The Occupy movement has brought attention to top CEOs as never before. Many are concerned that this pay is not linked to firm performance. Brian Bell from the LSE’s Centre for Economic Performance finds that while CEO pay is in fact linked to performance,most workers do not see similar increases when firms perform well.

The Occupy movement has brought attention to top CEOs as never before. Many are concerned that this pay is not linked to firm performance. Brian Bell from the LSE’s Centre for Economic Performance finds that while CEO pay is in fact linked to performance,most workers do not see similar increases when firms perform well.

In the wake of the financial crisis the pay of Chief Executive Officers (CEOs) in top companies is high on the agenda of policymakers all over the world. Two linked factors seem to be responsible for this. First, the pay of CEOs and other senior executives has risen much faster than that of ordinary workers. Second, there is growing concern that this pay is unrelated to the actual contribution of CEOs to the business they run. Corporate scandals from Enron to Worldcom to Merrill Lynch seem to suggest that executives are more concerned with extracting value from the business than improving the long-run performance of the firm. At the same time average employees’ real wages have been falling and the ordinary worker does not seem to benefit from the firm performance used to justify high CEO pay.

Since CEOs are clearly in ‘the top 1%’, they bear the wrath of the Occupy movement. And new research into the link between the pay of senior executives and the performance of their firms sheds more light on this issue. We have created a database of pay for CEOs, senior executives and workers covering over 400 UK firms since 2001. These firms account for about 90 per cent of UK stock market capitalization. This is the first time that data covering everyone from the CEO to a cleaner in a large sample of firms has been collected and linked to stock market performance in this country. It allows us to rigorously explore how pay changes as the performance of the company varies.

CEO pay rises more than that of ordinary workers

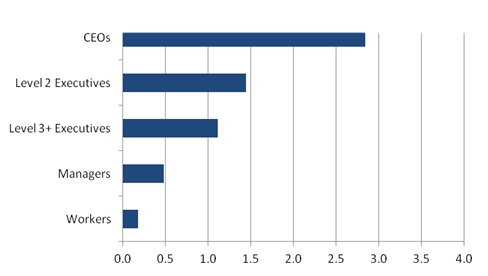

CEOs earn around 40 times more than the average worker – but this multiple rises to around 80 if we look only at the very top companies; i.e. the FTSE 100. The majority of pay for CEOs comes from bonuses and stock incentive plans, whereas 95 per cent of workers’ pay comes from basic salary. Our evidence shows that when performance improves, so does pay, but it goes up much more for CEOs than for ordinary workers. For example, if the firm’s value as measured by shareholder returns increases by 10 per cent, CEOs on average get an extra 3 per cent in pay, while workers get only 0.2 per cent more, as Figure 1 shows:

Figure 1: Pay increases for firms’ employees as shareholder return increases by 10%

This close pay-for-performance link among CEOs is a recent development. Evidence from the 1980s and early 1990s found almost no link between pay and performance for top executives. Our research shows that the correlation between pay and performance is now is driven by bonuses and incentive packages which have become more important in recent years.

So we now find a strong link between CEO pay and company performance. Poorly performing firms are much more likely to boot out their CEOs and when the firm does badly, CEO pay also goes down.

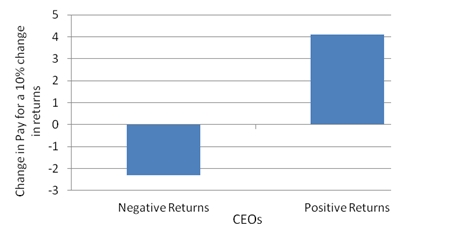

Figure 2: CEO pay changes and shareholder returns

CEO Pay goes down as well as up – but not by as much

An important fact to bear in mind, however, is that CEO pay cuts for failure are not as speedy as pay increases on the upside. So although it is true that CEOs are not just “rewarded for failure”, they get more pleasure when the company’s performance goes up than they feel pain when the company’s performance goes south.

Of course, these average effects of performance on pay cover both well-governed firms that use pay to incentivize their CEO and poorly performing firms that overpay for questionable talent. In addition, it is hard to claim that the majority of the pay gains for most CEOs over the last decade can be linked to performance given the relatively poor returns to shareholders over the period.

In terms of policy, we think there are strong grounds for encouraging a more transparent reporting of pay by companies. Many annual reports are unnecessarily complicated in reporting of executive pay and, perhaps inadvertently, tend to obscure the size and nature of the pay awards. We also think that there should be a requirement for each and every board to explain to shareholders and the public how the pay growth of their CEO is tightly linked to the performance of the company. Those that fail this test must be held to account by shareholders.

Full details of this research are available in “Firm Performance and Wages: Evidence from Across the Corporate Hierarchy” Brian Bell and John Van Reenen, CEP Discussion Paper 1088.

Please read our comments policy before posting.