As expected, the MPC revised upwards its GDP growth forecasts and predicted a return of the unemployment rate to the 7% threshold 18 months earlier than it previously thought. Costas Milas argues that despite the rising economic optimism and better economic data, unemployment might still take until the second quarter of 2016 to return to 7%.

As expected, the MPC revised upwards its GDP growth forecasts and predicted a return of the unemployment rate to the 7% threshold 18 months earlier than it previously thought. Costas Milas argues that despite the rising economic optimism and better economic data, unemployment might still take until the second quarter of 2016 to return to 7%.

In August 2013, the Bank of England’s Monetary Policy Committee (MPC) announced its brand new forward guidance policy. The MPC pledged to leave its policy interest rate unchanged (at 0.5%) and support the economy with quantitative easing (QE) at least until the unemployment rate returned from its current 7.7% level to 7% (which, the August inflation report, predicted to happen with a 55% probability only in the third quarter of 2016). Forward guidance would cease to hold if any of the following three “knockouts” were breached: (a) inflation forecasts (18 to 24 months ahead) turned out to be 0.5 percentage points or more above the 2% target; (b) medium-term inflation expectations no longer remained sufficiently well anchored; and (c) the currently loose monetary policy posed a risk to financial stability.

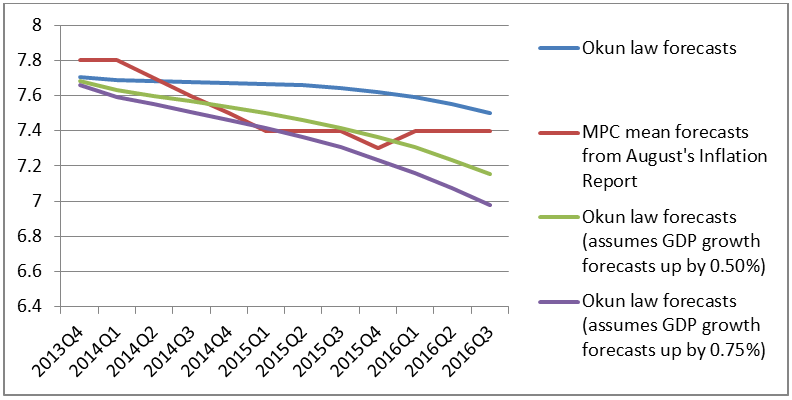

At the same time, the MPC was quick to emphasise that a return to the 7% unemployment rate threshold would not automatically trigger a tightening in monetary policy. Indeed, at 7%, the MPC would start thinking about a tightening in policy rather than pressing the “tightening button”. Since August, however, economic performance has surprised positively. Consequently, the MPC members are now revising downwards their unemployment rate forecasts. Back in August, the MPC’s average unemployment forecast was for the unemployment rate to remain above 7% at least until the third quarter of 2016. Will the MPC now predict a return to the 7% threshold much earlier than 2016q3. To answer this, Figure 1 plots the MPC’s mean unemployment rate forecasts (based on the August 2013 Inflation Report).

Figure 1: Unemployment rate forecasts, 2013-2016:

Note: Okun law forecasts are based on the following empirical model:

u(t)-u(t-1)=0.12-0.07*growth(t)+0.05*uncertainty(t), where u(t) is the unemployment rate, growth(t) is GDP growth and uncertainty(t) is GDP growth uncertainty generated by an AR(1) model of GDP growth with a GARCH(1,1) component. Adjusted R2=0.52; t-ratio on growth(t)=-10.3; t-ratio on uncertainty(t)=2.6.

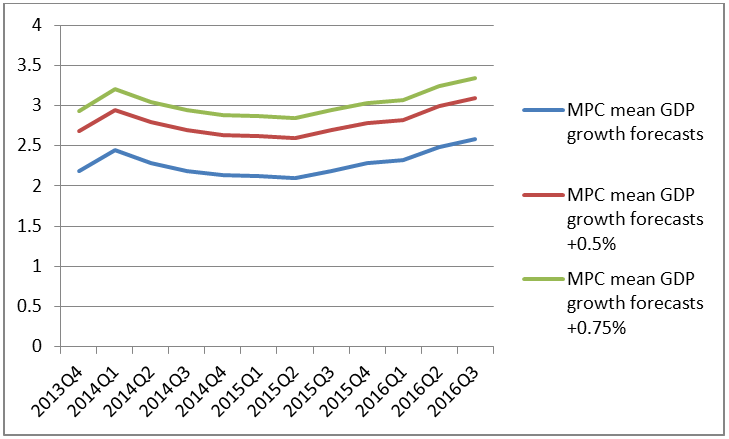

It is not quite clear to me which empirical model (and what type of collective judgement) the MPC members relied on to produce their forecasts. This is not a criticism. To understand their thinking, I run a simple “Okun law” model which estimates changes in the UK unemployment rate as a function of UK GDP growth (based on historical data over the 1970q1-2013q3 period) augmented by a GARCH-type measure of GDP growth uncertainty The idea is that changes in unemployment rate are negatively related to economic growth and positively related to economic uncertainty. The model uses as inputs the MPC’s mean GDP growth forecasts (see Figure 2) to produce unemployment rate forecasts up until 2016q3.

Figure 2: Alternative GDP growth forecasts

Using the MPC’s mean GDP growth forecasts, a revised set of unemployment rate forecasts are reported back in Figure 1 (labelled “Okun law forecasts”). Clearly, MPC’s unemployment rate forecasts provide a rosier economic picture since they are lower than those produced by the simple Okun law (which also relies on the MPC’s GDP growth forecasts!). With this in mind, two tentative conclusions emerge:

- The MPC has established a superior model which beats the simple Okun law. This is definitely a possibility. It will be nice, however, to know the details of their model. In any case, one might argue that since the MPC’s remit involves targeting a 2% CPI inflation rate, it makes sense for the MPC to produce more accurate CPI inflation rate (than GDP growth or unemployment rate) forecasts!

- If, instead, the Okun law is sufficiently “correct”, one can conclude that the MPC’s GDP growth forecasts are not quite compatible with their own unemployment rate forecasts. This is because the “correct” Okun law relies on the MPC’s GDP growth forecasts to predict a pattern of unemployment which is not “similar” to the MPC’s own forecasts. Notice also that I tried a much more sophisticated regime-switching Okun law model in which unemployment is allowed to respond differently to “booms” and “busts”. This model also failed to match the MPC’s unemployment rate forecasts. Other economic models (and pooling information from different models) are also possible to be estimated; this is on-going research (see, for example, work by myself and colleagues in the International Journal of Forecasting)

So, when should we expect the unemployment rate to return to the 7% threshold? The Okun law suggests NOT before 2016q3. However, the MPC is currently revising upwards its GDP growth forecasts and downwards its unemployment rate forecasts. With this in mind, I will assume two different possibilities: (a) the MPC lifts all its mean GDP growth forecasts by 0.5% and (b) the MPC lifts all its mean GDP growth forecasts by 0.75%; see Figure 2. Then, I rerun the Okun model with these more generous GDP growth forecasts as inputs. Turning back to Figure 1, one can notice that the unemployment rate will return to the 7% threshold in 2016q2 if, and only if, all GDP growth forecasts are simultaneously lifted up by 0.75%. To conclude:

- Despite the recent positive economic news, it is rather premature to expect that unemployment will return to 7% earlier than 2016.

- Therefore, despite the rising optimism about the economy and the emerging worries of tightening monetary policy as early as 2015, borrowers can be “reasonably confident” that the policy rate will stay at its historically low level at least until 2016 q2. This, as long as none of the three “knockouts” are breached. Obviously, the MPC can produce a new set of very strong GDP growth forecasts (much stronger than those reported in Figure 2.). This latest scenario would definitely suggest a much quicker return of the unemployment rate to 7%. Such a scenario, however, would seem rather questionable: how much would you trust a forecaster who, in the space of three months only, would be willing to make a complete U-turn in its forecasting judgement?

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Costas Milas is Professor of Finance at the University of Liverpool Management School. Email: costas.milas@liverpool.ac.uk

Follow-up comment from the author: The MPC revised today “heavily” its GDP growth forecasts by a 0.60% average over 2013q4-2014q3. The MPC now expects (mean) unemployment to be 7.1% in 2015q4; however, it believes there is a 53% probability that unemployment will “hit” 7% by 2015q3.