In a new piece of research, Silvia Avram argues that people react not just to the financial incentives embedded in taxes and benefits, but also to the way these are presented. She suggests that by changing the way a policy is framed, we may be able to change behaviour.

In a new piece of research, Silvia Avram argues that people react not just to the financial incentives embedded in taxes and benefits, but also to the way these are presented. She suggests that by changing the way a policy is framed, we may be able to change behaviour.

Since the Labour Party introduced the JobSeeker’s Allowance and the New Deal Reforms two decades ago, the question of how to help people transition into paid employment has been at the forefront of the policy agenda. Most politicians and policy analysts argue that the solution is to “make work pay”, i.e. to increase the gap between the income received in and out of work. In practice, the drive to “make work pay” almost invariably translates to welfare cuts. Yet, by framing policy differently, it may be possible to alter the design of welfare benefits so as to encourage people to take up work without necessarily cutting financial support.

How do people make decisions about paid employment?

While the importance of framing has long been recognised in fields such as psychology and marketing, much of public economics is still built on the premise that humans are rational agents trying to maximize “utility”. This premise translates into a belief that people are able to ignore factors that are irrelevant for their “bottom line”. When it comes to decisions about whether and how much to work, people are assumed to be managing a trade-off between two competing goals: to earn as much as possible and to work as little as possible. In this simplified framework, increasing the income that is available outside of work both reduces the need to earn a wage and makes work more expensive (as access to out of work benefits is lost when people move into work). To overcome the disincentives, one can either try to increase the effective wage rate (for example, by increasing the minimum wage or by introducing work related tax credits) or to cut the income support available outside of work. Both types of measures have figured prominently in the British public policy debates around ‘making work pay’.

Implicit in all these analyses is the assumption that people only respond to the financial incentives embedded in the labour market and in the benefit system. If people continue to rely on benefits even when jobs that would provide them with a considerable higher income are available, it must be because they dislike working so much. This view has been reinforced by research showing that welfare reforms implemented during the ‘90s in the US and in the UK that restricted eligibility and/or reduced the generosity of benefits have resulted in substantial caseload declines.

New insights from behavioural economics

A long and illustrious research tradition in decision-making sciences has established that people don’t always behave in rational ways and often rely on simple heuristics that can leave them vulnerable to biases. More recently, scholars have sought to incorporate these ideas into the analysis and design of public policies. The UK Government itself has established a unit dedicated to this purpose, the Behavioural Insights Team. In the field of taxation, several studies have shown that people tend to routinely misperceive the effect of taxes on their income and/or consumption even when all the information is readily available. Studies have also shown that people react differently to taxes that should affect them financially in the exact same way but are framed differently. Nonetheless, we still know relatively little about how framing affects decisions between benefits and paid work.

To better understand the role of framing in labour supply decisions, I conducted an experiment at the University of Essex. Subjects were required to perform a real-effort tedious but simple task (to move sliders on the screen) in return for experimental payments. How much they earned depended on the number of correctly positioned sliders on the screen. Experimental earnings were taxed in the same way, but the way the tax was presented differed across treatments. In one treatment, the tax was paid from the earnings themselves. In a different treatment, the tax was paid from a fixed sum (benefit) every participant received at the beginning of the experiment. Because money is completely fungible, it should not matter which source of income is used to pay the tax. However, it turned out that subjects who were asked to pay the tax from their benefit rather than from their earnings were around three times more likely to quit working early.

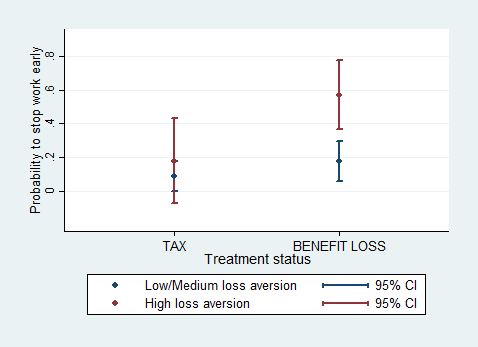

One possible explanation for this behaviour is loss aversion, a concept proposed more than thirty years ago by the psychologist and Nobel Prize winner Daniel Kahneman. Loss aversion is the human propensity to place greater weight on avoiding losses compared to realising gains of the same magnitude. In the context of my experiment, loss aversion will be important if the tax on experimental earnings is more likely to be perceived as a loss in one frame but not in the other. Supporting the idea that loss aversion may be playing an important role, I found that the strong effect of the benefit loss frame was concentrated among individuals who were more loss averse (see Fig 1 below).

Fig. 1: Probability of stopping work early by treatment group and loss aversion score

Note: Values represent average marginal effects; error bars corresponding to 95% CI. Source: ISER Working Papers

What does this mean for policy?

The results outlined above suggest that disincentives arising when means-tested benefits are taken away from people who increase their earnings may be stronger than those implied by the financial losses alone. Low skilled, loss-averse individuals may be less inclined to take up paid work then their better off peers partly because the environment they face triggers different perceptions and behavioural cues.

If confirmed by subsequent work, this finding has important implications for welfare policy design. If we are able to change the tax frame, we might be able to also “nudge” more people into employment. A radical approach would be to reconsider the prominence of means-testing in the British system in favour of a more universalistic and/or contributory system paid for by higher taxation (such as for example the Swedish system). If the widespread use of means-testing is called for by other political or normative considerations, there may be more limited mitigating measures such as increasing the level of earnings that can be accumulated before benefits are taken away or allowing former recipients to temporarily keep their benefits after entering paid work. Future research should tell us what measures are likely to work best.

__

Note: the article represents the views of the authors and not those of British Politics and Policy or the LSE. Please read our comments policy before posting.

Silvia Avram is a research fellow at the Institute for Social and Economic Research, at the University of Essex. This blog summarises research from her most recent report: Benefit Losses Loom Larger than Taxes: The Effects of Framing and Loss Aversion on Behavioural Responses to Taxes and Benefits

I’m not an economist so some of your terms went over my head but am currently on a zero -hours contract which though I don’t agree with them, will use them with the hope of getting full-time work. Unfortunately, the government isn’t helpful in helping me to gain extra hours because of the limitations placed – I cannot work over 16 hours. Surely, having a sliding scale of benefits will help people like myself.

Furthermore, I want a full-time job. A big issue is whereas councils will give a month’s allowance during the first month of a person working in a new, full-time position, the jobcentre doesn’t help with the travel costs. It would be most helpful if jobcentres and councils can work together in helping during the first month of a person working in a new job to prevent people from racking up debt.