With the Bank of England likely to announce a further £200bn of monetary economic stimulus soon to combat the economic impact of the coronavirus crisis, Caroline Bentham argues they should think carefully about what they do with the money. She makes the case for a different design of central bank monetary stimulus – direct money transfers to households – and explains how this would work.

The coronavirus crisis has been a time of unprecedented change and upheaval that has left few untouched. While the immediate impact has been devastating for many, with change comes opportunity for review and progress. Those searching for silver linings are citing the renewed value for what really matters- spending time with loved ones, a more relaxed pace of life, supporting our community.

As put by the new Chancellor in charge of UK government finance, Rishi Sunak: ‘This is not a time for ideology and orthodoxy, this is a time to be bold – a time for courage.’ Economic orthodoxies are dissolving in the face of the challenge presented by the physical health emergency and the direct and indirect economic impacts of that. Governments internationally have defied their own spending rules to tackle the pandemic and the economic downturn which is now unfolding- the same rules which demanded austerity measures which ravaged the UK over the last decade.

I have written previously on the issue of where the money to combat the virus is coming from, and how that money might be paid back – there is no magic money tree, fiscal spending will have to be paid for eventually, and now is the time to try the alternatives to austerity.

The other major tool of macroeconomic policy that receives less public attention is monetary policy. The independent Bank of England controls monetary policy, under the rationale that technical experts are the best people to make decisions about the plumbing of the financial system, rather than politicians. This ethos perhaps makes a lot of sense if we do think of the central bank’s role as like a plumber – tinkering with the practical operational parts to make sure that finance can flow freely. However, this makes less sense if we consider the unconventional programs of Quantitative Easing finance enacted by the central banks of many of the biggest economies since 2009.

From 2009 onwards, the UK’s program of supposedly temporary quantitative easing grew and was never stopped, reaching £445bn. Yes, billion – roughly 30% of total UK GDP. The Bank of England generates loans like any other bank, so it created this massive pot of cash and used it to buy mostly government bonds. Some say that quantitative easing is almost the same as funding fiscal spending directly because the central banks are indirectly buying a lot of government bonds anyway, and some central banks are even providing short-term direct overdraft-type facilities to governments. The main difference is that central banks are keeping tight control of the quantity, timespan, timing and so on: they call all the shots, not the government. This is to prevent the threat of spiralling price inflation that can happen where a government controls the ability to create new finance.

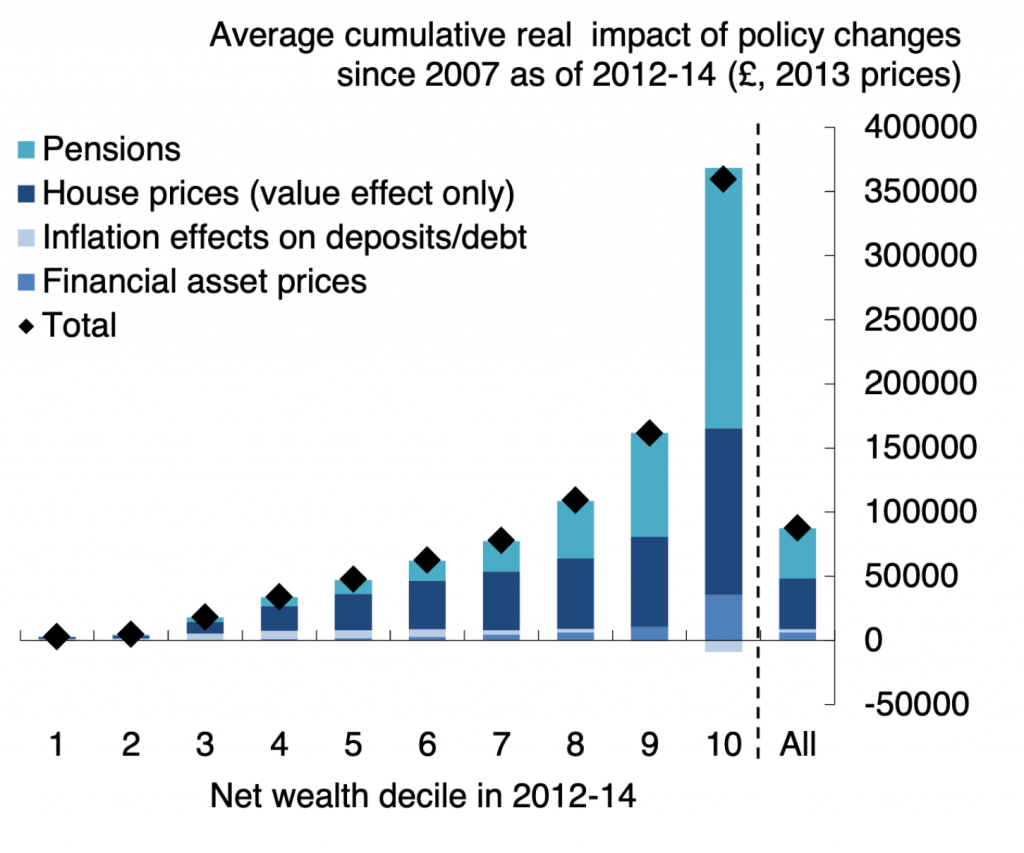

Quantitative easing was originally designed to stimulate the economy out of the recession brought on by the global financial crisis. But this stimulus policy’s deliberate effects since 2009 include making rich people richer and had questionable benefits as to how much it supported the finances of everyone else. There’s evidence that it increased intergenerational and wealth inequality through effects like driving up house prices.

Figure 1: Effects of monetary policy changes since 2007 on net wealth by wealth decile in cash terms

Note: Graphic produced by Bank of England staff.

Note: Graphic produced by Bank of England staff.

The Bank of England insist it’s not their job to prevent social side-effects of monetary policy- their only job is to control price inflation by stimulating the economy when necessary, and the government needs to implement policies to offset social inequalities caused by central bank policies.

A potential different design of central bank monetary stimulus is direct money transfers to households. The Bank of England’s own research shows cash transfers to households could be just as effective as quantitative easing at stimulating the economy. Studies of programs of universal payments to households show the endless potential benefits. Pilot studies of basic income payments to households have found benefits for a wide range of social wellbeing factors: a recent 1-year study in Finland found improved levels of mental, physical and financial wellbeing for recipients; a similar study in Namibia found positive results in areas like reduced community poverty and crime rates and improved education attendance. Researchers in Canada proposed a basic income pilot on the basis of evidence that it could reduce domestic violence, as greater financial independence supports abuse victims to walk away from abusive relationships.

A recent study of how basic income could be implemented in the UK finds the fundamental issues are of fiscal affordability and how to sufficiently support incomes of people in need. But this policy proposal would never be intended as a universal basic income. This is the Bank of England carrying out monetary policy easing to stimulate the economy. If the Bank of England is going to inject this amount of cash into the economy anyway, the issue of affordability has already been decided as null (though see here for arguments against this). The payments would not be designed to provide a full income: it would be a more equitable distribution of funds which otherwise might be hoarded by the financial sector as the Bank of England acknowledges happened in rounds of quantitative easing over the last decade.

The coronavirus crisis has caused a set of circumstances where a cash boost to households could be exactly what can best support both social wellbeing and economic recovery: the US Treasury recently announced they are giving all but the highest earners $1200 per person. A thriving financial sector is unsustainable if the lives of the masses of normal people are crumbling.

The Bank of England announced an additional £200bn of quantitative easing in March and has said it is possible they could announce more in the near future, perhaps as soon as their next meeting on 18 June. In this time of established economic orthodoxies being swept away, it is time to accept that the social impact of economic policies does matter. The design of central bank policies does matter. Further rounds of monetary stimulus must consider how effectively it supports the economy and society in the context of the COVID-19 crisis, especially if it is never paid back, as the Bank of England plans a large chunk of their previous rounds of quantitative easing to never be paid back.

If the Bank announces a further monetary policy stimulus of £200bn, that equates to £3000 for every person in the UK. This could be paid to individuals as a lump sum, or it could be paid as an income support grant of £250 per month per person for a year. This is not supposed to replace any social security income support but be a one-off coronavirus crisis policy in addition to fiscal spending. Conceptually at least, this represents somewhat equitable treatment if we consider that a person earning £100k would receive 3% of their income while a person earning £6k would receive a 50% income boost. A universal rate also reduces the cost and bureaucracy barriers to everyone receiving it, but leaves the possibility of the government reaping some back through taxation for higher earners.

This type of policy proposal has long been considered taboo so frustratingly little direct academic research has been conducted on it, though there is new interest in the coronavirus context. Cognate examples of short-term stimulus payment programs like basic income pilots, one-off tax rebates and small lottery wins can provide clues as to what the design and outcomes could be. Quantitative easing and other unconventional uses of central bank money were also considered taboo before 2008.

As Rishi Sunak has urged, now is the time for bold action. Policy makers must decide whether to maintain orthodox paradigms for which evidence is faltering, or have the courage to consider alternative policies in this time of change.

___________________

Caroline Bentham is a PhD Economics candidate at the University of Leeds, funded by a Stell scholarship for research in social and political sciences. She previously spent several years working in economic policy, including roles at the Bank of England, Ernst and Young Financial Services Advisory, and ending as an Assistant Director at the Department for Business, before returning to academia.

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science. Featured image credit: by Sandy Millar on Unsplash.

Good, clear article.

Maybe the time is right for some really ‘Bold Action’

I doubt people in 1 to 4 own property.

But it would be great for me to get £250/month.

But the upper decile people would hate it, and block it.