting for a Digital Future blog nor of the London School of Economics and Political Science.