With the second Brexit analysis leak, Michael Ellington and Costas Milas write that it is in no one’s long-term interest to keep such studies from experts until they are complete or leaked. Considering that the task of measuring Brexit’s impact is indeed a tall order, they suggest that the process be made more transparent and open to feedback.

With the second Brexit analysis leak, Michael Ellington and Costas Milas write that it is in no one’s long-term interest to keep such studies from experts until they are complete or leaked. Considering that the task of measuring Brexit’s impact is indeed a tall order, they suggest that the process be made more transparent and open to feedback.

The government has been wisely, but nevertheless not openly, working on a new paper, “EU Exit Analysis — Cross Whitehall Briefing”, a preliminary draft of which has been leaked to Buzzfeed. The paper looks at three of the most plausible Brexit scenarios to conclude that, in all cases, the UK economy will end up worse off over the next 15 years. We do not yet know the details of the paper to make a proper academic judgement. What we do know is that the lack of openness involved justifies Chris Giles’s remark that politics “has a forecasting problem”.

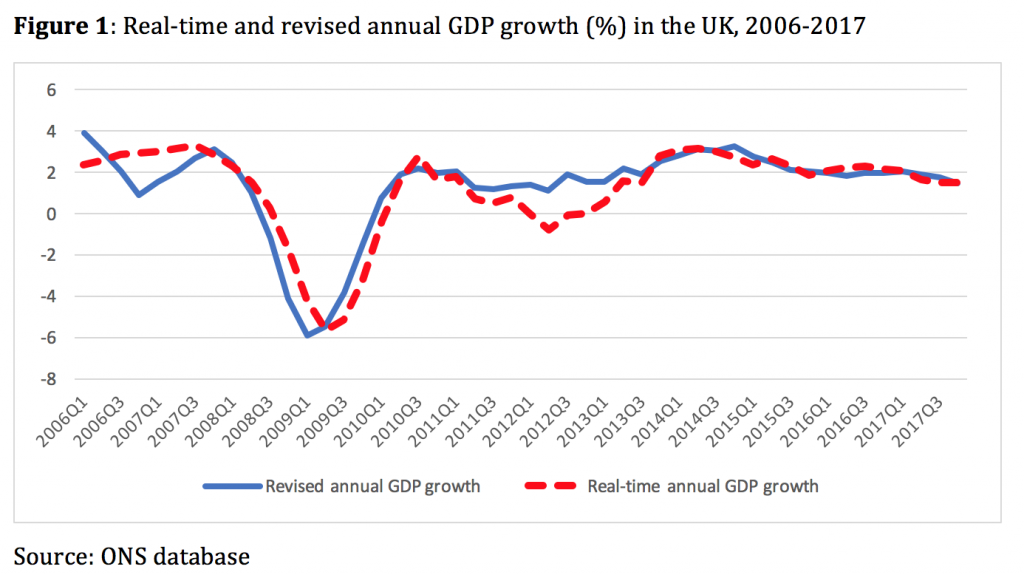

Although past data are often revised, it is more likely than not that even revised data will not alter the economic picture in a dramatic manner – unless, of course, a period of distress such as a financial crisis takes place. Indeed, as can be seen from Figure 1, revised GDP estimates of the UK economy suggest that it started ‘reversing’ one quarter earlier (in 2008Q3) than initially thought and that the drop in annual GDP growth was as deep as 6% per annum in 2009. That is, some 1.7 percentage points more severe than what earlier GDP estimates suggested.

On the other hand, attempting to forecast ahead is notoriously challenging, and much more so the longer ahead one attempts to make an economic judgement. Indeed, forecasting depends on a number of conditioning economic assessments and political assumptions. Did anyone foresee that the outcome of the EU Referendum would bring to an abrupt end David Cameron’s political career, or cost the government’s majority in a snap election? With this in mind, producing a quantitative assessment which declares that our economy will be worse off in 15 years by 8%, in the worst possible case, is a brave statement to make.

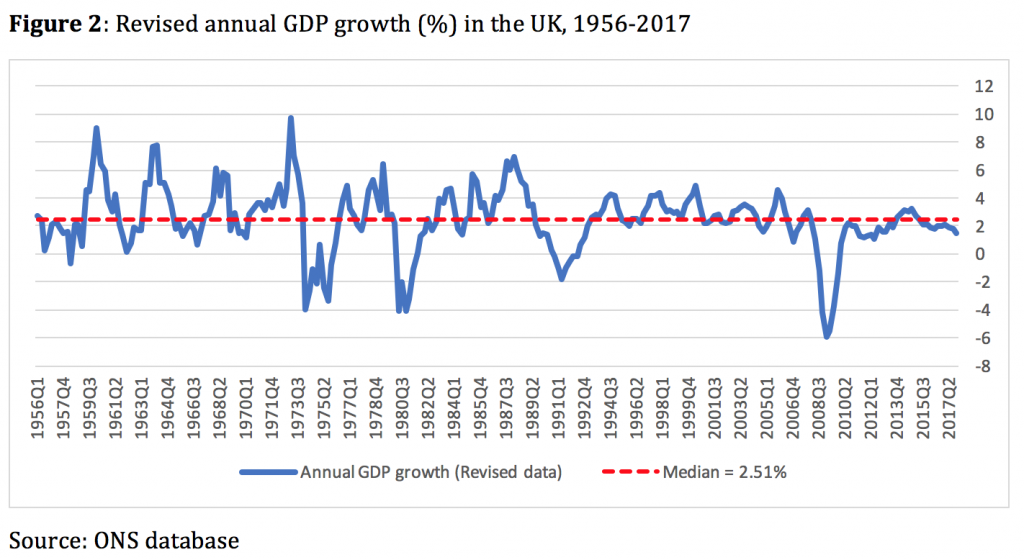

That said, we still take the view that Brexit will harm the economy in the short, medium, and longer-term. This is because we are trying to re-write, albeit in a more complicated manner, our trading relationship with the EU, our closest trading partner. This negative economic and political process is already taking its toll, as the latest economic data seem to suggest: the 1.5% annual growth rate recorded for 2017Q4 was the lowest one for more than four years and, indeed, a full percentage point below our median performance over the last 62 years or so. In fact, such a weak annual performance, has only been witnessed in 25% of all times since 1956 (see Figure 2).

The main point is that the Brexit headwinds are already slowing our economy down. We believe that the government needs to focus on building a plausible picture over the next few years before making conclusions regarding the long-term. We concur with Iain Duncan Smith that the leaks from this report should be taken “with a pinch of salt”. Things can turn out better (as Iain Duncan Smith seems to be hinting) but they can also turn much worse.

Academics often circulate our academic papers as ‘preliminary and incomplete’ drafts to the wider academic community before attempting to publish our revised and much more complete work. But even after then, our papers go through a rigorous refereeing process. Why then not treat the “EU Exit Analysis” paper in the same manner? After all, it will not be the first or the last time that sensitive topics of this sort have gone through a rigorous refereeing process. (For a recent example see here.)

By withholding the full paper from the academic community and the public, the result is that ministers end up losing faith in the work of their own government and personnel. Which begs the very unpleasant question: if Brexit ministers cannot trust and therefore rely on the Brexit findings of their own analyses, why should the public trust these ministers to deliver the best possible Brexit?

______

About the Authors

Michael Ellington is Lecturer in Finance, University of Liverpool.

Michael Ellington is Lecturer in Finance, University of Liverpool.

Costas Milas is Professor of Finance, University of Liverpool.

Costas Milas is Professor of Finance, University of Liverpool.

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science. Featured image credit: Pixabay/Public Domain.