Lutfey Siddiqi and Sharmine Tan argue that a holistic, nature-positive lens is the most effective means for private capital to help address climate change. Integrating net-zero initiatives with natural asset stewardship should lead to better outcomes for the planet, businesses, and communities.

Lutfey Siddiqi and Sharmine Tan argue that a holistic, nature-positive lens is the most effective means for private capital to help address climate change. Integrating net-zero initiatives with natural asset stewardship should lead to better outcomes for the planet, businesses, and communities.

The challenge

Three decades on from the Rio Earth Summit, almost two decades since the coinage of the term ESG (environment, social, and governance issues), and seven years on from the dual launch of the Paris Climate Agreement and UN Sustainable Development Goals (SDGs), mainstream economic and financial systems can no longer ignore their dependence and impact on the planet’s ecological systems. Business models need to change to better account for the full range of costs and benefits that they generate. The sheer scale of that change requires a pivotal role of private enterprise and private capital, complementing and multiplying public sector efforts at national and international levels.

The challenge is one of execution. How do we create and deepen markets for ecological solutions when the origin of the problem lies in externalities and market failure? How do we create financial markets where previously-unbankable projects can be securitised into investable assets?

What have we learnt from climate finance?

So far, the focus on greenhouse gas emissions (GHGs) has led the way. The 2015 Paris Accords fundamentally reset the tone and direction of regulatory policy and expectations, as every signatory committed to producing nationally determined contributions (NDCs) and strategies towards net zero.

The G20 Financial Stability Board swung into action by creating a Taskforce on Climate-related Financial Disclosures (TCFD). Almost overnight, the zeitgeist had changed for leaders in the private sector and their financiers. The taskforce provided an elegant template of four pillars – governance, strategy, risk management, and metrics – that allowed corporations to tell their climate impact stories from different starting points, and refine their approach over time. It helped develop common language for internal change within organisations, and communication with suppliers and investors.

Either on a voluntary or mandatory basis, the taskforce’s adoption has accelerated around the world. At the same time, we have seen a proliferation of green bonds and, to a lesser extent, other banking products linked to sustainability outcomes in recent years. As with all markets, an ecosystem of hard and soft infrastructure has started to take hold.

Green bond principles produced by the International Capital Market Association (ICMA) allowed investors and investees to converge onto this asset class. The Network for Greening the Financial System (NGFS) brings together central bankers as they chart out their regulatory and analytical work on green finance. Despite recent criticism, the Glasgow Financial Alliance for Net Zero (GFANZ) assembles banks and asset managers in their roles as catalysts of decarbonisation. In terms of reporting, there is a growing convergence of guidance and standards around sustainability-linked accounting across industries and regions. There remain known challenges, of course.

Principal amongst them are grades of greenwashing, and the apparent lack of consistency or comparability in summary measures such as ESG ratings. In recent months, the tragic war in Ukraine has also highlighted trade-offs between sustainability and security that might arise in the absence of a holistic strategy.

Notwithstanding these challenges, the pursuit of net zero and the role of climate finance remain directionally unaltered.

From climate to nature as the meta-ecosystem

However, the atmosphere is only one of at least four realms that make up our planetary system – land, freshwater, and ocean being the other three. The emission of greenhouse gases is only one of several related indicators of planetary health.

To appreciate the scope of natural assets as a system of systems, consider the role of oceans. According to a recent report by the World Economic Forum, the ocean covers 70% of the planet’s surface, transports 90% of global goods trade, and supports the livelihood of millions in both local communities and global industries. In addition, the ocean acts as a carbon sink, capturing almost a quarter of human-generated CO2 emissions.

Degradation of the ocean, in terms of acidification or extinction of habitats, harms its ability to provide economic and ecosystem services. Yet, in a classic tragedy of the commons, we take too much out of the ocean (over-fishing), and we put too much into the ocean (plastic waste). Without collaboration across stakeholders and effective governance mechanisms, commercial enterprise and private capital cannot be mobilised towards restoration, preservation, and responsible use of the ocean. In an effort to address the coordination failures that create market failure, the G20 has just launched the public-private platform, Ocean 20.

Riding on the coattails of TCFD, the Taskforce on Nature-related Financial Disclosures (TNFD) has introduced a framework for corporations to identify and assess their dependencies and impact on nature.

It asks the same four questions:

- What are your governance processes?

- How have you incorporated nature in your business strategy?

- How do you manage nature-related risks?

- And what metrics and KPIs do you use?

The first step for any organisation is to identify their interfaces with nature. For example, Finance for Biodiversity (F4B) suggests two distinct categories in which the balance sheets of Development Finance Institutions (DFIs) are linked to nature.

Dependency risk refers to the extent to which their investees rely on nature for their core business. For example, almond farming relies on the pollination services of bees. On the other hand, Nature Risk refers to the damage to nature, caused by business activities. For example, the conversion of rainforests into farmlands for the production of traded commodities diminishes the supply of ecosystem services.

In the case of development finance institutions, F4B estimates that their combined loan books harm nature to the tune of US$1.1 trillion annually and more than a quarter of their total loans of US$11.2 trillion is highly dependent on vulnerable ecosystems. Quantifying and accounting for both buckets of impact can provide a dollarised baseline for nature-positive investments. They can help assess the materiality of specific interfaces with nature and inform strategies for transition.

Capitalise on TCFD’s head start

The conceptual alignment between the two taskforces (on climate-related and nature-related financial disclosures) should ensure that nature reporting is not a completely new thing – that it makes use of the organisational muscle-memory built by TCFD in recent years. In fact, the two should be integrated as quickly as possible.

A closer look at companies that report under TCFD shows that most are comfortable with listing the risks that they are exposed to, and posting metrics about current and historical emissions. However, far fewer of them discuss how climate change might impact their business strategy and potential opportunities in future scenarios. It is precisely in these areas that the climate and nature stories should be developed jointly and connectedly, solving for both net-zero and nature-positive outcomes.

Given that many of the sources of carbon offsets are found in nature – mangroves, forest tracts, the African forest elephant for example – it makes sense to consider a company’s footprint on the fuller ecosystem. There may be projects or investments that would jointly address atmospheric and biodiversity health.

A more multi-dimensional approach might also guard against selective reporting on a narrow set of outcomes (e.g., emissions) without addressing material impact on critical issues (e.g., water use or plastics waste) that directly impacts the natural realm.

Two key levers for financial markets

Now, a reporting template in and of itself does not convert nature-positive initiatives into investable projects. In order for mainstream finance to make a significant contribution, two areas require further development: a) data innovation and b) deal structuring.

Data innovation

According to Nature Finance, over half (55%) of the fintech for biodiversity solutions are powered by blockchain. The combination of immutable ledgers, smart contracts and tokenisation of credits has the potential to revolutionise the capture, verification and monetisation of nature-related data. This in turn has the potential to inject integrity and trust in nature-related investments.

For example, biodiversity-relevant earth observation data (EO) can facilitate the tracking of activities linked to a financed asset’s value chain. This data could be integrated with ESG analysis tools for risk management, or to enable verification for impact bonds. Information about biodiversity footprint or offsets, using satellite imagery combined with artificial intelligence, could foster the creation of tokens, markets, and payments in ways that were previously infeasible. Finally, ESG data providers could use actual impact data when it comes to scoring companies, instead of relying on selective reporting by companies and other proxies. The Finance for Biodiversity Initiative (2022) has put out several biodiversity measurement approaches that promise to be particularly useful for financial institutions.

Deal structuring

With principles that are similar to the ones for green bonds, the International Finance Corporation’s Guidelines for Blue Finance help translate ocean economy projects into financial products. Such guidance will likely be required for other natural sub-systems. However, even with improvements in the “three Ds” of definitions, data and disclosures, some projects may simply not offer the mix of risk and returns required to bring in mainstream institutional investors. It is telling that right now, as pointed out by Standard Chartered bank, each dollar of financing from multilateral development banks crowds in only one dollar of financing from the private sector. In order for blended finance to be effective, the size of private capital must be multiples of that of non-commercial capital.

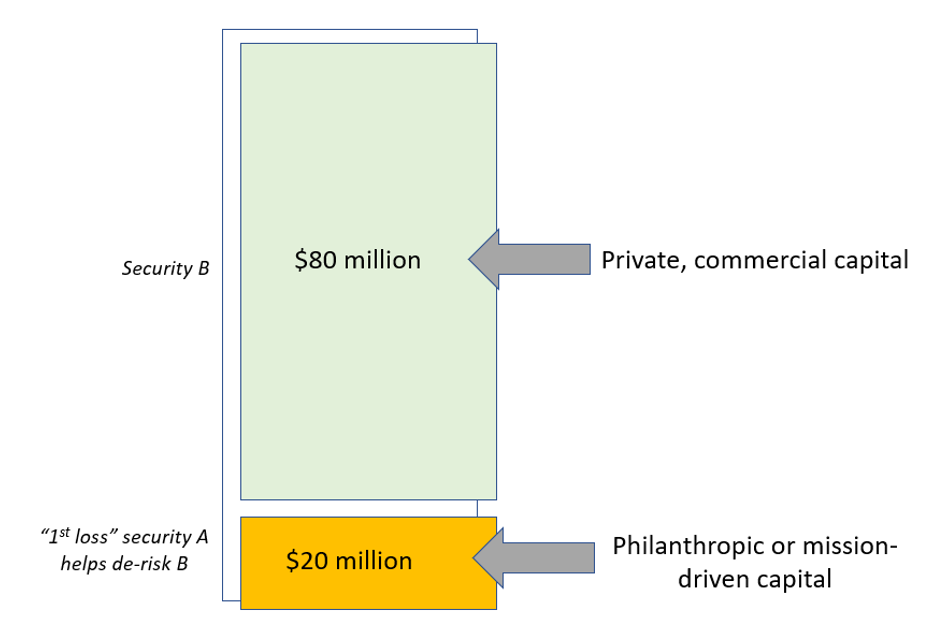

Towards achieving that result, the capital structure of nature-positive investments might have to be sliced into different tranches, each catering to a different provider of capital. For example, a ‘first loss’ piece of $20 million could be taken up by philanthropic, public sector or other mission-driven investors. This layer of cushion and de-risking could in turn crowd-in $80 million of private sector funds, taking the total investment to $100 million.

Of course, there need to be safeguards against abuse but conceptually, approaching this like securitised derivatives might lead to leveraged outcomes.

Figure 1

The way forward

The 15th Conference of the Parties (COP15) to the United Nations Convention on Biological Diversity (CBD) in December 2022 is expected to formalise a new global biodiversity framework with targets for protecting marine and land habitats, and addressing critical dimensions such as reducing pesticides, plastic waste etc. Once again, the transitions will require private capital. It is important that businesses and investors do not approach this as cognitive overload.

Rather, they should harness the head start afforded by climate initiatives and processes such as TCFD to map out wider natural systems. There is now sufficient familiarity with TCFD for its template to be widened beyond emissions. At the same time, its incorporation into corporate strategy or scenario analyses remains at a nascent stage such that its integration with TNFD is mostly non-disruptive.

Sustainability is a classic ‘wicked problem’ in a complex emergent system with tremendous challenges of sequencing and pacing. There are also knowledge gaps which will require collaboration across sectors (including academia) and domains. Most of all, it requires leadership of the highest order: leaders who can keep the eye on the prize even as they navigate twists and turns, drive through iterative change without inducing motion-sickness, and collaborate across traditional boundaries with creativity and compassion.

- This blog post first appeared at LSE Business Review.

- Featured image by Dustan Woodhouse on Unsplash

- Please read our comments policy before commenting

- Note: The post gives the views of its authors, not the position USAPP– American Politics and Policy, nor of the London School of Economics.

- Shortened URL for this post: https://bit.ly/3PuSYSn