The Bank of England’s Monetary Policy Committee should revisit the issue of publishing its own future path of interest rates, argue Michael Ellington and Costas Milas. They review the current process and explain why it is not very effective.

The Bank of England’s Monetary Policy Committee should revisit the issue of publishing its own future path of interest rates, argue Michael Ellington and Costas Milas. They review the current process and explain why it is not very effective.

It was widely expected and indeed happened. The Bank of England’s Monetary Policy Committee (MPC) decided, by a 7-2 majority, to raise (for the first time in 10 years) its policy rate from 0.25% to 0.5%. Yet, financial markets appear not to have taken seriously either the hike or the MPC’s additional message that (at least) two further interest rate hikes will happen in the next two to three years.

Indeed, in response to the interest rate hike, the 2-year government bond yield moved downwards instead of upwards. How confusing for investors and consumers who are supposed to take the Bank’s action at face value so that they can plan for the future. Needless to say, all this returns to ‘haunt’ the Bank as it appears to be rendering its monetary policy ineffective which, in turn, might force the MPC members to proceed with another interest rate hike earlier rather than later in order to signal emphatically that they ‘mean business’.

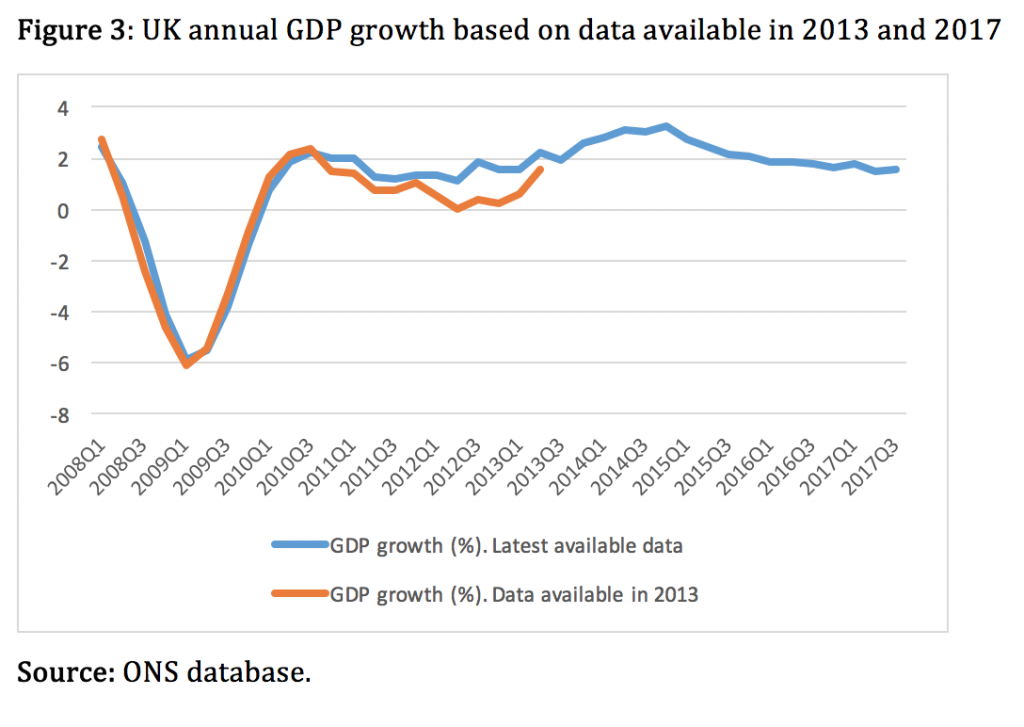

So it seems that the Bank has difficulty in passing its message around. This should not come as a surprise. One possible reason relates to its forecasting record with reference both to CPI inflation and output growth. The MPC sets its current policy rate with the aim of hitting a CPI inflation target of 2% some 2 years into the future. Yet, the MPC’s ability to forecast 2 years ahead CPI inflation is quite weak.

Figure 1 plots the MPC’s 2-year ahead inflation forecast together with the actual outcome. Since 2006, the MPC has under-predicted CPI inflation by an average of 0.34% per annum. More worrying is the fact that the actual outcome moves in opposite direction to the forecast (their correlation is -0.21). What we learn from Figure 1 is that by under-estimating actual inflation, the MPC has set its policy rate at a lower level than it should have done.

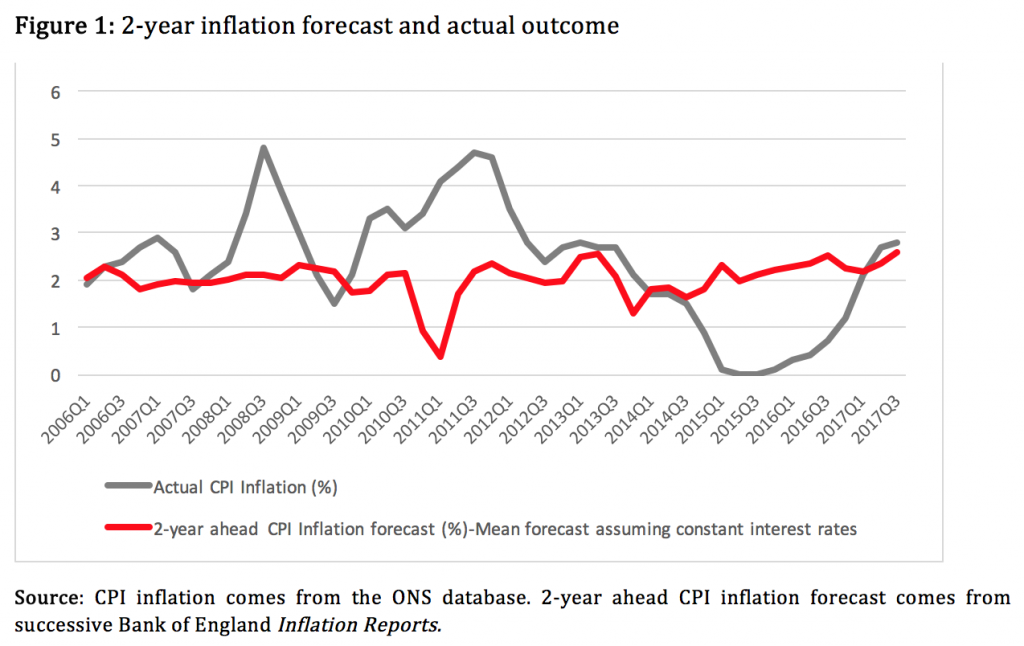

Yet things are not that simple. The MPC targets inflation but, at the same time, it pays close attention to GDP growth developments. That said, its forecasting record with respect to GDP growth is also weak. Figure 2 plots the MPC’s 2-year ahead GDP growth forecast together with the actual GDP growth outcome. In doing so, we use the actual GDP growth based on the ‘first’ (or ‘preliminary’) estimate of GDP as well as the ‘revised’ (or so-called ‘final-time’) estimate by the Office for National Statistics.

Notice that since 2006, the MPC has over-estimated the preliminary and the revised estimate of annual GDP growth by an average of 1.5% per annum in the case of the former and by an average of 1.4% per annum in the case of the latter. The correlation between the MPC’s estimate and the actual outcome (whether the preliminary or revised estimate) is extremely weak (at -0.07). What we learn from Figure 2 is that by over-estimating actual GDP growth, the MPC has set its policy rate at a higher level than it should have done.

With the MPC both under-estimating inflation and over-estimating GDP growth it should not come as a surprise that financial markets appear not to be getting the message on future interest rates movements. To make things worse, financial markets still recall the MPC’s earlier ‘forward guidance’ set in August 2013 according to which the MPC would not have raised its policy rate at least until (among other things) the UK unemployment rate dropped to 7%.

In fact, ‘forward guidance’ was abandoned only six months later (in February 2014) when it became clear that the unemployment rate was dropping much faster than initially predicted. Indeed, the MPC’s forecast (in August 2013) was for the unemployment rate to approach 7% in late 2016; yet, the unemployment rate fell below 7% in early 2014.

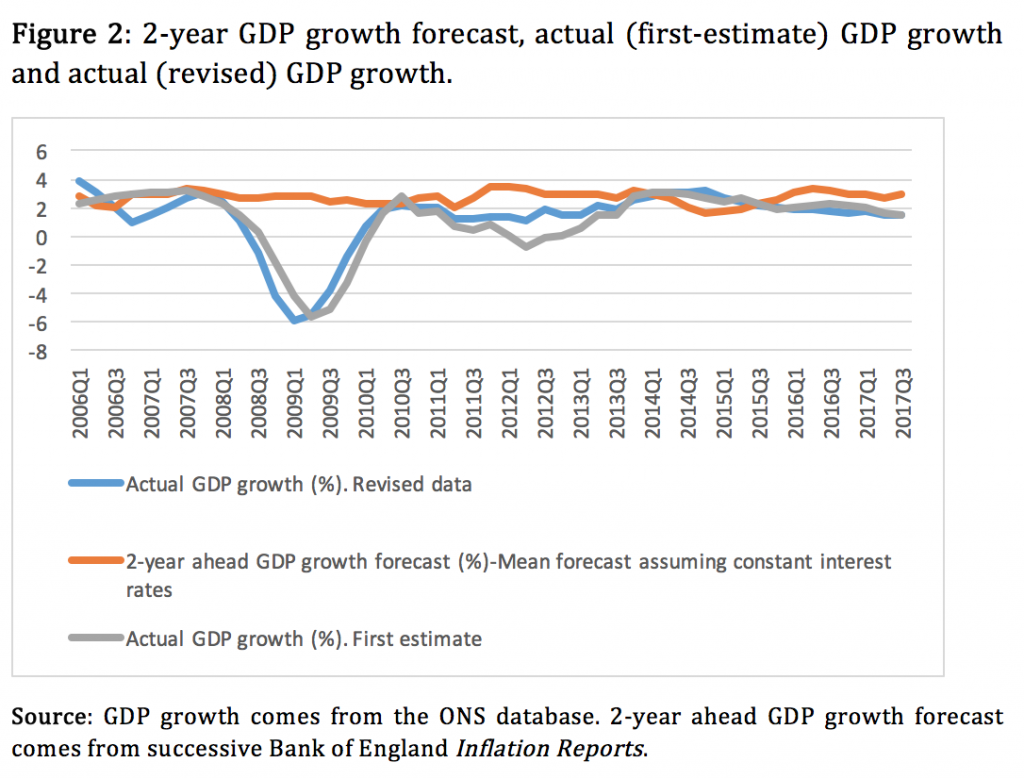

It is not fair, however, to put the whole blame on the MPC. In fact, part of the MPC’s unemployment forecasting failure and the drop of its ‘forward guidance’ in 2014 has to do with extensive GDP revisions. Figure 3 makes this point by plotting annual GDP growth published in 2013 (when the MPC introduced its ‘forward guidance’) together with revised GDP growth based on the most recent data (October 2017). The earlier data suggested much lower annual GDP growth than that indicated by the most recent data. In other words, the MPC’s forward guidance had (at least partly) to be scrapped because the economy was actually performing much better (and creating many more jobs) than what ONS data was indicating at that time.

The main point is that financial markets are not currently taking seriously the MPC’s main message that future interest rates are on the cards because of the MPC’s premature drop of ‘forward guidance’ in 2014 as well as the MPC’s ongoing weak forecasting record of inflation and GDP growth. All this questions the direction or the timing (and perhaps the intensity) of future movements in the policy rate.

The main point is that financial markets are not currently taking seriously the MPC’s main message that future interest rates are on the cards because of the MPC’s premature drop of ‘forward guidance’ in 2014 as well as the MPC’s ongoing weak forecasting record of inflation and GDP growth. All this questions the direction or the timing (and perhaps the intensity) of future movements in the policy rate.

To strengthen its communications strategy, the MPC needs to become more explicit. For instance, it could follow other Central Banks like the Reserve Bank of New Zealand or the Swedish Riksbank in producing (in a probabilistic manner) its own future path of interest rates. This was dismissed 10 years ago by (then) Governor Mervyn King. Since then, the emergence and the intensity of the recent financial crisis has arguably changed the way Central Banks and policymakers think, let alone operate. With this in mind, the MPC should perhaps think again about publishing its own policy rate path.

_____

Michael Ellington is Lecturer in Finance, University of Liverpool.

Michael Ellington is Lecturer in Finance, University of Liverpool.

Costas Milas is Professor of Finance, University of Liverpool.

Costas Milas is Professor of Finance, University of Liverpool.

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science.

Many thanks for the comment. Point taken. Incidentally, the median, which is more robust than the mean to ‘outliers’ (let’s…bravely call the recession points ‘outliers’) is 1.04% p.a. in the case where the actual outcome is based on revised GDP data.

Regards,

C Milas

I suggest that the article’s comments on the forecast vs actual growth are not appropriate. The article says:

“the MPC has over-estimated the …. revised estimate of annual GDP growth …by an average of 1.4% per annum”. This is an example where an average, though arithmetically true, is very misleading and should not have been used..

Looking at the graph, the growth forecasts have generally been much less poor than this. I would characterise the record along the lines of:

The differences between forecast and GDP growth estimates have been [something much smaller than 1.4%] except during the period around 2008, when the negative growth was not forecast at all.