New research suggests that benefit cuts, harsher benefit rules and the rising costs of essentials are all hitting poor families in the UK at the same time. This can only serve to reinforce the urgency of making sure people on low incomes are protected, writes Moussa Haddad.

New research suggests that benefit cuts, harsher benefit rules and the rising costs of essentials are all hitting poor families in the UK at the same time. This can only serve to reinforce the urgency of making sure people on low incomes are protected, writes Moussa Haddad.

The years since the financial crisis have been a tough time for those on the lowest incomes. Policies of austerity in response to the economic downturn have hit the poorest the hardest.

We have many of the pieces of the picture already. The final verdict on tax and benefit redistribution under this government is in from the IFS, and they show the two poorest tenths losing the most, followed by the richest tenth, with those on middle to upper-middle incomes well protected. Indeed, this transfer of resources made no contribution to deficit reduction. We know the enormous impact of uprating decisions taken in this Parliament, with child benefit alone losing 14 per cent of its value. The IFS projection that child poverty will hit four million this year – a rise of 400,000 over the current Parliament – singles out uprating as a key reason. By 2020, poverty will have risen by 700,000.

We know, too, that these figures understate the impact on the budgets of those on the lowest incomes. Poor people have been affected most by inflation in recent years. And parents especially: the minimum cost of raising a child has risen by 8 per cent for a couple and 11 per cent for a lone parent in the two years since CPAG started, once again, to measure it. Moreover, looking beyond individual household budgets, cuts to public services affect low income groups disproportionately. To this we can add evidence on differential inflation affecting the poorest families most, and research showing that poorer areas have been hardest hit by public spending cuts.

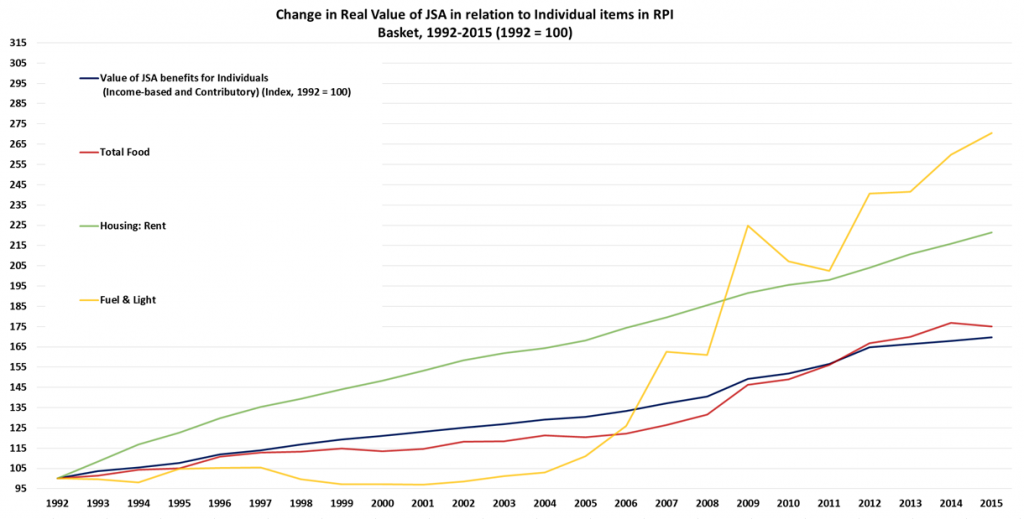

Bad as things have been, research commissioned by CPAG suggests even this litany of woe may understate the impact on low income households. To explain this, we need to delve a little way into the past. For those claiming benefits, the years before the financial crisis were no land of milk and honey. Benefits rose with prices from 1980 through to 2010, and as a result fell in that time from around a fifth to around a tenth of average earnings. Yet, as the chart below demonstrates, between 1992 (a year chosen on the basis of data availability) and around the mid-2000s, benefit claimants were to some extent insulated from that fall away from the mainstream of society by low increases or even falls in the cost of essentials. (The chart presents individual JSA for the purposes of simplicity; couple JSA and other income replacement benefits show a near-identical picture.)

Figure 1: benefits and the cost of essentials since 1992

Since the mid-2000s, however, prices of food and – in particular – domestic energy have increased rapidly. Even before recession hit, domestic energy costs had outstripped benefit increases over the period, and food prices followed close behind. After 2010, this has been compounded by the move to uprating by CPI and three years of below-inflation uprating of benefits. These have coincided to create a double-whammy of a rising cost of essentials and real-terms cuts in benefits, which has hit families hard. It will take more than the recent, modest falls in food prices to close the gaps.

The case of rent is a curious one, and links to the story of recent changes to social security. Prior to the Welfare Reform Act of 2012, housing benefit increased with reference to actual rents, so offering families protection (even if this was imperfect, since many households were nonetheless left with a shortfall to make up). Since then, however, the level of housing support has been decoupled from changes to actual rents; alongside other cuts to housing support, this means the rising cost of rent falls increasingly on families’ remaining budgets.

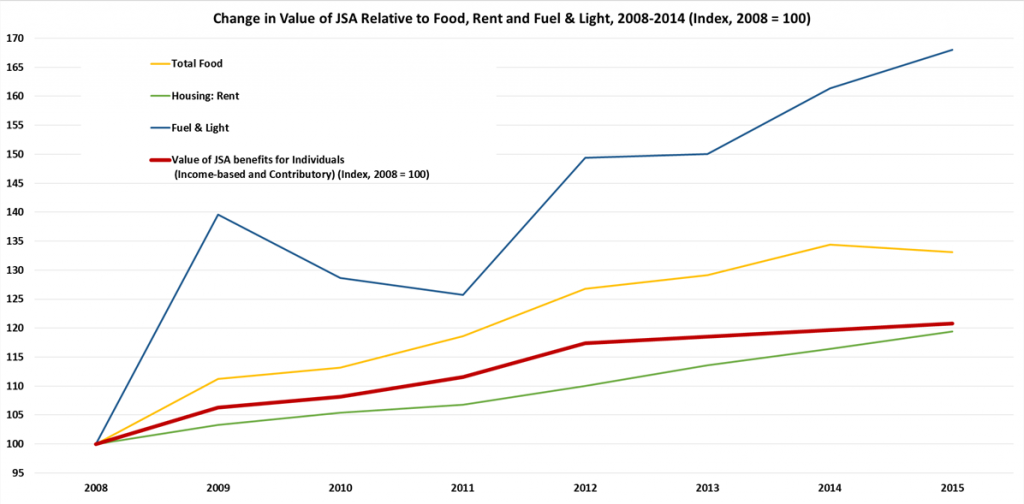

Zooming in on the picture since 2008, the squeeze on family budgets is stark. The chart below presents the same data as above, but focuses on trends since the financial crisis hit, from 2008 onwards. The combination of small increases in benefits and rapidly rising food and domestic energy prices has led to a substantial gap opening up between the cost of essentials and the benefits designed to help families meet them. While the picture on rents looks more optimistic, the data used is for all rents, both private and social, and thus is likely to understate recent increases in private rents.

Figure 2: benefits and the cost of essentials since 2008

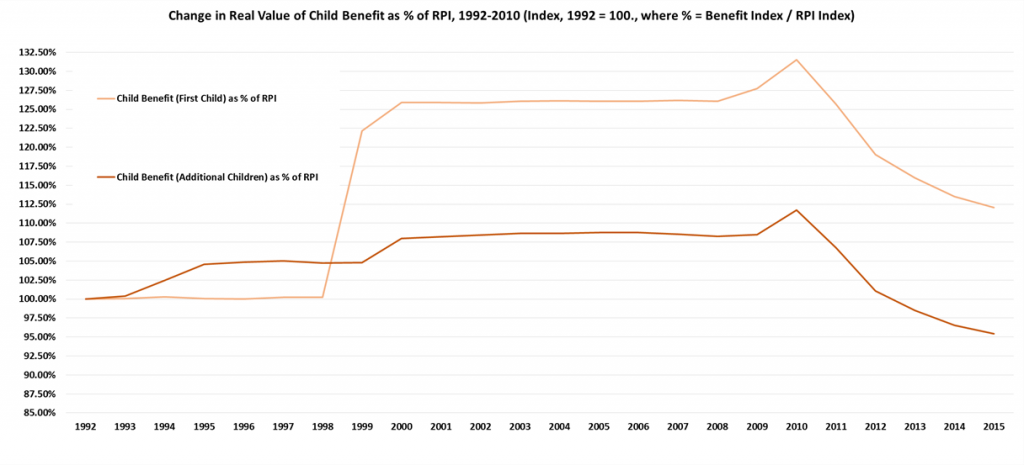

Finally, we considered the fluctuating fortunes of child benefit – crucial to families both in and out of work – since 1992. As the chart below shows, the real value of the benefit for a first child was stable until the end of the 1990s, when it received a big boost, followed by a smaller boost in 2010. Since then, it has fallen significantly under this Parliament, due to being frozen until April 2014 then increased by 1% in each of the next two years. Child benefit for additional children has had a more stable trajectory, with modest increases in the early and late 1990s, and a further modest boost in 2010; but it, too, has seen significant falls since.

Figure 3: changes in the real value of child benefit since 1992

Half of the increase in child benefit for the first child between 1992 and 2010 has now been erased under the coalition government. At its peak in 2009, child benefit for the first child was worth £23.28 a week in today’s money; in 2015, this drops to £20.70. Meanwhile, child benefit for additional children is now worth less than at any point in the last 35 years. In 1992, it was worth £14.05 a week in today’s money; in 2015, that falls to £13.70. Seemingly small decisions on uprating can have a substantial impact – and one which builds quickly.

Families on low incomes are, by their nature, vulnerable to even relatively small drops in income. Our research suggests that poor families have gone from having a degree of insulation in a period of falling costs to experiencing a significant squeeze on their budgets from all directions – with benefit cuts, harsher benefit rules and the rising costs of essentials all hitting at the same time. That squeeze has had substantial impacts on families, of which rising food bank use is but one – visceral – manifestation. This can only serve to reinforce the urgency of making sure people on low incomes are protected – and of starting to restore the lost value of benefits that are vital for families.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting. Featured image credit: epSos .de CC BY 2.0

Moussa Haddad is Senior Policy and Research Officer at Child Poverty Action Group.

Moussa Haddad is Senior Policy and Research Officer at Child Poverty Action Group.