In this article, John Van Reenen looks at the UK’s economic performance since the global financial crisis and assesses the impact of austerity policies. He also examines the fiscal plans of the three major parties over the next Parliament, finding that, while all are currently planning for continued and severe austerity, the Conservatives’ plan would bring down the debt level more quickly but at the cost of lower investment, growth and employment.

In this article, John Van Reenen looks at the UK’s economic performance since the global financial crisis and assesses the impact of austerity policies. He also examines the fiscal plans of the three major parties over the next Parliament, finding that, while all are currently planning for continued and severe austerity, the Conservatives’ plan would bring down the debt level more quickly but at the cost of lower investment, growth and employment.

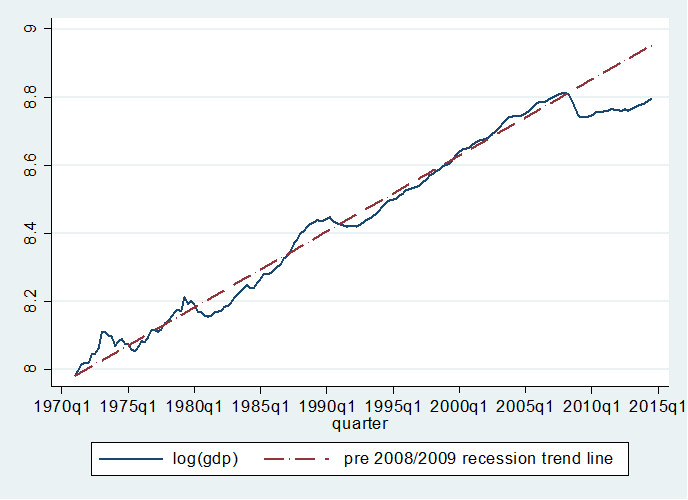

UK economic performance has been dismal in recent years. Compared with historic trends, GDP per capita was nearly 16% lower in 2014 – a loss of about £4,500 per person (see Figure 1). The much-lauded growth rate of 2.7% in 2014 is flattered by population growth (net immigration is running at triple the government’s 100,000 target), poor eurozone performance and the fact that the economy has been stagnant since the 2008-09 global financial crisis. Jobs have held up surprisingly well with almost three quarters of the working age population in jobs, back to pre-crisis levels. But this is largely due to average real wages falling by about 9% since 2008, which has kept labour costs down. Productivity as measured by GDP per hour is also about 16% below trend, and 17% below the G7 average.

Figure 1: UK GDP per capita (log series) 1970Q1- 2014Q3

Notes: Trend line at 0.558 per cent per quarter (linear trend from 1970Q1 to 2008Q1 when recession began). Growth 2010Q2 to 2014Q3 was 0.195 per cent per quarter. Quarterly Gross domestic product (average) per head (series IHXW), market prices (downloaded from ONS February 23rd).

Austerity past

In 2010, the coalition government created the Office for Budget Responsibility (OBR) to make independent fiscal judgements and assess its plans. This was a welcome development. The government set a primary mandate to balance the cyclically adjusted current budget over a rolling five year horizon. This is a good idea in ‘normal times’. Unfortunately, the situation was not normal as interest rates were near zero, rendering monetary policy relatively ineffective. The standard macroeconomic medicine at such a point is fiscal expansion. By contrast, the coalition accelerated austerity already planned by the outgoing Labour government, taking out an additional 1.2% of national income. VAT was increased to 20% in 2011 and an addition £32 billion of spending cuts announced by 2015.

This was particularly severe in fiscal years 2010-11 and 2011-12 with an enormous 40% real cut in public investment. The standard medicine is to increase such investment (e.g. on road repairs) in deep downturns as it has a big ‘multiplier’ effect on output. And since world interest rates were low and British infrastructure already creaking, there was no shortage of good projects. After 2010, the nascent recover petered out over this period and since 2012-13, fiscal policy has been much less contractionary. The elimination of the structural deficit was wisely pushed forward into the next Parliament.

Did austerity play a role in the UK’s poor economic performance? Or is the Chancellor right to say that things would have been even worse if the pace of fiscal consolidation had been slower?

To be sure, many factors outside the government’s control helped create the worst recovery this century, as illustrated in Figure 1. The European Union is our biggest trading partner, and the eurozone crisis has had a drag on the UK. Of course, part of the reason for this is that the eurozone has also been pursuing similar austerity policies. Furthermore, high commodity prices and the decline of high productivity sectors like oil and finance were a drag.

Taking account of such factors, the OBR estimated that 2% of GDP was lost due to austerity policies (1% in 2010-11 and in 2011-12). This is likely to be a conservative estimate because recent research suggests much larger multipliers in severe downturns.

The main justification for accelerating austerity and taking this growth hit was that the UK faced the risk of a Greek-style debt crisis. This argument is wholly implausible – unlike the eurozone, the UK has its own currency so liquidity crises do not become insolvency crises. We also had larger public debt levels – over 80% for half the twentieth century (1917 to 1968) – and have avoided formal defaults.

Austerity present

In the December 2014 Autumn Statement, the Chancellor laid out his plans through to 2019-20. The aim is to have a £21.6 billion surplus on the overall budget achieved through cutting public spending to 35% of GDP, the lowest level since 1948. This will come from reducing real spending on public services by 14.1% between 2015-16 and 2019-20 (see Table 1). The other half of public spending is welfare and this is projected to continue rising by 13%, mainly because of generous public pensions. For ‘unprotected’ departments (all except health, schools and overseas aid) this means cuts of a quarter (following on from cuts of a fifth in the previous five years).

Table 1: Potential departmental spending under alternative party proposals

| 2015-16 to 2019-20 | 2010-11 to 2019-20 | |||

| Percentage | £billion | Percentage | £billion | |

| 2014 Autumn Statement | -14.1% | -51.4 | -22.2% | -89.5 |

| Given party fiscal rules | ||||

| Conservatives | -8.3% | -30.1 | -16.9% | -68.3 |

| Labour | -1.9% | -6.8 | -11.2% | -44.9 |

| Liberal Democrats | -1.7% | -6.2 | -11.0% | -44.4 |

| Given party fiscal rules & stated intentions | ||||

| Conservatives | -6.7% | -24.8 | -15.5% | -53.1 |

| Labour | -1.4% | -5.2 | -10.8% | -43.3 |

| Liberal Democrats | -2.1% | -7.5 | -11.3% | -45.7 |

Notes: Potential departmental spending under the alternative parties’ proposals assume that they all stick to the Autumn Statement 2014 plans for investment, that they borrow the maximum amount their fiscal rules allow, and that they implement their specific tax and benefit reforms and stated intentions as of December.

Sources: 2014 Autumn Statement; Various editions of Public Expenditure Statistical Analysis; OBR’s 2014 Economic and Fiscal Outlook and IFS Green Budget (2015, Table 7.7).

The current plans are for continued and severe austerity. Real public service cuts per capita have never been achieved for more than two consecutive years since the series began in 1964-65 and the current plans imply 10 years of continuous cuts.

Austerity future

What could happen after the election? All parties have signed up to the coalition’s spending plans through 2015-16, cutting the debt over the next parliament and balancing the cyclically adjusted current budget deficit by 2017-18. But there is disagreement over what should happen in the latter half of the next Parliament.

Interestingly, all the three main parties could stick to their plans and be less austere than the 2014 Autumn Statement. The Conservatives are committed to balancing the overall budget by 2019-20, not necessarily generate a surplus. Hence they could reduce real public spending by 8.3% 2015-16 to 2019-20 instead of the 14.1% in the Autumn Statement. By contrast, both Labour and the Liberal Democrats are committed to balancing the current budget (that is, excluding public investment). Hence they could reduce spending by as little as 1.9% and 1.7% respectively and still meet their fiscal rules.

The question of whether public investment is included in the fiscal rule is an important one. It makes sense to treat capital differently from current spending as investment creates an asset that can aid growth in the future. And the UK has a poor track record on investment in transport, energy and housing compared with other countries as shown by the LSE Growth Commission. The Conservatives’ plans leave much less room for borrowing for public investment and raises the concern that once again, the UK will sacrifice long-term prosperity for short-term gains. The Conservatives’ plans would bring down the debt level more quickly but at the cost of lower investment, growth and employment.

Conclusion: the taxman cometh?

Another difference between the parties is over taxes. Conservative plans are to reduce taxes and have all austerity met through spending cuts. Labour have announced several tax increases. Like the other parties, however, their tax and spending plans have not been given much detail, especially after 2015-16.

All elections since 1992 have been followed by net tax increases of around £5 billion in today’s money. It is incumbent on all political parties to be honest and spell out where the tax rises are likely to be.

This article is part of the CEP’s series of briefings on the policy issues in the May 2015 General Election.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting. Featured image credit: David Holt CC BY 2.0

John Van Reenen is Professor of Economics and Director of the Centre for Economic Performance, London School of Economics

John Van Reenen is Professor of Economics and Director of the Centre for Economic Performance, London School of Economics

“This is a good idea in ‘normal times'” – I am always astonished that it never seems to be the right time to reign in exploding budgets. We all know, but few would admit, that current budgets are run on public debt to a degree that can never be paid back. This is nothing but a stealth tax since eventually someone will need to do a “bail in”. If I understand your stance correctly, you advocate extending the previous policies, even though it seems they landed us in this mess in the first place?

Surely, austerity should only be compared to a psychological depression amid a financial depression. Thus, a policy or ‘attitude’ that purely hinders development & growth in the lives of those who are already challenged, can only contribute to psychological pressures.

Without a clear policy or ‘attitude’ that presents a ‘hand-up’ approach to understanding obstacles and goals – including the psychological depression one is experiencing – of those who seek positive change towards social mobility – surely, the reality on the ground remain bleak, isolated and desperate.