The wage share – wages expressed as a share of total national income – has fallen since the early 1980s, highlighting the decoupling of earnings from output and accounting for a third of the decline in median wages relative to GDP in the UK over the last 35 years. Howard Reed summarises his recent report, arguing a new social contract is required, and estimates the contribution that a selection of policies might make towards reversing the decline in the wage share.

The wage share – wages expressed as a share of total national income – has fallen since the early 1980s, highlighting the decoupling of earnings from output and accounting for a third of the decline in median wages relative to GDP in the UK over the last 35 years. Howard Reed summarises his recent report, arguing a new social contract is required, and estimates the contribution that a selection of policies might make towards reversing the decline in the wage share.

Since the early 1980s, living standards for most of the UK’s workforce have becoming progressively detached from growth. The gains from a growing economy became increasingly unevenly divided in favour of a small group at the top, leaving significant sections of the rest of the population (roughly the bottom 60 percent) lagging behind the average rise in prosperity, and at an accelerating rate. Following the Great Recession of 2008-09, average UK net incomes have declined in real terms – by over 13% between 2009 and 2012 according to recent ONS research.

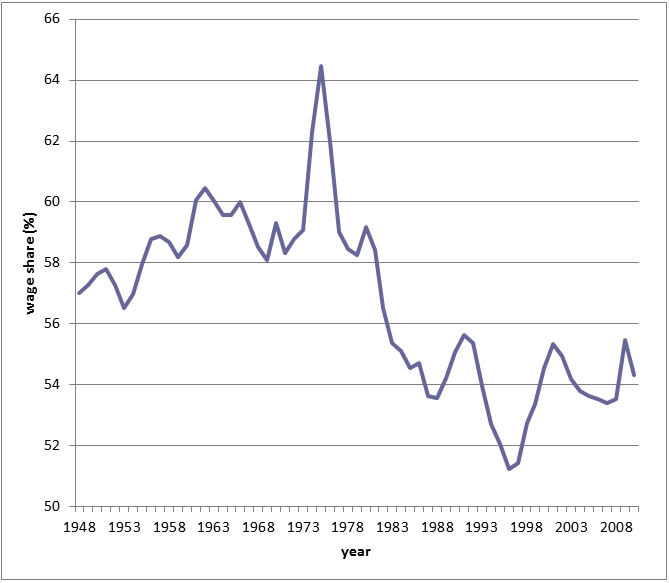

A recent research report by Stewart Lansley and myself for the TUC examines these trends in real wages through the lens of the ‘wage share’ – wages expressed as a share of total national income using data from the UK National Accounts. As Figure 1 shows, between 1960 and 1980 the share of wages in national income fluctuated between around 58 and 61 percent (apart from a brief upward spike in the mid-1970s) but declined sharply in the early 1980s and has been below 56 percent since 1982, falling as low as 51 percent in the late 1990s. Meanwhile, the profit share (operating surpluses as a percentage of national income) rose from 24 percent in 1980 to 28 percent in 2011. The decoupling of earnings from output is not a phenomenon unique to the UK but has occurred in a majority of rich nations, although to varying degrees.

Figure 1. The falling wage share, UK, 1948-2011

At the same time that the wage share has been falling, the UK dispersion of earnings has been widening, with real full time earnings at the 90th percentile doubling between 1978 and 2008 compared with growth of only 25 percent at the 10th percentile (and no growth at all in the bottom half of the earnings distribution since 2003). Overall, our research finds that the falling wage share accounts for about a third of the decline in median wages relative to GDP in the UK over the last 35 years, with the other two-thirds being accounted for by increased dispersion of earnings.

Why has the wage share declined? The evidence suggests that while skill-biased technological change and globalisation have played some role, labour market reforms promoted by the OECD and other neoliberal economic commentators – in particular the reduction in trade union and collective bargaining coverage in the workplace – are the most important explanation. “Financialisation” – the increased role of financial activity and the rising prominence of financial institutions in national economies – is also found to be a key driver of the upward concentration of income and thus of falling wage shares at the bottom. Our research finds that the whole of the upward trend in the profit share over the last thirty years is attributable to the increased profitability of the financial sector. And while profits have risen, investment and research and development spending as a share of GDP have both fallen since the early 1980s. Rather than funding increased investment or research and development, increased profits have been used to fund vastly increased remuneration packages for directors, financiers and executives in finance and parts of the corporate sector, and a surge in mergers and acquisitions and private equity activity.

Based on a review of the literature on the relationship between the wage share and economic growth as well as time series modelling using UK macroeconomic data for the last 65 years, our research suggests that rebalancing the economy toward a higher overall wage share, a lower dispersion of earnings and a reduced dependence on low pay, stronger growth and less economic turbulence is a necessary condition for achieving sustained economic recovery. Achieving this rebalancing requires, above all, a new social contract with labour, underpinned by a new set of governing rules between the state, the workforce and business. In the UK, the current contract has broken down. Growth no longer automatically delivers improved living standards for low and middle earners, while a large and growing proportion of the workforce is being denied secure work and decent pay.

The main elements of this new social contract should be as follows:

Raising the wage floor for those currently in work. Today, around a fifth of the workforce – some 4.8 million employees – are on hourly wages less than the living wage (£7.45 per hour outside of London and £8.55 in London). The number of employees receiving the living wage could be raised without adverse employment effects by:

- Public sector organisations setting the standard by ensuring that all their employees are paid the living wage;

- Public employers doing far more to ensure that businesses with whom they contract are paid at living wage rates through the greater use of social clauses in procurement contracts (including the Social Value Act 2012).

Capping and/or restraining pay at the top. There is no real evidence that the vast increases in remuneration over the last three decades for corporate executives – particularly in the private sector – have been matched by improved company performance. We recommend tougher rules on corporate governance along the lines of the recommendations in the High Pay Commission’s 2011 final report, as well as greater use of non-statutory pay ratios between the highest and lowest paid employees in a company – as recommended by the 2011 Hutton Review of public sector pay.

Extending the role of collective bargaining. Ultimately, increasing the wage share will depend on a fundamental shift in the balance of economic and social power and influence away from the dominance currently enjoyed by boardrooms, big business and the City. More power needs to be shifted from boardrooms to the workforce through the empowering of employees and the spreading of collective bargaining. The strong body of empirical evidence on the effect of de-regulation goes against the grain of orthodox economic thinking. There is evidence that high levels of collective bargaining have a range of economic benefits at the micro and macro level including associations with boosting skills, innovation and productivity, and more successful macroeconomic management, as well as lower inequalities.

Reinstalling the goal of full employment (a goal effectively abandoned in the 1980s in favour of lowering inflation and never reinstated) would not just help to create more jobs but would be an important instrument in securing decent wage growth, reducing wage dispersion and closing the wage-output gap. The recent announcements in the US and the UK that interest rates will not rise until unemployment moves below a target level (6.5 percent in the US, 7 percent in the UK) are clear signs of a new recognition of the need for a shift in monetary policy away from obsessive focus on low inflation to a greater emphasis on growth and employment, but a lot more needs to be done.

Our report presents estimates of the contribution that a selection of the policies above might make towards reversing the decline in the wage share over the last 30 years. A combination of:

- increasing the minimum wage from £6.19 to £6.60 per hour (its real terms value in 2009);

- extending the coverage of the living wage so that half of the employees in the UK who are currently paid at hourly rates below the living wage are moved up to the living wage;

- extending the coverage of collective bargaining agreements so that half of the employees in the UK who are not currently covered by such agreements are moved onto them; and

- Reducing unemployment (on the ILO definition) to 3.5 percent – closer to the level that prevailed in the 1950s and 1960s;

would, on our calculations, eliminate up to 25 percent of the “wage gap” – the difference between the wage share in 1980 (59.2% of GDP) and the wage share in 2011 (53.7% of GDP). To close the rest of the gap would require more fundamental structural reforms of the UK economy through industrial policies designed to alter the industrial structure of the economy in favour of the types of jobs that are more likely to support high-wage employment. By contrast, the danger with the current trajectory of falling real wages which the UK economy has slipped into is that, with labour becoming ever cheaper in real terms, the “low road” route becomes more and more attractive to employers as an alternative to capital investment. In effect, falling real wages are a driver for reduced innovation and productivity. In this scenario the UK economy is likely to become increasingly stagnant and any growth that does take place is unlikely to show up in workers’ living standards. This makes the case for an alternative approach to UK industrial policy – one which doesn’t rely on falling real wages as the primary route to boost competitiveness – even more pressing.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Howard Reed is Director of the economic research consultancy Landman Economics, which specialises in policy analysis and complex econometric modelling.

Your link to “your report” actually goes to an unrelated – tho interesting – ONS paper. Please correct that.

Thanks for pointing this out! Correct link in place.