Yuval Millo argues that the patterns of decision-making in hedge fund management are the key to understanding financial risk events. Lawmakers would benefit from identifying and regulating these networks in order to create a more effective assessment of market risks.

Yuval Millo argues that the patterns of decision-making in hedge fund management are the key to understanding financial risk events. Lawmakers would benefit from identifying and regulating these networks in order to create a more effective assessment of market risks.

The elaborate connections between hedge funds contribute to the emergence of market crises. In a recent paper, my colleagues and I collected data from 26 hedge funds and eight brokerage firms in Europe, the United States and Asia between December 2007 and June 2009. The hedge funds analysed controlled 15 per cent of all assets managed by hedge funds.

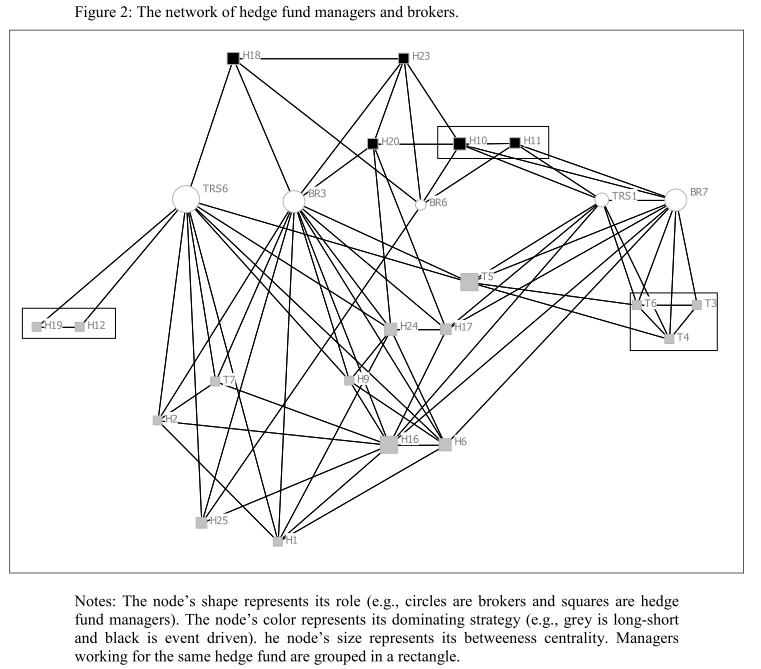

The data revealed that decision-making in these hedge funds relies crucially on a two-tiered structure of connections – the first amongst hedge fund managers and the second between themselves and brokers. This structure of connections contributes to a situation whereby, once hedge funds collectively accepted an investment idea and invested accordingly, they “locked in” on the idea, ignoring warning signs.

To understand how connections can contribute to the emergence of financial risk, we need to take into account the motivations of the different actors. Hedge fund managers interact with brokers who execute trades on their behalf and provide them with “flow information’. Flow information is descriptive information about the conditions surrounding a possible investment action.

For example, whether there are more buyers than sellers for certain assets, the type of institutions that are interested in buying or selling, and the magnitude of specific orders. The brokers’ flow information is frequently combined with initial trading ideas. In contrast, hedge fund managers interact with other hedge fund managers to compare and test their initial trading ideas, to look, jointly, for potential flaws and to establish robust reasoning for choosing particular trading positions.

These different motivations and practices can be defined as different “logics of connectivity”. Logic of connectivity is the set of intentions guiding the actor’s communicative actions, which, if reciprocated by the actor’s counterparties, are likely to lead to the establishment of connections. The findings show that the hedge fund managers’ dominant logic of connectivity encourages creating connections with other hedge fund managers, but hedge fund managers tend be selective, preferring connections within small and cohesive groups.

Brokers’ logic of connectivity, on the other hand, motivates them to create and maintain communicative connections with as many hedge funds as possible, but not with other brokers. In other words, brokers aim to position themselves at the centres of star-like network formations. The two logics of connectivity identified and their resulting structure of connections are inherent to decision making amongst hedge funds and have a crucial impact on their structure of opportunities and risks.

These findings inform financial regulation and lawmaking. For example, SEC regulations that follow the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 demand hedge funds to disclose, among other things, details about their trading and investment positions and their valuation policies and practices.

Such information can be used to construct networks, similar to the ones identified above and thus produce a view of the popularity of different trading positions and the hedge funds who share these positions. Future regulation could also incorporate the properties of the actors and networks when assessing risks, requiring the regulator to be equipped with rules that allow it to uncover these networks, supervise them and where necessary intervene in them.

Please read our comments policy before posting.

Dr Yuval Millo is a lecturer in the Department of Accounting at the London School of Economics

1 Comments