Erin Hengel and Costas Milas discuss some ways through which economists can improve their quantitative models in order to help policymakers tackle today’s economic challenges, as well as to equip future economists for situations similar to the COVID-19 crisis.

Erin Hengel and Costas Milas discuss some ways through which economists can improve their quantitative models in order to help policymakers tackle today’s economic challenges, as well as to equip future economists for situations similar to the COVID-19 crisis.

Economics did not have a ‘good’ financial crisis in 2008–2009, not least because they failed to predict it. The financial crisis thus triggered a lively debate among policymakers and the economic profession on what went wrong with their forecasting ability. For instance, the Head of the Monetary and Economic Department at the Bank of International Settlements, Claudio Borio, noted that ‘financial factors had progressively disappeared from macroeconomists’ radar screen’ for most of the post-war period.

Economists took account of the above comments. Noting the valid criticism that models often used in the current literature are not flexible enough to track the changing nature of key economic variables over time, economists have paid more attention to the use of time-varying models as opposed to those with constant parameters. In recent research, for instance, one of us showed that a time-varying empirical model which distinguishes between illiquid and liquid stock market conditions in the UK is able to out-perform the GDP growth forecasts produced by the Bank of England’s Monetary Policy Committee.

Apart from re-writing theoretical and empirical models to emphasise financial variables and the time-varying nature of the data, economists also made an effort to revamp economic courses offered to university students. Indeed, a shift was recently made towards using ‘data and real-world examples to counter students’ complaints that courses are too abstract’.

Yet, a serious lack of trust in the economics profession remains. For instance, Economics Editor of The Financial Times, Chris Giles, wrote recently that economists perform much worse on trust surveys than scientists or medics, although they score better than journalists and politicians.

Without doubt, we, economists, should take seriously the lack of trust in our ‘expert opinion’. This can be done in a number of ways. First we should flag that our predictions are almost exclusively based on real-time data and therefore come with health warnings. Real-time data are heavily revised over time and, therefore, updated data might reject one economic pledge that was potentially supported by earlier data. Second, we should use different model specifications to test whether an economic pledge can lead to different, and often contradicting, answers. In other words, by experimenting with different datasets and models, we should be clear to the public that politicians and policymakers cannot necessarily tackle economic problems by relying solely on a particular school of economic (and often political) thinking. It is our job to inform the public that there are no ‘right answers’ to every economic question.

This issue has become much more pressing in the context of COVID-19 where economic forecasts, made only six to eight months ago, have again turned worthless. In January 2020, for instance, the International Monetary Fund expected global growth of 3.3% in 2020 and 3.4% in 2021. In June 2020, these forecasts were massively revised to -4.9% and 5.4% respectively.

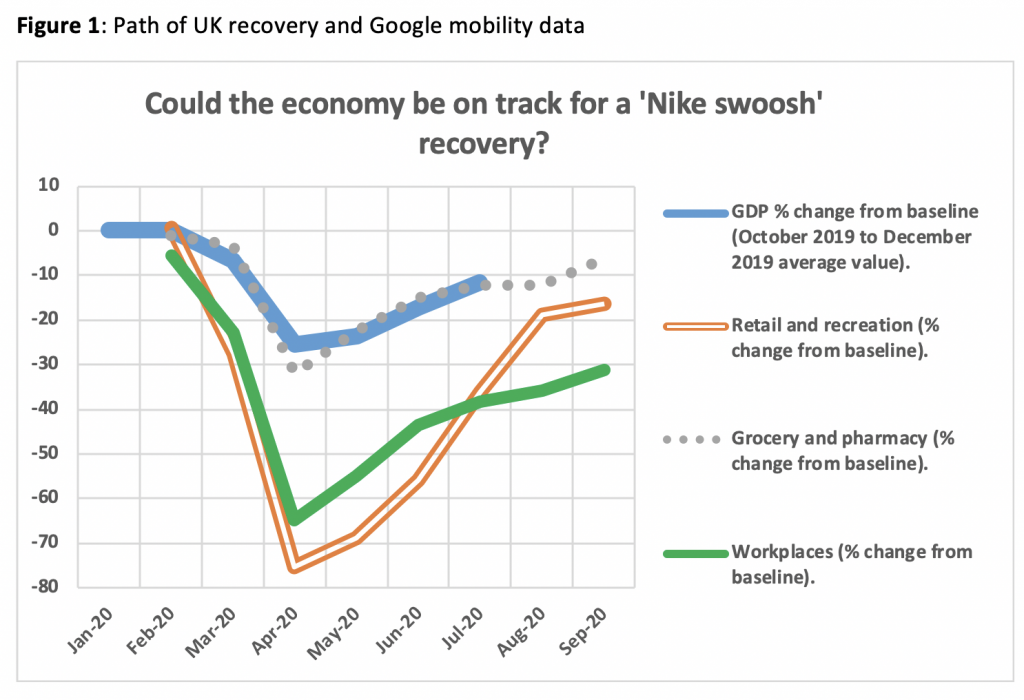

We responded to the recent financial crisis by revamping our models to include financial indicators. We can address the adverse impact of pandemics through a number of ways. First, we can allow the forecasting ability of core economic variables to be influenced by Infectious Disease Equity Market Volatility Trackers. Second, we can debate whether the COVID-19 pandemic should be treated as a massive outlier which is capable of severely distorting parameter estimates and hence forecasts of econometric models, in which case, empirical models should pay particular attention to large changes in the volatility of macroeconomic series (such as unemployment or consumption) when forecasting the impact of the pandemic. Third, we can allow real-time Google mobility data to inform policymakers about the shape of the economic downturn and the subsequent recovery. In fact, the current recovery appears to look more than a ‘Nike Swoosh’ one rather than a ‘V-shaped’ one predicted, among others, by the Bank of England’s Chief Economist Andy Haldane. As can be seen from Figure 1, GDP remained, in July 2020, a massive 11.6% below its pre-pandemic level (that is, the October to December 2019 average). UK GDP follows quite closely the path of Google mobility data which is a good proxy for the expenditure of consumers. The latest data from September 2020 confirm that expenditure is lagging behind its pre-pandemic level quite substantially.

Data sources: UK real GDP and Google mobility data

If anything, mobility towards workplaces as well as mobility towards grocery and pharmacy appears to be losing steam. The implication is that a quick rebound of UK GDP in the second part of 2020 might not be that straightforward. Add to this the increasing evidence of a second COVID-19 wave and we end up with the extremely likely scenario of a very slow type of recovery: the ‘Nike Swoosh’ type, one which will probably force Rishi Sunak to extend or even bring into force a new version of the Job Retention Scheme. If a very slow recovery turns out to be the case, the UK’s unemployment rate will most likely exceed the 7.5% peak level currently predicted by the Bank of England for 2020Q4 and, at the same time, take more than three years to revert back to the 4.1% unemployment rate currently realised.

Apart from improving our quantitative models with the aim of helping policymakers to tackle today’s economic challenges, economists can adapt teaching programmes by offering modules on the economics of pandemics or include in finance modules material for practitioners on how to avoid a coronavirus debt crisis.

All of the above are arguably good ideas that will go some way towards restoring ‘confidence’ in economics. We should not, however, hide from the fact that economics continues to receive criticism — not only from outsiders but also from within the profession itself. Indeed, recent research by one of us finds that female-authored papers published in top economics journals are cited more than male-authored papers. Moreover, men’s citations rise when they co-author with women but women’s citations fall when they co-author with men, conditional on acceptance. Under reasonable assumptions, these results suggest papers by women are held to higher standards. As a result, journals may not always publish the highest quality research and the profession may not always attract, support, and retain the very best researchers who can provide path-breaking research towards tackling the emerging economic challenges.

Greek philosopher and mathematician Thales of Miletus is thought to have said that ‘It is difficult to know yourself; it is easy to give advice to others‘. It might not be that difficult for economics to provide useful policymaking advice especially if it is willing to learn from the lessons of the recent financial crisis and the COVID-19 pandemic. Much harder, however, might be for economics to know itself, especially when it comes to recognising and addressing some of its own issues.

__________________

Erin Hengel is Lecturer in Economics at the University of Liverpool.

Erin Hengel is Lecturer in Economics at the University of Liverpool.

Costas Milas is Professor of Finance at the University of Liverpool.

Costas Milas is Professor of Finance at the University of Liverpool.

Photo by Kristian Egelund on Unsplash.