Kitty Stewart explores the potential consequences of Brexit for domestic social policy. Drawing on existing research and evidence, she sheds light on the many ways in which social policy in the UK has been affected by EU membership, and hence the likely implications and challenges arising from the decision to leave.

Kitty Stewart explores the potential consequences of Brexit for domestic social policy. Drawing on existing research and evidence, she sheds light on the many ways in which social policy in the UK has been affected by EU membership, and hence the likely implications and challenges arising from the decision to leave.

How are the effects of Brexit expected to fall across different groups in the population? We consider the possible differential impact by region, sector, skill-level and income group, and what government might do to mitigate some of the effects.

Effects by region

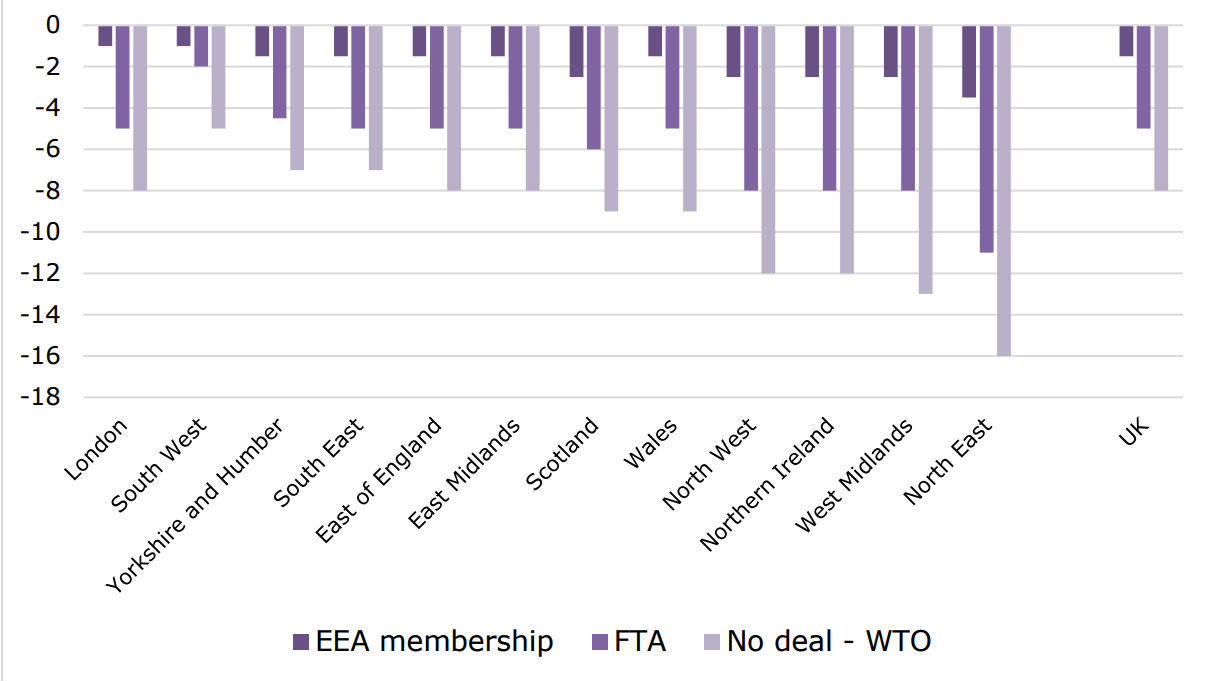

In terms of the regional impact, studies have reached some contrasting conclusions. Figure 1 presents Whitehall estimates of the effects of different Brexit scenarios by region. The North East, West Midlands, Northern Ireland and North West are projected to be hardest hit. There is a strong overlap with the regions where living standards have already been most squeezed by inflation. Larger predicted effects on regional growth result from a higher dependence on exports in the regional economy and a greater exposure to a change in trade barriers due to the regional composition of goods and services for export. These are different mechanisms to those driving differential inflation – higher expenditure shares in some regions than others on food and drink, clothing and fuel – but if Whitehall projections are right, some regions seem to be doubly exposed.

Figure 1: Provisional growth projections under three Brexit scenarios: Gross Value Added in 2033 compared to retaining status quo

Los et al (2017) use historical data to calculate the share of local economic activity that is dependent on trade with the rest of the EU. Like the Treasury, they find that London and the South East stand to lose least from Brexit, while the North West loses more than 12%, and there are large losses also in Yorkshire and the Humber, the West Midlands and East Midlands and the South West. Notably, between 2000 and 2010 local dependence on EU demand was growing in almost all regions except London, where it was falling: London increasingly competes globally (helped by EU human capital) rather than on a European stage. This study also finds a clear positive correlation between the proportion of Leave voters in an area and the extent to which local employment is dependent on the EU, and the authors suggest that we can expect to see a deepening of regional inequality after Brexit; areas already being left behind will be those most affected by the decision to leave.

The conclusions of Dhingra, Machin and Overman (2017) are rather different. They seek to adjust for the extent to which industries could substitute EU inputs from domestic or other sources, and for differences in the level of likely trade barriers in each sector. They conclude that London and the South East might in fact be the regions most negatively affected by Brexit. First, as the importance of EU trade declines, the South East will lose the advantage of geographical proximity to Europe, and other ports around the country may gain from a greater dispersion of trade. Second, trade barriers are generally higher for services, within and outside the EU, so areas specialising in services will be harder hit than those specialising in goods. This is especially true under a ‘hard’ Brexit scenario, as under WTO rules there has been much less progress in liberalising trade in services than goods. Financial services are at particular risk, because under all scenarios except

the Single Market the UK financial sector is expected to lose the ‘passporting’ rights which enable it to operate in other Member States.

Thus in contrast to Los et al, Dhingra et al project that the areas hit hardest will be those which had higher average wages to begin with. However, the authors underline that the differences in expected impacts remain swamped by existing disparities.

Further, while the immediate negative impacts are predicted to be smaller in poorer

regions, households in these regions may have more difficulty adjusting to those shocks as they start from a more vulnerable position. In addition, the bigger immediate shocks may not be the most negative in the longer run. The authors point to a parallel with the 2008 crisis, in which London and the South East were most sharply affected but recovered more strongly, the size and diversity of the regional economy easing the adjustment process.

Effects by sector, gender and education level

In terms of effects on different sectors and groups of workers, Levell and Keiller (2018) estimate that the highest exposed industries are clothing and textiles, transport equipment (including car manufacturing), chemicals and pharmaceuticals, and finance: these export high shares of output to the EU, or purchase high levels of inputs from the EU (or both). The authors identify men as being more likely to be employed in these industries than women, and men with few formal qualifications most of all. The most highly exposed are workers in process, plant and machine operative occupations, who tend to be older men with specific skills: Levell and Keiller note that history suggests these workers may struggle to find equally well-paid work if their current employment were to disappear. The authors also look at regional differences, and argue that differential effects by gender and education level within regions are likely to be greater than average differences between regions, though there are regional differences in the share of low-educated workers employed in the most exposed industries: these industries employ 25% of low-educated men in Northern Ireland and 24% in the West Midlands, compared to 19% in the UK overall.

Note, however, that Levell and Keiller consider only the sectoral effects of new trade barriers with the EU. What happens to particular industries will be affected by other factors too, including what happens to trade barriers with other countries, and, for agriculture, what happens to farm subsidies. Complexity also arises from the fact that the propensity to trade with the EU within a given industry may vary geographically: firms in Northern Ireland may do more EU trade than firms in the same industry in Britain, leaving them more exposed. In short, a great deal of uncertainty remains about how the impacts will play out.

Could some of the negative effects of reduced trade on lower-educated workers be

offset by reductions in migration? Migrants from the newer EU Member States, entering from 2004, are known to have moved primarily into low-skilled employment (even though often not low-skilled themselves) (Portes and Forte, 2017). An end to the free movement of labour might therefore be expected to reduce labour market competition faced by British lower-skilled workers, increasing job opportunities and pushing up wages.

The Migration Advisory Committee, in its recent review of the evidence of the labour market impact of EU migration, finds that migrants have had little or no impact on the employment and unemployment outcomes of the UK-born workforce.

This is also true for sub-groups who might be more likely to be affected, such as young people. Rather than replacing UK-born workers, migration appears to boost overall employment more or less one-for-one.

On wages, based on existing evidence and its own analyses, MAC concludes that migration is not a key determinate of the wages of the UK-born workforce. Some evidence does suggest that there are small negative impacts on the wages of lower skilled workers, while higher skilled workers benefit. For example, Nickell and Salaheen (2015) find a 10 percentage point increase in the share of foreign-born workers in the regional semi-skilled/unskilled service sector leads to around a 2% reduction in wages for UK-born workers in that region and sector. A reduction in migrant workers competing for these jobs might therefore be expected to have similar small positive consequences. But it should be emphasised that these are small effects. The MAC report cites Breinlich et al’s (2017) finding that the fall in the value of the pound after the referendum vote raised prices by 1.7%, and notes that this is almost certainly a larger impact than the effect on residents’ wages and employment opportunities of all the EEA migration since 2004.

Effects on income poverty and inequality

Living standards are projected to be lower on average in the future as a result of exiting the EU, with larger effects for scenarios which create more trade barriers with European markets. The Joseph Rowntree Foundation explores the potential impacts on living standards of people in low-income households specifically. They project that the effects will be felt across the whole distribution, rather than disproportionately hitting those at the bottom, and therefore the impact on relative poverty is small for most scenarios. But an increase in prices (expected to be larger under ‘harder’ forms of Brexit) would affect lower-income households very differently depending on government decisions about the uprating of benefits and tax credits. Most working-age benefits have been frozen in cash terms since 2015.

What about incomes at the other end of the distribution? Could it be that, via a reduction in the importance of financial services to the economy, Brexit might lead to a fall in very high incomes and therefore in some measures of income inequality? A substantially smaller financial services sector seems a highly plausible outcome of Brexit, though one that is likely to play out over the long-term. The Bank of England has revised downwards its estimates of the immediate “Day 1” impact on City of London jobs: the estimate remains 5-10,000 jobs, but is now at the lower end of that range. Around 377,000 people work in financial and associated services in the City of London, so this a relatively small fraction of the total. Deputy Governor Sam Woods underlined that “the bigger question is where this goes longer term, and that fundamentally depends on what kind of deal is struck”; in particular whether a model of equivalence can be agreed, which would allow some of the benefits of passporting to be retained.

Could a reduced financial services sector have positive effects for Britain? On the one hand, one must weigh up job losses, including those in supporting sectors (catering, cleaners, IT services) and lower average income for London; on the other, reduced pressure on London housing, less conspicuous wealth and inequality in the capital, and possibly a boost to other industries in other regions. This last could result from a reverse ‘Dutch disease’ effect due to a permanently weaker pound; the opposite of what can happen when the discovery of oil leads to an appreciation of the currency, making manufacturing less competitive. But there is no evidence that any such effect would outweigh the impact of new trade barriers.

Despite their conclusion that low-educated men are most exposed to new trade barriers, Levell and Keiller (2018) estimate that earnings inequality may fall after Brexit. This is not (solely) a financial services effect but results in part from the fact that men are more affected (and in general better paid) than women, and in part because men working in exposed industries tend to be the better paid employees within their education bracket. Thus among low-educated men, highly exposed workers are paid on average 24% more than other low-educated workers, with equivalent figures of 35% for mid-educated workers, and 24% for those with degrees. Brexit may reduce earnings inequality by removing the better-paid jobs for men within each bracket.

What can be done to mitigate the risks of Brexit for inequalities?

There is a strong consensus among economists that Brexit will leave the UK poorer overall in the medium-term. In addition, as discussed here, there is reason for concern that regional disparities could widen, while lower-income households could feel the effects of rising inflation if benefit uprating policy is not revisited. Some good quality jobs are at risk, and there is very limited evidence that falls in migration could help UK-born workers with lower qualifications find employment or see wages rise.

There are a number of actions government could take to try to mitigate these risks. A major strategy for regional and industrial investment is essential. Investment is also needed in education and training: this would allow UK youngsters to fill gaps in health care and other public services. In the immediate term, an end to the freeze on working-age benefits, with retrospective action to restore their value, would ensure those living on the lowest incomes were not left in increasingly difficult circumstances as prices rise due to currency depreciation.

The major challenge, however, is that – despite the claims on Vote Leave’s touring bus – Brexit will mean less not more money available for public spending. The Office for Budget Responsibility project a hit to public revenue of about £15 billion a year by the early 2020s as a result of Brexit, and a cross-Whitehall study increases in annual public borrowing of between £20 and £80 billion by 2033-34, depending on trading arrangements reached. Even with the necessary political will, all the actions proposed will be made much more difficult by these financial constraints.

____________

Note: This post was first published on LSE Brexit. It is an edited extract from What does Brexit mean for social policy in the UK? by Kitty Stewart, Kerris Cooper and Isabel Shutes. Featured image credit: Pixabay.

Kitty Stewart is Associate Professor of Social Policy and Associate Director of the Centre for Analysis of Social Exclusion (CASE).

Kitty Stewart is Associate Professor of Social Policy and Associate Director of the Centre for Analysis of Social Exclusion (CASE).

5 Comments