What lies behind Britain’s crisis of housing affordability? As Paul Cheshire explains, it is nothing to do with foreign speculators but decades of planning policies that constrain the supply of houses and land and turn them into something like gold or artworks. He also exposes myths about the social and environmental benefits of ‘greenbelts’.

What lies behind Britain’s crisis of housing affordability? As Paul Cheshire explains, it is nothing to do with foreign speculators but decades of planning policies that constrain the supply of houses and land and turn them into something like gold or artworks. He also exposes myths about the social and environmental benefits of ‘greenbelts’.

When things go wrong, it is always handy to blame foreigners and currently even the liberal press are blaming them for our crisis of housing affordability. The problem is not 50 luxury houses empty on London’s Bishops Avenue (as The Guardian reported in January) or foreign speculators buying luxury flats to keep empty in London. It is that we have not been building enough houses for more than 30 years – and those we have been building have too often been in the wrong place or of the wrong type to meet demand.

For example, twice as many houses were built in Doncaster and Barnsley in the five years to 2013 than in Oxford and Cambridge. Even that was better than the most distant date for which there are data on all four places, 2002/03: then, the northern cities managed nearly three times as many houses as the prosperous southern pair. Policy has been actively preventing houses from being built where they are most needed or most wanted – in the leafier and prosperous bits of ex-urban England.

In the 19 years from 1969 to 1989, we built over 4.3 million houses in England; in the 19 years from 1994 to 2012, we built fewer than 2.7 million. In 2009, the National Housing and Planning Advice Unit (which was set up as an independent technical source of advice in the wake of the Barker Reviews of housing supply and planning) estimated that to stabilise affordability, it would be necessary to build between 237,800 and 290,500 houses a year.

On a conservative estimate, that implies building 260,000 houses a year, which over 19 years would mean a total of over 4.9 million. Taking the difference between actual building between 1969 and 1989 and the advice unit’s estimate of necessary annual building, this implies that between 1994 and 2012, building fell short of what was needed by between 1.6 and 2.3 million houses.

This is what explains the crisis of housing affordability: we have a longstanding and endemic crisis of housing supply – and it is caused primarily by policies that intentionally constrain the supply of housing land. It is not surprising to find that house prices increased by a factor of 3.36 from the start of 1998 to late 2013 in Britain as a whole and by a factor of 4.24 over the same period in London.

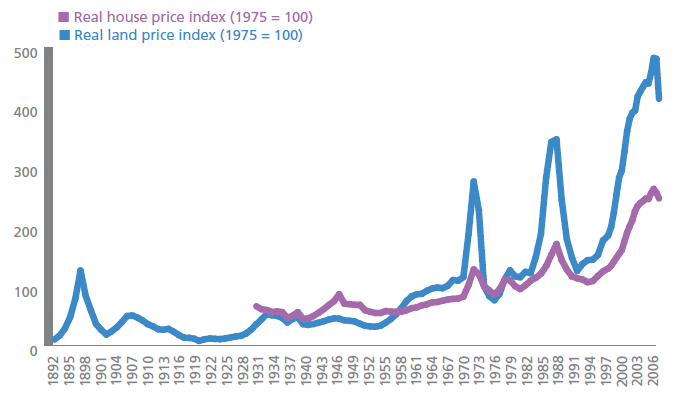

As Figure 1 shows, this is a really longstanding problem. Discounting inflation, house prices have gone up fivefold since 1955. But the price of the land needed to put houses on has increased in real terms by 15-fold over the same period.

Figure 1: Real land and house price indices

Source: Cheshire, 2009

Notes: House and land data for war years are interpolated

Land is an input into housing. What developers will pay for it directly reflects the difference between construction costs and the expected price of the houses that can be built on it. Of course land can be substituted out of production – and it is. That is why new houses in England are not only some of the most expensive but also the smallest in the developed world.

But it is not possible to eliminate land from house construction altogether. Moreover, people value land directly as space – in living areas and gardens. Not only is ‘space’ a normal good, the demand for which rises as real incomes rise, it is particularly valued as people get richer. They do not want to buy more beds but bigger beds and bigger bedrooms, maybe a spare bedroom; they want a bit of garden and off-road space to park their car. Estimates suggest that a 10% increase in incomes leads people to spend about 20% more on space in houses and gardens.

It is true that rising real house prices mean that house owners feel richer. That was the political motivation for the ‘Help to Buy’ scheme. But what rising house prices also mean is that young people will have to wait even longer to get any house at all, never mind a decent house with a bit of garden, and the quality of housing falls because houses become ever smaller as land prices are bid up.

What also happens – and this is central to our ‘blame the foreigners and speculators’ scapegoating – is that houses are converted from places in which to live into the most important financial asset people have; and the little land you can build them on becomes not just an input into house construction but a financial asset in its own right.

In other words, what policy is doing is turning houses and housing land into something like gold or artworks – into an asset for which there is an underlying consumption demand but which is in more or less fixed supply. So the price increasingly reflects its expected value relative to other investment assets. In the world as it has been since the financial crash of 2007/08, with interest rates at historic lows and great uncertainty in global markets, artworks and British houses have been transformed into very attractive investment assets.

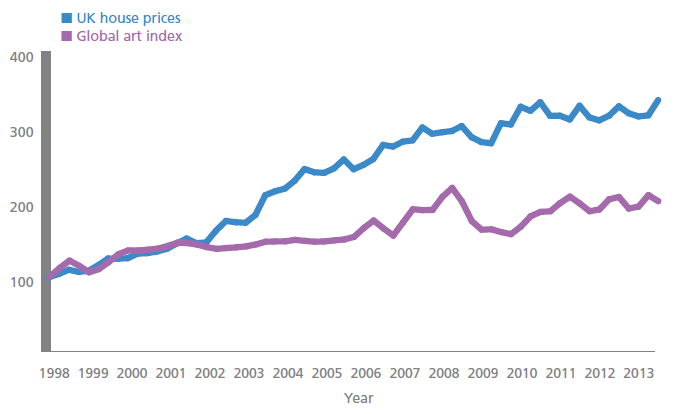

Figure 2 tracks an index of global art prices against house prices since 1998. They move pretty closely together and the price growth of both hardly faltered with the 2007/08 crisis; but the price of houses has risen faster. At least one reason for the outperformance of houses is that while artworks may generate pleasure, they generate very limited income. Houses, however, provide more obviously marketable pleasure in the form of ‘housing services’ – we can live in them or rent them out.

Figure 2: Art and British house prices 1988-2013

Source: Cheshire et al, 2014

The more tightly we control the supply of land and houses, the more housing and housing land become like investment assets. In turn, the stronger the incentives for their owners to treat them as an option to hold in the expectation of future price rises.

So to blame speculators for housing shortages and rising prices is simply incorrect. It is our post-war public policy that has converted a good that is in principle in quite elastic supply into a scarce and appreciating asset. We can see this from the behaviour of housing and land prices before we imposed our constraints on land supply in the mid-1950s. We can also see it from housing markets – such as Switzerland or Germany – where policy ensures adequate housing is supplied.

Cities expanded at historically unprecedented rates in Britain during the nineteenth and early twentieth centuries, but urban land was not in restricted supply because new transport – commuter rail, trams, London’s underground and then arterial roads – opened up land as it was needed. This was stopped by the 1947 Town and Country Planning Act, which expropriated development rights, invented a new legal definition of development so that any change of use required specific ‘development’ permission, and imposed urban containment policies with ‘greenbelts’ (see my work on this here).

Additional barriers to building houses come from our pattern of government, how our local fiscal system interacts with property taxes and our insistence on using ‘development control’ (which requires any legally defined development to get specific permission from the local planning authority) rather than a rule-based system (as in continental Europe or the United States, where there are plans covering local communities and as long as a development conforms to these, it can go ahead). Details on these arguments are in a new book that brings together the wide range of work by the Spatial Economics Research Centre (SERC) over the past seven years.

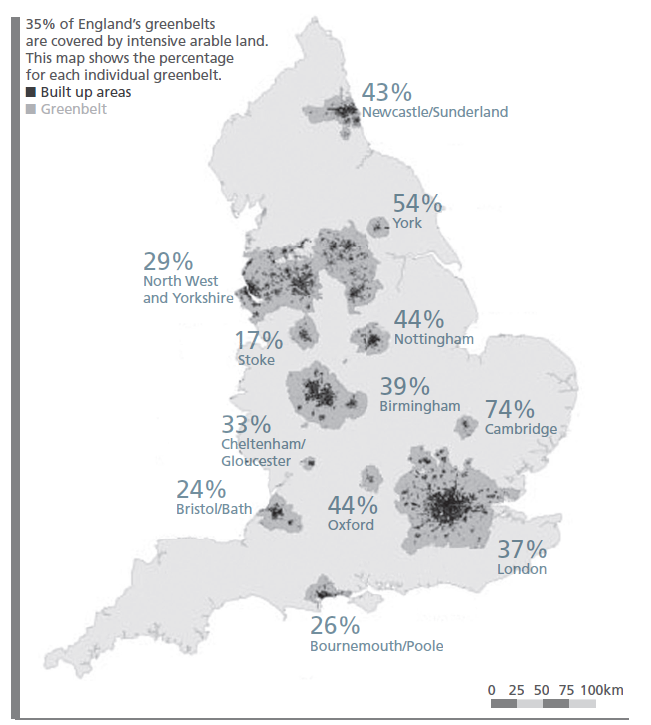

Supporters of urban containment policies argue that Britain is a small island and we are in danger of ‘concreting it over’. But this is a myth: greenbelts in fact cover one and a half times as much land as all our towns and cities put together. Figure 3 shows the boundaries of England’s greenbelts with the urbanised areas they surround.

Figure 3: Percentages of intensive arable land in England’s greenbelts

Note: This map was prepared by Sevrin Waights. Calculations are based on Land Cover Map 2000. Intensive arable land was defined as use categories 4.1, 4.2 and 4.3 and so is a conservative estimate of ‘intensively farmed agricultural land’.

Moreover, our towns and cities are far greener than greenbelts: not only is the biggest land use within them parks and gardens, but they also provide far richer biodiversity than intensively farmed land. Just less than 10% of England is built up, but gardens cover nearly half that area (see the Foresight Land Use Futures Project). In contrast, the most important land use in greenbelts is intensive arable (74% in Cambridge), which generates negative net environmental benefits (See the 2011 UK National Ecosystem Assessment).

So the second myth about greenbelts is that they are ‘green’ or environmentally valuable. They are not because intensive farmland is not. Moreover, there is little or no public access to greenbelt land except where there are viable rights of way. Greenbelts are a handsome subsidy to ‘horseyculture’ and golf. Since our planning system prevents housing competing, land for golf courses stays very cheap. More of Surrey is now under golf courses – about 2.65% – than has houses on it.

The final myth about greenbelts is that they provide a social or amenity benefit. The reality is that a child in Haringey gets no welfare from the fact that five miles away in Barnet, there are 2,380 hectares of greenbelt land; or in Havering another 6,010 hectares.

What SERC research has shown is that the only value of greenbelts is for those who own houses within them. What greenbelts really seem to be is a very British form of discriminatory zoning, keeping the urban unwashed out of the Home Counties – and of course helping to turn houses into investment assets instead of places to live.

So the solution to our crisis of housing affordability is not to blame speculators or foreign buyers but to sort ourselves out. We need to allow more land to be released for development while protecting our environmentally and amenity-rich areas more rigorously than we do at present.

Building on greenbelt land would only have to be very modest to provide more than enough land for housing for generations to come: there is enough greenbelt land just within the confines of Greater London – 32,500 hectares – to build 1.6 million houses at average densities. Building there would also reduce pressure to build on playing fields and amenity-rich brownfield sites such as the Hoo Peninsula and improve the quality of housing.

Moreover, instead of workers in central London having to jump across the greenbelt to find affordable space as they do at present (a Greater London Authority study shows that London’s higher skilled workers travel in significant numbers from all over southern England, as far away as Norwich or Bournemouth), they could have easy daily commutes – so reducing carbon emissions.

Note: This article was originally published by the Centre for Economic Performance and gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

About the Author

Paul Cheshire is Professor Emeritus of Economic Geography at LSE and a SERC researcher.

Paul Cheshire is Professor Emeritus of Economic Geography at LSE and a SERC researcher.

This is the usual tired and polemical argument that is one sided and fails to comprehend the complexity of how land and property markets operate. It is just too easy and simple to blame one part of the complex interrelationships between property actors, governments, etc. Building more per se will do nothing to solve any housing crisis

More misinformed finger-pointing at the planning system. Data shows that planning permissions have stayed high throughout the 2010’s and have become more efficient – what has declined are construction rates. Why? Because landowners are incentivised to sit on their land assets rather than construct. The construction market needs reform and there are lessons to be learned from Germany/Netherlands.

http://progressive-capitalism.net/2016/01/boosting-britains-housing-stock-stop-blaming-the-planning-system-for-everything/

The answer is Land Value Tax

Until then housng has become Giffen Goods and we are doomed

The issue is that the government has ignored the majority of the public and allowed the population to swell with immigration.

Similar issue in NZ, Australia and parts of Canada in relation to population growth and housing affordability. Andrew Coleman and John Landon-Lane published a Reserve Bank discussion paper in 2007 showing that a net immigration flow equal to one percent of the population is associated with an approximately 10 percent increase in house prices. This relationship has existed since the 1960’s.

http://www.rbnz.govt.nz/research_and_publications/discussion_papers/2007/dp07_12.pdf

I think you’re being a little disingenuous, Paul. None of the arguments you put ‘for’ greenbelts have ever been arguments for greenbelts, except insofar as people have misunderstood the rationale for setting them up. The only purpose of the green belt is to stop cities expanding forever. And in that sense, they have been spectacularly effective.

One important aspect that you don’t cover which is important is the under-taxation of housing.

The two most important ones are the exemption of owner occupied housing from capital gains tax and the failure to tax imputed rents.

According to the Hills Review, these tax advantages were worth £16 billion 10 years ago and will be worth far more today given the rapid rate of house price inflation http://eprints.lse.ac.uk/5568/1/Ends_and_Means_The_future_roles_of_social_housing_in_England_1.pdf

This is seriously distorting for the economy and the housing market: it pushes resources out of the productive economy to tax-favoured investment in second hand housing, encourages people to inefficiently invest in increasing the size of their homes and makes people live in houses that are far too big for themselves due to the investment motive to do so (see the massive rate of underoccupation in the owner occupied sector: this is where the bedroom tax is needed rather than in the social sector where underoccupation of 2+ rooms against the bedroom standard is basically unheard of!).

Little talked about in public debate though for some reason!

Sadly, it won’t matter how many more houses we build now. The damage of the past 30 years has been done, and for many generations born after 1980 the damage is irreversible. These generations will never afford to buy a house, and they now face extortionate rent costs that, due to their paltry defined contribution pensions, will mean that they will never afford to retire, and will have no legacy to pass to their children. This is all because of the way we view property in the UK; as a free capitalist market. This way of thinking is rapidly widening the wealth gap between Baby Boomer parents who own property, and so can easily afford to buy more, and those who can’t, and so whose children never will either. The only way the fortunes of our children can be improved is by viewing houses as homes, not investments. The best way for that to happen is by changing our property laws to not so heavily favour owners of multiple properties. Here is a petition that I implore you to share with your friends, and sign! bit.ly/1aB2IST