As the UK experiences an increasingly gloomy economic outlook, the new government under Prime Minister Rishi Sunak is expected to ignore calls to implement progressive taxes. With research suggesting that low tax rates lead to increasing inequality and, consequently, sluggish economic growth, the new government, argues Paul Whiteley, needs a new path to avoid electoral defeat.

The new UK Prime Minister, Rishi Sunak, has already eased the pressure on the economy created by the financial markets’ reaction to his predecessor’s “minibudget” on 23 September 2022. But the costs of government borrowing started to increase when Liz Truss became Prime Minister on 6 September, which the announcement of large unfunded tax cuts supercharged two weeks later. Despite new leadership in the Conservative Party helping to stabilise the situation, markets have not yet returned to their levels prior to those economic announcements.

The reason is that a black hole is perceived to exist in state finances, which indicates the need for further tax rises and cuts in public spending. A government U-turn on cutting taxes for high-income taxpayers does little to address this. As the director of the Institute for Fiscal Studies, Paul Johnson, explained: ‘At a medium-run cost of around £2 billion a year, it [the tax cut] represented only a small fraction of the Chancellor’s mini-Budget announcements. His £45 billion package of tax cuts has now become a £43 billion package – a rounding error in the context of the public finances.’ Since then, further U-turns by new Chancellor Jeremy Hunt have reduced this total, but it is clear that more needs to be done.

Three days after the “mini budget” was announced, the Bank of England started stress testing the effects of a rise in interest rates on the UK economy in 2023. The testing assumed that the rate would rise to 6% as the Bank tries to reduce inflation. In its report the Bank concluded that the consequences would be a fall in Gross Domestic Product by 5% (about £120 billion), unemployment would more than double and property prices would crash by nearly a third. It was at pains to point out that this is not a forecast but rather a simulation of what might happen if it is obliged to raise interest rates to this crisis level.

While interest rates are currently rising throughout the world, particularly in the United States, there are reports of hedge funds betting that the Bank of England will be forced to raise rates even higher in response to the current turmoil in the UK economy. So, 6% could be a real possibility.

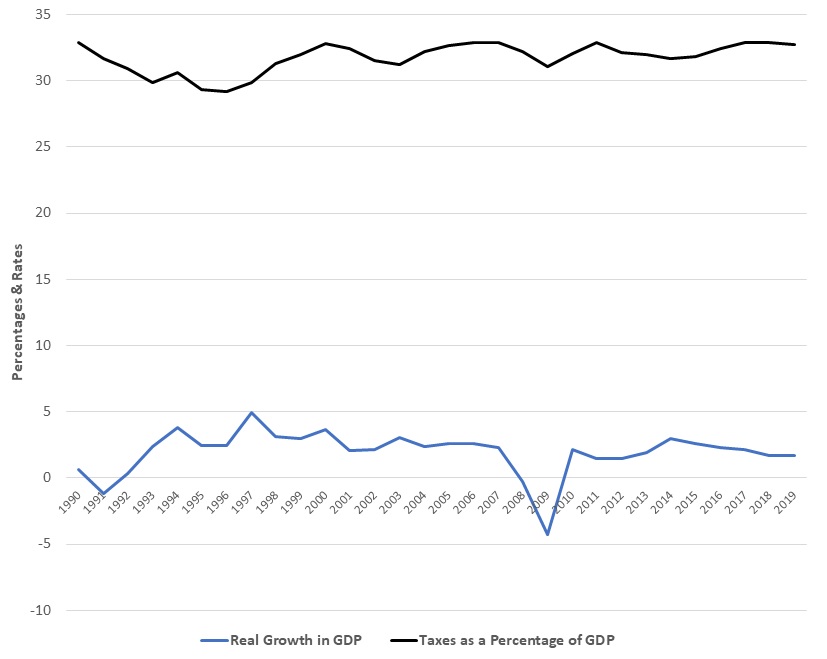

None of this would matter if the government’s underlying strategy of cutting taxes to stimulate growth worked (by encouraging investment). Unfortunately, there is no evidence that as taxes fall growth rates in the UK increase. This is shown in figure 1 which looks at the growth in Gross Domestic Product (GDP) and taxation as a percentage of GDP over a 30-year period. The correlation between these two measures is negligible (-0.10), indicating that they are essentially unrelated.

In addition, there is strong evidence to suggest that reducing taxes for the rich specifically will have no impact on growth. In a state-of-the-art modelling exercise, two LSE economists David Hope and Julian Limberg examined the effect of tax cuts for the rich on inequality, growth and unemployment across 18 OECD countries over a period of 50 years.

Their analysis found, not surprisingly, that reducing taxes for the rich produces higher rates of inequality in the long run but has no discernible effect on economic growth. They also showed that tax cuts tend to increase unemployment in the first four years after they are implemented, but the effect does not last beyond that point. The latter finding is interesting, since it implies that if the tax reductions had gone ahead as planned, the government would have had to face the voters in 2024 with rising unemployment. This is regardless of anything else that might happen to the economy in the meantime.

A recent book by the eminent economic historian Brad Delong argues that progressive taxation was one of the key ingredients in the recovery from the Great Depression in the United States in the 1930s. The mechanism driving this is well known. The rich spend a smaller proportion of their incomes on day-to-day consumption than the poor, so increasing inequality sucks effective demand out of the economy and leads to slower growth.

The electoral consequences of this major shock to the British economy look very serious for the new government. A recent YouGov poll showed that only 19% of respondents in a national survey who would vote in a general election would vote Conservative. These results are rather similar to the polling that preceded Labour’s landslide victory in the 1997 general election. Unless the government pursues an unexpected path, Rishi Sunak is likely to be out of a job at the latest date of the next election in 2024.

_____________________

About the author

Paul Whiteley is Professor in the Department of Government at the University of Essex.

Paul Whiteley is Professor in the Department of Government at the University of Essex.

Photo: Chancellor Rishi Sunak MP at the House of Lords Economic Affairs Committee in 2021. Credit: Copyright House of Lords 2021/Photography by Roger Harris.