Using novel historical data, Per F. Andersson demonstrates that left-wing governments tax more regressively in proportional representation systems and more progressively in majoritarian ones. He illustrates how political risk shapes the strategies of key actors and helps explain the divergence in tax policy using the examples of Swedish and British tax policy after 1945.

Using novel historical data, Per F. Andersson demonstrates that left-wing governments tax more regressively in proportional representation systems and more progressively in majoritarian ones. He illustrates how political risk shapes the strategies of key actors and helps explain the divergence in tax policy using the examples of Swedish and British tax policy after 1945.

We like to believe that our political choices matter, that it makes a difference whether the government is run by the right or the left. Yet researchers have found that the link between partisanship and policy is surprisingly weak, and some even find that left-wing governments are associated with heavier taxation of the poor. In a new paper, I argue that whether the left taxes regressively or progressively depends on the institutional context, not – as has been the common explanation – on constraints from unions or rising expenditures. Drawing on a unique, cross-country database of historical tax revenues and archival material from the UK and Sweden, I find that it is the electoral system that affects how left-wing governments make tax policy.

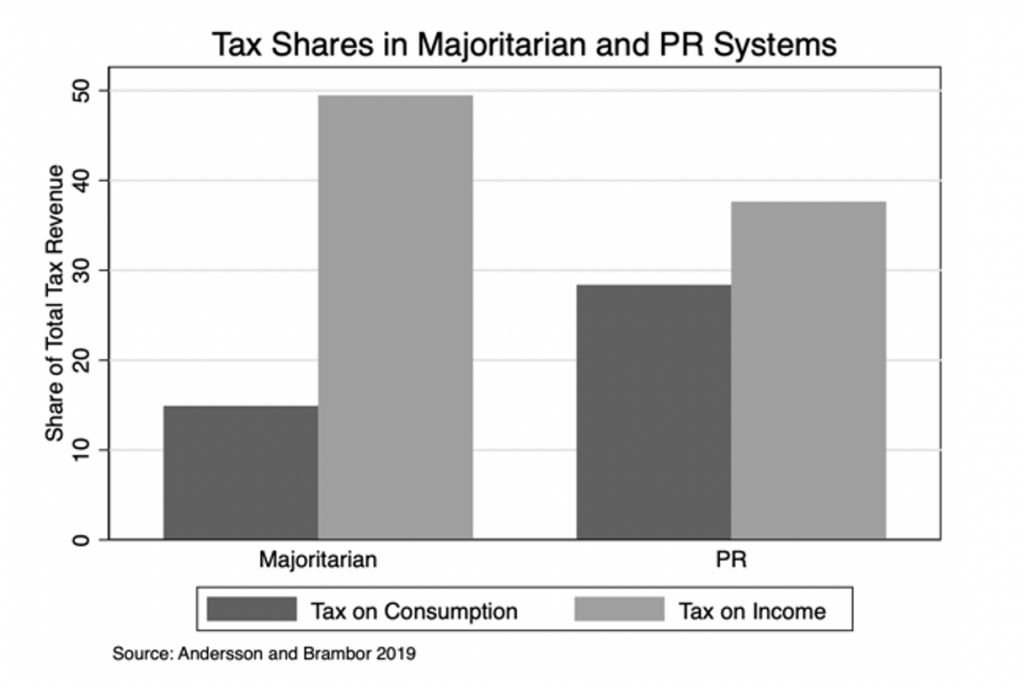

The cross-country analysis reveals that the left relies more on consumption tax in proportional representation (PR) systems and more on income tax in majoritarian systems. The figure below shows the average share of government revenue from consumption and income taxes in a sample of 24 democratic left-wing governments from 1900 to 2012 (the dataset can be accessed here.)

The same pattern appears when looking at the introduction of taxes: historically, there were only five instances of a personal income tax (which is generally progressive) being introduced by a left-wing head of government, and all of those occurred in majoritarian countries. In contrast, among the six left-wing introductions of a general sales tax (the precursor of value-added tax, VAT), four were in PR systems. The pattern is the same for VAT, where six out of the eight left-wing introductions occurred under PR.

What’s behind this difference in left-wing tax policy? I argue that the left uses different strategies for redistribution. One is to use progressive taxation to reduce inequality, another is to focus on revenue maximization and redistribute through generous transfers. The second strategy has more potential for reducing inequality but is riskier politically since it involves compensating for the regressive impact of tax policy with progressive spending.

Where political power is concentrated – as in majoritarian systems – the risks associated with losing office are greater, and the left chooses the less effective but safer strategy of progressive taxation of income. In systems with greater opposition influence – as in PR systems – the risk of combining high-yield regressive taxes with progressive spending is lower since compensatory spending can be protected.

Broad-based consumption taxes – such as VAT – are efficient, generate a lot of revenue, and are harder to avoid. However, since the poor consume a larger share of their income, they are disproportionately hurt by these taxes. As such, consumption taxation presents left-wing governments with a dilemma: it is a formidable tool for expanding the welfare state, but at the same time it hurts the very groups the left seeks to help.

In the post-war era, the left in Britain and Sweden faced exactly this dilemma. Both the Swedish Social Democrats and the British Labour Party recognised that reducing inequality could be achieved by combining an efficient, high-revenue tax system with targeted spending programs. For instance, prominent Labour politician Anthony Crosland held that socialist taxes should not exclude high-yielding consumption taxes. Similarly, key individuals within the Swedish labour movement argued that judging indirect taxes only on its incidence and not on what the revenue was used for was like throwing the baby out with the bathwater. So, not only did both parties seek to reduce inequality, but they also agreed that a broad-based consumption tax could help reach that goal.

Why did the left implement this idea in Sweden but not in Britain? How left-wing governments deal with this dilemma depends on political institutions. The British electoral system ensured that Labour could win a record number of votes, yet still be short of a majority in parliament. For instance, in 1951, Labour won 48.8% of the vote, but these resulted in 295 seats; the Conservatives’ 48 % of the vote resulted in 321 seats. Labour could never be certain about its future power; even if it gained votes, it could still be defeated. Moreover, defeat meant losing to a unified right-wing party which would be able to dictate policy without any opposition influence. In other words, when Labour set tax policy, it did so knowing that the future was uncertain.

This uncertainty affected the way key actors on the British left thought about tax policy. The Trade Union Congress, for instance, was worried about the future compensation for a regressive consumption tax. It was not willing to risk supporting a tax that would hurt the poor, while being unable to control how that revenue was spent. This insecurity and volatility associated with the winner-take-all system made Labour prefer a safer – but less efficient – tax strategy. Labour’s fear turned out to be true: when the Tories introduced VAT in 1973, they did so without compensatory spending.

In Sweden, the more predictable political system made it possible to reform the tax system and compensate the poor at the same time. The Social Democrats introduced an efficient consumption tax – despite opposition from trade unions – confident that they were able to ensure compensatory welfare spending in the future. This confidence stemmed from a proportional electoral system ensuring predictable results and substantial opposition influence. Moreover, a fragmented right reduced the risks associated with losing power, and further increased opposition leverage. The strategy of combining consumption tax with an expansion of welfare programs was successful, both in fighting poverty and in winning votes; after the reform, the Social Democrats were able to push down the poverty rate while also gaining seats in the following election.

The puzzling relationship between ideology and tax policy is not so puzzling once political institutions are taken into account. Left-wing governments choose different strategies for redistribution depending on the political environment. This idea is consistent with the experiences of Britain and Sweden in the decades after the Second World War, and also with quantitative evidence from a global historical sample.

__________________

Note: the above draws on the author’s published work in Comparative Politics; a free version of the paper is available here.

Per F. Andersson is a postdoctoral researcher at Copenhagen University.

Per F. Andersson is a postdoctoral researcher at Copenhagen University.

Photo by Amol Tyagi on Unsplash.

I was under the impression that VAT was a requirement of EU membership, no matter that it hits the poor relatively harder.