George Osborne failed to mention the dire performance of productivity since 2008 in the budget speech. This was a disappointment as raising productivity is crucial for a robust recovery. Policies on tax, regulation, business support and funding for science and research can create help businesses invest and become more productive, writes Anna Valero.

George Osborne failed to mention the dire performance of productivity since 2008 in the budget speech. This was a disappointment as raising productivity is crucial for a robust recovery. Policies on tax, regulation, business support and funding for science and research can create help businesses invest and become more productive, writes Anna Valero.

In his budget speech, the Chancellor cherry-picked a whole host of statistics to demonstrate how successful he has been for UK plc. But he failed to mention the number one problem facing the economy: low productivity. Not only were the dismal productivity figures brushed under the carpet, but there was no coherent approach to tackling the issue. This was a surprise, as productivity growth is crucial for a sustained recovery and long-run prosperity in the UK.

Productivity since the financial crisis

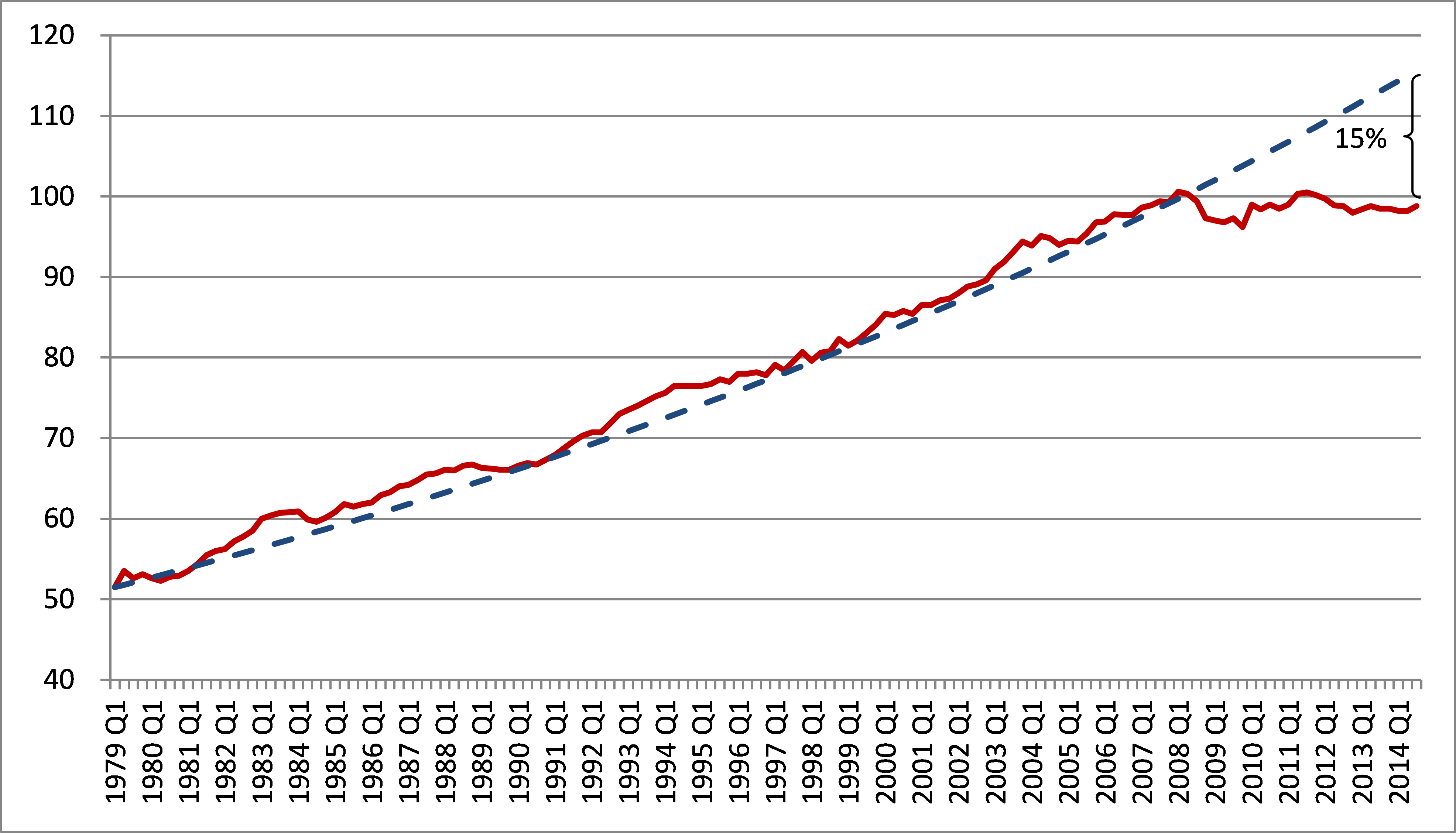

Productivity in terms of GDP per hour collapsed in 2008, and has not recovered. Today, the gap between actual productivity and the long run trend is around 15 per cent.

Figure 1: UK productivity growth – GDP per hour worked, 1979Q1 to 2014Q3

Source: Whole Economy GDP per hour worked, seasonally adjusted (2011=100). ONS Statistical Bulletin, Labour Productivity, Q3 2014, downloaded 6 February 2015.

Note: Predicted value after 2008 Q2 is the dashed line calculated assuming a historical average growth of 2.3% per annum (the average over the period 1979 Q1 to 2008 Q2).

This dire performance has been dubbed the “productivity puzzle” because no single explanation seems to be able to account for it. Most economists now agree that a mixture of cyclical and structural effects are at play, and that the fall is not entirely permanent. This means that fiscal contraction, insofar as it has depressed demand, is likely to have contributed to the problem.

One factor that has been shown to be important is slow growth in the capital-hours ratio, or the amount of equipment per worker. As the Chancellor boasted, employment rates are now back to pre-crisis levels (73 per cent of 16-64 year olds were employed in 2014Q4 according to the ONS). But a reason for this is that real wages have fallen by 8-10 per cent since 2008. A higher cost of capital for firms wishing to invest, combined with cheaper labour has dampened investment incentives.

The productivity gap in levels

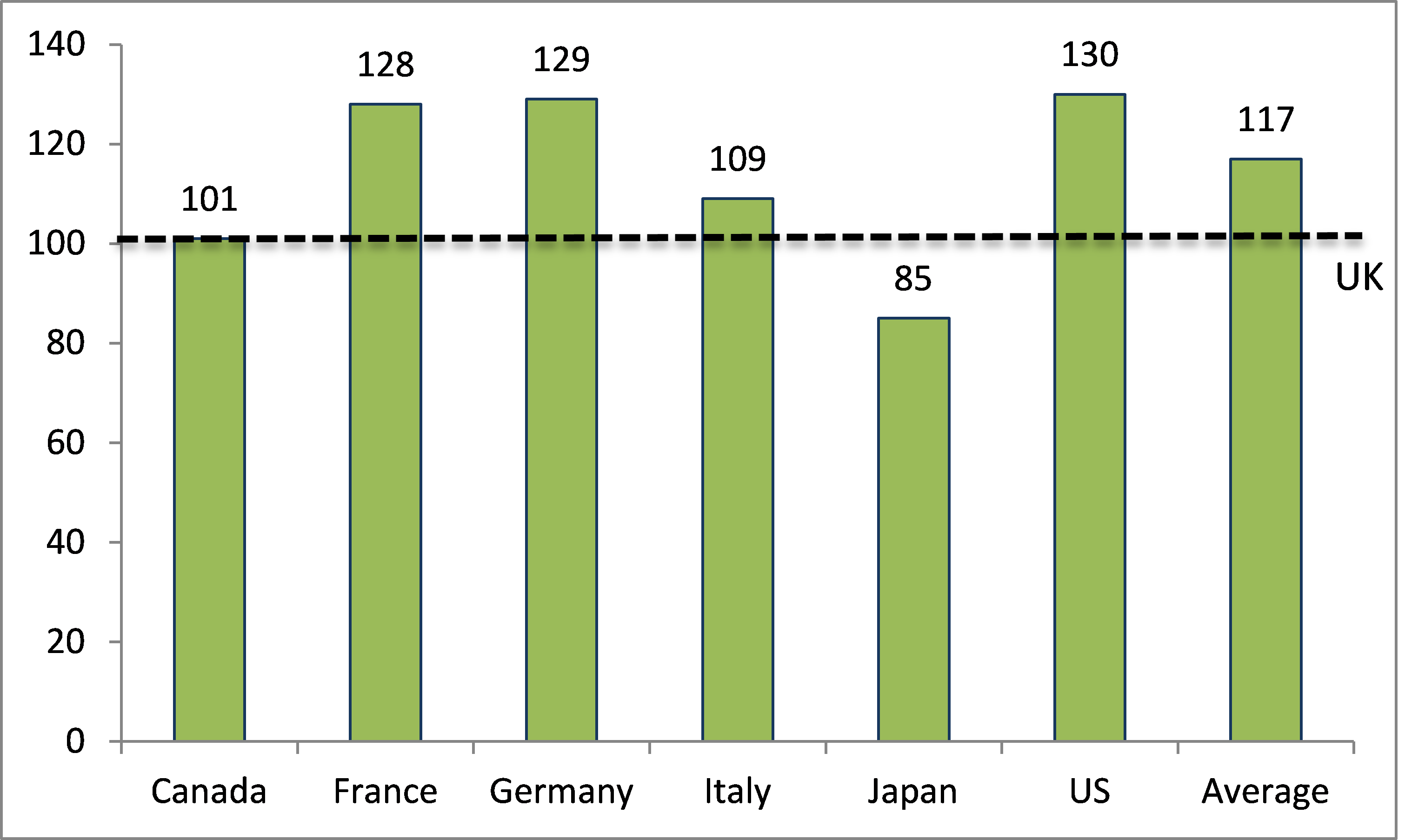

Although there was improvement in the decades pre-crisis, the UK’s productivity level has lagged behind its peers for decades. Figure 2 shows the most recent numbers, with GDP per hour 17 per cent below the G7 average. Poor performance since the financial crisis has widened the gap to its largest level since 1992.

Figure 2: Output per hour worked, G7 Countries (UK=100)

Source: Current price GDP per hour worked from ONS data, International Comparisons of Productivity, First Estimates, 2013 (downloaded 6 January 2015). Average refers to G7 average, excluding UK.

Our low productivity level compared to other countries has been attributed to chronically low investment especially in infrastructure and innovation, poor management and weak intermediate skills (LSE Growth Commission, 2013).

How can policy raise productivity?

Policies on tax, regulation, business support and funding for science and research can create help businesses invest and become more productive. What is needed is a long-term framework to create stability for businesses and create the right environment for innovation (the pay offs of which are often uncertain or a long way off). Clearly, this ties in with many other policy areas, not least ensuring that there is an adequate supply of skills and a strong infrastructure network. This pre-election budget could have done more to assure us that the Conservatives are serious about restoring growth. What follows is a summary of what we know drawing on the CEP 2015 Election Analysis on business and productivity policies.

Taxes

One area we may have expected more from the Chancellor is tax incentives for businesses. However, beyond a review into business rates, little was said on the topic. While tax credits for R&D (increased by this government) have been successful, the ‘patent box’ (tax relief on the royalties of patents) is an expensive form of tax competition that does not aid innovation. Furthermore, while the UK main rate of corporate tax is the lowest in the G7, effective tax rates are much worse- largely due to UK capital allowances (deductions from taxable profits for investment) which are low by international standards- in particular on industrial buildings, which dampens investment by manufacturers.

Another issue that holds back investment in capital or innovation in the UK is market short-termism. Labour has been considering an “allowance for corporate equity” which would remove some of the debt bias, and promote equity finance which is more conducive to longer-term, riskier investments.

Science budget

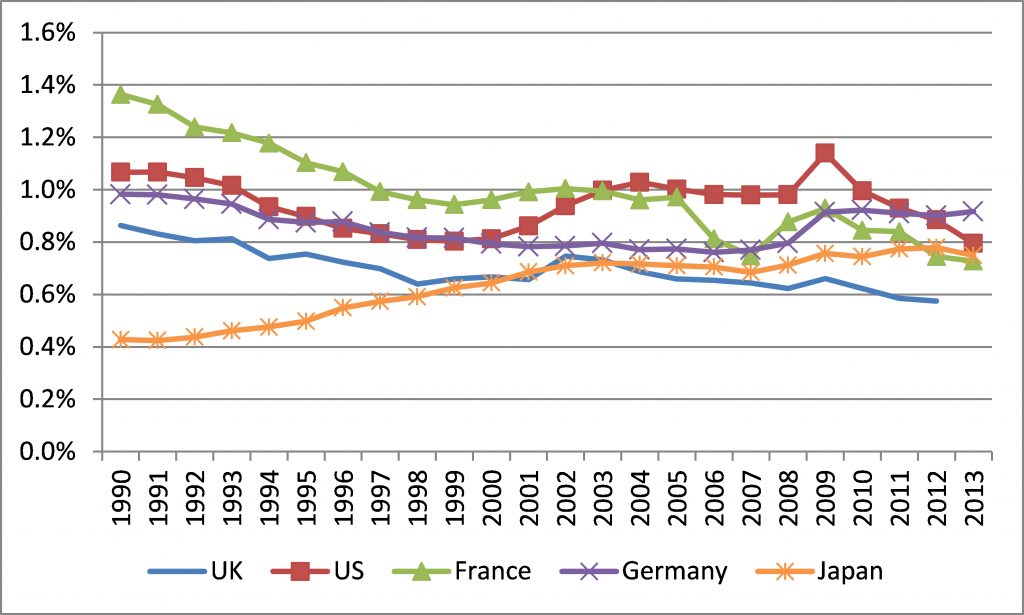

Government spending on R&D is important, both in its own right, and due to spillovers to businesses. While the science budget has been ring-fenced in nominal terms by this government, it has declined in real terms. Furthermore, government spend on R&D as a share of GDP is below the UK’s international peers (Figure 3). This is bad for innovation. The Chancellor mentioned some additional support for research students and the research councils, but nothing on the science budget. Indeed, none of the main parties have signalled that they would go beyond a nominal ring-fence should they win the election.

Figure 3: Government budget appropriations or outlays for R&D (GBAORD) as a percentage of GDP

Source: OECD MSTI, data extracted on 28 Jan 2015.

Notes: The US saw a sharp rise in GBAORD in 2009, which is due to the economic stimulus package, the decline since then is mainly due to a fall in defence R&D. In France, the government introduced a €35-billion state-funded “Investments for the Future Programme” (IFP) at the end of 2009.

Finance for innovative businesses

Smaller, innovative firms have problems accessing the finance they need to grow. This has been attributed to weak competition, short-termism and bad debts in the banking sector, issues that have been heightened since the financial crisis. Pro-competition policies in banking have so far delivered limited results. An increase in the bank levy, intended to encourage banks to move to less risky funding profiles, is welcome, but not enough.

There are myriad government schemes for improving access to finance and information: while these are valuable in principle, they have generally not been rigorously evaluated. Policy-makers must work with researchers to implement controlled policy experiments that would allow robust evaluation. Labour’s idea of a Small Business Administration to co-ordinate all government support for SMEs would rationalise these schemes.

Commercialising innovations

The UK is weak at commercialising innovations made in academia. For example, while graphene was discovered in the UK, so far most graphene related patents have been filed in China or South Korea. The Catapult network, which Budget 2015 will extend by one centre (on energy), brings together businesses and academics working researching areas where the UK has strength and is so far considered a success.

Conclusions

Budget 2015 not only omitted to discuss productivity, but announced only a handful of policies to raise it. This was a disappointment as raising productivity is crucial for a robust recovery. It was also surprising from a party that considers itself “pro-business”. What is needed is an over-arching, long-term framework for productivity and innovation – sadly, this is less of a vote-winner than a penny off a pint.

This article draws on the CEP’s 2015 Election Analysis on business and productivity policies.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Anna Valero is in her fourth year of the LSE MRes/PhD in Economics, and works on the Productivity and Innovation programme. Her work is focused on firm organisation and workforce skills, and their effects on productivity and innovation.

Anna Valero is in her fourth year of the LSE MRes/PhD in Economics, and works on the Productivity and Innovation programme. Her work is focused on firm organisation and workforce skills, and their effects on productivity and innovation.