By Riccardo Crescenzi (LSE), Arnaud Dyèvre (LSE) and Frank Neffke (Complexity Science Hub, Vienna)

By Riccardo Crescenzi (LSE), Arnaud Dyèvre (LSE) and Frank Neffke (Complexity Science Hub, Vienna)

How do new centres of technological excellence emerge? R&D activities of foreign multinationals can act as powerful boosters of local innovation and growth in the cities where they invest. However, for the most innovative multinational companies, the risk of leaking knowledge to local competitors often outweighs the benefits of learning from those same competitors, thus reducing the incentives of ‘very innovative multinationals’ to embed themselves fully into the local innovation system. Second-tier multinationals—those outside the top 20% of innovating firms—that start R&D activities in foreign regions generate more knowledge spillovers than higher ranking multinationals and consequently, foster greater growth in local innovation.

Introduction

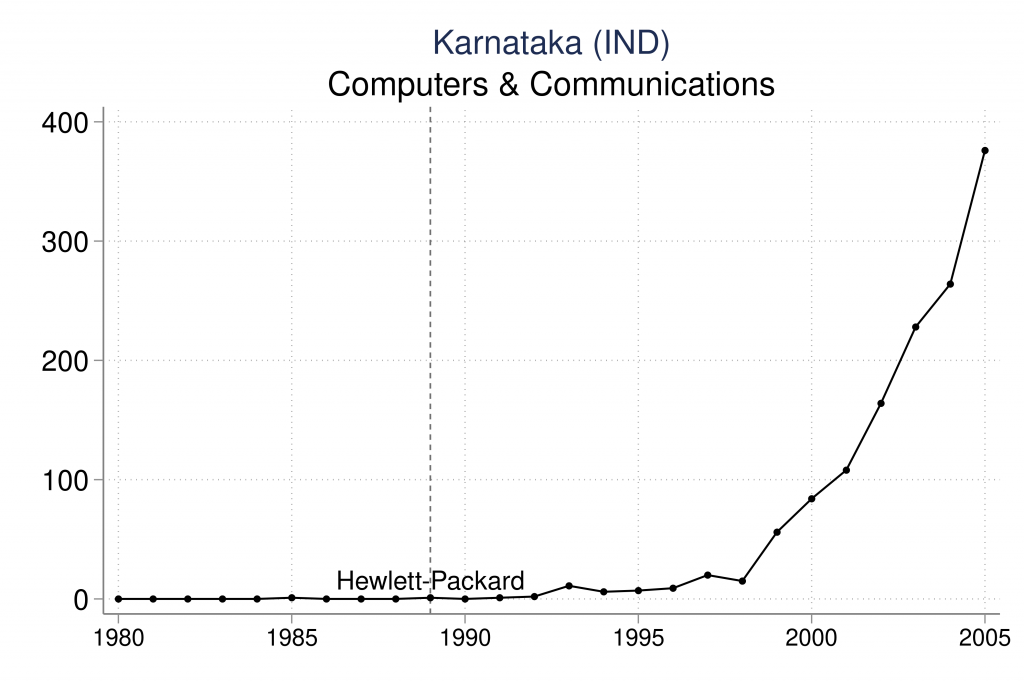

Cross-border Research and Development (R&D) investments have expanded drastically in recent years. Between 2003 and 2017, R&D capital invested abroad roughly doubled, from projects worth 18.7 billion USD to 34.4 billion USD. Cities and regions compete fiercely over such projects, in the hope that they will create high-quality jobs, help develop local innovation capabilities and put the region on the map as a recognised centre of technological excellence. Local governments often try to charm the largest and most technologically advanced MNEs to invest in their regions. These governments may have in mind the experience of Bangalore, India’s high-tech powerhouse, which attracted highly innovative MNEs such as HP and Texas Instruments in the late 1980s and subsequently experienced dazzling growth in local innovation. The graph below shows this impressive growth in innovativeness.

Is trying to entice the most innovative MNEs the right strategy? All too often this approach overlooks the fact that the MNEs behind these investments have few incentives to share their knowledge and practical know-how. On the contrary, technologically advanced firms often have a lot to lose and little to gain from local knowledge exchanges.

Just because firms invest abroad to access knowledge assets outside their home regions, they do not necessarily want to share their own knowledge assets with potential competitors. In fact a large body of research has argued that firms value inward spillovers that allow them to learn from others, but shun outward spillovers through which their own knowledge ‘leaks’ to competitors. The underlying cost-benefit tradeoff between inward and outward spillovers will depend on knowledge differences between the originators and the recipients of such knowledge flows. Although technology leaders may in principle be capable of generating the largest knowledge spillovers, they have the least to gain and most to lose from them. Therefore, they will strive to prevent their know-how from leaking to competitors. In contrast, for companies further down the technological ladder, the balance tilts in favor of engaging more fully in reciprocal local learning processes. To understand how MNEs affect local learning processes, it is critical to consider these strategic tradeoffs.

We test this idea on data from the United States Patent and Trademark Office (USPTO), covering patenting activity in the regions of virtually all countries of the world. First, all inventors who file patents on behalf of foreign firms are identified. Such patents are taken to signal that a foreign firm has developed R&D activities in a location and considers these events as ‘treatments’ to the local economy, just like Hewlett-Packard in Bangalore. Next, regions with and without such treatments are contrasted to assess the impact of foreign firms on a region’s innovation rate[1].

Do host regions benefit when hosting MNE foreign R&D centres?

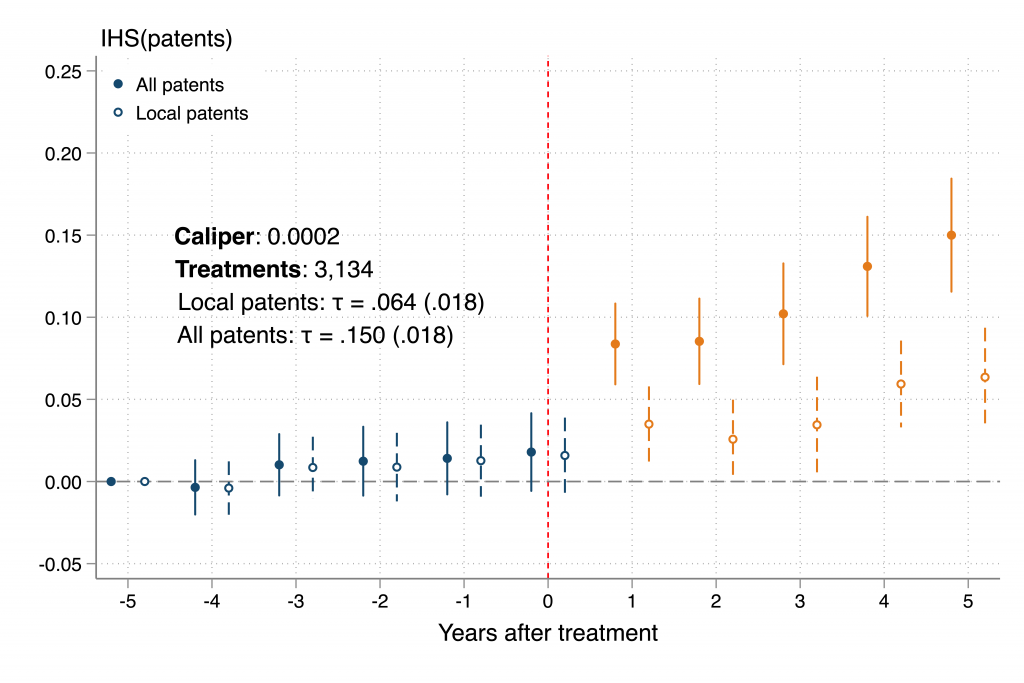

Over a 5-year period, patenting rates in regions hosting new MNE foreign R&D activity climb 14 centiles in the global innovation ranks compared to what would have happened in the absence of foreign activity. This increase is quite spectacular, given how persistent ranks of innovativeness of regions are (see this previous post of ours). In part, this is attributable to local knowledge spillovers: the emergence of R&D activities by a foreign MNE causes an increase in patenting by domestic firms. Another factor is due to demonstration effects: the fact that an MNE is able to produce patentable inventions signals to other foreign firms that the region is capable of supporting high-tech R&D activities, attracting further R&D activities from other foreign firms. The difference-in-differences graph below shows the causal effect of R&D activities in regions, decomposed into local and newly arrived foreign innovation.

Not all foreign firms increase local innovation rates equally.

Contrary to much received wisdom, technology leaders are not the main contributors to local innovation capabilities. Indeed the arrival of technology leaders generates fewer spillovers to the local economy than the arrival of MNEs that rank lower in their technology field’s patenting distribution. A closer inspection of some of the channels through which knowledge spillovers materialise sheds light on why it is the case. Foreign technology leaders engage in fewer local alliances than lower-ranking MNEs and they also exchange fewer workers with local firms. Instead, they rely more on their headquarters as a source of labor and see their patents cited less frequently by local firms.

What can policy makers learn?

To make the most of foreign investments, regions need to accompany them with sound local policy. For instance, our findings point to the importance of labor pooling and strategic alliances between foreign and local firms. These interactions may be hindered by barriers associated with organisational, cultural and – often – cognitive distance. Public policy should therefore aim towards reducing transaction costs between MNEs and local actors, particularly in less technologically advanced regions. For instance, regions can (co-)invest in human-capital-building institutions such as universities and research centres that reduce the gap between the local pool of human resources and the requirements of foreign firms. They can also leverage dedicated local organisations such as regional investment promotion agencies (IPAs) to facilitate the search and matching to local suppliers or to other potential local partners

However, whether or not knowledge transfers from foreign firms materialise depends not only on the strength of the local innovation system and its absorptive capacity, but also, and crucially, on the type and strategic considerations of foreign firms themselves. This echoes words of caution about the ’dark sides’ of FDI, and findings that foreign firms might end up creating ’enclaves’ in their host economies. In fact, these regions risk brain drain rather than gain, when foreign firms ring fence the most talented human capital in the region. Where they fail to engage with local actors, foreign firms may therefore further fragment the investment ecosystems of less developed regions. When attracting foreign companies, policy makers should therefore consider complementing such efforts by policies that promote knowledge transfers, such as workforce training and local sourcing agreements. Whereas policy makers often try to attract technology leaders, our study suggests that the value of such flagship FDI may be overestimated. For each Bangalore-like story, there are many underwhelming experiences of regions that attracted big firms without seeing large innovation gains. A more prudent approach would focus on less visible players. This may not only require less generous incentives, but also generate more spillovers to the local economy.

[1] We take great care in making sure that the non-treated regions are suitable comparison points for the treated ones. For instance we do not allow Bangalore, who already had a well-educated population before HP’s investment, to be compared to a region with very low average years of schooling.

This blog post is based on the article “Innovation catalysts: How multinationals reshape the global geography of innovation”, published in Economic Geography. This research benefited from financial support by the ERC.

Interested readers can explore our data visualization about this article here.

Riccardo Crescenzi is a Professor in the Department of Geography and Environment at the London School of Economics

Arnaud Dyèvre is a PhD student in the Department of Economics at the London School of Economics

Frank Neffke is a Group Leader of the Science of Cities program at the Complexity Science Hub in Vienna

This post represents the views of the author and not those of the GILD blog, nor the LSE.