By Vito Amendolagine (UNIPV, far left), Andrea Presbitero (IMF, centre left), Roberta Rabellotti (UNIPV, AAU, centre right), and Marco Sanfilippo (UNIBA, Antwerp, far right)

By Vito Amendolagine (UNIPV, far left), Andrea Presbitero (IMF, centre left), Roberta Rabellotti (UNIPV, AAU, centre right), and Marco Sanfilippo (UNIBA, Antwerp, far right)

The increasing involvement of developing countries in Global Value Chains (GVCs) could enhance the spillover effects of Foreign Direct Investment (FDI), write Vito Amendolagine, Andrea Presbitero, Roberta Rabellotti and Marco Sanfilippo. Our analysis shows a high degree of complementarity between involvement in GVCs and FDI. Policies supporting the entry and upgrading of countries in such chains – especially via a strong institutional setting and a well-educated labour force – can help maximise the spillovers from foreign investments.

The golden opportunity of joining global value chains

In the last fifteen years developing countries have been affected by two major trends: the upsurge in foreign direct investment (FDI), and their increasing participation in the process of production fragmentation. First, the new wave of FDI has swept across Sub-Saharan African (SSA) countries, where inflows are becoming more diversified, both geographically (thanks to emerging economies) and sectorally, shifting from exclusive concentration on extractive sectors to light manufacturing and services [1] [2]. Second, through their participation in Global Value Chains (GVCs), firms in developing countries have become fully qualified participants in the global market, specialising in specific stages of the production process, and exploiting their comparative advantages without having to develop all the capabilities needed along the whole chain [3] [4] [5]. The opportunity of joining the production chain, just in one or a few specific stages, is of particular relevance in countries with a limited manufacturing base, such as many SSA countries, where participation in the global market through GVC involvement may represent a “golden opportunity” to promote inclusive growth [5] [6] [7].

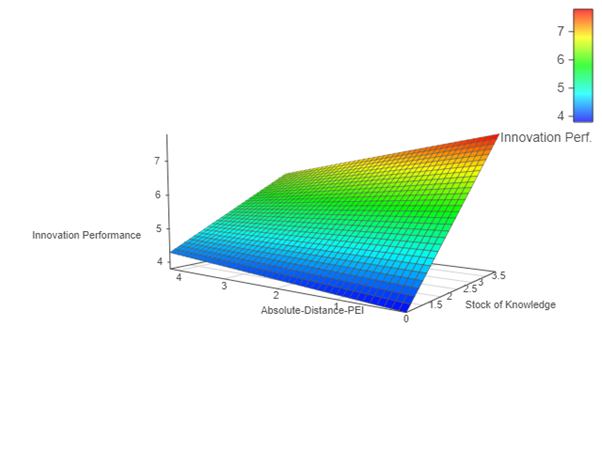

In a recent paper we show that the degree of involvement in GVCs could be a novel dimension to explain the potential spillover effects of FDI, via an increase in the demand for local inputs. An intensive participation in GVCs exposes local firms to the requirements of international markets, to a more sophisticated demand, and to learning opportunities; this is thanks to knowledge and technology transfers within the value chain from global leaders to local suppliers [8]. The empirical analysis is based on firm-level data, and matches the African Investor Survey (AIS), undertaken in 19 SSA countries, and the Vietnam Industrial Survey (VIS) [9], with two indicators of GVC involvement measured at the country-sector pair to assess whether the degree and modalities of involvement in GVCs matter for the local sourcing of intermediate products by foreign investors. A joint analysis of SSA countries and Vietnam allows the comparison of a region relatively less attractive to foreign manufacturing investments with a country recently assuming a central role in the rapid expansion of the global fragmentation of production.

Measuring the participation and the position in the GVCs

We calculate two indicators of GVC participation and position at the host country-sector level. GVC participation is measured as the sum of foreign value added (FVA) and indirect domestic value added (IVA, e.g. the value added embodied in intermediates re-exported to third countries), divided by total sector-country exports. The second indicator measures the relative position of the sector-country pair within the GVCs, calculated as the log-difference between the upstream (IVA) and the downstream component (FVA) of the GVC participation index. Thus, positive values indicate an upstream specialisation in GVC phases of the production process far from the final demand (e.g. production of intermediates products used by other countries in their exports) and negative ones denote downstream specialisation in phases close to the final demand (e.g. use of intermediates to produce final goods for exports).

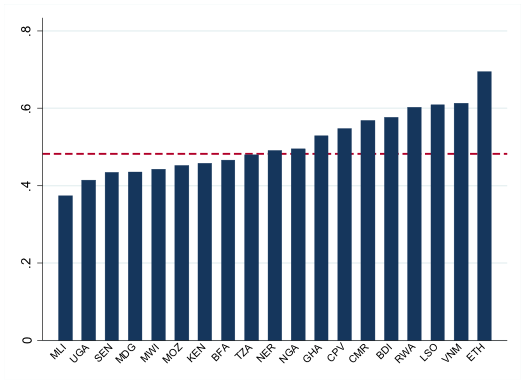

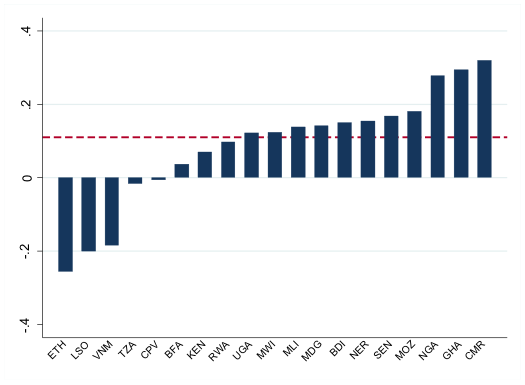

Figure 1 shows the indicators of GVC participation and position across SSA countries and Vietnam. Many SSA countries are characterised, at the same time, by an upstream specialisation and a relatively low level of GVC participation, since they are involved in the very initial stages of the manufacturing transformation of inputs then exported for further processing. On the other hand, countries with a relatively high participation in GVCs (e.g. Ethiopia, Lesotho and Vietnam) are generally characterised by a more downstream position [10].

Figure 1: GVC involvement across countries

a) GVC Participation

b) GVC Position

Source: our elaborations on Eora Multi Region Input-Output database.

Domestic sourcing of intermediate inputs and GVCs

When analysing GVC involvement and local sourcing, our results indicate that the greater the amount of inputs bought locally by foreign investors, the greater the participation in GVCs. The position within GVCs also matters [11]. Foreign firms in countries and industries with an upstream specialisation in phases of the production process far from the final demand, such as the production of intermediate products used in exports by other countries, report higher shares of local sourcing from foreign investors. This result, while to some extent obvious, is of particular interest for SSA countries, whose involvement in GVCs has so far been confined to the exporting of primary inputs or basic manufacturing products that are transformed elsewhere. While the literature on GVCs usually associates a more upstream specialisation with lower value added and less structural transformation, we show that this pattern of integration in value chains may still offer opportunities to attract FDI with high local content. The experiences of upstream sectors such as the agricultural industry or mining, where both FDI and the recourse to greater local sourcing of inputs by foreign firms are rising, are broadly in line with our findings.

These findings are not exclusively driven by the relatively high participation of Vietnam in GVCs, as in SSA countries the relevance of GVC participation, albeit weaker, remains significant. Furthermore, the relationship between GVC involvement and local sourcing is stronger in countries with stronger rule of law and higher education spending, supporting the view that a good institutional environment and the availability of a relatively well-trained labour force are important factors to attract foreign investors, especially if the aim is to create local linkages with domestic suppliers.

Implications

Our analysis shows a high degree of complementarity between GVCs and FDI and suggests that policies providing support to the entry and upgrading of countries in GVCs can offer an additional advantage in maximizing the potential spillovers from FDI. Improving institutions and investing in education can magnify the positive relation between GVC involvement and FDI spillovers.

Yet, achieving high levels of GVC involvement is not a guarantee for attracting FDI with high sourcing potential. Countries and sectors with high GVC involvement may attract footloose investments, should they offer foreign investors low cost inputs and other export incentives. This is a common case in some SSA countries, specialised in the textiles industry, and even in Vietnam, which is highly involved in labour-intensive stages of production. Policies supporting stronger interactions with local suppliers, their upgrading and the raising of the local content, may help to avoid such occurrences.

In this respect, our findings support recent policy efforts in some SSA countries (i.e. Ghana, Nigeria, Mozambique, Ethiopia and Rwanda) aimed at fostering the use of local inputs by foreign investors, by improving infrastructures, boosting education and training standards to build a skilled labour force and to meet the more sophisticated demand of global markets [6] [12].

This post is based on the following IMF working paper by Amendolagine et al. (2017): FDI, Global Value Chains, and Local Sourcing in Developing Countries. This post represents the views of the authors and not those of the GILD blog, nor the LSE. It first appeared on VoxEU.org

Vito Amendolagine is a Research Fellow in the Department of Political and Social Sciences at the University of Pavia.

Andrea Presbitero is an Economist at the International Monetary Fund (IMF).

Roberta Rabellotti is a Professor of Economics in the Department of Political and Social Sciences at the University of Pavia, and an Assigned Professor at the University of Aalborg associated with the IKE (Innovation, Knowledge and Economic Dynamics) Research Group.

Marco Sanfilippo is an Associate Professor of Political Economy at the University of Bari, and a Visiting Professor in Globalisation and Development at the Institute of Development Policy and Management, University of Antwerp.