The ONS released figures this week showing expanding employment while wages continue to stagnate. What is behind this puzzling picture? Geraint Johnes writes that the slack that has remained in the labour market, in the form of the underemployed and self-employed, offers one explanation for sluggish wage performance.

The ONS released figures this week showing expanding employment while wages continue to stagnate. What is behind this puzzling picture? Geraint Johnes writes that the slack that has remained in the labour market, in the form of the underemployed and self-employed, offers one explanation for sluggish wage performance.

The latest labour market statistics show numbers in employment rising by 150,000 during the second quarter of this year while wages, rising at an annual rate of just 0.4 per cent, well below the rate of increase in prices, have continued to stagnate. The employment statistics paint a healthy picture while the data on earnings suggest all is not well. That might look like a paradox. It isn’t – it’s the fall in real wages that has allowed employers to hire more workers. But nonetheless there are aspects of the labour market that have puzzled economists for some time.

On the basis of past experience, one might have expected wage pressures to be growing at this stage in a recovery. Unemployment has fallen sharply over the last year – having been stubbornly static for a long time, it fell from 7.8 per cent in the second quarter of last year to 6.4 per cent in the space of just twelve months. In normal times, that would indicate a significant tightening of the labour market, and would lead to employers playing leapfrog with wages in order to attract a limited supply of workers.

But these haven’t been normal times. They may become more normal soon, but they aren’t normal yet. There has remained considerable slack in the economy. Data that we have published at Lancaster University’s Work Foundation suggest that the recession led to many people in work working fewer hours than they wanted to – that is, it led to a marked increase in underemployment. While these people are employed, they form an army of workers who could readily switch from part-time to full-time work as the demand for labour increases. Indeed, in the latest statistics, we are seeing that begin to happen. Over the second quarter of this year, employment rose by 0.5 per cent, but the number of hours worked increased by twice as much. And over the same period, the number of employees in part-time employment actually declined by some 19,000, while the number in full-time employment grew rapidly.

Another form that labour market slack has taken in recent years, rather unusually, is self-employment. Numbers of workers in this category have increased rapidly, and now over 15 per cent of all those in work in the UK are self-employed. Little is known about these new self-employed workers. Many are likely to have chosen self-employment whatever the weather, but it seems as though some, at least, have chosen it in the absence of other, more attractive, alternatives. Around a quarter of the new generation of self-employed workers would prefer not to be self-employed – a far higher proportion than has been observed in the past. Moreover, there is evidence to suggest that the real earnings of the typical self-employed worker have fallen faster than those of employees. But the latest data suggest that the increase in self-employment is now starting to slow – another sign that the labour market is starting to return to normal.

The slack that has remained in the labour market offers one explanation for sluggish wage performance. Another important factor has been the failure of labour productivity to pick up in the aftermath of recession. There is a plethora of reasons underpinning this so-called productivity puzzle, and we have explored these at length at a recent event at the Work Foundation.There are, however, encouraging signs. Business investment, which had been stagnant since the onset of recession, has made a spectacular recovery in the last two quarters for which data are available; in the first quarter of this year, it stood about 10 per cent higher than a year earlier. That is a quite remarkable recovery. Such investment in capital should help increase labour productivity. Once growth in labour productivity is resumed, real wages will start to rise. Just how quickly that comes about remains to be seen.

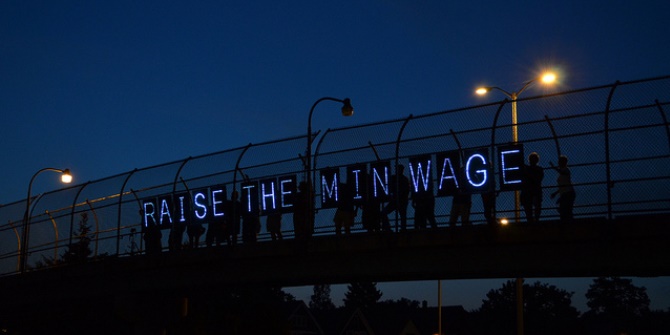

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting. Featured image credit: INTVGene CC BY-SA 2.0

Geraint Johnes is Director of The Work Foundation and Professor of Economics at Lancaster University.

Geraint Johnes is Director of The Work Foundation and Professor of Economics at Lancaster University.

I, like many others, have been extremely surprised by the instant attention to ‘stagnation in wages’ following the news that unemployment has dropped. Firstly, like many others, I have been appalled at the rather WEAK and Pathetic journalism at the BBC (and other powerful news media organisations) at their failure to hold Iain Duncan Smith to account on so many questions. For example, one would have thought that a viable follow-up question to such a drop in unemployment would be “how many claimants have had their benefits either stopped or suspended are included in this drop?” or “is it true that Work Programme customers do not get counted as unemployed?” So many questions.

Having acknowledged similar outrage by many on social media about this failure to hold IDS to account, one can only be left with the feeling that the BBC fails to be independent and, thus, journalism continues to remain at its weakest point – failing to engage with those challenged by policy and holding government/MPs/politicians to account by asking the RIGHT questions.

Shameful at the weakness of journalism in newspapers, TV…etc NOT willing to ask such viable and fundamental questions of our politicians.

SHAMEFUL.

Because unemployment is not falling, sanctions on the employable, rejection of valid claims for ESA and DWP, does not mean that these people are working, it means they are just not getting the vital financial support they need. The differential between those at the top and those at the bottom is increasing because it is the ones at the bottom paying for the mistakes of the bankers, and with the influx of foreigners from the destitute nations within the eu the job market is being flooded so wages are being kept down by the amount of unemployed so desperate to work they will accept zero hours contracts.

Helpful commentary and I agree that it’s puzzling but perhaps we should be thankful…yes we’re all poorer, but perhaps there’s at last somehow an awareness that if increased wage costs lead to increased prices than perhaps earners don’t gain that much, and perhaps the pound’s likely to slip and so import costs (espec commodities such as energy, fuel, food to get more expensive too. Even though no one wage deal will make any great difference, perhaps our collective anxiety about the massive economic shock we’ve been through, and the fragility of the current return to growth, means that we are in general more restrained for now than in a normal boom bust cycle. i think that’s quite rational.