The LSE’s Centre for Economic Performance (working with the Centre for Cities think tank) has carried out a study shedding light upon the local economic impact of Brexit. Henry G. Overman writes that it is the richer cities, predominantly in the south of England, that will be hit hardest by Brexit, with this effect particularly apparent in areas specialised in services.

The LSE’s Centre for Economic Performance (working with the Centre for Cities think tank) has carried out a study shedding light upon the local economic impact of Brexit. Henry G. Overman writes that it is the richer cities, predominantly in the south of England, that will be hit hardest by Brexit, with this effect particularly apparent in areas specialised in services.

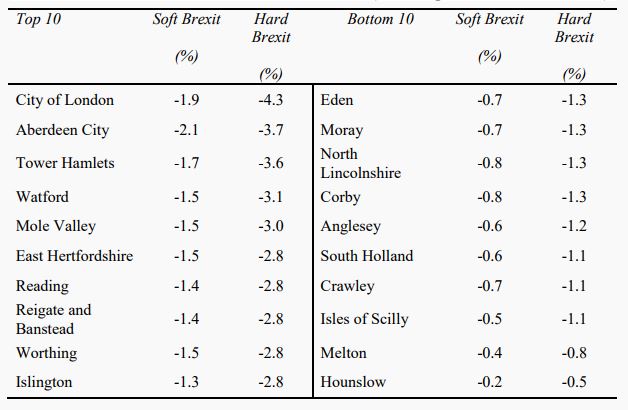

Our research (with Swati Dhingra and Stephen Machin) looks at the difference in predicted effects across all Local Authority Areas and across Primary Urban Areas under a ‘soft’ and a ‘hard’ Brexit scenario (the former involves zero tariffs, but increased non-tariff barriers with the EU, the latter involves non-zero tariffs and even higher non-tariff barriers). It also provides some initial analysis on whether these predicted impacts are likely to exacerbate or alleviate existing disparities, and looks at how the predicted economic impacts of Brexit correlate with voting patterns from the referendum.

The results show that every local authority area is predicted to see a fall in Gross Value Added (GVA) as a result of Brexit. The impacts are predicted to be more negative under ‘hard Brexit’ in every local authority area, as the increase in trade costs would be larger. Cities are predicted to see larger falls in GVA than non-urban areas in both scenarios. The average decrease in GVA under ‘soft Brexit’ is 1.2 per cent in cities compared to 1.1 per cent in non-urban local-authority areas, and 2.3 per cent compared to 2.0 per cent, respectively, under ‘hard Brexit’. There is less variation between cities compared to individual local authorities, however, as urban economies tend to have more diverse sectoral profiles.

The report also suggests that in both scenarios, it is richer cities – predominantly in the south of England – which will be hit hardest and most directly by Brexit. This reflects the fact that these cities specialise in financial and business services that are predicted to be hardest hit by the increase in tariff and non-tariff barriers that Brexit could bring. This pattern of results means that the predicted negative impacts are biggest for areas that tended to vote remain.

We aren’t yet able to model how those initial impacts will change as the economy adjusts. It’s quite possible that the places experiencing the biggest initial shock are not necessarily those that will experience the most negative effects once the economy has adjusted (we draw parallels with the financial crisis).

You can read more about all of these issues in the reports, so let me take the opportunity to highlight my personal take on a few important issues:

- These are predictions relative to trend (i.e. what would have happened if the UK had stayed in the EU).

- We don’t take a stance on detailed institutional arrangements. Soft Brexit is ‘like a customs union’ – in that we assume zero tariff barriers and external tariff as now; but we take no position on changes in external tariff and who would decide on those.

- The model estimates the medium to long run impact of changes in trade costs. We’re ignoring effects on innovation, immigration, inward investment, etc. We’re also ignoring adjustment. All of this should be clear from the report, but worth highlighting I think.

- Be careful on over interpreting the sector specific effects – particularly for industries like oil and air services where non-trade factors matter more. The technical paper has some discussion of the issues.

- The findings in which I have the most confidence are the general trends (1) bigger negative effects for areas specialised in services (setting aside any concerns about the exact sectoral predictions, we know non-tariff barriers and substitution away from UK supply will matter a lot for those sectors); (2) general north south pattern given those sectoral impacts; (3) correlation with vote remain (those predicted to be hardest hit voted to stay); (4) correlation with median wages (rich places hit worse); (5) once the economy adjusts things could look quite different.

- I would avoid getting too hung up on exact rankings. These will change as analysis is refined, other factors added in, etc. (I realise that nothing I say here will stop people from doing this).

Table: Most and least affected local authorities (% Change in Gross Value Added)

Source: CEP, 2017.

Source: CEP, 2017.

The figures in this paper represent a first attempt to look at the Local Authority impacts of the increases in trade barriers associated with Brexit. Further work will be needed to better understand these impacts, to understand the impacts working through other channels, such as migration and investment, and to understand the longer run impacts as the economy adjusts. In short, these figures are far from the last word, but they do provide an initial indication of the way in which the impact of Brexit may be felt differently across the areas of Great Britain.

_______

Note: A version of this article originally appeared at the blog of the Spatial Economics Research Centre (LSE) and on EUROPP – European Politics and Policy. You can read the full Centre for Economic Performance study here and a less technical Centre for City piece here.

Henry G. Overman is Professor of Economic Geography at the Department of Geography and Environment, LSE, and the Director of the What Works Centre for Local Economic Growth.

Henry G. Overman is Professor of Economic Geography at the Department of Geography and Environment, LSE, and the Director of the What Works Centre for Local Economic Growth.

Given we do not know how severe the overall impact of Brexit will be, how that will vary by sector or the time-scales involved at the national level, the value of making some (unavoidably) arbitrary assumptions and extrapolating those to the local area is questionable.

I was surprised that rich cities in the South were the worst affected. I doubt it. Some areas in the North are equally or more dependent on exports and manufacturing, both of which we would expect to be adversely affected by shifts in investment and trade flows as well as any future tariff and non-tariff barriers. That the model does not as yet incorporate some of these effects makes me doubt the value of the prediction.

Finally, if future overall economic growth is constrained – for example, from lower levels of inward investment and slower growth in the workforce – we might expect the less resilient areas to suffer the most.

Why is Northern Ireland local not included in the analysis?

It would be at least worthy of mention that one of the areas most arguably impacted by Brexit is not included in this study, which purports to be of the UK.

Like many economic studies, uses what in my opinion is a poor metric. In this case it’s GVA, but what should interest us is GVA per head.

Anton

There’s very little between GVA and GVA per head unless you think there’s going to be a big change in the population which seems unlikely.

Even if the government achieves it’s target of reducing net immigration by 200,000 that is 0.3% of the population. The estimates in this modelling have a much bigger margin of error.