The UK is particularly exposed to the energy crisis sweeping across the world – partly due to its dependence on gas for heating and electricity generation and poorly-insulated housing stock. After predictions that annual household bills were due to rise from around £1,000 to £3,500 in October 2022, the government announced it would provide support for households and businesses. LSE’s Anna Valero explains why there is now a need to double down on our efforts to build resilience through investment and meet net zero targets.

The UK is particularly exposed to the energy crisis sweeping across the world – partly due to its dependence on gas for heating and electricity generation and poorly-insulated housing stock. After predictions that annual household bills were due to rise from around £1,000 to £3,500 in October 2022, the government announced it would provide support for households and businesses. LSE’s Anna Valero explains why there is now a need to double down on our efforts to build resilience through investment and meet net zero targets.

#LSEUKEconomy: Explore our dedicated hub showcasing LSE research and commentary on the state of the UK economy and its future.

The UK is currently in the middle of an energy crisis, which is a key driver of the cost-of-living crisis now hitting households. Inflation rates are soaring to around 10%.

The energy crisis has been building up over the past year, as increased demand during the post-Covid reopening of economies coincided with Russia’s invasion of Ukraine and a subsequent squeeze on gas supplies into Europe. Consequently, a steep rise in the wholesale price of gas has driven up the amount that energy providers pay for gas and electricity – and that cost is now being passed on to the consumer – though recent policy interventions have somewhat helped cushion the extent of this impact.

Why has the UK been particularly affected?

Many countries are affected by the energy crisis, but the UK is particularly exposed to increases in gas prices for a number of reasons.

First, around 85% of households use gas boilers to heat their homes, and around 40% of electricity is generated in gas fired power stations. Second, these are higher proportions than other European countries. Third, houses in the UK are poorly insulated compared to elsewhere on the continent. Recent analysis from the IMF showed that UK households have been the worst hit in Western Europe in terms of the impacts on spending power.

How were energy bills set to rise before recent policy announcements?

Last winter, annual energy bills for the typical household were around £1,000. Before recent policy announcements, these were set to rise to over £3,500 in October 2022 and were expected to exceed £5000 in 2023. Many households already struggling after years of stagnant real wages – in turn linked to our anaemic productivity growth – simply would not be able to afford this type of increase.

As soon as Liz Truss became Prime Minister (and despite spending the summer insisting that there would be no handouts as a way of tackling the cost-of-living crisis), she announced a new deal whereby an energy price guarantee now sets the highest amount suppliers can charge households for every unit of energy they use.

The guarantee initially implied that the typical household’s energy bill would not exceed £2,500 a year for a period of two years, with support provided for all households regardless of income. Following the market and political chaos caused by September’s “mini budget”, and amid numerous tax policy reversals, the new Chancellor Jeremy Hunt has announced that this support will last only until April 2023 with targeted support beyond that for the most vulnerable.

What is the impact on industry?

Businesses have warned of a “cost of doing business crisis”, as the impacts of higher energy bills have been felt on top of recent volatility and change due to Brexit and COVID-19, and against a longstanding productivity problem.

In the current environment, there are limits to the extent to which higher costs can be passed through to consumers, meaning there is a risk of redundancies or businesses going bust – such risks vary by sector and business type.

In response to this, support was also announced for businesses. There will be protection for six months initially, with vulnerable businesses receiving more support beyond that date.

Many have called for raising funds to pay for energy support through solidarity taxes on people who can afford it, or windfall taxes on the excess profits of energy producers or generators.

The need for immediate and continued support for the most vulnerable

Given the scale of the challenge it was always clear that significant levels of support were needed to see households and businesses through a challenging winter. But untargeted support clearly has a number of drawbacks – cost being a key one. Support is being channelled to all households and businesses, even those that would find the increase in energy prices quite affordable. At the same time, the level of support is unlikely to be enough for others.

Government now has until April to work out how to better target support – at that point the latest estimates predicting annual bills to be over £4,000 for the average household.

Looking to the future

Importantly, however, freezing prices also means that the price “signal” is dampened. Being exposed to rising fossil fuel prices provides strong incentives for actions and investments that can not only increase our resilience and energy security but also aid the transition to net zero.

No one knows how long the energy crisis will last, but high gas prices are likely to persist for some time. We therefore need to complement immediate support policies with doubling down on our efforts to build resilience.

As this energy price crisis is driven by the price of fossil fuels, the urgency of moving forwards to meet our legal commitment to achieving net zero greenhouse gas emissions by 2050 is even clearer, which requires significant action and investment this decade to remain on track. Indeed, there are many actions that will build resilience that are also consistent with net zero:

- Reduced demand through behaviour change. There are simple things that can be done to reduce household demand for energy with little impact on comfort, such as changing boiler settings. This is another area of recent policy reversal. Number 10 initially rejected the idea but has now approved a public information campaign on these issues. European governments are also taking various additional steps to curb energy use, for example limiting the heating of public buildings.

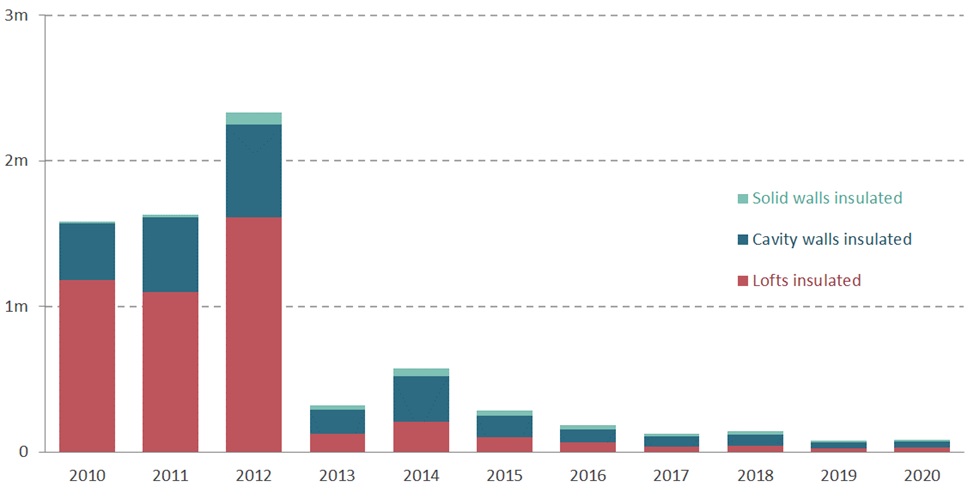

- Energy efficiency improvements in homes. Efficiency installations fell by more than 90% from over 2 million per year in 2012 to less than 200,000 per year since (Figure 1). Bills would have been lower if our homes were not so leaky, but progress has stalled.

- Zero carbon homes. Heat pumps, solar panels on roofs, electric vehicles will all deliver operational savings once initial investments are made, but we need to consider how lower income households can be supported to make these investments.

- Expanding ever cheaper renewable energy. This is a crucial way to cut energy bills and increase security of supply in the medium term. While onshore wind was recently given a boost in the government’s growth plan, current plans to ban solar farms on agricultural land are counterproductive.

Investment for sustainable growth

These actions fit with net zero targets as well as the broader approach we should be taking to address the UK’s stagnant productivity growth since the financial crisis: increasing investment.

Given the UK’s innovative strengths and specialisms in a number of crucial areas, including offshore wind and carbon capture usage and storage, and growing domestic and international demand for “clean” technologies, there is reason to believe that doubling down on investments in clean innovation is worthwhile. It will not only contribute to improving resilience and meeting net zero commitments, but it also has the potential to generate stronger, more sustainable growth and good jobs across the country.

Watch Anna Valero explain what led to the current energy crisis and how the transition to net zero emissions will help.

_____________________

Dr Anna Valero is a Senior Policy Fellow at the LSE’s Centre for Economic Performance, Deputy Director of the Programme on Innovation and Diffusion (POID) and an Associate of the Grantham Research Institute. She completed an ESRC Innovation Fellowship in 2021, obtained a PhD in Economics at the LSE in 2018, and was a Research Director for the LSE Growth Commission in 2017. Previously, Anna was a Manager at Deloitte’s Economic Consulting practice where she qualified as an ACA.

Photo by Annushka Ahuja.